MARKETSCOPE : Suckers Rally

November, 02 2022And So The Cycle Goes

Bear market rallies are called “suckers rallies” for a reason.

So the word to the wise is…don’t be a sucker !

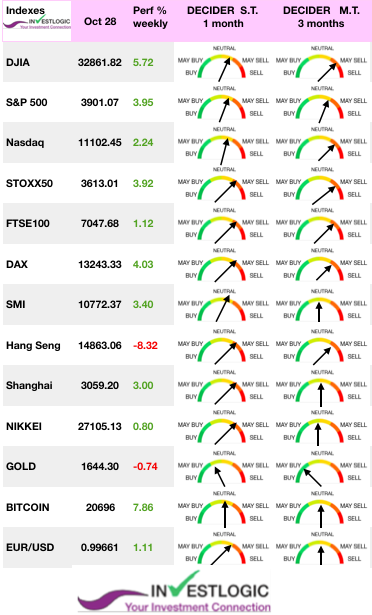

Stocks continue to bounce last week even in the face of very weak earnings from many leading bellwether stocks.

The Dow Jones is up 4 straight weeks (+14%) – its biggest 4-week gain since April 2020. Meanwhile, the Nasdaq is ‘only’ up 5% on the month.

Actually, stocks rose last week but offered widely divergent returns, as investors reacted to contrasted Q3 earnings reports. Energy and industrial stocks handily outperformed growth shares, with the latter weighed down by steep declines in several mega-cap tech stocks.

The third-quarter earnings season will continue this week, but the bulk of results is now behind. Microsoft, Alphabet, Amazon and Meta (ex-Facebook) have been heavily punished, a sign that big tech stocks are no longer the sanctuary they once were. On the other hand, several sectors managed to maintain their earnings improvement trajectories against the backdrop of rather heavy macroeconomic news.

The third-quarter earnings season will continue this week, but the bulk of results is now behind. Microsoft, Alphabet, Amazon and Meta (ex-Facebook) have been heavily punished, a sign that big tech stocks are no longer the sanctuary they once were. On the other hand, several sectors managed to maintain their earnings improvement trajectories against the backdrop of rather heavy macroeconomic news.

All eyes are now on the Fed (Wednesday 2) and the US mid-term elections (Tuesday 8).

In Europe, the ECB hiked rates by 75bps but hinted increases may slow as recession looms. ECB tightened monetary policy and the euro took advantage of this to climb back onto an equal footing with the greenback. STOXX Europe 600 Index ended the week 3.7% higher.

China stocks tumbled on Monday following Communist Party’s 20th Congress where Xi Jinping tightened its grip on power.

