What Are the Chart Telling Us ?

December, 22 2022

THE BROAD PICTURE

Check our previous What the charts are telling us.

A chart of 2021 and early 2022 may have helped you forecast a down year globally for stocks this year. The full-year picture may be telling some of the same story heading into 2023, although that could change at any time. Here are some of the biggest chart trends that helped shape the market this year—and might provide clues for what to expect for our scenario.

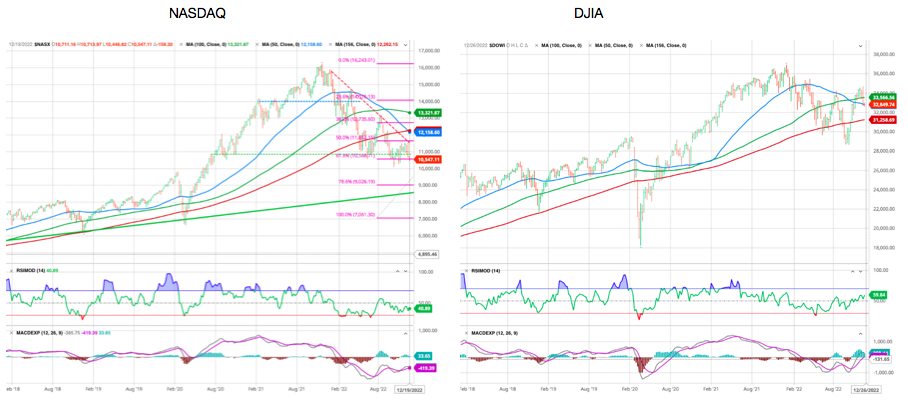

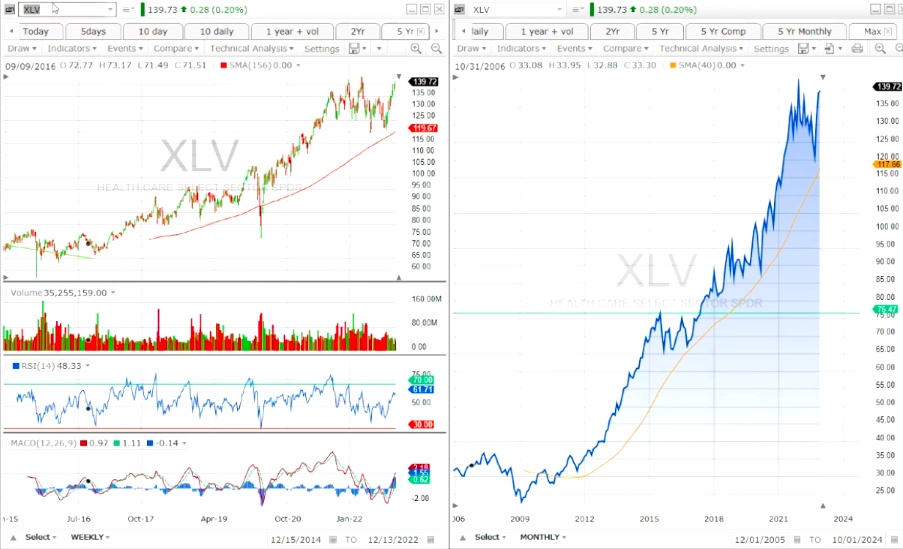

As usual we use the weekly charts which give a better view of the trends along with the 156 week moving average -the closest to the 3 year business cycle.

