We cannot command the winds but we can adjust the sails

January, 06 2022

INVESTMENT STRATEGY & OUTLOOK 2022 part 1.

2022 may be one of those times given a swirl of headwinds. Among them: a new COVID variant that threatens to slow global growth, supply chain bottlenecks, rising inflation, and expectations that the Federal Reserve will raise interest rates.

2022 may be one of those times given a swirl of headwinds. Among them: a new COVID variant that threatens to slow global growth, supply chain bottlenecks, rising inflation, and expectations that the Federal Reserve will raise interest rates.

How to navigate the headwinds? We are going to give you some point of view and opinions and hopefully to use it as a compass for 2022.

2022 will probably test the nerves of equity investors as the main developed markets central bank plan to taper QE. More pain ahead for tech stocks as central banks aim to normalize monetary policy? It is probably not a pure coincidence to see the Nasdaq 100 rising alongside the huge expansion of Fed, BoJ and ECB combined balance sheets since the Global Financial Crisis. The year ahead may be noteworthy for being more “normal”–still growing, just slower.

- We expect the markets to mean-revert back to trend-like growth.

- Stocks are poised to deliver positive returns in 2022, but likely not as much as they did in 2021, as earnings growth slows and the Fed tightens.

- The Fed will take the first steps on the road back to a neutral monetary policy.

- Attempts by the Federal Reserve to tighten monetary policy could potentially affect real rates, with impact on the markets and the economy.

- Growth stocks could continue to outperform value if interest rates stay low. They have been leading the market since 2014.

- We can expect that the secular bull market that began in 2009 will continue, driven by demographics, low rates, and strong cash flows from the “big growers.”

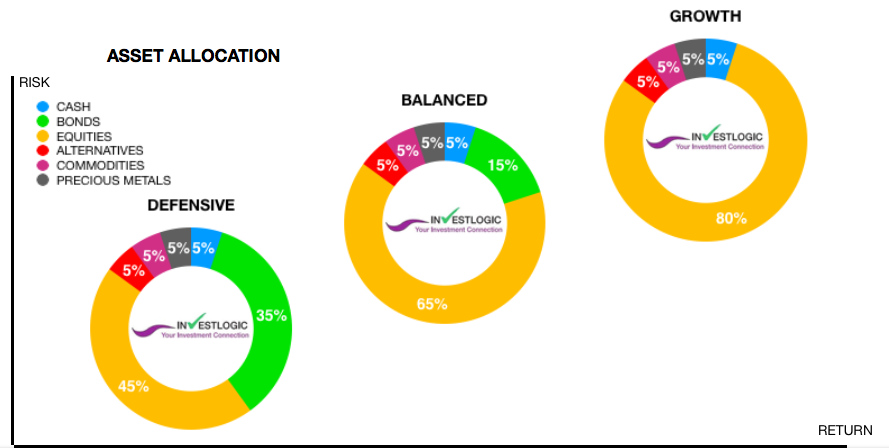

INVESTMENT STRATEGY

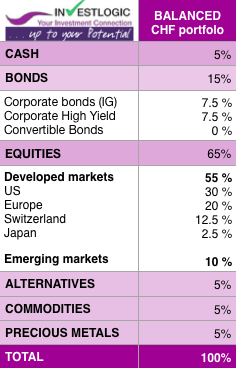

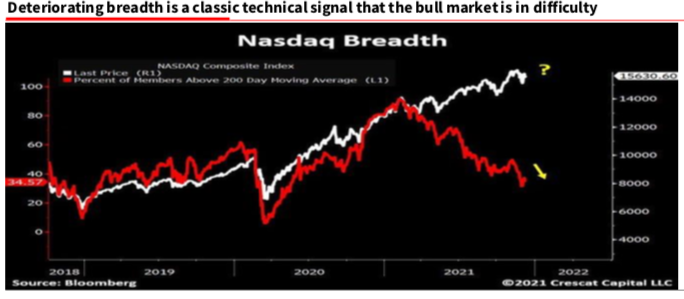

We remain overweight risky assets, particularly equities, and underweight bonds and cash. Within equities, the focus is on cyclical regions and sectors that combine strong earnings growth with attractive valuations (e.g. industrials, automakers and energy). The rise in interest rates should continue to benefit the financial sector, with banks in particular having substantial cash to return to shareholders.

