Investment Strategy and Asset Allocation for Q4

October, 23 2023

Scary Investing : Autumn securities picked up by shovel

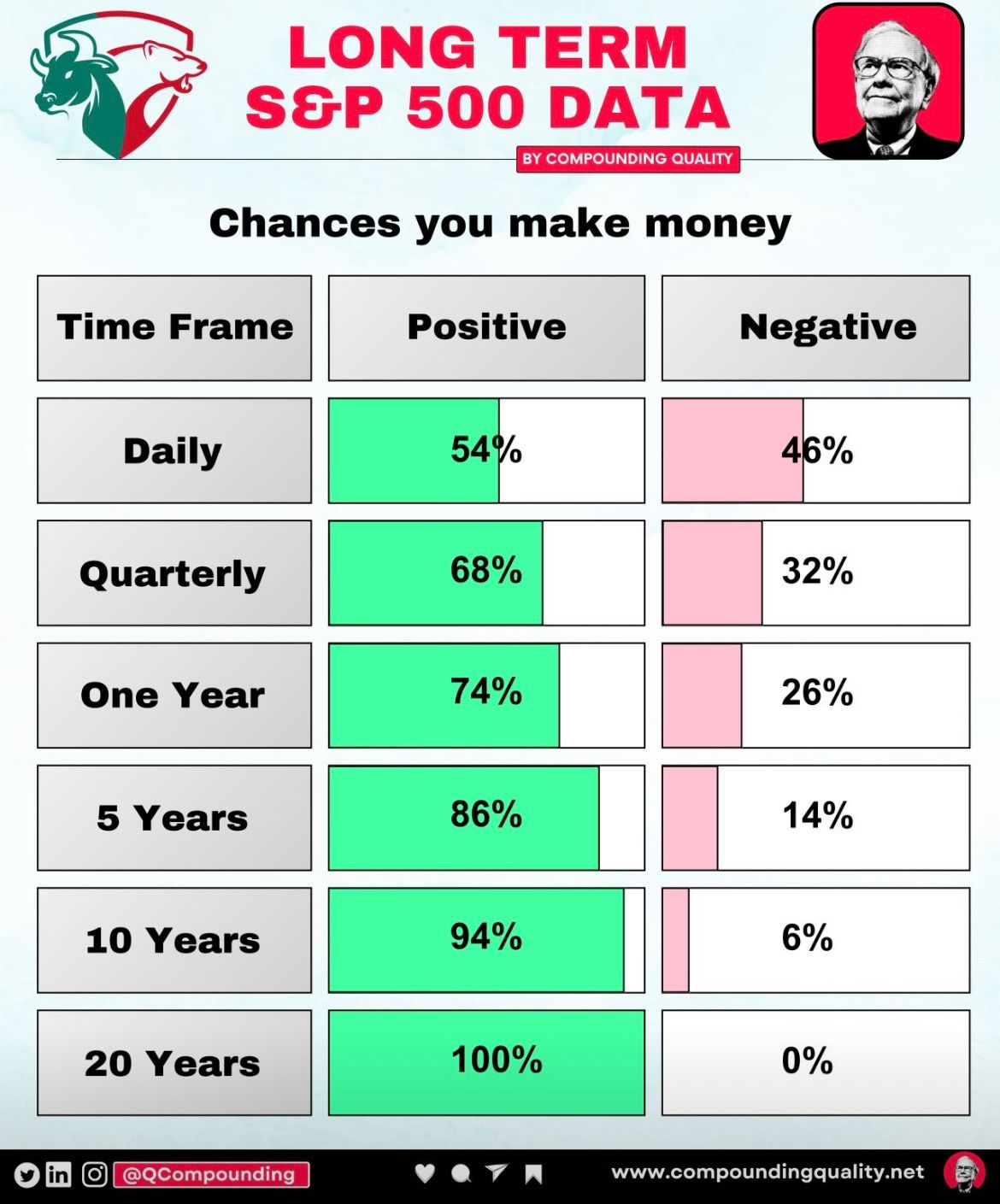

Time in the market beats timing the market !