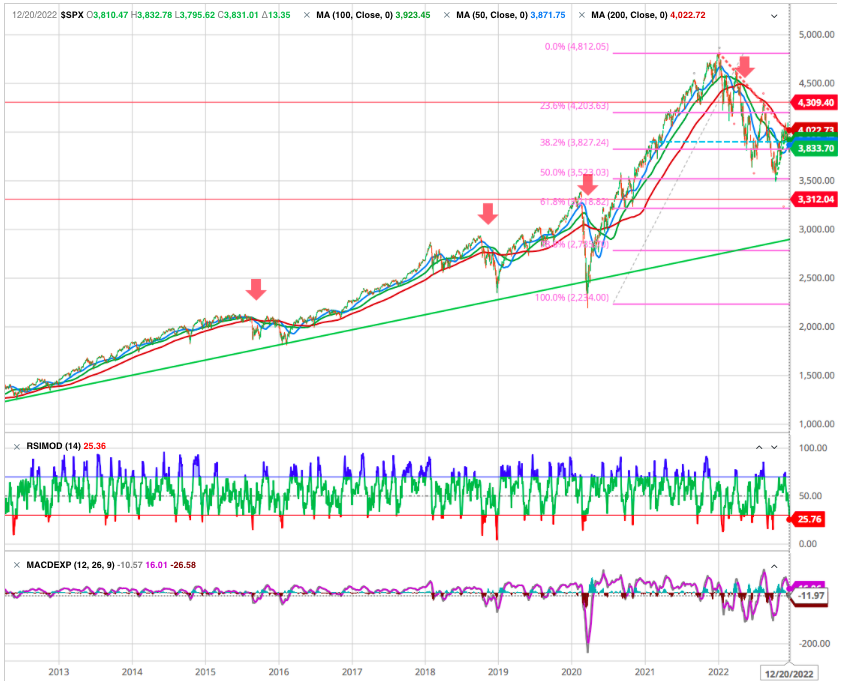

We can see that the market is once again challenging the 156 WMA, if broken would lead to a major downleg. As our readers know we still target the 3200 area.