RISK TAKING : A MID-CYCLE MARKET

SEE our ABS Matrix

For 2022, we expect that stocks will perform much as they have in previous mature mid-cycle expansions by continuing to advance, but not as much as they did earlier in the cycle when the economy was just emerging from the COVID recession.

Equity markets may not perform as well in the coming years as they have in recent years, but we still see them rising. Fundamentals remain strong, and earnings should remain strong through 2022, with companies showing impressive resilience.

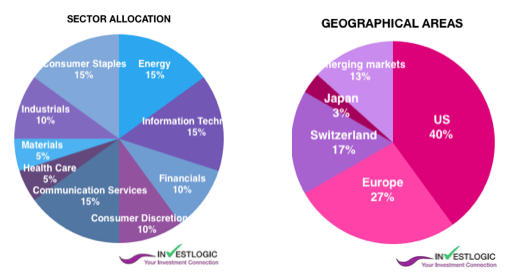

While 2022 will likely be a positive year for stocks overall, it’s less clear how various types of stocks may perform. In 2021, growth stocks and value stocks took turns outperforming each other and that could continue in 2022.

If interest rates stay low in 2022, growth stocks could well continue to dominate because value tends to be more of a play on inflation. Should we have both?

For instance, value stocks are looking increasingly cheaper vs growth stocks (or at least less expensive vs extreme expensive growth stocks)… value keeps getting crushed by growth.

The reason for the underperformance of ‘value’ is not simply explained by the outperformance of technology ‘growth’ stocks. It is also because the financial crisis catalysed the era of super-cheap money. A significant proportion of this poured into equity markets, much through passive funds which bought the index. As a result, all stocks began to move in similar ways regardless of the profitability of the underlying companies.

We favour the leading sectors which we think will continue to perform well. Inflation scares also saw investors rotate away from high-multiple tech stocks and into sectors that hold up better in a rising rate environment. Those include financials, energy and consumer goods, as well as industrials and real estate.

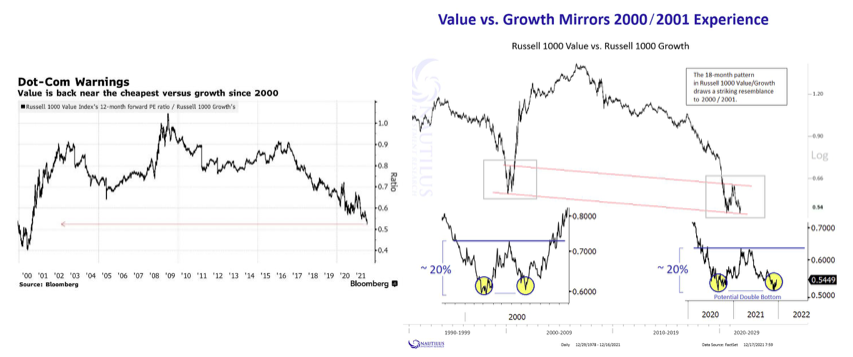

Market internals are also giving out loud warnings. Just as in 2001, could the unravelling of the recent tech bubble trigger the Vortex of Debility that destroys all before it?

The US tech sector specifically – will risk having the rug pulled out from under them. This year the US tech sector (and also the FAANGs) could hold the key for markets. Unlike any other major equity market, the S&P is dominated by these stocks and if they go belly up, inevitably so too does the whole market.

The excellent chart looking at deteriorating leadership within Nasdaq, notes that it is “Truly remarkable. Nasdaq is just 2.6% from all-time highs while only 35% of its members are above their 200-day moving average. Such breadth deterioration only happened at the peak of the tech bubble. Beware of times when the generals lead but the soldiers don’t follow.”

We maintain our preference for a “barbell” approach with cyclicals on one side and technology on the other. The solid earnings growth of US technology companies and their defensive nature in a more volatile environment should remain highly valued by investors.

There is still a lot of reopening to come, which should support cyclicals, as these sectors still have a lot of potential to catch up. The energy, materials and financials sectors should all benefit, especially with a cold winter and a strong recovery in industrial production as demand improves and bond yields rise.

This scenario should also be particularly positive for European assets, given their structural value bias, although with higher growth and earnings in the U.S., it may be difficult to outperform the U.S. for the year as a whole. We keep the exposure to Europe, particularly through industrial and healthcare stocks. We believe this positioning is appropriate given the strong growth forecast for the coming years, particularly low company valuations and buoyant flow dynamics.

