Better an Egg Today than a Hen Tomorrow

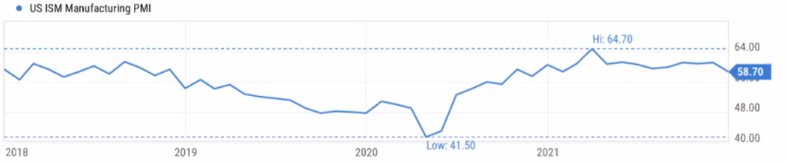

February, 22 2022The ISM Manufacturing PMI for the US fell for a second straight month to 57.6 in January of 2022 from 58.8 in December, compared to market forecasts of 57.5.

The reading pointed to the weakest growth in factory activity since September of 2020. Our view is that a rapid ebbing of the economic cycle in H2 of this year, with the ISM falling below 50, …driven in large part by the tightening already in the system.

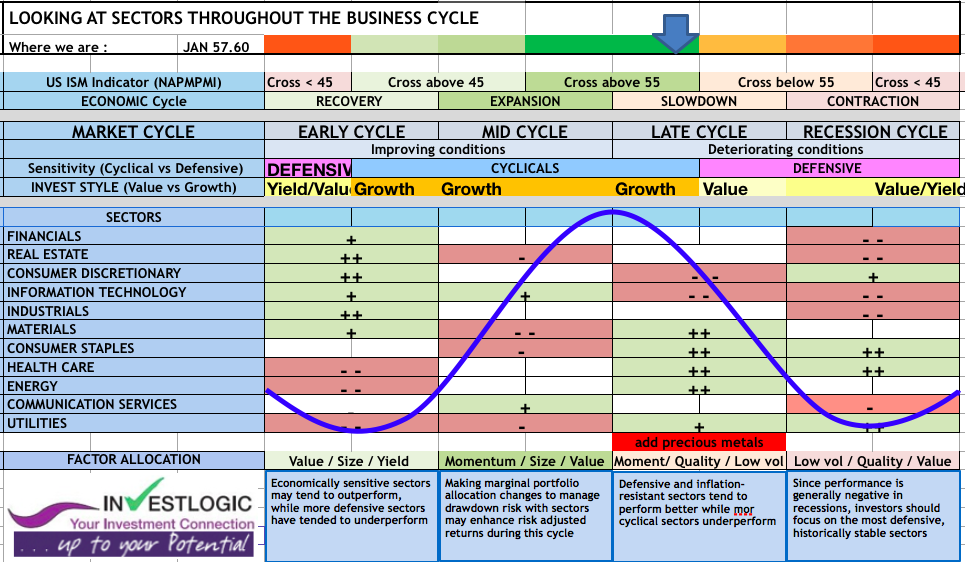

The stock market tries to anticipate the economic cycle which results in certain sectors outperforming the market at different points of that cycle. To that purpose we developed our proprietary matrix to adapt our strategy and sector allocation according to different investment approaches/styles to the market cycle based to the ISM manufacturing PMI indicator to gauge where we are in the economic cycle (i.e. the business cycle).

Note: The typical business cycle shown above is a hypothetical illustration. There is not always a chronological progression in this order, and in past cycles the economy has skipped a phase or retraced an earlier one. Unshaded (white) portions above suggest no clear pattern of over- or underperformance vs. broader market. Double +/– signs indicate that the sector is showing a consistent signal across all three metrics: full-phase average performance, median monthly difference, and cycle hit rate. A single +/– indicates a mixed or less consistent signal.

