MARKETSCOPE : The Clock Is Ticking

May, 08 2023History Doesn’t Repeat, But It Often Rhymes

“Whenever the Fed hits the brakes, someone goes through the windshield” — Old Wall Street Adage

All-in-all, it was a pretty typical week for this bear market, filled with shock, disbelief and panicked buying and selling. Investors are looking for the next catalyst.

Despite a rally on Friday, the sentiment was largely negative during the week, weighed down by jitters over the stability of the regional banking space and the future of the Federal Reserve’s monetary policy.

Despite a rally on Friday, the sentiment was largely negative during the week, weighed down by jitters over the stability of the regional banking space and the future of the Federal Reserve’s monetary policy.

For its part, the ECB gave a small turn of the screw to its own rates, but did not mention a pause. Christine Lagarde and her team still fear rising price. The ECB is expected to raise the cost of money again in June.

In addition, unease around the U.S. debt ceiling may also have weighed on sentiment, as U.S. Treasury Secretary Janet Yellen notified congressional leaders in a letter that the agency might not be able to meet its debt obligations “potentially as early as June 1. A pervasive negativity set in about the political will needed to solve the debt ceiling. U.S. Credit Default Swaps (CDS) hit all-time highs.

As the title says it History Sometimes Rhymes and we invite you to read our comments from ten years ago with the same issue : here, here and there .

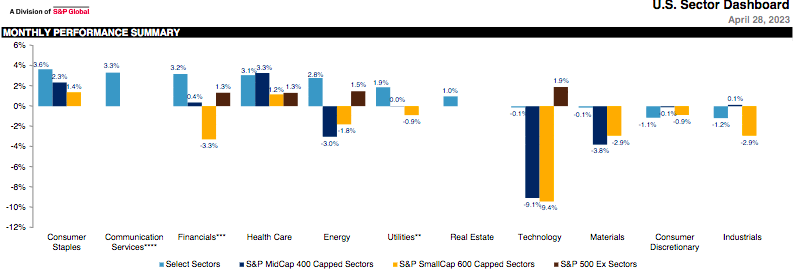

Out of 11 S&P 500 sectors, eight ended in the red, led by a nearly 6% slump in Energy amid an extended decline in crude prices. Financials came in second among the losers.

The regional banks subsector in the S&P 500 experienced significant volatility during the week, reflecting concerns about the potential for additional bank failures. (see below). Regional Bank index was down 8% this week…and that’s after a 4.7% rally on Friday.

A Pause Is Not A Pivot

After raising rates by 25 basis points, the Fed hinted that it might pause in the hike depending on upcoming economic data, but did not close the door to a hike if necessary but the idea that inflation will come under control very swiftly is critical to them. As for the very short term, there’s very little anticipation of a significant decline for inflation when the April numbers are revealed Wednesday.

The economy sounds resilient largely because the American consumer is also far more robust than many believed. The labor market remains obdurately healthy withUS nonfarm payrolls report showed strength in the labor market, with the economy adding 253k new jobs in April. The ISM Manufacturing PMI in the United States rose to 47.1 in April 2023, up from a three-year low of 46.3.

The problem for the Federal Reserve is the banking crisis. As rates remain high, money flows out of banks and into money market funds with a 5% yield.