In our European sector allocation, our overall positioning is tilted toward Cyclicals over Defensives. We like being more geared to the economic recovery, and Cyclicals are now trading back at a discount compared to Defensives in Europe. Within Cyclicals, our preference is for companies tilted to corporate and government spending (Industrials, Construction & Materials and IT) over those geared to consumer-related sectors (both Consumer Discretionary and Staples). Our allocation factors in the energy transition and digitalisation ( IT). We Overweight Financials (except Real Estate) to gear our allocation to rising bond yields.

We like the emerging markets of Eastern Europe, Poland and Hungary, which show solid economic growth and reasonable valuations. Russia is a market we favor, given its cheap valuations and rising commodity prices. However, geopolitical risks persist, and given the recent rise in tensions with the West, we remain attentive to developments. >>CHECK our blog for comments 2021 Review of the Russian Economy and Equity Markets

Emerging market equities are in a similar situation. They are playing the global recovery, but they remain dependent on China, where regulatory interventions continue to weigh on sentiment.

We have chosen to maintain our exposure to China by strengthening certain stocks in the portfolio in the middle of the year in order to limit dilution in the region. We are convinced that the Communist Party, after asserting its power, should soften its stance. China will then be in a position to return to growth with the likely support of a central bank that has been rather passive until now.

Emerging market equities are in a similar situation. They are playing the global recovery, but they remain dependent on China, where regulatory interventions continue to weigh on sentiment.

HIGHER YIELDS IN PROSPECT

The issue of bond yields remains the big challenge. With negative real yields in the U.S. and negative nominal yields in most of the developed world, the outlook for yields remains weak for the coming years. Moreover, from the current starting point, yields are expected to move in only one direction: up.

We remain cautious on sovereign debt, although we do not expect yields to rise quickly, given the factors mentioned above. Nevertheless, with growth solid and the reopening expected to continue, we prefer to take credit risk rather than duration risk. Credit spreads have been resilient during most of the volatile periods in equities this year, a trend that should continue next year.

Interest rates matter a lot for how this will play out. For investors there’s not much reason anymore to buy bonds for their yield (nominal or real), other than for their diversification benefits. The diversification effect or ability of bonds to protect against drawdowns in stocks remains proven.

CRYPTO

As demand for cryptocurrencies increases and the asset class becomes more accessible, prices are expected to rise.

Bloomberg Crypto Outlook Global Cryptocurrencies 2022 Outlook by claude-investlogic on Scribd

There are literally hundreds of different cryptocurrencies and tokens in circulation today, and each day it seems that a new one gets its 15 minutes before fading from the spotlight. The only two cryptos of significance at this point, though, are bitcoin and ether. Together, the two account for more than 60% of all cryptocurrency market cap, and no other crypto accounts for more than 4% of the sector’s entire market cap. That’s not to say that this will continue to be the case going forward. In fact, heading into 2021, you could have made the argument that bitcoin was the only relevant crypto.

Still so much profit to take, so much hype and so little interest as we can see int his total crypto market cap.

Unless the New Year somehow kicks off massive buy volume more correction is in store in the short term. We do not believe we have another bull-pump in this market, at least anytime soon.

US DOLLAR

The Fed’s newfound hawkishness (as they admit that maybe higher inflation is not so transitory after all) is underpinning a buoyant dollar. This together with the tightness of the China Credit impulse this year has taken the shine off commodities.

If you are betting on cyclicals, then you are basically betting on the Euro. Trading one asset class is trading blind.

Since commodity related stocks including precious metals, and emerging markets as well as value stocks seem to be weak amidst US dollar strength (and strong when the dollar weakens), we need to briefly discuss the outlook for the US dollar., should the dollar weaken in 2022, it would likely cause emerging markets, value stocks and precious metals to perform better. In this respect it is interesting that current seasonality is favorable for silver, although I have to admit that the price action has still been poor.

CONCLUSION

There are some concerns in the outlook and the transition to a post-Covid world will probably not be entirely smooth. However, with strong fundamentals, sustained earnings, and continued support from fiscal and monetary policies, we remain confident about risky assets for 2022.

Keep an eye on the long term to weather uncertainty

As the past 2 years have shown, the best-laid plans can be undone by forces beyond anyone’s control. Investors with a long time horizon may find some comfort in the fact that there’s a 50% chance the market will go up on any given day. But if you extend that time horizon to 5 years, historically the market has gone up 80% of the time. Over 10 years, it has historically gone up 90% of the time.

Stay tuned : look at our part 2 main economic outlook 2022 next week