Leaving an extended mid-cycle period and peaking into a late cycle phase

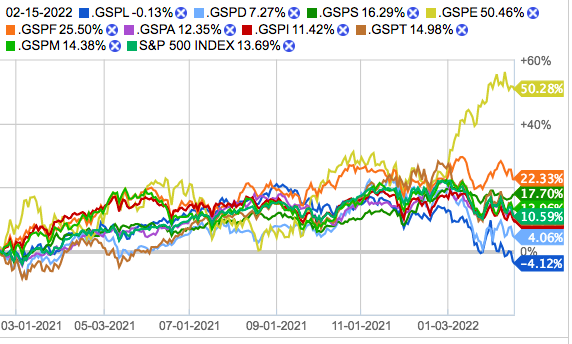

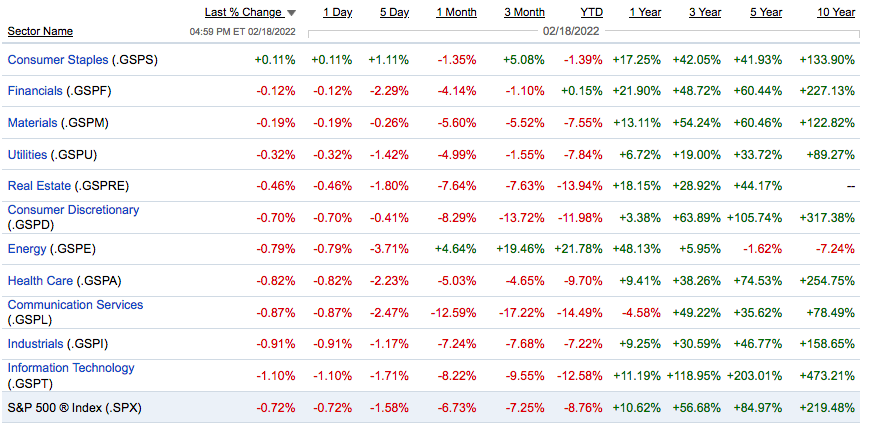

We have clearly passed an inflection point in November 2021 (chart sector perf below) – no surprisingly corresponding to inflation rebound and FED hawkish comments, as can be seen on the sector performance chart. -table at the end ANNEXE-

- Cyclical stocks generally outperformed in the final quarter of 2021, with real estate, tech, and materials leading the pack.

- Materials companies showed the strongest earnings-per-share growth over 2021, while tech ranked the best on return on equity.

-ALSO you can check our methodology further HERE –

Our KIS Strategy -KEEP IT SIMPLE-

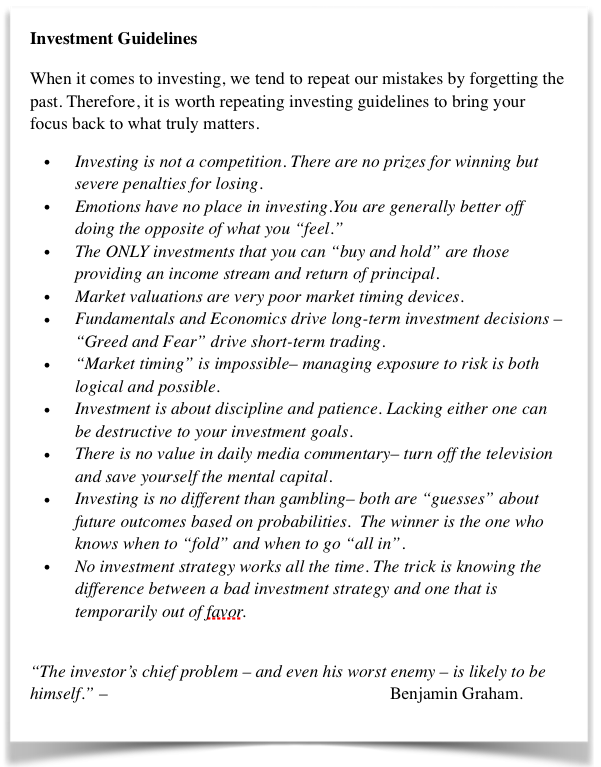

Discernment and discipline should be our main words with the end of the bull market. The financial anomaly linked to the mass of liquidity injected into the global economy economy will sooner or later have to be rebalanced.

In the short term, the preferred scenario is a flat consolidation or even a continuation of the correction accompanied by occasional rebounds. We have not yet seen a capitulation movement which is why a return back to the lows is more than likely, if we refer to the trends observed in such a configuration in the past. The famous “TINA”, “ Buy the Dip” and the like are currently less relevant.

Check our Anatomy of Bear Market

Fundamental analysis should make a comeback back (versus the momentum trend following of the last 18 months) : cash flow, growth, pricing power, debt levels and, above all, valuation will be more appropriate decision drivers than simply than just bargain hunting (playing the greatest fool theory). This is evidenced by the clear outperformance of of value stocks over growth stocks since the beginning of 2022, even if we believe that that not all growth stocks should be put in the same basket.