MARKETS: Another Bear Market Bounce

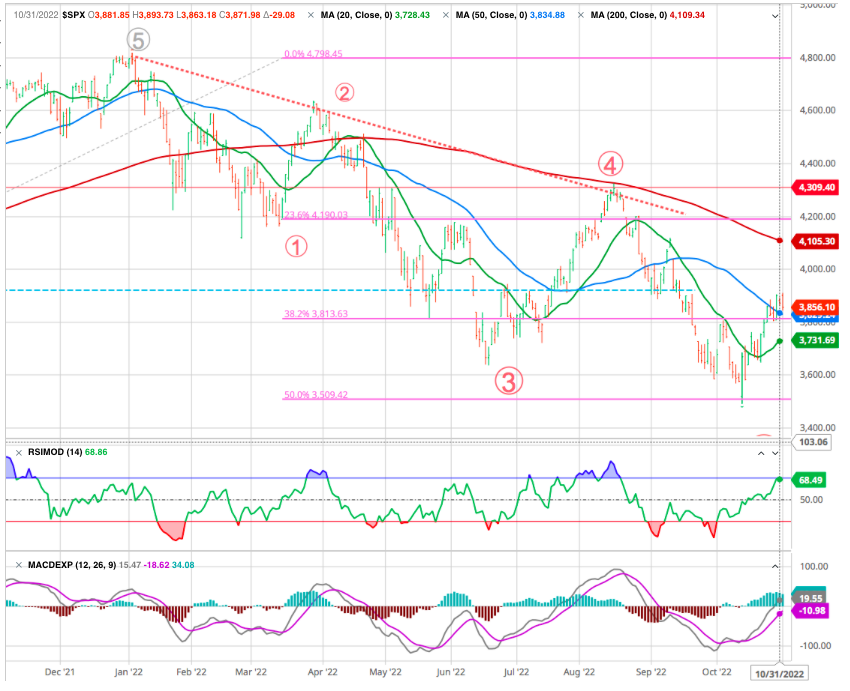

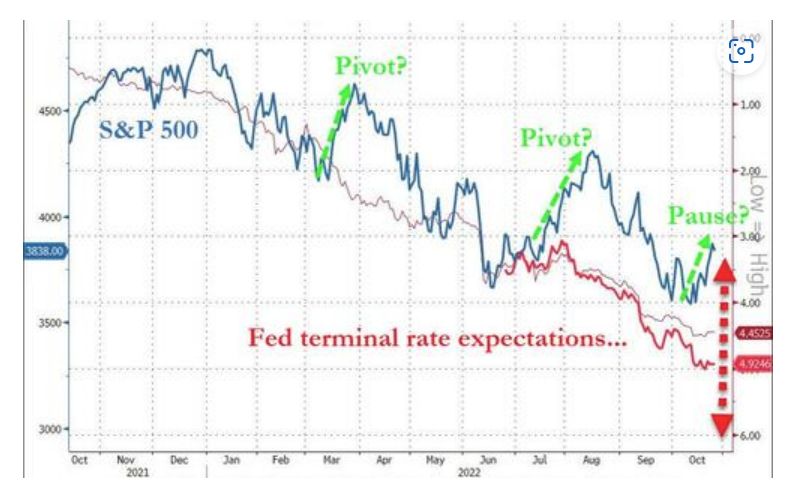

The S&P500 is currently in its third bear-market rally since it started falling from its January high. How far could it go? Could it be the last one?

Remember that a rally in the midst of a bear market is no more meaningful than a correction in the midst of a bull market. They can happen at any time for any reason.

Markets move in 5 waves. 1,3,5 are in the direction of the predominant trend, while 2 and 4 are corrections within the larger trend. Like we stated prior, most major markets have put in a bottom and have begun a new uptrend before the S&P 500’s current October 13th low. SEE ANATOMY OF A BEAR MARKET and HERE

The bear market is messy and overlapping, which is characteristic of 4th waves. We’ve been dissecting past bear markets and looking at some of the technical orientations of key indices; but conclude that despite the recent improvement in the technical outlook, signs of fragility remain.

The key is to realize the long term trajectory is unchanged and that we have not yet seen the lows for this bear market cycle.

The nearly 9% rally for the S&P 500 from the recent bottom has been impressive. Then again so was the 18% rally back during the summer that fizzled out before new lows were made. THIS TIME IS NOT DIFFERENT!

The first thing to notice on the chart is how many failed rallies there have been already this year before new lows were made.

- From 14 March to 29 March: the S&P500 gained 11% in 15 days

- From 16 June to 16 August: the rally was 17.4% and lasted 37 days

- The current rally is running at 11.8% since the intraday low that followed the CPI reversal 15 days ago.

That includes the seemingly impressive 18% rally from June to August that sucked in many investors only to spit them out with a move to new lows.

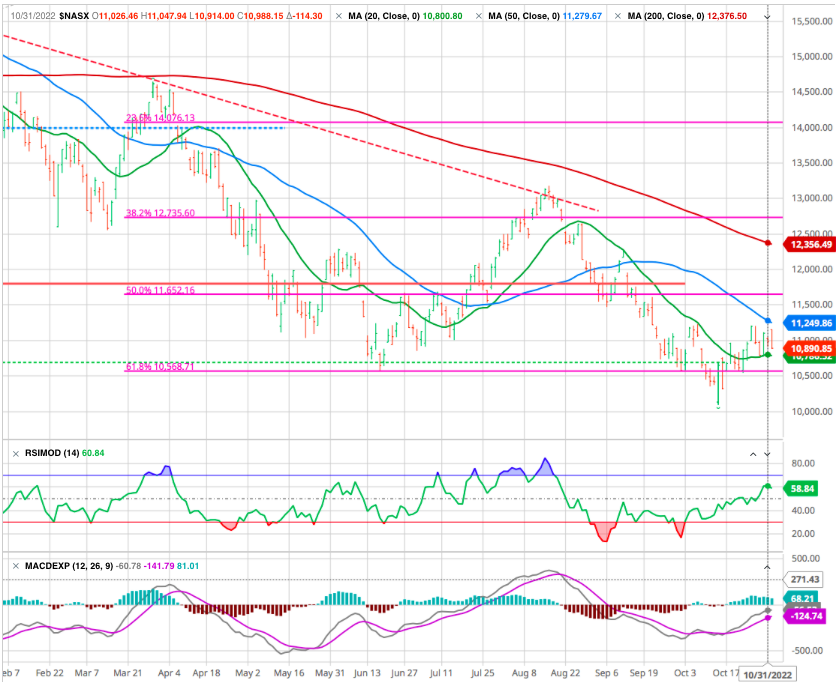

The Nasdaq index in the short term,has broken below a series of supports and the momentum indicators have reached oversold levels. It may be attempting a local low, but the technical outlook will remain challenging as long as the price remains below the 50-day SMA (currently at 11,961). A daily close above the 12k would be a positive first signal suggesting that the relief rally has begun towards the 200-day SMA

Despite the recent improvement in the technical outlook, the underlying pattern remains the same, namely a bearish rally that took off from the fertile ground of extremely negative sentiment and oversold markets.

