STRATEGY : Is this Time Different ?

May, 20 2022

It’s The Cycle, Stupid !

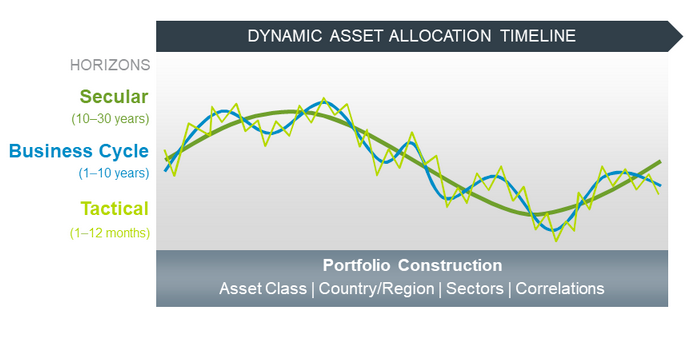

After reading this message, we were a bit puzzled and wanted to check where we were with our strategy. Fortunately, quickly we got reassured looking at our previous strategy developments, to go defensive (see here & previous) and investment allocation updates (here) and at our road book. So we are happy to share with our faithful readers and trustful clients our Strategy Q2 2022.

Key takeaways

- Rising bond yields and increased expectations of Fed tightening caused asset prices to stumble out of the 2022 starting blocks; the war in Ukraine exacerbated the volatility and led to higher commodity prices.

- The global economic expansion continued, with most countries entering in a late-cycle phase and a near-term risk of recession in the US.

- China’s industrial cycle still appears to be bottoming, but COVID and political headwinds are hampering progress.

- Inflation rates should moderate from high levels, but increasing wage growth and inflation expectations could lead to persistently high inflation.

- While many investors may be concerned about the impact of high inflation, interest rates hikes on the economy and markets. Do we head toward a soft landing, a Recession or even Stagflation ?

- The war in Ukraine is a stark reminder that we’ve shifted to a secular environment of higher geopolitical risk.

- Investment conclusion

- A more unstable backdrop makes portfolio diversification as important as ever.

- Looking ahead, a combination of low valuations and rising interest rates could give a boost to the financial sector.

- Energy and utilities stocks were the main outperformers in the first quarter, as oil and gas prices rose and investors sought defensive plays.

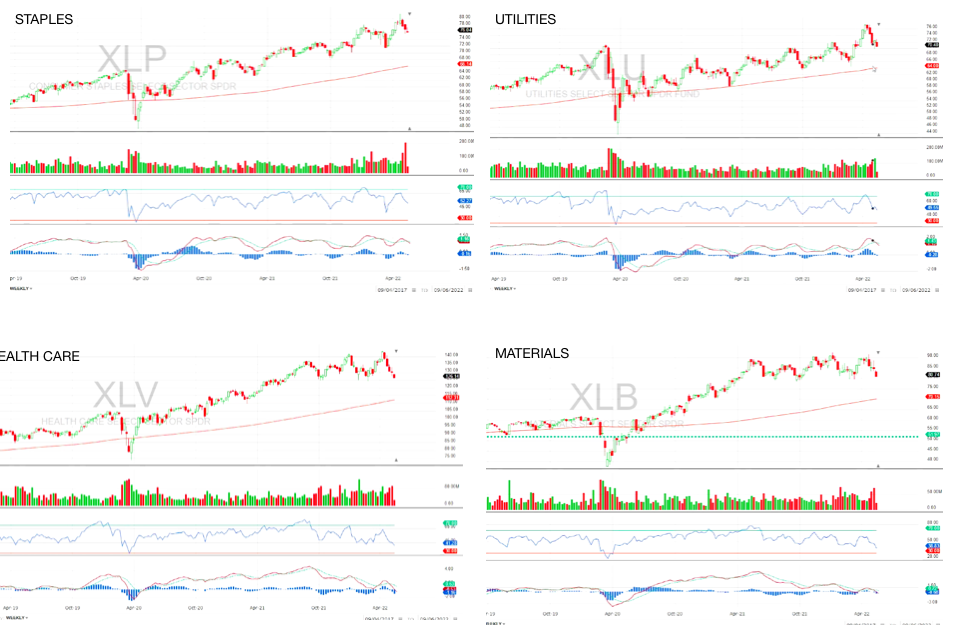

- The consumer staples and health care sectors could also offer opportunity. Both look exceptionally cheap relative to their own histories.