This year, we will have to sort the wheat from the chaff, with no doubt some good opportunities, to be selected without haste, with a view to strengthening / building a barbell strategy.

Emerging countries will also deserve our full attention; sorting more attractive valuations than those of Developed countries, these zones have already largely started to raise interest rates – or are even in the process of monetary support, as is the case in China.

The central banks have (finally) blown the whistle of the the end of the recess, we will have to be flexible in order to adapt management to the new working environment:

- a more constraining macroeconomy,

- a resilient microeconomics

- global political uncertainties

are acting as a lead cloak that maintained the precarious stability of the system.

Finally, only one thing seems certain: the return of volatility (see end ), which will bring investors back to the classic rules of asset allocation:

i.e. diversification, risk control and scrupulous asset analysis.

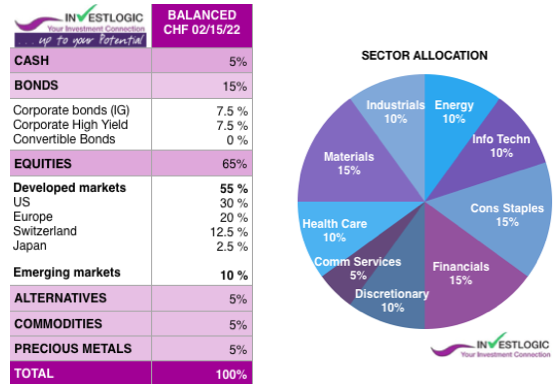

To approach this next sequence of the cycle, we are deliberately adopting a clearer position in our asset management with a return to simplicity while rebalancing our portfolios.

But simplicity does not mean simplistic. We have to assert clear convictions and prioritize three elements in portfolio construction :

The first is a requirement for consistency of liquidity within within each of the segments that make up our portfolios files.

The second is to maintain a high degree of legibility by avoiding the risk of uncontrolled allocation and hidden overexposure (e.g. holding direct GAFAM securities, and via thematic investments, etc.).

And finally, the third is the application of limits by recalibrating each line line correctly and by applying systematic stop-loss loss rules, hedges and systematic profit taking.

see the ANNEXE for the table of elements and sector rotation

We must be aware of the risks and navigate markets accordingly. Therefore, we approach risk management in the market by choosing to hedge risk and reduce potential liabilities.

As such, given the market’s current dynamic, there are three options currently:

- Do Nothing – if the markets correct, we lose capital and time waiting for the portfolio to recover.

- Take Profits – This has been our choice on the recent reflexive rally. Taking profits, raising cash, and reducing equity exposure in advance of a correction mitigates the damage of a decline. However, if wrong, we can repurchase positions, add new ones, or resize portfolio holdings as needed.

- Hedge – We have also opted to hedge by adding a position to the portfolio that is the “inverse” of the market. Such allows us to keep existing positions intact. By “shorting against the portfolio,” we effectively reduce our equity risk (and related capital destruction) during a market correction.

As noted, we have opted to use a combination of both #2 and #3. Doing nothing leaves us too exposed to an unexpected “volatility shock” in the market or the reversal of bullish psychology.

While we are reducing capital risk opportunistically, we are very aware we could give up performance in the short term if the market rallies. For us, that is a choice we can live with if we potentially bypass the risk of a more significant correction.

The year 2022 is definitely full of opportunities, but these can only be exploited by a rigorous management and more in-depth work in each segment within each portfolio. In 2022, the tactical allocation (stock selection) will certainly regain its nobility after a decade devoted to passive investments and vehicles that replicate indices, risk premiums or themes.

2022 KEYNOTES

- 2022 is unlikely to see strong valuation-driven price gains. Instead, price gains will likely hinge on earnings growth.

- Looking ahead: While rising inflation may be spooking some investors, there’s a good chance inflation may decelerate from here.

- We may be in an entering late-cycle, with modest price gains, but also more wobbles.

- On a technical basis, the market still looks vulnerable.

