ANATOMY OF A BEAR MARKET (part 2.)

April, 06 2022

Following our first Anatomy of a Bear Market (FEB 09) we thought it might be appropriate to add some precisions and comments.

Recently, a lot of people have been talking about the possibility of a multi-year recession. So we propose additional key points of understanding of bear market structures, and influence of market sentiment. In this post, we will be going over Ken Fishers’ rules and conditions that must be met in order for a market to be clarified as a bear market, and how you can best position yourself to minimize downside risk.

Bob Farrell, a legendary investor, is famous for his 10-Investment Rules to follow.

Rule #8 states:

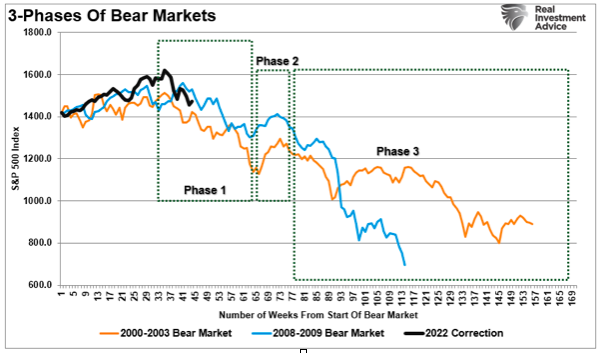

Bear markets have three phases – sharp down, reflexive rebound and a drawn-out fundamental downtrend

- Bear markets often START with a sharp and swift decline.

- After this decline, there is an oversold bounce that retraces a portion of that decline.

- The longer-term decline then continues, at a slower and more grinding pace, as the fundamentals deteriorate.

Dow Theory also suggests that bear market phases consist of three down legs with reflexive rebounds in between.

The Four Rules of a Bear Market

- The first rule is the two percent rule: a bear market typically declines by about 2% per month.

Sometimes it declines by more than 2%, sometimes it is less—but overall and on average, bear markets don’t often begin with the sharp , sudden drop some anticipate.

If a bear does drop by more than 2% per month, there is often a market counter-rally that can provide better opportunities for investors to sell.

- The three month rule: This rule advocates waiting three months after you suspect a peak has happened before calling a bear market.

Rather than trying to guess when a market top might come, this rule ensures one has passed before taking defensive investment action.

It provides a window of time to assess fundamental investment data, market action and possible bear market drivers.

Lots of people try to call market tops and bottoms, and time the market perfectly, but it needs to be clearly understood that this is not the right approach to understanding the market.

- Next, we have the the two-thirds / one-third rule.

About one-third of the stock market’s decline occurs in the first two-thirds of a bear’s duration, and about two-thirds of the decline occurs in the final one-third.This was the case in the bear market caused by the financial crisis, as well as many other bear markets including that of 1973.

Combining this with the three month rule, it also implies that if you have identified that a market has indeed begun its bear run, you might be better off taking profits/losses on your position, managing risk by increasing your cash holdings, and buying back when capitulation has happened.

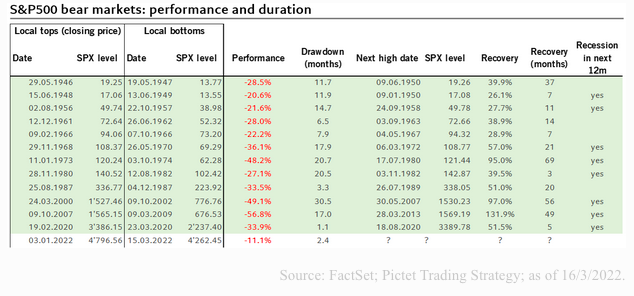

- And finally, we have the 18-month rule. While bull market durations vary considerably, statistics demonstrate that the average bear market duration, since 1946, has only been 16 months.

Very few in modern history last fully two years or longer. If you’re engaging a defensive investment strategy, you probably shouldn’t bet on one lasting so long.

The longer a bear market runs, the more likely you’re waiting too long to re-invest. If you remain bearish for longer than 18 months, you may miss out on the rocket-like market ride that is almost always the beginning of the next bull run. Missing that can be very costly for investors.

Bull market corrections are not fun, but it’s important as an investor for you to be able to distinguish bear markets/recessions from bull market corrections.

Choosing to undertake a bear market investment strategy and go defensive should be rare and shouldn’t be done by gut feel or by your neighbor’s opinion. Exiting the market is among the biggest investment risks we can take—if we are wrong and we have a need for portfolio growth, missing bull market returns can be extremely costly.