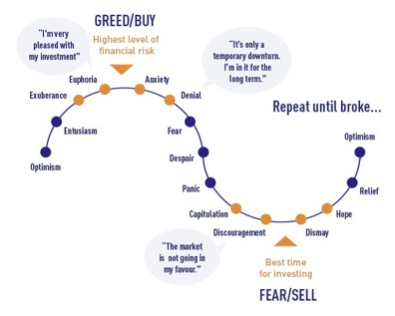

The recipe for success is a well-planned investment with limited risk. If you have a clear, long-term strategy, you should stick to it. Investment is similar to many other aspects of life: patience and perseverance lead to long-term success.

*****************

The following chart shows you that being invested in the broad equities market (in this example: the S&P 500 index) will tilt the odds in your favour as time goes on.

**************

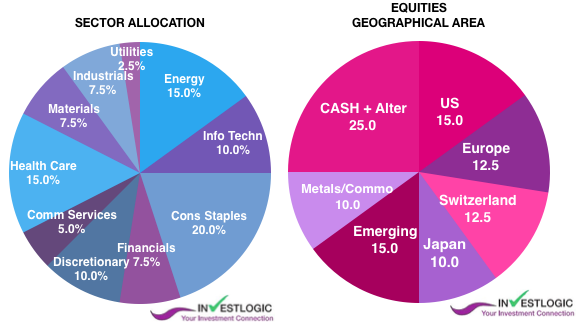

That’s why we have opted for an investment strategy that works well during challenging times, too, focuses on the major growth opportunities of the future, but is risk-aware. The subdued economic outlook allows us to maintain our overall defensive positioning.

Executive Summary

-

Financial markets during the summer period were under pressures, slowly but steadily increasing volatility, culminating in a bond melt-down towards the end of September, which also left its mark in other asset classes.

-

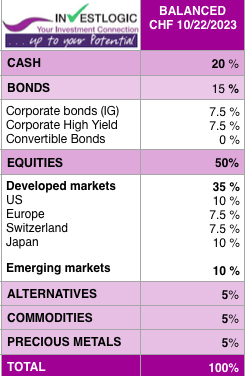

We continue to overweight liquidity, money market investments, given their still attractive pay-offs. However, we keep an eye on roll-over risk. (We’ll discuss it below)

-

In fixed income we slowly start extending duration risk after having been at the very short-end for several quarters now. We also increase credit quality of our exposure.

-

In equities, we move to a cautious underweight, given the fragility of the current environment and the general geopolitical environment. We remain positive on Japan.

-

We remain optimistic about emerging markets, We like equity exposure to specific parts of Asia (India, Indonesia), but also continue to watch others (China).

-

We keep our defensive exposure in precious metals.