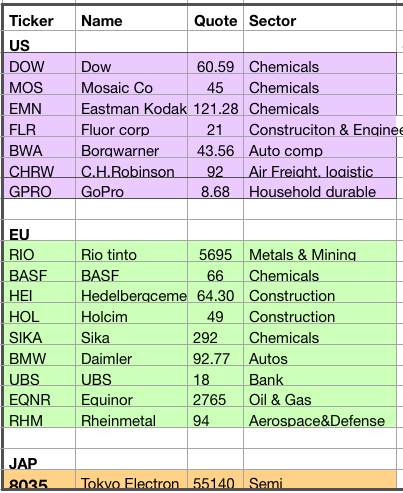

Cyclicals to Shine

As we enter into a late cycle phase. As the economic recovery matures, the energy and materials sectors, whose fate is closely tied to the prices of raw materials, have typically performed well, as have defensive-oriented sectors. If inflation decelerates but stays high, it may set the stage for financials and energy to outperform. Rising wages could also boost consumer discretionary stocks.

As a result, given the current economic and financial environment, we would still continue to prefer the more cyclical, value and reflation-oriented sectors, and on a regional basis, Europe, which has historically tended to benefit the most from growth-to-value rotations.

In a market that in general index ratios looks expensive mainly if rates rise or inflation stays higher and for longer, there are still some opportunities that have not shown their full potential or have not normalised, mainly in Europe where valuations are more reasonable.

The reasons for investing in value-style European equities are as follows:

- Savings accumulated in the pandemic era where spending was reduced.

- Replenishment of inventories in a calmer health and economic outlook.

- Investments in capital goods to make the economy more competitive.

- European Commission recovery plan.

- Negative real interest rates.

We continue to look at banking, energy, commodities and construction material stocks. These are companies that have strengthened their financial structure, reducing costs and therefore improving their operating leverage, with a certain capacity to pass on costs.

Particularly in the banking sector, we are all aware of the reduction in costs, the increase in commissions charged, the increase in credit due to the coming recovery and the rise in interest rates, as well as the traditional support of the economic authorities for the sector, which is considered a fundamental part of the economy.

On the other hand, the rise in the price of energy has not yet been fully reflected in the rise in company prices.

The reopening of the leisure and tourism sector will promote the growth of these sectors. But it depends mainly on the evolution of the pandemic.

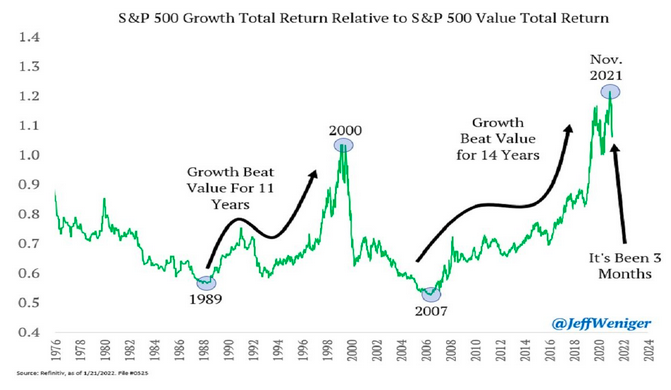

Despite the recent rotation, the value gap is still extreme

Relative valuations are still cheap between value and growth.

Over the past decade (during which markets have enjoyed very accommodative monetary conditions) growth stocks have been comfortably outperforming their value peers with value rotations usually short-lived. The question now is whether this time it is different.

This inflexion has been sharp, with energy and financials the main beneficiaries and at the expense of the Nasdaq’s unprofitable growth stocks.

In fact, the two main styles of growth and value investing have a long history of moving in opposite directions from each other and then playing catch-up.

The catalyst for this trend change has everything to do with the Federal Reserve’s plan to begin raising interest rates.

While value stocks are characterized by low price/earnings ratios, their relative valuation compared to growth stocks has fallen steadily over the past decade as low to-negative real rates have proven a tailwind for growth stock valuations.

However, it is still very difficult to forsee a secular change at this level. Inflation may be running at the highest level seen over the past 40 years, but interest rates are likely to remain historically low levels and at these low levels growth stocks should continue to trade at a significant premium to value over the coming months.

Historically, inflation decelerating to an above-average rate has been good for value stocks —those that trade at lower prices than stocks of other companies with similar earnings—, particularly financials and energy. It hasn’t been good for technology, which tends to outperform when inflation drops to low levels.

Strong fundamentals and relative strength have made consumer discretionary look appealing, and may help to offset high valuations. Meanwhile, financials had cheap valuations and recovering fundamentals. In health care, inexpensive valuations and good fundamentals may help outweigh poor relative strength.