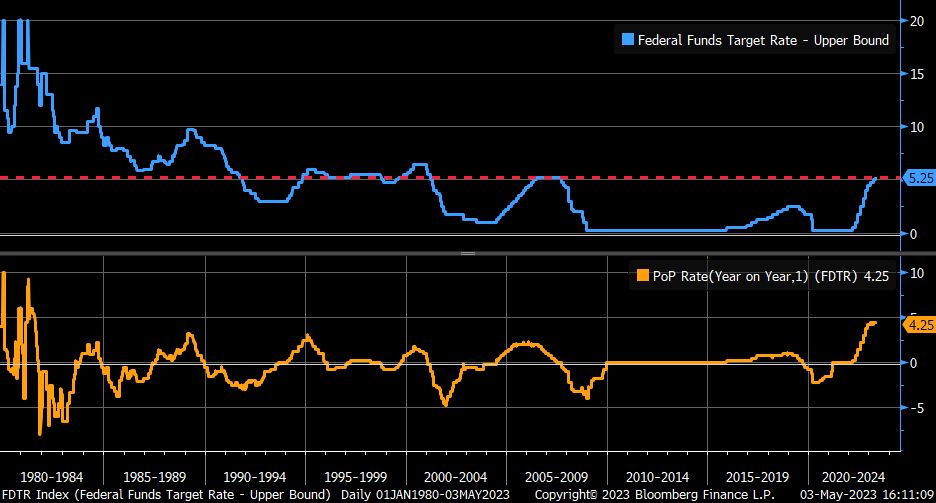

Fed rate hike brings fed funds rate to highest since 2007; upper bound of 5.25% is what terminal rate was in that cycle … back then, it took 2 years to get there from prior lower bound; this time, it took just over a year … year/year change (orange) still fastest since 1980s (source Liz Ann Sonders / Charles Schwab)

However, it seems like the sense in the markets is that the Fed is done. According to the CME FedWatch tool, the odds of no hike at the central bank’s June meeting is now at ~93%, and the odds of a 25 basis point cut at the July meeting is now at ~38%.

The market continues to price in a couple of rate cuts by the end of this year—clearly not what the Federal Reserve has been communicating. This is a disconnect that needs to be resolved.

Something must give ! either the Fed or the market. (See the excellent article by John Authers from Bloomberg)

Our view continues to be that the green light for the Fed to not just pause, but to pivot to rate cuts would necessitate much weaker economic growth.

However, it’s eminently reasonable to brace for a recession before much longer. That could be the right time to pivot. We continue to believe that what has been called a “rolling recession” is likely to roll into an officially declared recession; especially if credit conditions tighten further. As a reminder, even before SVB fell and ignited the banking crisis, credit conditions had already tightened into recession levels.