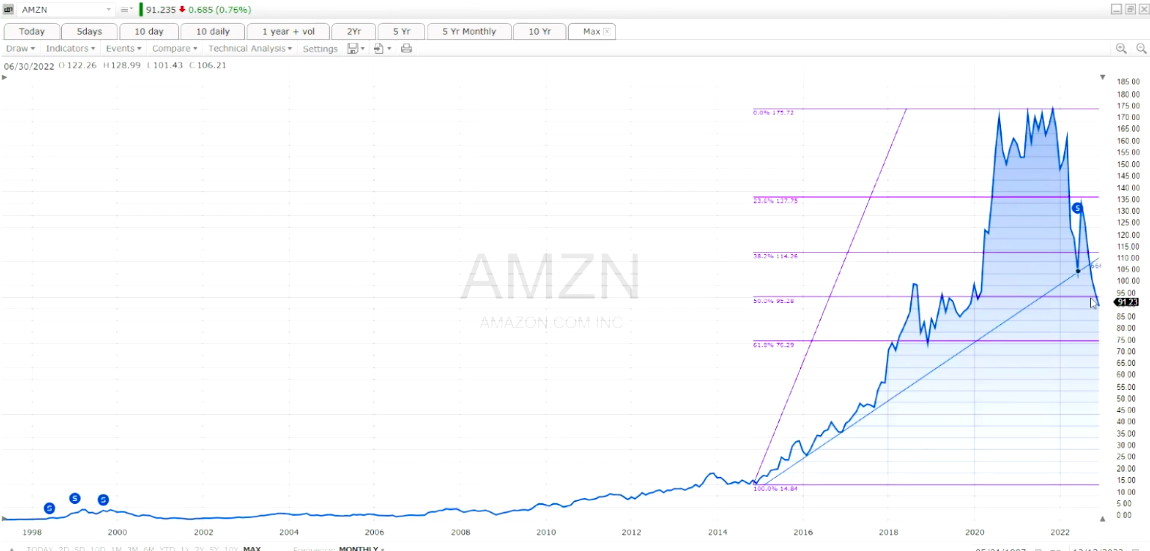

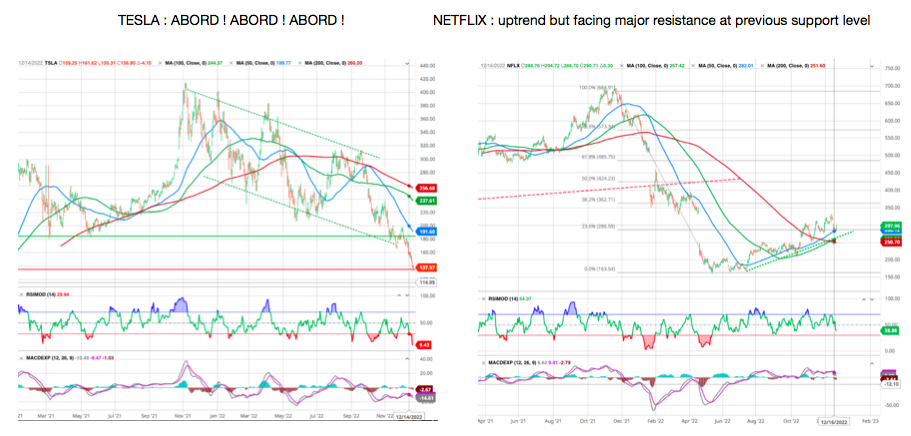

Interestingly, the Nasdaq and with it the TECH sector is more vulnerable (like AMZN , TSLA, META…)than the less aggressive stocks measured by the Dow Jones Index -which made higher lows

In contrast to 2021—when stocks marched higher for most of the year—the trend has been mostly bearish in 2022 (see After 2021 rally, stocks fall in 2022 chart). The MSCI World Index is down 21% and the S&P 500 is down 16% year to date on a total return basis (i.e., including dividends).

There are reasons to think 2022’s bearish momentum could trickle over into 2023, including recession risks for global economies. With that said, stocks have had a historical proclivity to bounce back from negative returns the following year.

Clues in the charts

Two widely watched indicators foreshadowed 2022’s downtrend. After the January barometer gave a negative signal for 2022, a death cross struck the S&P 500 in May. The death cross is a bearish moving average crossover signal that occurs when a 50 moving average crosses below a 200 moving average. Since the death cross, the S&P has fallen 6%, and had fallen as much as 13% earlier in the year (see daily Death cross red arrow).

Among many, 2 key fundamental factors helped paint the picture this year: Inflation and interest rates.

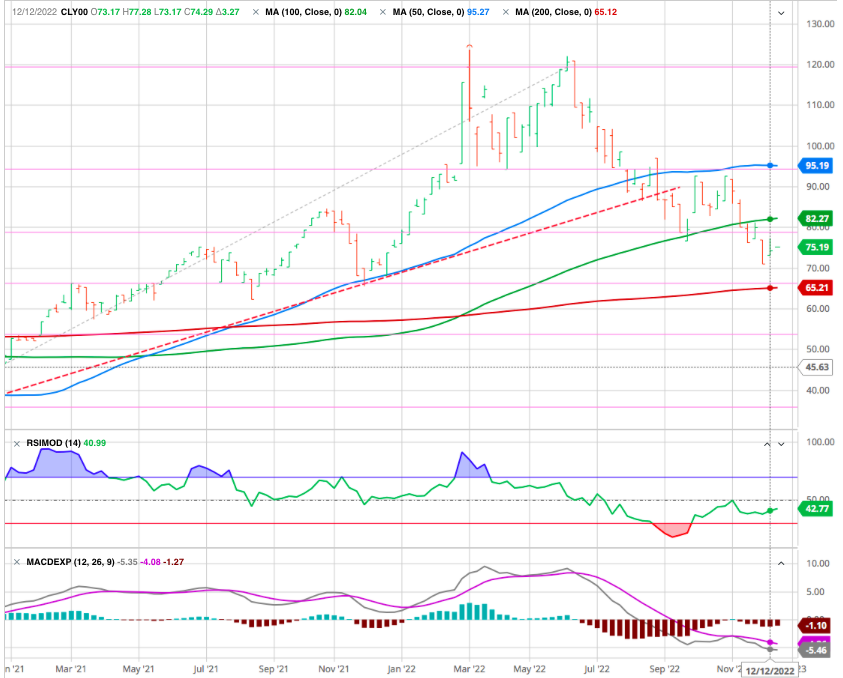

The inflation flashpoint was Russia’s invasion of Ukraine, which exacerbated the multiyear global supply chain upheaval. Soon after, commodity prices soared, including oil, metals, grains, and fertilizers. Oil prices in particular shocked global markets, sending inflation readings to record levels in the middle of the year (see Oil prices soar, subside chart). Both oil prices and inflation have since subsided to varying degrees. We discuss it below.