Investment Strategy and Asset Allocation : Recession Odds Are Rising

The current backdrop could easily be the most complicated backdrop that investors have ever faced, so our hope is to put things into perspective. The bottom line? Supply chains and inflation remain in flux. Although economic activity remains positive, there are legitimate signals that demand has peaked and a recession could develop in the second half of the year.

Positioning portfolios for recession means deciding that the Fed will fail to win a game in which it ultimately controls nearly all the cards and sets nearly all the rules. In other words, to steer the US economy into a recession is still an active choice that the Fed may have to take.

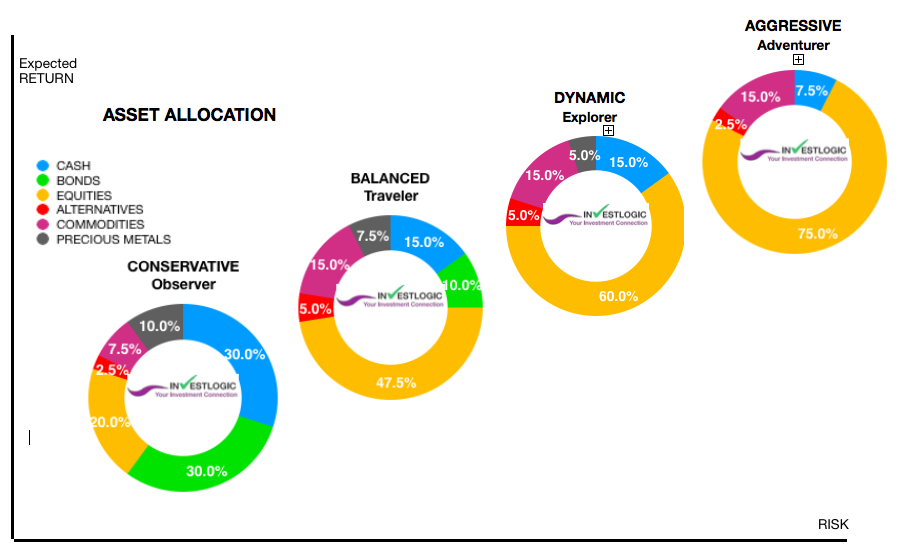

FIND your Client Profile here.

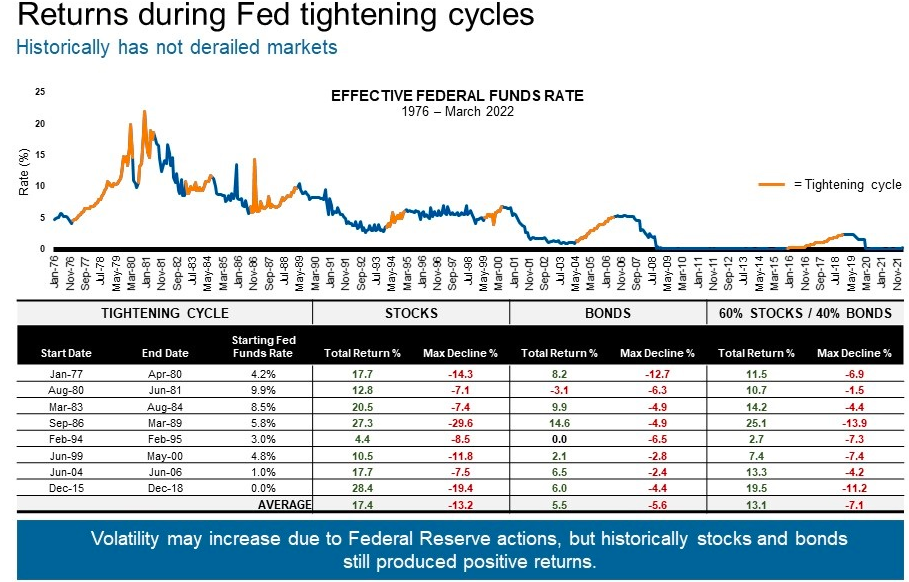

It is important to remember this fact, especially in turbulent times like these. In the short term, risks relating to geopolitics, inflation and – a little further down the line – the economy are legitimate concerns.