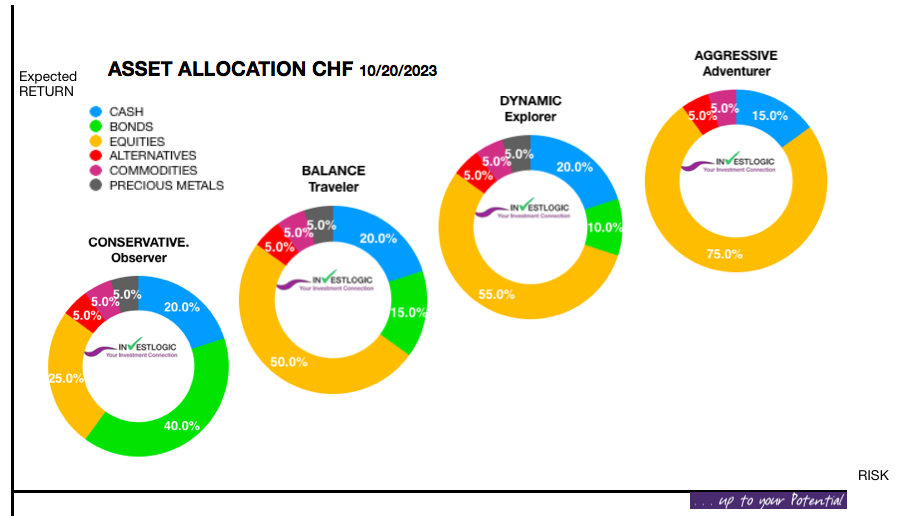

Find YOUR INVESTMENT STYLE here

INVESTING OBSERVER >> go to your profile

NVESTING TRAVELER >> go to your profile

INVESTING EXPLORER >> go to your profile

INVESTING ADVENTURER >>go to your profile

Scenario : Gloomy Outlook

With the latest geopolitical developments, the global situation is very bleak at present. Things are very tense and the situation on the financial markets is unclear.

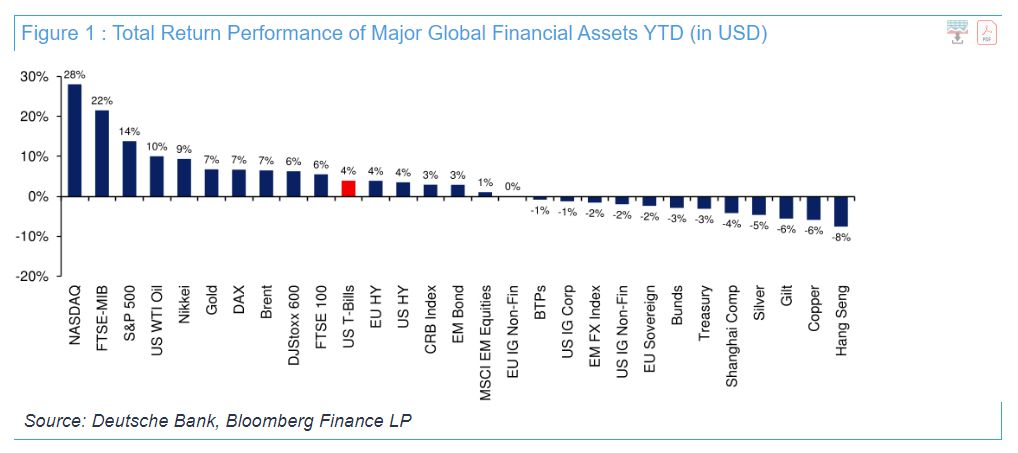

With the last bond sell-off there is now no fixed income asset that has outperformed USD cash in 2023 amongst the main assets we use in our performance review YTD. (Oct 19)

This means reducing investment risks in challenging times. At the moment we recommend a lower equity allocation than usual, and holding more liquidity than the long-term average, keeping our underweight on the equity markets with a slight preference for emerging markets.

That’s shown by our underweight in bonds and the equity markets over the past year. Our trading positioning in equities last June and the profit taking during the summer has proven to be correct.

Our positioning against losses on the European and US stock markets due to the gloomy economic outlook still calls for patience.

Is cash a trap ?

Investors do have some investment assets alternatives. The 10-year Treasury yield has almost reached 5% for the first time since 2007, and cash is yielding more than that. A quick look at the yield of six-month Treasury bills proves their point. For the first time this century, cash pays a higher yield in interest than the S&P 500 does in earnings — and with cash you actually get the cold hard money in your hands, rather than relying on accountants to calculate corporate profits correctly:

Source John Authers Bloomberg opinion

Strategy is decisive : No Pain, No Complain

Check weekly updates in our Marketscope

A year ago, we expressed concerns that there was an unsustainable imbalance in consumer behaviour. We also pointed to the continual weakening of the leading indicators.