Meanwhile, the Fed was already raising rates heading into 2022. Surging prices poured gasoline on that trend, accelerating the pace at which the US central bank pushed rates up to fight inflation (see US target rate approaches multiyear high chart). Rates haven’t been this high since before the financial crisis, and after the most recent rate hike bullish investors are hoping that the Fed may slow its pace of rates hikes in the coming months if inflation continues to cool down.

Uncharted territory

There’s no shortage of factors at work that might help dictate what 2023 looks like for investors. What’s clear from the charts is that things can change at any moment. Many expected 2022 to once again be driven primarily by COVID. That quickly morphed into a multipronged story of rising rates, Russia’s invasion of Ukraine, and surging inflation. These factors are still at play to some extent heading into 2023. We shall closely keep an eye on the charts for clues to help best position yourself.

OUTLOOK FOR SECTORS

Looking to 2023, there are clearly risks on the horizon. Nevertheless negative sentiments has already been priced into stocks.That backdrop could set the stage for a year when investors start to pay attention to fundamentals again—and stock selection matters. We review our favorites below.

We continue to favor recession proof and defensive sector according to our ABS matrix related to the business cycle (here and here) and according to our DECIDER indicators

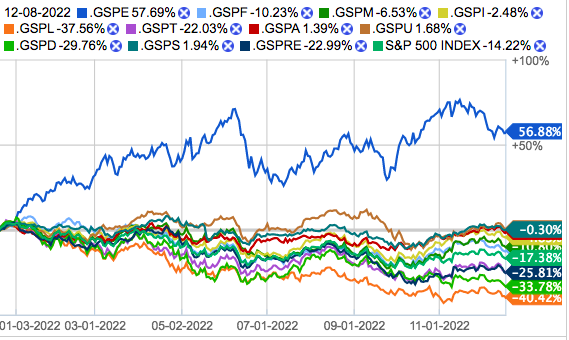

Turning to the market’s sectors, we noticed in May that at that time, most of the major market indexes had fallen into the Red Zone of our indicator, indicating that a severe decline was underway. Yet there were still a few pockets of relative strength among individual sectors.

These included Industrials (XLI), Energy (XLE), Utilities (XLU), and Health Care (XLV).

By the time the major indexes hit their year-to-date lows in mid-October, every sector but Energy had succumbed to the selling pressure.

The “big picture” hasn’t changed since the October lows. Energy is still the lone holdout in the Green Zone, while all other sectors remain in the Red Zone.

Let’s dig deeper:

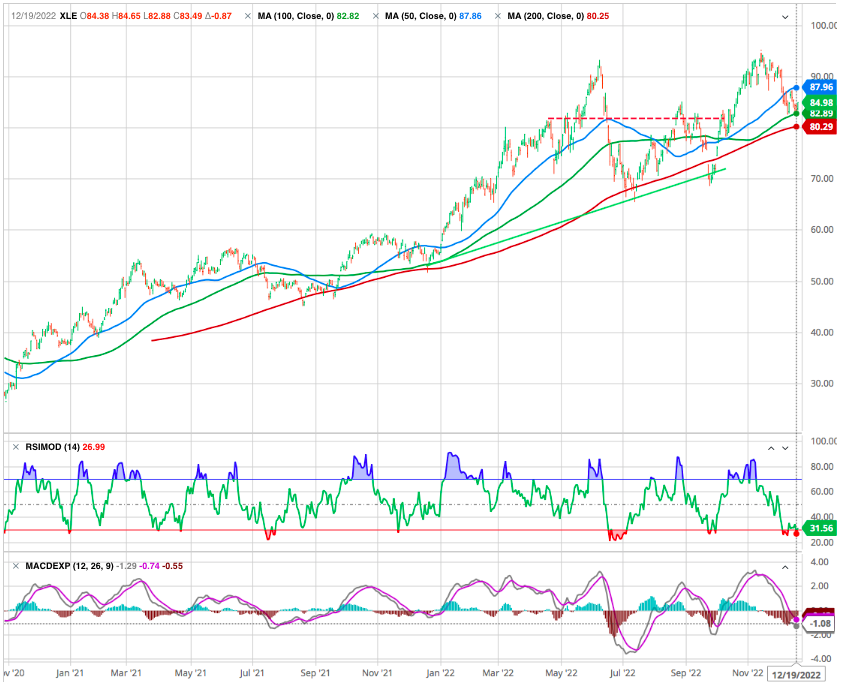

XLE ENERGY : Another banner year ahead?

Energy sector compare to the above crude price chart hold pretty well

Divergences like these eventually resolve in one direction or another.

If energy prices continue to move lower in the near term (which is certainly possible if the economy weakens), this divergence could resolve to the downside. That means we could finally see some significant weakness in the Energy sector for the first time this year. And if the selling gets intense, this sector could fall into the Red Zone as well.

So, if you have a great deal of exposure to energy stocks, it might be time for taking some profits at these levels.

XLE weekly

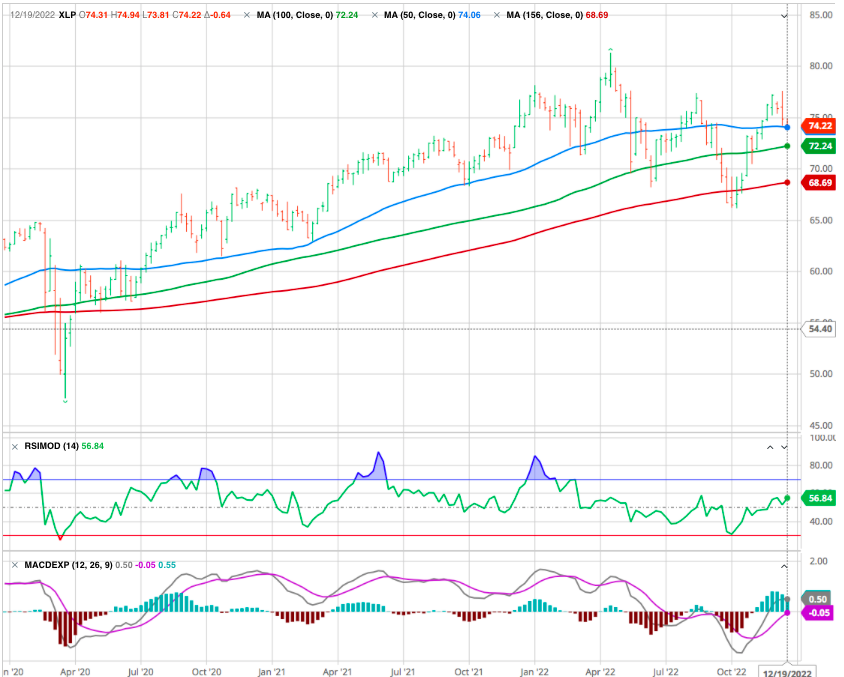

XLP CONSUMER STAPLES : Feeling the pinch

While Consumer Staples (XLP) is currently in the middle, it now has more than 50% of its component stocks in the Green Zone. That isn’t true for any other sector besides Energy.

Consumer Staples is considered a “defensive” sector that typically outperforms during periods of economic weakness. So, it’s not surprising to see signs of strength here as recession risks are rising significantly.

We shall be watching this sector closely in the days and weeks ahead. If XLP can return to the Green Zone, it could provide some relatively low-risk opportunities for folks looking to get back into stocks today.

In 2023, the companies best positioned to navigate these headwinds may include those that can raise prices without losing sales volumes, those with exposure to emerging markets, and those that make the cheaper “private label” brands (i.e., generic products sold under a store’s own brand) that consumers often trade down to in such times.