As noted above, bear markets tend to end with a sharp decline and investor capitulation. This is not to say that it is a necessary condition for a major bottom to form, but the recent divergence among the major U.S. indices is a sign of fragility in our view. Some broader participation to the rally would be a better setup for it to continue and, in this context, the recent underperformance of the large tech names is also a warning signal in our view.

With the general decline in the equity markets, many quality defensive stocks have experienced significant selling over the past week, have lagged the rest of the defensive part of the market and have are not yet overbought – also potentially offering buying opportunities for longer-term investors.

This relief rally has, once again, been led by the more speculative corners of the market, and if the momentum continues, a defensive stance might now be preferable.

This rally will also fail as we are right now pressing up against the 100 day moving average. We could easily run out of steam at this level especially given the way we ended the week.

We have shared the view that the likely bottom of this bear is somewhere around 3,100. And if things fall into their typical bear market pattern that is happening in the first half of 2023 just as the economy is likely finding the depths of the recession.

Yes, it is possible that stocks could keep moving higher a bit longer not unlike the illogical mid-summer rally before new bear market lows were established. Expect this rally to fizzle out, as early as this week. But probably no higher than the 200 day moving average at 4,100 that capped the last rally.

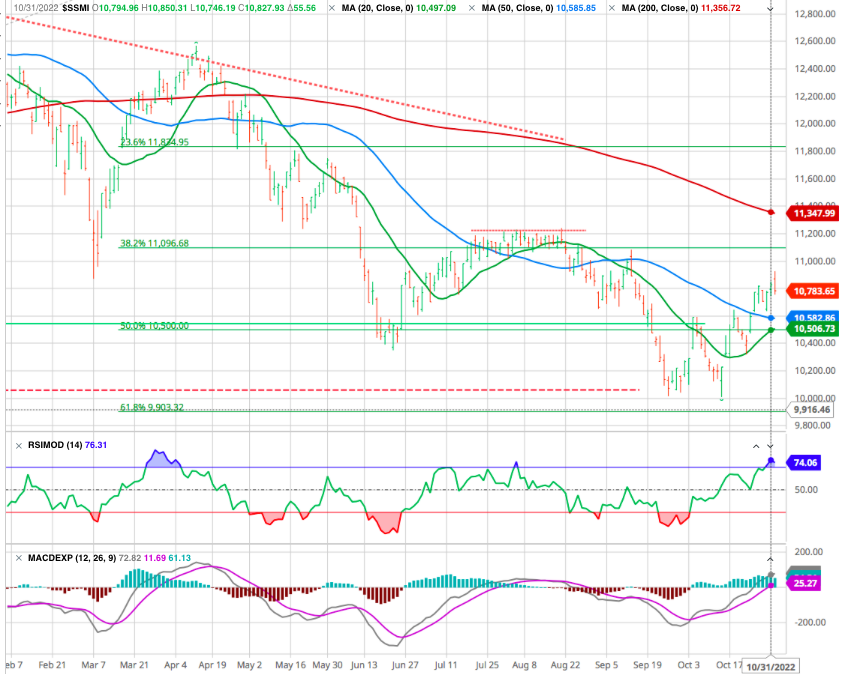

Swiss Market Index

It is also interesting to see how the 20 DMA (green line) plays its role of resistance support level on the short term.

We also note the the Swiss market is a good place to find a kind of safe haven. (SEE our Investment Strategy)

GOLD

As we move towards 2023, we should focus on assets, which are likely to perform well over the next 12 months or so. The fact that precious metals have despite their relatively strong performance, disappointed so many investors is to be viewed positively.

In contrast to rallies in gold over the last few years, when on each advance, investors increased their exposure to gold rapidly, the current advance is atypical in the sense that speculators are not showing any sign of interest by increasing their positions in gold ETFs as was usually the case in the past.

Central Banks Pivot?

A survey showed U.S. job openings unexpectedly rose in September, suggesting that demand for labor remains strong even as the central bank has embarked on a path of aggressive rate hikes in an effort to bring down stubbornly high inflation.

That is the concern for the market is we know the Fed wants to slow down the labor market, they want to slow down hiring so demand drops in the economy, which will help inflation.