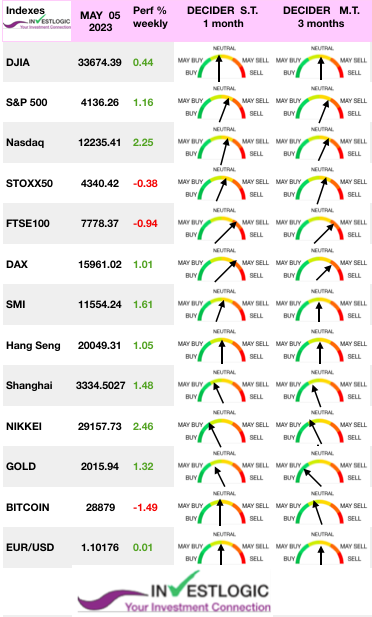

MARKETS

Sectors performances in April

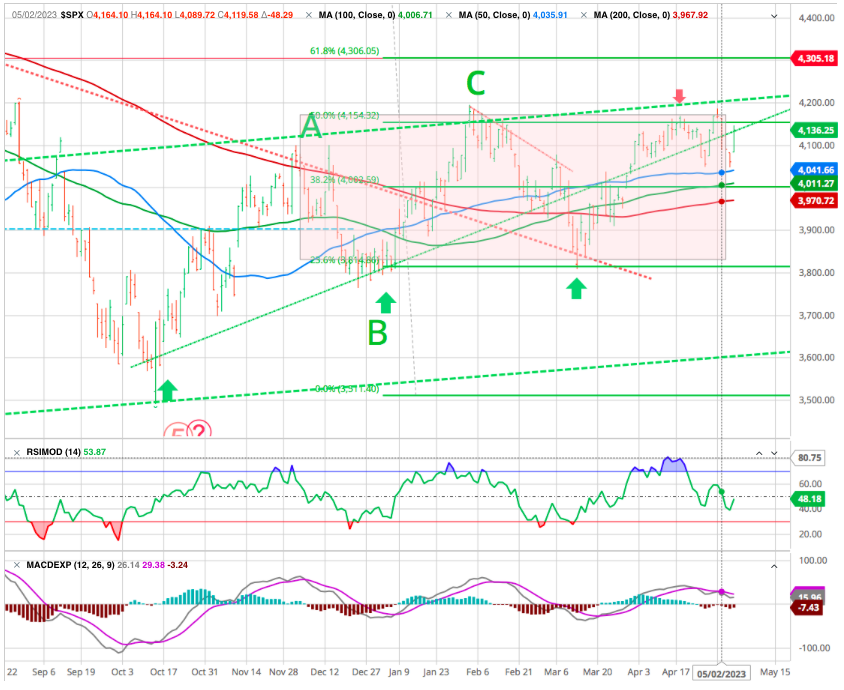

While the market rallied to the February highs last Thursday and Friday, the signals kept us out of trouble of being overly exposed to equity risk.

When an event happens, we immediately look for headlines to blame for the sell-off or advance, but the market is usually ahead of whatever the trigger turned out to be. Technical signals more often than not they are picking up on the “herd mentality” of the market.

The market remains on a “sell signal” and again tested and held critical support at the 50-DMA (blue) but unable to break the resistance line.We expect the market will continue to trade within it rectangle box.