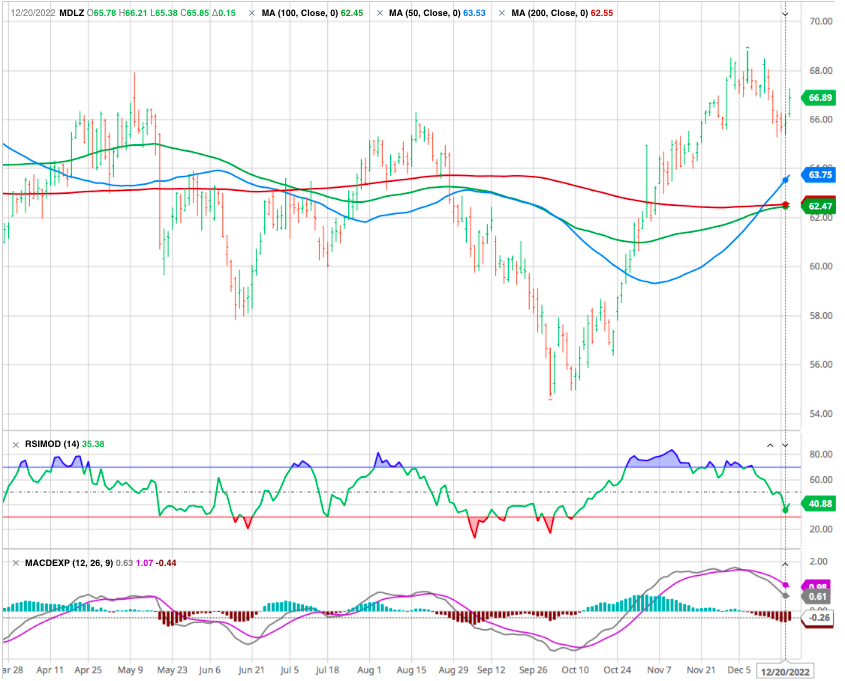

Many emerging-market nations have been battling inflation for decades, which means consumers are used to seeing prices rise and less likely to change their purchasing decisions in reaction to price hikes. One example of this investment thesis is Mondelez International (MDLZ)

XLF FINANCIALS : Finding value in an unloved sector

The financial sector declined along with the rest of the market for much of 2022. However, the group outpaced the broader market over the latter part of the year, accompanied by a fresh surge in bond yields. Rising interest rates tend to boost bank profitability by widening the differential between what banks earn (on loans they make) and what they must pay (on deposits they hold).

The sector remains technically positive with a strong support at 30.3 (200 WMA)

Moreover, in any economic thinning you have to finance it. Of course, there’s no way to know exactly how the current economic cycle will play out, or whether 2023 could bring an outright recession or a soft landing. But if banks are being cautious in setting aside capital for loan losses, it could mean that they are better positioned than the market expects. That could bode well for banks’ ability to navigate a variety of economic scenarios that may arise, while staying positioned to benefit from any potential subsequent recovery or extension of the current economic cycle.

