Market Comments as of October 21: All pain no brain!!!

October, 23 2013A No-Surprise Deal Kicked the Can Down the Road

“We must increase our debt limit so that we can pay our bills.”

“We must increase our debt limit so that we can pay our bills.”

That is the most disturbing sentence uttered during the debt ceiling debate/government shut down, one that should raise some concerns by both political parties.

Think about that for a moment. The U.S. has become the single largest debtor nation on the planet as welfare dependency rises and government spending continues to increase as economic growth slows. However, what is ironic about this situation is the continuing increases in debt, which is directly responsible for the decreases in economic growth.

Although potentially cataclysmic damage to the economy was avoided, GDP will take a hit because of the loss of output associated with the 16-day partial government shutdown and the associated furlough of government workers.

Monetary policy was also likely impacted by this debacle. The minutes of the September 18 Fed meeting suggested that the approaching budget/debt ceiling impasse played a role in keeping the FOMC from tapering. Moreover, the hit to growth inflicted by the shutdown and the lingering uncertainty over near term economic prospects likely takes an announcement at the October 30 FOMC meeting off the table, which effectively pushes the start of actual tapering into early 2014. Indeed, expectation of an easier Fed for longer is evident in market price action across the asset classes.

Meanwhile, over at the APEC summit in Bali, we saw a rather humorous representation of the decline of the American Empire. President Obama couldn’t attend the summit, given he is stuck in Washington trying to avert a technical default on the nation’s huge debt levels. It’s probably not much of an analogy. But it goes to show, when you’re the world’s biggest debtor you can’t just close up shop and go to the pub whenever you feel like it. You’ve got to make sure the money keeps coming in… because there are bills to pay and you can only pay those bills if the money keeps rolling in.

Worldwide long-term interest rates may have bottomed several months ago, but rate will remain low for several more months. It is becoming clearer to many that the Federal Reserve is most likely not going to reduce the $85 bln of long-term securities it is purchasing every month. The BOJ remains committed to buying the equivalent of $75 bln of assets a month. The ECB continues to provide full allotment at its fixed rate repo operations, even if strong banks have repaid their long-term repo borrowings. The Bank of England’s economist Dale tweeted at the end of last week that UK rates are unlikely to rise next year. The Reserve Bank of Australia is at the tail end of its easing cycle. Many think it is done. However, we continue to see scope for another rate cut, especially if, as we suspect, this week’s Q3 CPI report is tame. In addition, the strengthening of the Australian dollar also tilts the odds in favor of a cut.

This again favors carry trade strategies, risk assets, including emerging markets, commodities and equities. It will likely reinforce the flow into Spanish and Italian assets, and European distressed asset more broadly, including Greek bonds and stocks. The recovery in emerging markets can continue, even if more selectively. Here, South Korea, Taiwan and India have stood out in recent weeks.

Equities: Equities rallied partly on relief that the crisis was over, but partly on delayed tapering.

The S&P 500 and all ten sectors are now in overbought territory, according to Bespoke Investment Group. The biggest rippers— energy, financials and health care—are actually sitting at extreme levels this morning (which Bespoke defines as more than 2 standard deviations above the 50-day moving average).

Earnings : While the shutdown drama held the financial media hostage over the past couple of weeks, earnings season limped into action. Expectations are low—just as they were in the second quarter. Thanks to crappy performance over the summer, analysts have already braced investors for a bad trip…

The revisions are startling. Analysts were expecting to see third-quarter earnings for the S&P 500 rise to 5.1% growth as recently as this summer, according to MarketWatch. As of today, the consensus is 1.4% growth. Once again, they’ve set the bar low enough to take a lot of the worry of huge misses out of earnings season. Rocky financial performance probably won’t derail stocks this quarter. In fact, I’m guessing sold-out bulls will fight hard to get back into stocks.

Here we share the Director of Research for Zacks Investment Research latest analysis, on corporate earnings trends for the past several quarters and consensus expectations going forward, and asks, “How realistic are these expectations?” -Not very, he says, and tells us why : Earnings Growth to Ramp Up ?

Bonds: Speculation that a Yellen-led Fed would defer quantitative easing (QE) tapering for “risk management” reasons, Significant stress in near maturity Treasuries disappeared, and bonds rallied more broadly. (See chart below showing government debt as a percentage of GDP as compared to the annualized rate of change in economic growth).

Commodities: Gold rose 3% on Thursday and ended the week up 4%. WTI oil was down about 1%.

Currencies: USD was broadly lower. The dollar is making a third lower high against the yen since peaking in late-May near JPY103.75. The euro is approached the year’s high, set in early February near $1.3711, though stopped just shy of it. The emerging market (EM) currencies I’m watching, generally ticked up last week and seem to be stabilizing at levels 5-15% below where they were at the end of April.

Yin – Yang and Yuan : China Voiced its Currency Concerns – Loudly

“The reality is that Washington has now committed itself to a policy of permanent debt increase and QE infinity that can only possibly end in one way: a currency crisis”. Peter Schiff

China’s official news agency published a piece very critical of the Washington circus. It called, in essence, for a de-Americanization of the global economy and a new global reserve currency to replace the dollar – a full-out rant.