Finding ideas : Making the Case for Materials

But while value may be poised to outperform the broader market, discovering value can present challenges, even for experienced investors.

Making the case for materials: the macro backdrop looks supportive, indicators remain bullish for the sector, and it is attractively valued both on an absolute and relative basis.

The prospect of more policy support in China, higher commodities prices, and healthy earnings across the sector should all in our view support materials, while the sector’s historical correlations with economic activity data and inflation also suggest room for more upside performance both in the US and Europe on a relative basis for materials stocks.

We continue to prefer the more cyclical and reflation-oriented sectors (i.e. banks, energy, materials and industrials), that historically tend to thrive in an economic environment featuring rising interest rates, strong economic activity and higher levels of inflation.

Some stocks we accumulate on weakness

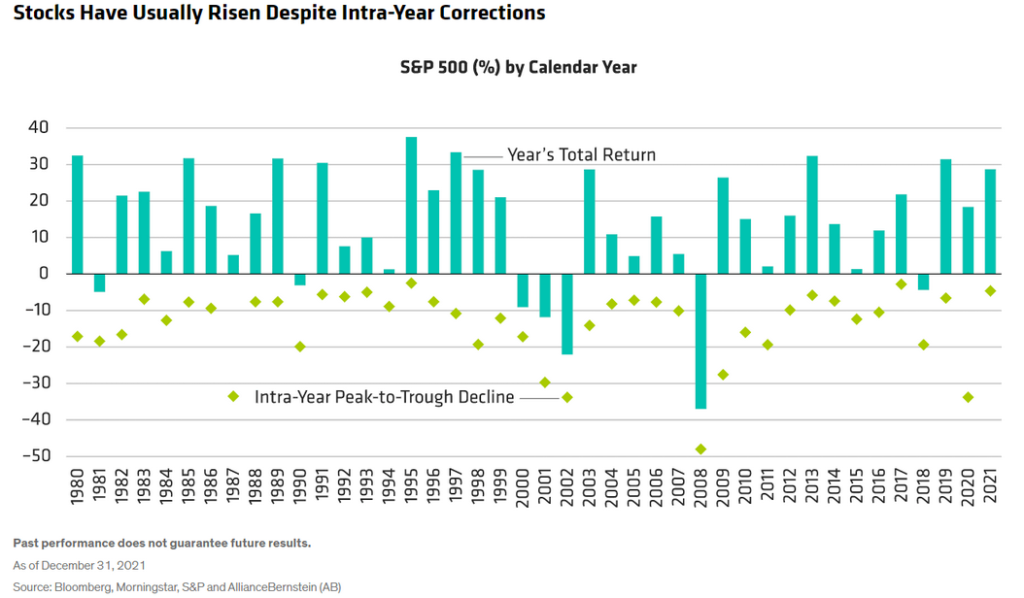

Peak to Through and Total Market Returns by Year 1980 to 2021

Volatility has returned to the US equity markets with a vengeance. Stocks were flying smooth last year and always seem to go in only one direction. That is no longer the case. Right the start of the year, starts are swinging wildly taking investors on a stomach churning ride. Even professional investors are struggling to keep with the market as their bets on hi-flyers start to sour.

But retail investors have an edge over professional traders and investors. Unlike them, retail investors need not worry about beating a benchmark or increasing their reputation or even earning a bumper bonus. In times like these retail investors can simply ride out the storm and not make any rash decisions. The key is to be patient and not get carried away by emotions.

The performance of the S&P 500 over many decades shows that stocks mostly tend to earn a positive return for the year despite going thru dramatic intra-year declines as shown in the chart below:

When stocks fall on a given day this year, one can always find a reason for that. Some of the reasons include:

- Rising interest rates

- Uncertain growth rates

- Covid-19

- Russian invasion of Ukraine

- Supply chain issues

- China attacking Taiwan

- Relentless rise in oil prices and so on.

The list of causes of a plunge are endless. Stocks always try to climb a wall of worry. There is hardly any year or day where everything is perfect. There will be always be something negative happening somewhere in the world.

Instead of worrying about all these factors that are beyond one’s control, investors can simply focus on things that are under their control and adhere to their long-term investment goals. So even though stocks may swing wildly most of the times they return positive returns.

Stay Tuned

ANNEXE