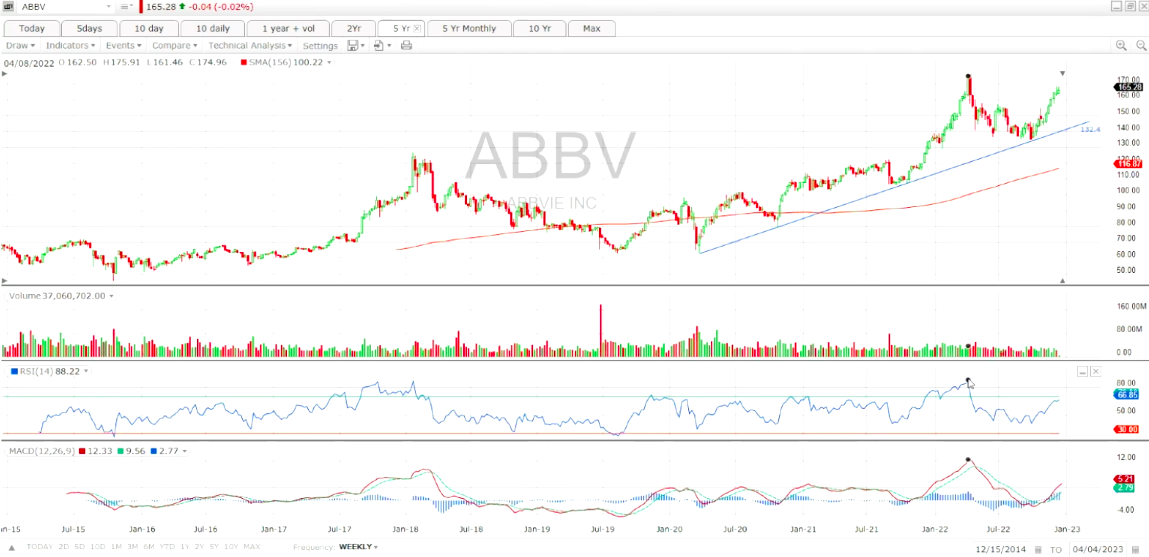

XLV Health care: Short-term defense, long-term growth potential

The group is positive

Health care stocks are typically viewed as defensive, given that people generally go to the doctor and take their medications regardless of what’s going on in the economy. The sector lived up to that reputation in the past year—performing substantially better than the broad market.

That outperformance was led by segments of the sector that can offer relative safety, such as large-cap pharmaceutical companies and large-cap managed care companies. Those segments have relatively steady businesses and limited cost pressures, which could help them weather weakening growth and rising costs.

Another part of the industry that could show resilience in the face of further inflationary pressures is the so-called life sciences segment—which includes companies that make specific tools or ingredients used in manufacturing biotech and other drugs. These companies often have strong pricing power due to the highly specialized nature of their products.

Large biotech index points to a strong resistance 156 WMA. Once broken it might start a recovery trend. We shall wait confirmation

example BIOGEN still negative

Small biotech companies made a 50 % rally lately and it could meet its resistance at the 156 WMA

No matter where US markets are headed next, the health care sector can offer a combination of defensive and growth characteristics that may be attractive in a variety of scenarios.

XLK TECHNOLOGY : Big trends to watch

After the so-called “tech wreck” of 2022, the sector did suffer from the same challenges as the broad market, including investor anxiety related to high inflation and rising interest rates. And with consumers and businesses increasingly worrying about growing recession risk, some buyers reduced spending on technology, some investors may be wondering if the information technology sector’s best days are now behind it.

The sector is strugling against its long term MA and is very vulnerable as the QQQ index is showing. At best we are going for a long sideways consolidation.

While a recession would pressure the pace of the long-term changes that are pushing the sector forward, best-in-class companies benefiting from these themes could nonetheless present long-term opportunities as well as attractive valuations.