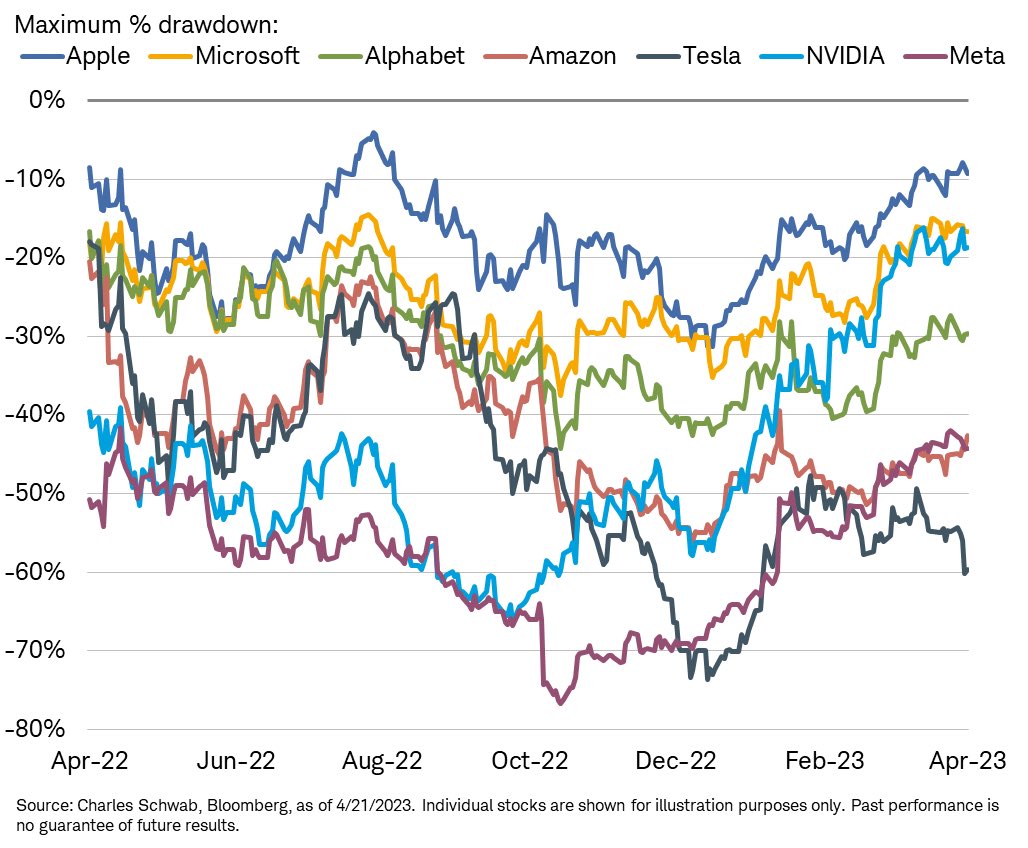

Five largest stocks in S&P 500 at start of year have all seen nice gains YTD. Berkshire Hathaway is outlier relative to peers (which are not all in Tech sector). – Liz Ann Sonders_

Across both the equity and fixed income markets we continue to emphasize high quality. Specific to the equity side, we maintain our bias toward factors like high interest coverage, low volatility, strong balance sheet, healthy free cash flow.

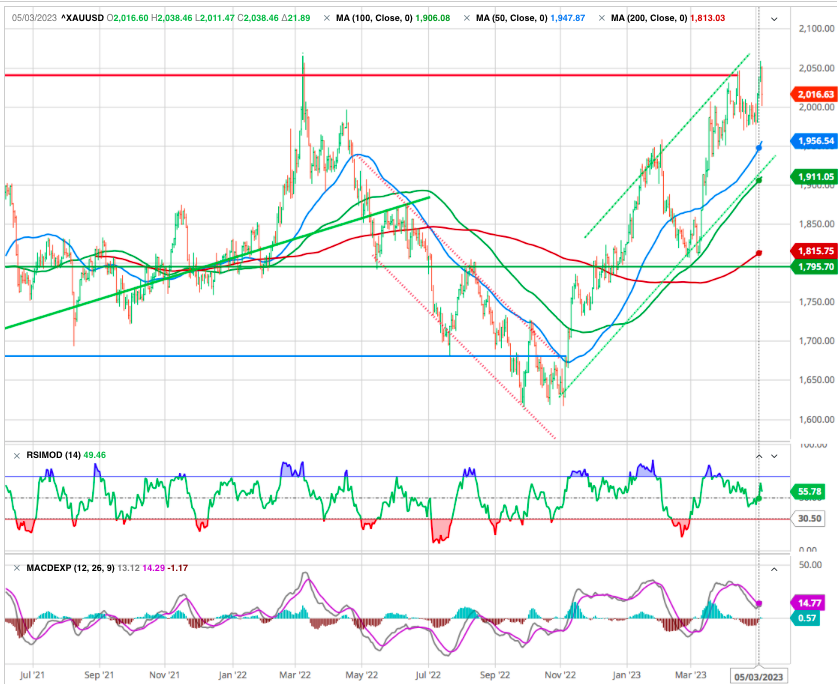

GOLD

The precious metal is popular: it is benefiting from a fall in bond yields, which could continue to fall with the possible end of Fed rate hikes, but also from a rise in risk aversion with the setbacks of US banks.

The gold price reached out its long terms resistance heading for its prior high, but a pause may occur before the positive momentum resumes sending it higher.

Crypto.

Bitcoin is just about balanced last week, still hovering around $29,000. For its part, the ether is clearly outperforming the market leader by recovering more than 3% since Monday.

However, still lacking strong positive catalysts, digital currencies remain globally dependent on economic conditions and will therefore remain sensitive to upcoming economic statistics.