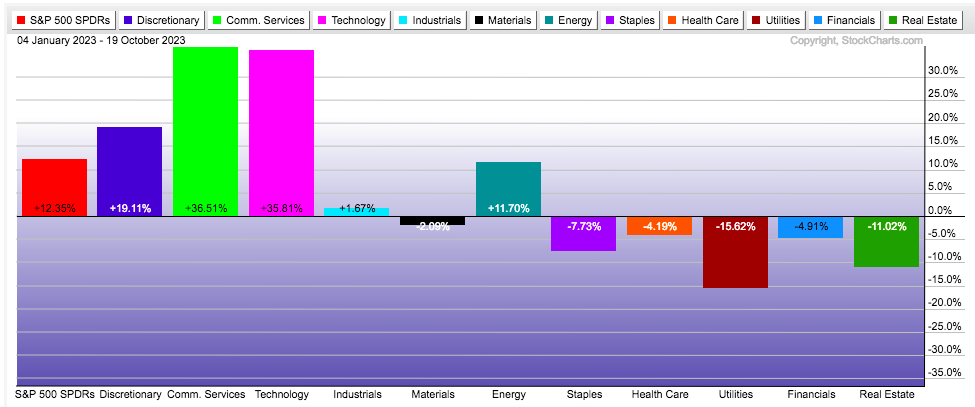

Inflation and thus interest rate policy relevant economic data dominated events on the financial markets over the year. The result was ups and downs with a heavy concentration on few names (7 magnificents).

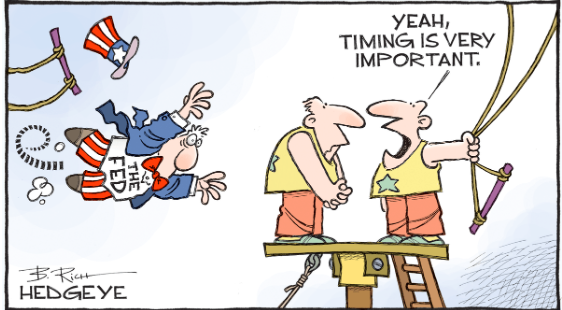

Monetary policies are likely to remain restrictive for longer than expected in order to get a grip on inflation rates that are still above the target bands. The central banks’ restrictive monetary policy looks set to continue for longer as inflation is only slowly returning to normal. It is relatively clear that the central banks’ cycle of interest rate hikes is higher for longer.

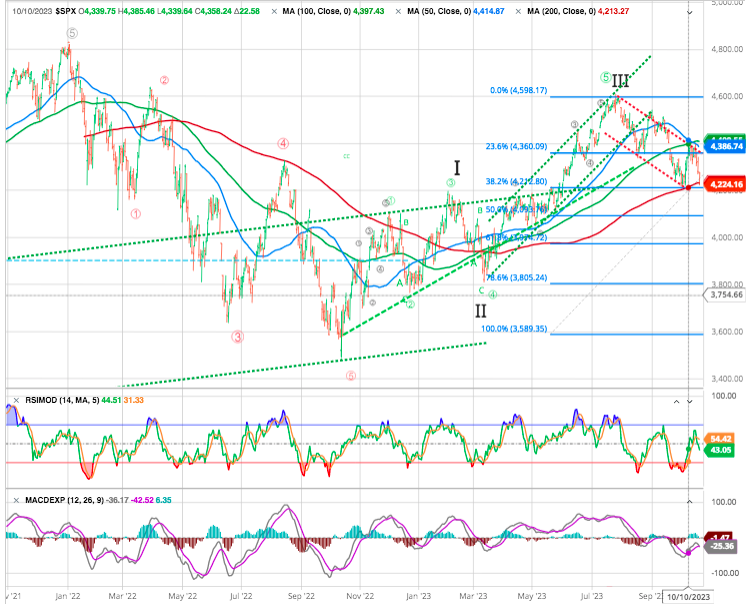

While the US economy remains remarkably robust, it’s also gradually beginning to weaken. We expect a sudden stop in the US growth in the coming months (soft or hard landing) therefore some more downtrend in the stock market. Actually we would look for a true investors’ capitulation before this bear market will unfold and we will increase our exposure. We expect a pivot will be occur in the first half of 2024, an election year.