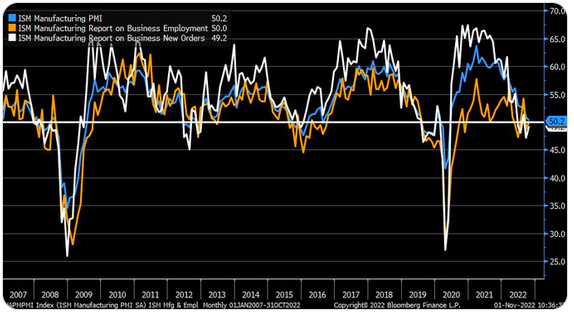

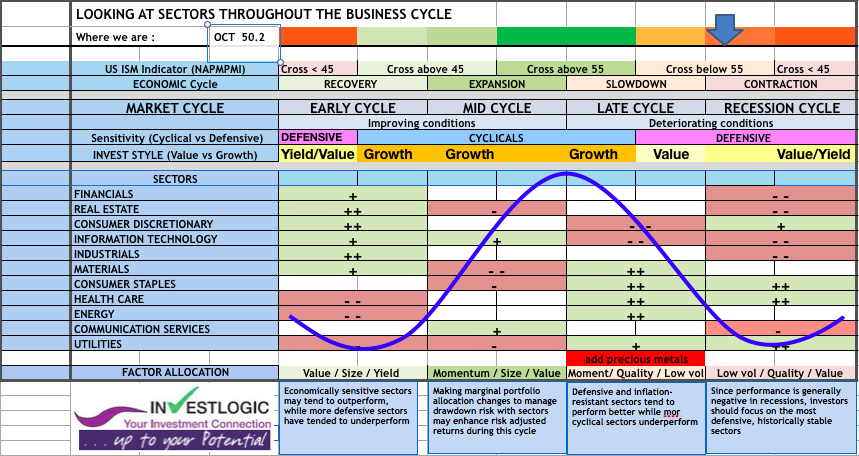

The sharp focus on labor market data overshadowed another report which showed U.S. manufacturing activity grew at its slowest pace in nearly 2-1/2 years in October as rising rates cool demand for goods and pricing pressures on manufacturers lessened. October ISM Manufacturing down to 50.2 vs. 50 est. & 50.9 in prior month; new orders ticked up but still contracting; production moved higher, prices paid fell into contraction, deliveries moved into contraction & inventories eased but are expanding … employment moved up to 50.

Accordingly we update our strategy following our proprietary ABS Matrix -See also our latest Investment Strategy–

Investors have repeatedly attempted to buy us shares on every dip, though that hasn’t been a successful strategy so far. Pivot expectations were the drivers of bear market traps in March and July. This time it looks like a pause is enough as a driver. But of the terminal rate is any guide for the #sp500, then there is more downside ahead. And if the Fed needs to raise rates even further than levels of around 5% the markets anticipate, then the downside risk for the S&P 500 could be 2,700.

Hopes that the Federal Reserve might slow its pace of rate increases seemed to be a driver of positive sentiment during the week. Unfortunately data indicating that the labor market remained on solid ground dimmed hopes the Federal Reserve might have enough reason to begin reducing the size of its interest rate hikes.

The latest move upward is generally celebrated by traders — but they should know that stocks’ gains are robbing the Fed of the wealth effect it needs before it can pivot toward lower rates.

Why? Because stock market weakness is precisely what’s the FED hope. It lies in a behavioral economic theory called reverse wealth effect, in which consumers spend less as their wealth decreases. That should lead consumers to buy less stuff, particularly on big-ticket items like homes. And that should either prevent or at least slow the much-feared inflationary spiral.

Now, keeping the stock market down for a while matters far more to today’s Fed under Jerome Powell than it did to the Paul Volcker Fed of the early 1980s.

This is a critical point. Inflation tends not to stay at its peak for long. Historically, it has moved in waves. So it’s eminently reasonable to expect that inflation will steadily trend downward from here. But it’s not reasonable to expect it to drop in a hurry all the way to the 2% target.

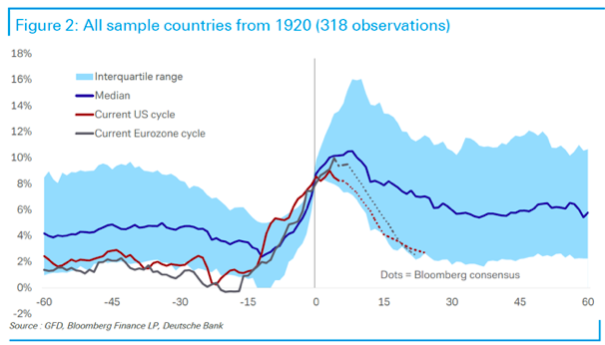

Here is a piece of financial archaeology from Jim Reid at Deutsche Bank looking at what happens to inflation after it has reached 8%. He found 318 such cases over the last 100 years in a range of emerging and developed economies.

That implies that the macro-economy is unlikely to offer the chance of a pivot any time soon. A financial accident caused by draining liquidity might easily force central banks to reverse — but in that case, we would all need to be careful what we wished for.

Happy trades