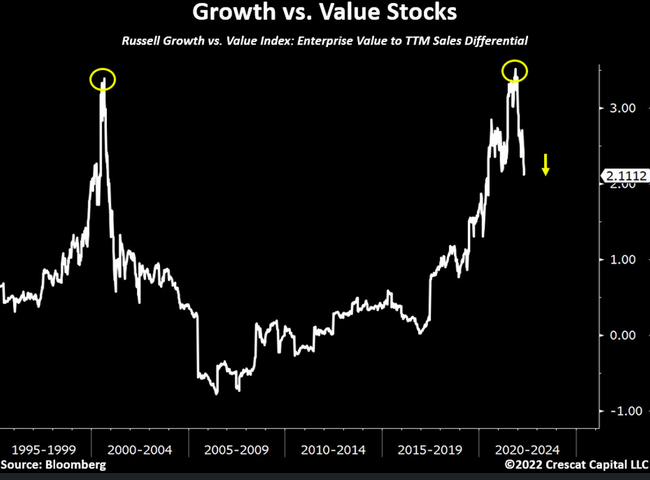

We remain tactically defensive in our investment committee. It is still important for investors to adopt a long-term perspective and not become over pessimistic. We favor positioning in value stocks, which tend to outperform in environments of high inflation and rising policy rates. Second, by positioning in healthcare, investors can mitigate recession risks —healthcare stocks tend to be less sensitive to economic fluctuations.

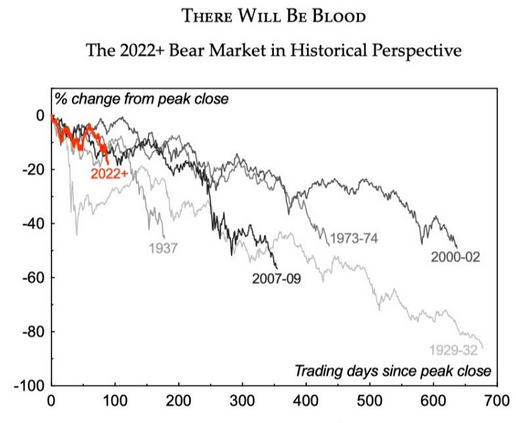

Global equity markets are nearing bear market territory, being down nearly 20% from their recent peak. The acceleration of the market pullback seems to indicate that investors are starting to anticipate a “hard-landing” of the global economy. In other words, they fear that central banks will fail to tame inflation without triggering a recession or sharp economic downturn.

Lower share prices make it more expensive for companies to raise equity, and have a wealth effect. People’s portfolios shrink, they feel less well off, and they are less likely to buy stuff. That is exactly what the Fed wants. It needs share prices to fall enough to influence behavior, which means that policy makers need this to turn into a true bear market, and not like one of the 20%-ish declines that were followed by rescues and resumed exuberance. It needs to avoid disorderly conditions that could create systemic problems, and a serious crash that would drive a recession.

Should we give in to panic and pessimism? The decline in equity markets since the November highs already incorporates a lot of bad news. At this stage, we are looking to identify a real catalyst for a relief rally, but nothing more. We remain on the cautious side – at least for now. Selling rallies certainly seems to be the prudent course of action at this stage of the equity cycle.

Our technical oscillators and trend and market breath give negative signals. Overall, we remains negative. As such, we maintain a underweight view on equity markets in general. We do a have a positive bias on US and China equities. We are least favored toward Eurozone equities (be selective) and we maintain a cautious view on the UK and Switzerland.