In contrast, the economic downturn in Europe is already under way. Germany, Europe’s economic driving force, is probably already in recession. The Swiss economy, which failed to grow in the second quarter of 2023, is also increasingly losing momentum due to economic weakness in its two main sales markets.

However, we remain optimistic about emerging markets, such as India and Indonesia, China’s economic recovery remains sluggish.

OUTLOOK : Winter Is Coming

The situation on the equity markets is equally confusing. The markets point to continued encouraging growth in corporate earnings. However, the high earnings valuations reflected in the prices make little sense in view of current interest rates.

There’s a subdued mood among companies and consumers face financial concerns, with high interest rates and stubborn inflation. Western industrial nations are heading into the colder months facing huge challenges. The economy is subdued, especially in Europe.

In some countries, economic growth has already weakened significantly over recent months. While the US economy’s current resilience is encouraging from this perspective, it’s becoming a growing problem for the US Federal Reserve in its fight against inflation.

Equities

It’s been a turbulent summer on the equity markets. Rising and falling concerns over inflation and interest rates played a key role here. Just as on the bond markets, the main reason for this performance was likely to have been the rise in interest rates. No positive impetus is currently expected from the economic outlook, which remains gloomy.

USA

S&P 500

The US economy is still proving remarkably resilient. Near-term forecasts from the Federal Reserve Bank of Atlanta point to above- trend growth in the third quarter to date. US consumer spending continues to prop up economic performance.

Consumption remains high thanks to stable income development, which is mainly due to high capacity utilization on the labour market. Consumer spending is particularly strong in the services sector.

By contrast, the indicators for the US industrial sector are increasingly deteriorating. Production is falling, capacity utilization is declining and order intake is also lower. This means the US economy could soon face a downturn, too.

The imbalances in the US economy are proving a challenge, especially in terms of inflation. Inflation rates have risen slightly again over the last four months due to higher energy prices and may not return to the US Federal Reserve’s target range soon given the current situation. This means further interest rate rises cannot be ruled out.

US sector performances YTD

Europe

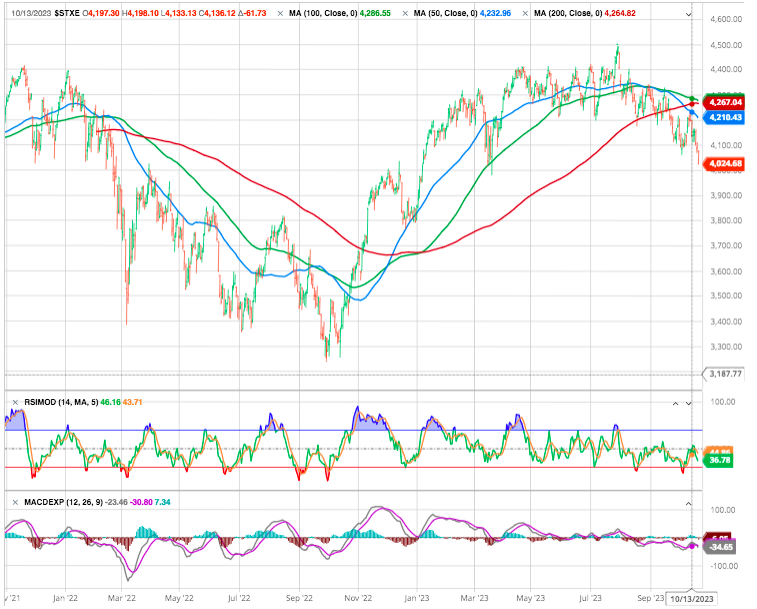

EuroSTOXX 50

The indicators for the European economy worsened again last month. The major factor weighing on growth is the significant downturn in Germany, the economic area’s largest economy.

After a slight recovery over recent months, consumers are becoming much more cautious again in view of the gloomy economic outlook and personal financial constraints.