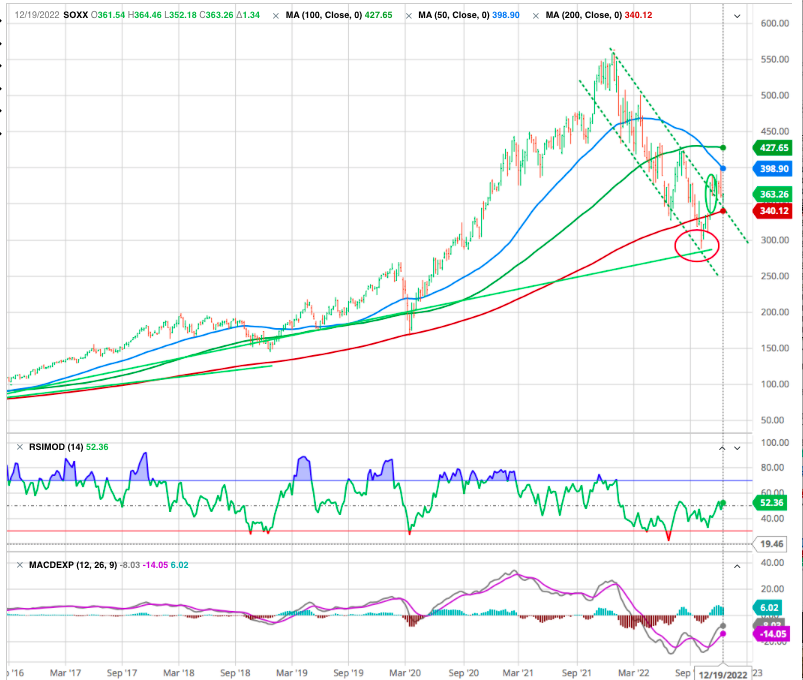

Semiconductors are key to bringing all of these technologies to life, and demand for semiconductors could remain high in 2023. The pandemic disrupted supplies of chips for many industries, particularly in automotive production. In response to those disruptions, new chip factories are being built and planned in multiple regions to create more certainty of domestic supplies in the years ahead.

The sector is often compare to the new Transport index and any rebound could not be effective without it. The chart shows we avoided a high long term risk (red circle) of collapsing. Fortunately it seems that a the break of the downtrend (dotted green) could show some signs of confidence -green circle- after a probable retest of the upper line of the downtrend.

XLI INDUSTRIALS : A new dawn for US manufacturing?

After decades of underinvestment and recent supply-chain challenges brought by the pandemic, both US companies and the federal government are now seeking to bolster domestic manufacturing. That support is likely to advance 3 key trends impacting the industry: sustainability, digitization, and onshoring.

The Trend is still positive although the index is facing a resistance at its latest all time high.

Across many industries—notably automobile manufacturing—companies were forced to curb production due to a lack of essential parts.

The upshot of this disruption is that companies are increasingly making plans to diversify and reinforce their supply bases, and to bring supply chains closer to home, likely meaning more manufacturing facilities built in the US, Mexico, and Canada.

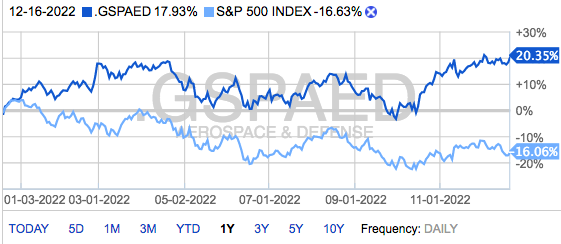

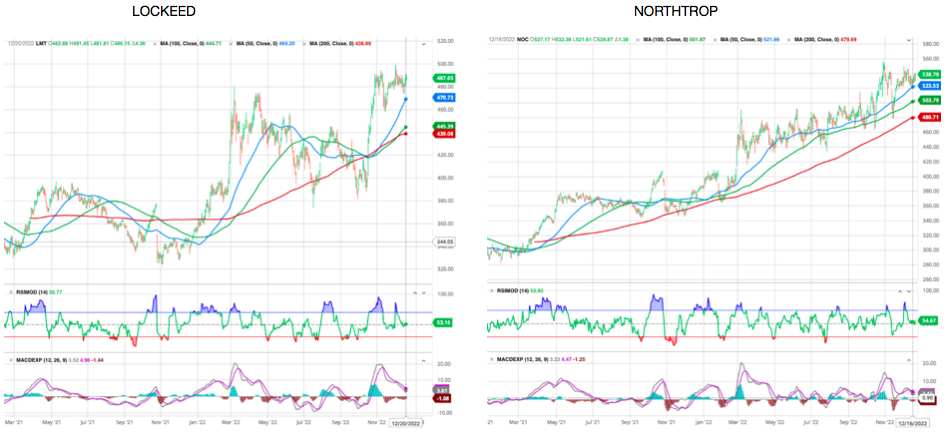

DEFENSE : An economy of war

A special word on the defense industry, traditionally a major segment for the US, favor the companies in this field.

We are at disposal for any particular question on particular stocks

Stay tuned