Looking forward for the sentiment to pick up, we position for the current uncertain environment. First, we favor positioning in value stocks, which tend to outperform in environments of high inflation and rising policy rates. Second, by positioning in healthcare, investors can mitigate recession risks —healthcare stocks tend to be less sensitive to economic fluctuations.

We are underweighted equities and prefer the U.S. to Europe with a special mention to Switzerland.

Switzerland should be less prone to serious producer price inflation (and its currency, regarded as a haven, should do well in times of global trouble). Vincent Deluard of Stonex Group Inc. points out that producer prices in Switzerland, whose exports concentrate on luxury goods and pharmaceuticals, both of which are relatively unaffected by surging raw materials, are inflating radically less than in Germany”.

If stagflation takes hold, then that promises to be awful for German industry. Swiss stocks, according to the MSCI indexes, have outperformed of late (shown on the left-hand scale), while they now trade at a higher multiple of prospective earnings. But it’s easy to imagine the trade being taken further.

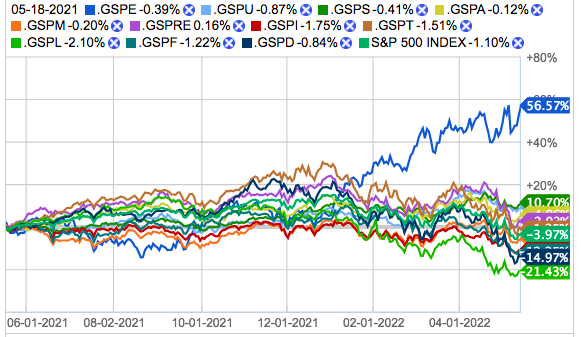

From a sector perspective, cyclicals and value have been leading over the last few months but defensives have been doing better more recently.

It is consistent with where we stand in terms of the macroeconomic cycle – see ABS Matrix -. We favor our equity exposure toward value, energy, and more defensive sectors like healthcare.

In Fixed Income, we remain cautious on rates and keep an negative stance on credit spreads.

And finally, by positioning in commodities, investors can manage geopolitical risks. We keep a positive view on Commodities. The potential for a sustained period of higher inflation presents risks for a multi-asset portfolio. Inflation-resistant assets, including commodities and commodity-producer equities, can help hedge against surprise increases in inflation while providing potential for capital appreciation in a high nominal-growth environment.

We mainain a safe haven stance on Gold. Favorable conditions for precious metals shares include inflation pressure, reasonable valuations, and very early indications of economic weakness.

The chart below shows the total returns during previous Fed tightening cycles dating to 1976, broken down by stocks, bonds and a typical 60/40 stock-bond portfolio.

SECTORS : The market gets defensive

Scorecard: Favoring Health Care and Financials

Low valuations in health care and financials have made those sectors appealing, while consumer discretionary’s strong fundamentals may help the sector overcome high valuations. Energy and materials also continue to look attractive.

Health care has produced weak earnings growth relative to the market and sports a low valuation compared to its own history. Also like staples, the combination has tended to precede outperformance and health care has the additional advantage of high and rising margins.

Global Interest Rates Look Bullish for Financials

Financials have struggled with low interest rates in the U.S. and negative rates around the world. Now yields are rising in the U.S. and in Germany, and German bond yields have turned positive after languishing below zero for years. In the past, simultaneously positive and climbing yields in the U.S. and Germany have been great news for financials, both domestically and in Europe.

Financials’ Valuations May Position the Sector to Outperform Financials also are very cheap relative to their own history. Bottom-decile valuations are uncommon, but when they’ve occurred, the sector historically has advanced 90% of the time over the following 12 months, outperforming the market by an average of 16%.

Staples Appear to Be on Sale

The consumer staples sector has been trading at an extreme discount to its own history, likely because its earnings growth has lagged far behind the market’s in recent years. The combination of weak past earnings growth and rock-bottom valuations historically has been a buying opportunity.