The weak economy puts the European Central Bank (ECB) in a difficult position. When deciding whether to tighten monetary policy even more, the ECB needs to weigh up whether it wants to break the high inflation trend as quickly as possible, or prevent – or at least not continue to fuel – an economic downturn.

Switzerland

SMI

Data published recently by the State Secretariat for Economic Affairs (SECO) indicates that the Swiss economy continued to slow in the second quarter of 2023 and failed to post any further growth.

The economic downturn, which has persisted since mid-2021, has continued in recent months. Short-term indicators point to Swiss economic growth entering negative territory in the third quarter of this year.

Weak international demand, primarily due to the global decline in the goods cycle, and recession in Germany and China, the two main export markets, continues to weigh on the export- oriented Swiss economy. Unsurprisingly, sentiment amongst industrial companies remains pessimistic. Domestic demand may also come under greater pressure over the coming months.

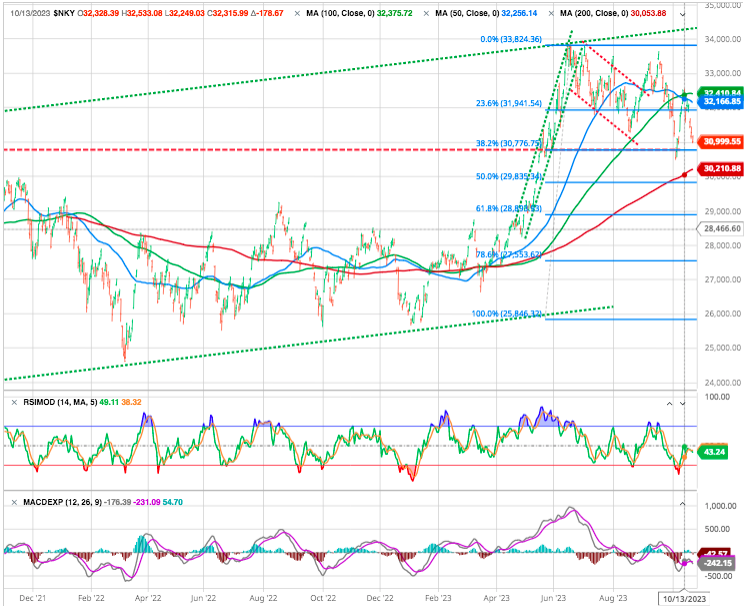

JAPAN

Nikkei 225

Many investors are turning more attention this year to Japan than they have in previous years. Here are some reasons why Japan is looking more attractive in the current environment:

- Many of the companies in Japan are making medium to long-term growth plans – This will lead to EPS growth and thus to market price appreciation.

- Japan has struggled for decades to hit its Inflation target of 2% but has now accomplished it. This will enable Japan’s nominal GDP growth rate to approach the desirable 4% level, which will enable the expansion of wealth creation.

- An aging population means rising healthcare and pension outlays in a low interest environment.

- Japanese companies service domestic consumers where consumption is strong and on a consistent growth track – Personal consumption is 60% of Japan’s GDP and the primary driver of GDP growth.

- Japanese companies provide products and services to growing markets, such as greater Asia, where population growth is expanding rapidly

With such a positive outlook for Japan, we expect to see its continued outperformance.

Emerging markets

EM equities ended the quarter with losses but performed better than their developed market peers. Stock markets in the emerging Asia region declined overall, with most registering losses. China’s property sector woes—plagued by liquidity worries and lack of demand—continued. The sector’s weakness also spread to consumption stocks amid worries about spillover effects. We believe that local, consumption-driven growth will remain a core theme for many EM economies.

China, the emerging markets’ largest economy, remains the greatest cause for concern. However, China shows signs of stabilization after a long period of slowdown and disappoitning data over the spring.

China’s Q3 growth exceeds forecast, buoyed by consumer spending and industrial production. Sentiment among industrial companies improved slightly in August, but industrial output declined for the third time in a row.