For years, the Chinese have held down the value of their currency to support export-led economic growth. By doing so, they have accumulated huge foreign exchange (FX) reserves, largely invested in U.S. Treasuries. Their currency remains under upward pressure. QE-fueled weakening of the USD exacerbates that pressure, costing them money; the possibility of a default concerns them. It’s understandable that they’re upset.

Sure the Chinese are trying to spend their bucks as soon as they can. They’re buying oil, farmland, gold and other commodities. It’s a global resource grab – but to China it’s a way out of holding U.S. debt.

As the largest holder of U.S. treasury debt, China is getting a little itchy. We’ve seen the nagging itch get stronger over the past five years, too. With a growing stack of someone else’s liability, China has been strategically trying to reduce its U.S. default risk – or, at minimum, reduce its exposure the declining purchase power of the greenback.

To put this in perspective, the Chinese are on a good faith mission to advance their currency while the U.S. is in the midst of a fiasco that further tarnishes the dollar’s reserve status. Indeed, the tide is starting to flow away from the U.S. dollar. While the U.S. wallows in its own default worries, a Fitch downgrade looms and the dollar weakens – the Chinese are marching.

Comment: As the old banker put it: “If I owe you a thousand, I have a problem; if I owe you a million, you have a problem.” China may have a problem.

“Beijing has moved to broaden the yuan’s use to give it a higher global profile and eventually challenge the dollar as the world’s de facto currency” the WSJ reports citing ambassadors from China on a five day trip to the U.K

In short, China wants to be the world’s next financial power. They want to have a seat at the table for their currency, the yuan.

See Also : Stephen Roach: What The Debt Ceiling Debacle Should Teach China

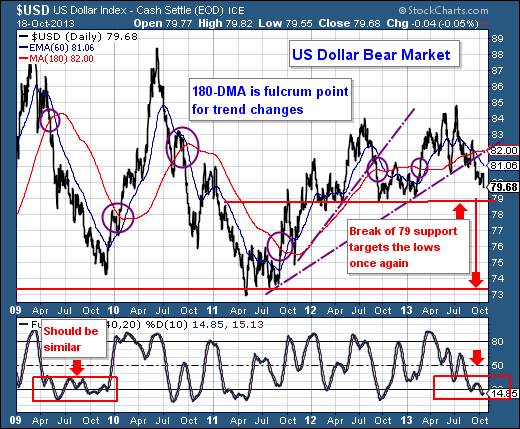

PREMIUM RECO : Technically speaking : Loss of Faith in the US Dollar

The trend has turned bearish this summer when the USD broke below the 180-day moving average fulcrum point between bull and bear markets, and it has broken trendline support off the 2011 low. Thus, one should be sellers of the USD on rallies. However, the real “fireworks” if you will shall begin once the 78-to-79 zone is breached, for it has provided support to the USD since the beginning of 2012. A break of this zone would target the lows at 73-to-74, and perhaps even lower.

Our choice for shorting the USD is a long Swiss Franc position, for it has broken out of a longer-term “head & shoulders” bottom, and should lead all the currencies higher…including the Japanese yen. This is the price of continued government dysfunction…a loss of faith in the currency.

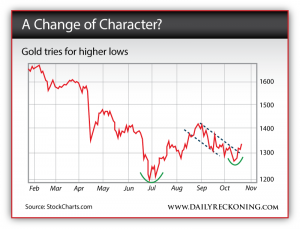

Gold from zero to hero

Sometimes maps can be very easy to read. If the dollar is doomed, gold should rise.

While the dollar’s status as reserve currency, and America’s position as both the world’s largest economy and its largest debtor, will create a difficult and unpredictable path towards that destination, the ultimate arrival can’t be doubted. The fact that few investors are drawing these conclusions has allowed gold, and precious metal mining stocks, to remain close to multi year lows, even while these recent developments should be signaling otherwise. This creates an opportunity.

Recent market action tells the whole story. Even as investors have jerked stocks back and forth during the shutdown madness, gold hasn’t been able to sustain any upward momentum. Over the past week, gold has gone from zero to hero, breaking off an $80 run in just five trading days. That helps the metal to consolidate and reverse its short term trend. In fact, gold stocks might even move significantly higher before we finish out the year.

Fakeouts lead to breakouts

On Oct. 15, gold futures plummeted to a low of $1,251. This drop signaled a clear break below critical support at $1,275. That morning, it looked like the floor was about to drop out. I suspected gold futures would soon test their late June lows of $1,179… That’s when buyers stepped in

After faking a move lower, gold futures have broken above resistance, posting the first higher low since early July. This could be a significant short-term bottom—especially since it was preceded by a false move lower. I think gold (and miners) can move higher from here. It will messy. There will be big down days mixed with the intial thrusts higher. But right now, gold appears to be setting up for a solid fourth quarter. Something is brewing right now that could spark a significant move.

You should closely monitor gold this week. If gold continues to fight higher and consolidate its current uptrend, a more powerful rally could await just over the horizon.

Ron Paul Knows “The Longer QE Lasts, The Worse It Will End”

Ron Paul shares his opinions on a number of topics, including investing in physical gold and silver, the future of the U.S. dollar and the role of the Federal Reserve.