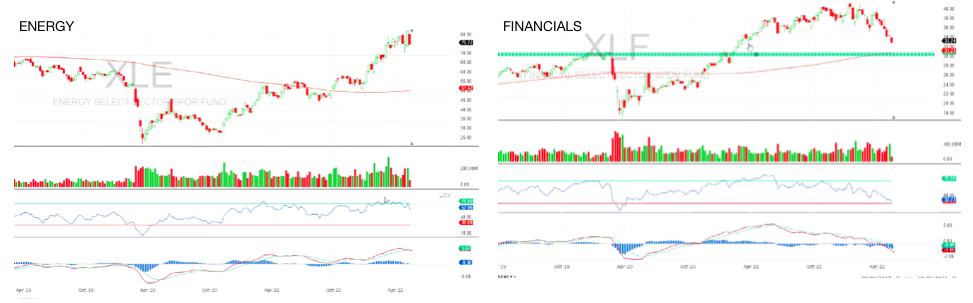

Looking at our now useful weekly graphs and MA 156 weeks strong pivot level we are comforted with our fundamental sector selection.

Positive

Negative

A review of the price/earnings (P/E) ratios of the various equity markets shows that most of the decline in equity indices is due to a compression of valuation multiples and not to a downward revision of earnings growth expectations.

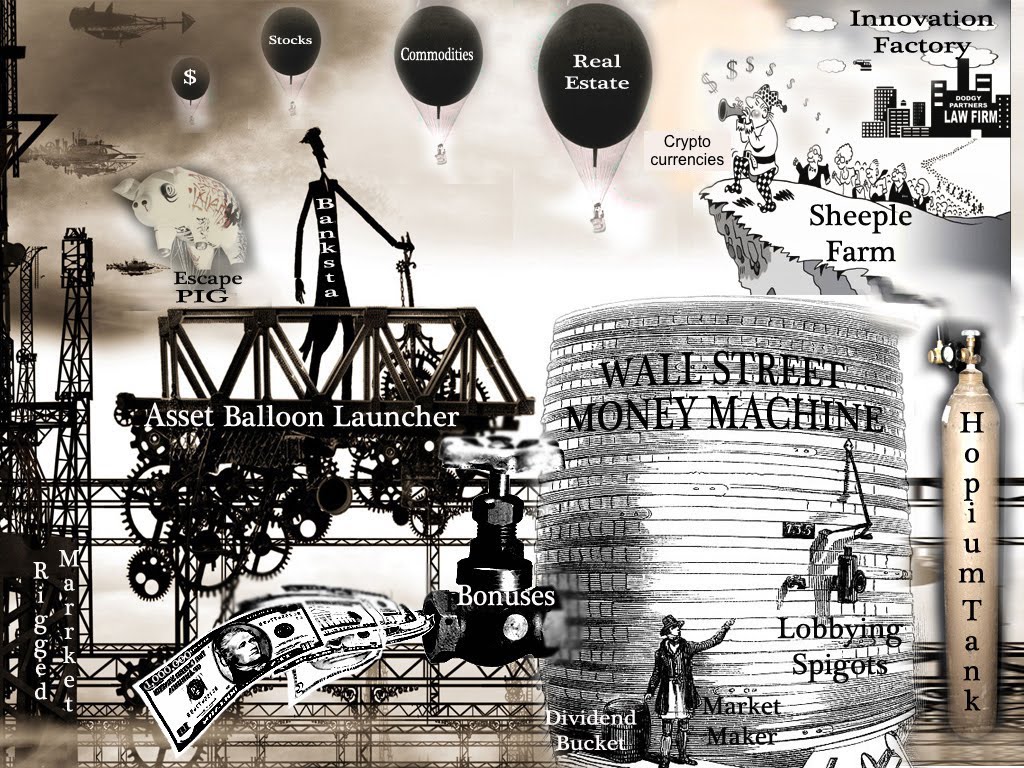

THE MACHINE IS GRIPPED

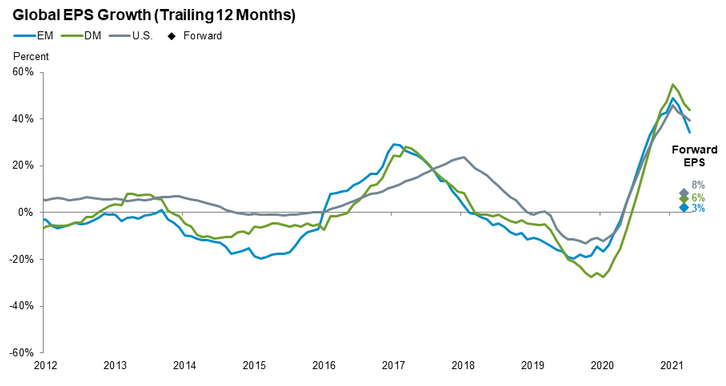

Global earnings growth slowed to start the year, as growth moderated from the decade-high rates registered during the earnings recovery in 2021. More moderate growth is expected this year across all major categories of global equities—US, non-US developed markets, and emerging markets—with forward estimates in the single digits.

The bear trend has been a “valuation reset”—repricing an overvalued market. If, on the other hand, you believe that in addition to a valuation problem the market may have an earnings problem, then this reset might not be over. In that case, the question is whether earnings growth will remain intact.

Having said that, earnings growth has clearly already hit its peak for this market cycle and is now declining. The growth rate for trailing earnings per share peaked at 40% last year and is down to 18%, on its way to 10% in 2022. Expectations for S&P 500 earnings growth for 2023E, consensus expects S&P 500 earnings to grow by 7.9%.