China authorities are unlikely to pursue more aggressive stimuli as they don’t want to create another credit bubble. They are probably happy to see better numbers on the consumer side but will continue to monitor the situation on the real estate side. Should the housing bear market continues, there is always a risk the consumer gets hurt creating teh risk of a deflationary spiral.

In our view, stimulus spending kickstarted China’s recovery, but corporate reinvestment will be crucial to achieving the country’s long-term growth plan.

In contrast, the Indian equity market continued to perform strongly, with momentum remaining in positive territory. India’s market managed to eke out gains as it benefitted from a moderation in inflationary pressures.

Markets in the Latin America region also tracked lower despite an improvement in the macroeconomic environment. Inflationary pressures in Mexico moderated during the quarter, with annual core inflation slowing to a 20-month low, aided by lower input prices and a lagged effect of elevated real interest rates. Brazil’s economy also logged improvements, with stronger- than-expected second quarter gross domestic product (GDP). Brazil’s central bank also commenced its rate-cutting cycle.

Fixed Income

Central banks have made it clear that restrictive monetary policy will continue for some time. This means interest rate cuts now seem a long way off, which initially led to a substantial rise in long-term capital market interest rates, triggering a downward trend on the bond markets. However, renewed conflict in the Middle East caused long-term interest rates to fall again recently.

Central banks have made it clear that restrictive monetary policy will continue for some time. This means interest rate cuts now seem a long way off, which initially led to a substantial rise in long-term capital market interest rates, triggering a downward trend on the bond markets. However, renewed conflict in the Middle East caused long-term interest rates to fall again recently.

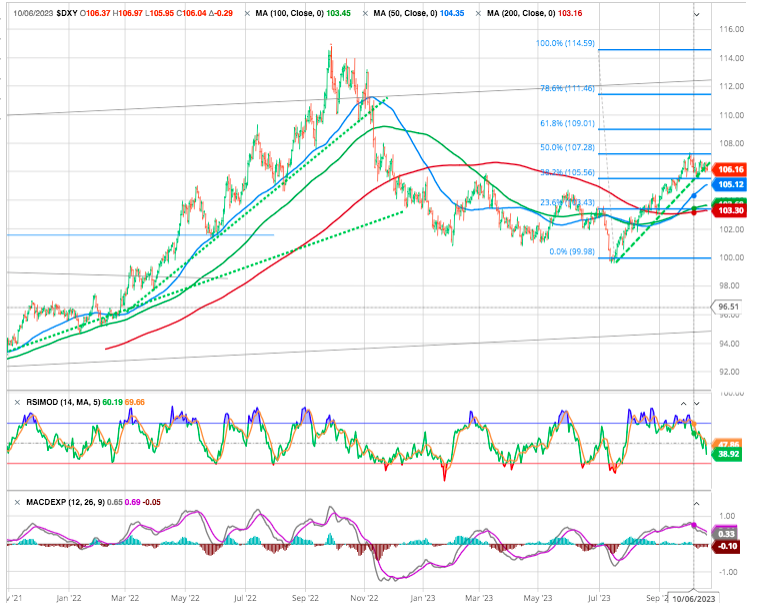

Currencies

The US dollar remains very strong. After weakening at the start of the year, the US currency has continually made gains since mid-July.

The US dollar remains very strong. After weakening at the start of the year, the US currency has continually made gains since mid-July.

The value of the dollar now stands well above its year-opening value on a trade-weighted basis.

After the SNB’s slightly surprising decision to leave the policy rate at 1.75 percent for the time being, the Swiss currency depreciated on a broad basis. However, the Swiss franc has recovered slightly since early October.

The Chinese renminbi and Japanese yen are currently stabilizing, bringing the downward trend to a halt.

Gold

The gold price fell sharply towards the end of September before recovering again.

The gold price fell sharply towards the end of September before recovering again.

The price per troy ounce went back up close to 2000. While that’s lower than in spring, annual performance remains in positive territory. The precious metal remains popular. That’s unlikely to change much while inflationary pressure in western industrial nations persists.

Until next time