So are we currently in a bear market?

That selloff set up a “reflexive bounce.

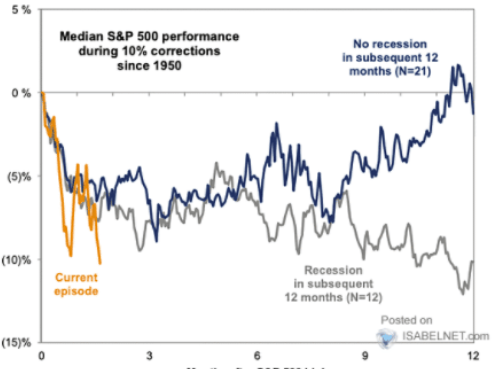

The question is simple. What is the difference between a 10% decline in a bull market versus one that leads to a bear market?

As shown, it all depends on whether you are entering into a recession or not.

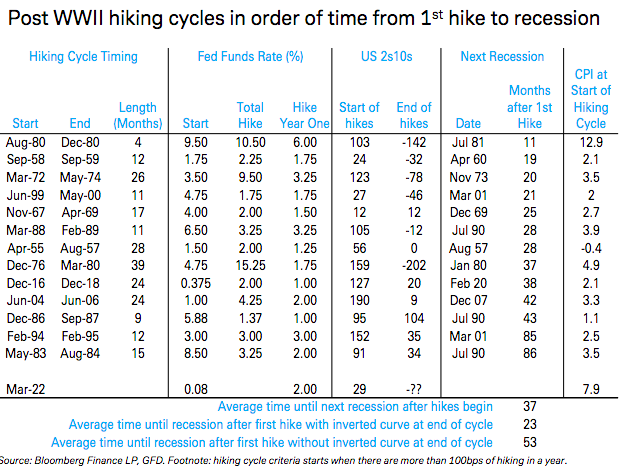

The risk of a “bear market” is rising. Inflation was surging before the surge in oil prices. Now those higher prices are impacting consumption as liquidity support is reversing.

The massive infusions of fiscal liquidity in 2020 and 2021 are gone. The Fed’s QE program ended, which is extracting more liquidity from the markets. the Fed is hiking interest rates and according to Brainard they will reduce the Central Bank balance sheet , further tightening monetary policy.

So YES we are increasing sharply the risk of recession,

Path of the S&P500 around 10% market correction

While a reasonably significant “reflexive rally” is likely, given investors’ more extreme negative sentiment and positioning, a recession will likely lead to substantially lower prices. Such will occur as investors reprice overvalued assets for slowing future earnings.

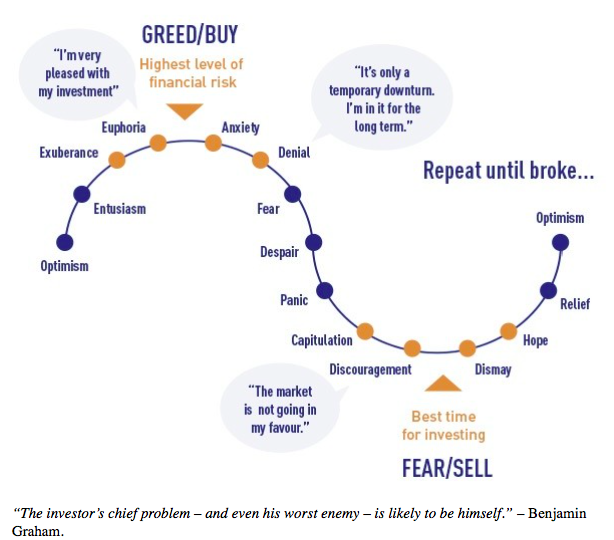

Investor’s Psychology

Bear market rallies are dangerous. Investors will “feel like” they are “safe” as the media proclaims the “correction” is over.

However, that is precisely what “bear market rallies” do. They lure investors back into the markets just before they get mauled again in “Phase 3.”

Just like in 2000 and 2008, the media/Wall Street will be telling you to “hold on.” Unfortunately, by the time “Phase 3” got finished, no one wanted to “buy” anything.

We suspect when we find the actual market bottom, it will be much the same.

Of course, as shown, extremely negative investor sentiment tends to be the hallmark of the bottom of corrections and bear markets. The biggest driver of investing failure over time is psychology.

Until next time and take care !