Note that US corporate margins currently stand at a record high (see chart below), which means that companies have so far been able to pass input cost increases onto consumers.

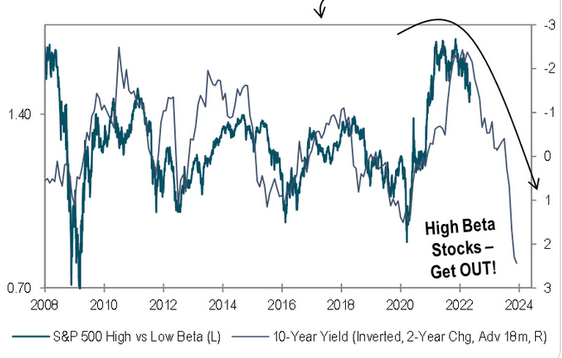

Now the relative valuations of high-risk stocks have risen, while low-vol factor valuations hover the lower average. Historically, the low-vol factor’s odds of outperformance have improved when risk gets expensive, especially outside of recession.

OUTLOOK : QT MATTERS

“If we have to go past neutral, we won’t hesitate,” Chair Jerome Powell

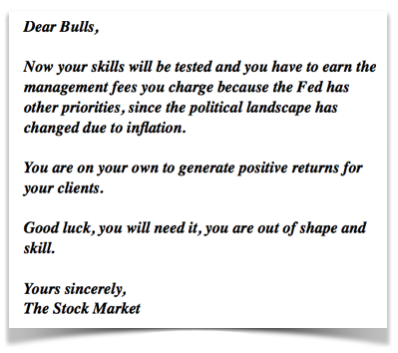

The extraordinary monetary policy implemented over the last decade has played a major role in the double bull market (stocks + bonds). The influx of liquidity propelled financial assets to the top. Investor confidence was fueled by the (implicit) existence of a “Fed Put”, i.e. central bank support via rate cuts or an increase in the size of the balance sheet in case of a market crash. In recent months, this “Fed

Put” seems to have disappeared to be replaced by Hawk Jerome Powell who now fighting inflation and sending a message to investors that the Fed is no longer there to “save” the markets.