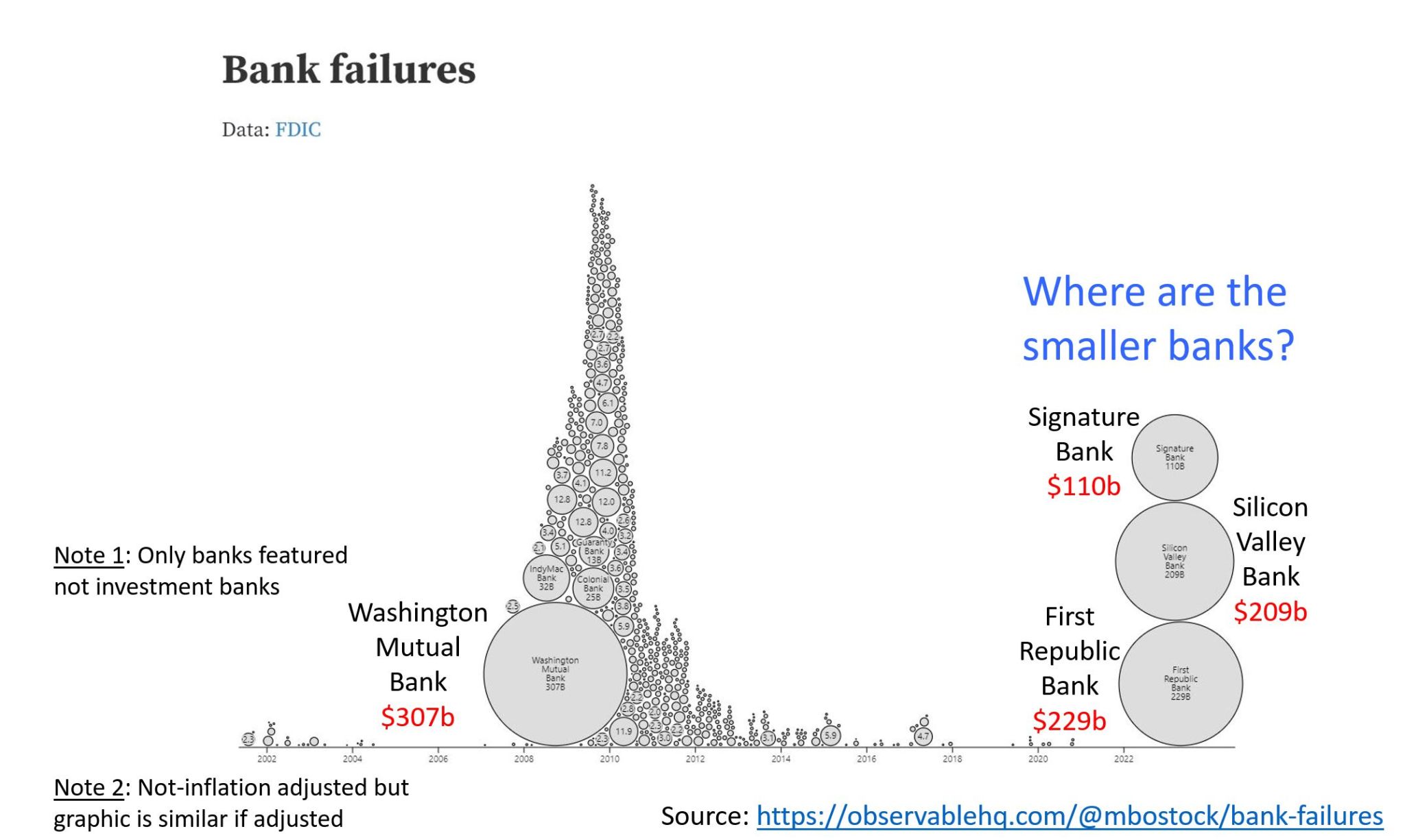

Regional Banks

The aggressiveness of this cycle, with the Fed fighting a four decade high in inflation, has put increasing pressure on the banking system, with three of the four largest bank failures occurring just in the past couple of months (Washington Mutual maintains the top spot from the GFC era).

If you see three cockroaches (leading to $500b in bank failures), how many are behind the wall? – from Campbell Harvey –

The emergency funding facility the Fed put in place following the failure of Silicon Valley Bank in March initially eased some strains, but with the more recent (and larger) failure of First Republic, those strains have re-emerged. Trying to quell burgeoning concerns, the FOMC statement reiterated that “the U.S. banking system is sound and resilient.”

Happy trades