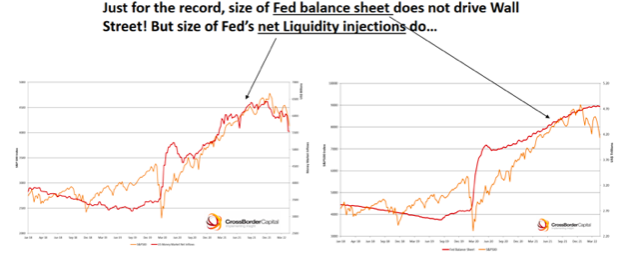

While everyone is braced for quantitative tightening, it doesn’t necessarily follow that it has already wrought all that it is going to wreak. Even if we know what’s coming, the practical impact of liquidity being removed from the system is yet to be felt. It is what the Fed does with its balance sheet at the margin that matters for asset prices, and there is little or no lag.

The following charts from Mike Howell of Crossborder Capital Ltd. demonstrate that the S&P 500 tends to react in real time to rises and falls in the balance sheet. The Fed has already made some liquidity reductions since the turn of the year, and they coincided more or less exactly with the beginning of the trouble for the stock market:

A further factor is QT’s effect on collateral, or on the ability to roll over or refinance investments. It will leave less cash in markets, and make it harder to find collateral when it is needed. That implies a drastic tightening of conditions and the risk of financial accidents. For an analogy, remember the subprime debacle.

While rising rents and wages are already contributing to an inflationary spiral in the US, the surge of crude oil prices and new supply chain bottlenecks are likely to keep inflation at an uncomfortably high level for much longer.

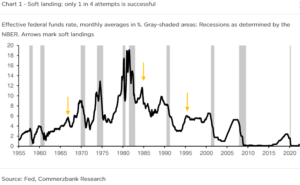

This risk of a “hard landing” shouldn’t be dismissed. First because history shows that the Fed doesn’t have a very good track-record in engineering “soft landings”.

Second, aggressive monetary tightening might not be very effective in lowering inflation triggered by persisting supply-side issues. Third because hiking rates and lowering the size of the Fed’s balance sheet often carries the risk of triggering financial accidents (liquidity or credit event, failure of a bank or large corporate bankruptcy, etc.).

From a macroeconomic perspective, a “hard-landing” aka Recession is thus our core scenario. It will come with a scary dose of turbulence during the journey. This macroeconomic outcome is dangerous for risk assets and it drives us to favour the scenario of a full-blown recessionary bear market.

Lower share prices make it more expensive for companies to raise equity, and have a wealth effect. People’s portfolios shrink, they feel less well off, and they are less likely to buy stuff. That is exactly what the Fed wants. It needs share prices to fall enough to influence behavior, which means that policy makers need this to turn into a true bear market, and not like one of the 20%-ish declines that were followed by rescues and resumed exuberance. It needs to avoid disorderly conditions that could create systemic problems, and a serious crash that would drive a recession.

On the monetary policy side, central banks are not investors’ friends anymore. The Fed has firmly entered into a rate hike cycle (+75 bps since March 2022) and the ECB might soon follow. Overall, the global liquidity context acts as headwind for risk assets.

2023 recession risks likely to rise this fall

A general rule-of-thumb is that it typically takes 12 months or less for changes in U.S. monetary policy to work their way through the system and have real, demonstrable impacts on the economy.

Historically, another telltale sign of a recession is the inversion of the U.S. Treasury yield curve—where shorter-dated bonds yield more than their longer-dated counterparts. In many—but not all—cases, a U.S. recession occurs around 15 months after the yield curve first inverts.

This lends some credence to the idea of a recession potentially beginning in the fall of 2023, given that the yield curve briefly inverted in March, when 10-year yields fell below two-year yields.

Conclusion

Most of the central banks are independent and monetary policy credibility has generally strengthened over the decades, but hiking rates hurts businesses and households at a time when they already see their real income eroded by rising prices.

With private and public debt levels at historic highs as a share of GDP, central bankers can take policy normalisation only so far before risking a financial crash in debt and equity markets.

We continue to keep our reduced equity exposure at lower levels. With the market deeply oversold, we are holding our current allocations.

We continue to expect the next few weeks, and even the next couple of months, to remain frustrating. This month was no exception.

Critically, it remains important not to overreact to that volatility and wrongly position portfolios due to an emotional reaction. More often than not, such actions turn out to be far more harmful than the market itself.

Until next time