MARKETSCOPE : Higher Rates for Longer

January, 09 2023

If 2022 Was the Year of Inflation, 2023 Is the Year of… Recession

At the outset of our first weekly investment comment of 2023, we want to take another opportunity to wish readers a healthy, happy year. Whatever the markets hold for the year ahead, 2023 will be a successful year if we can look back upon it as one of good health and happiness.

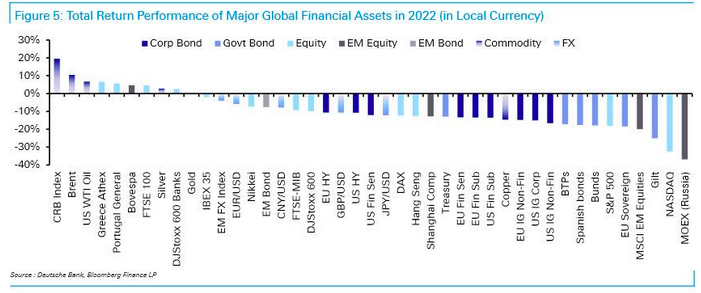

As we close out the year and reflect, we’re reminded of just how challenging 2022 it’s been for most investors (particularly those that don’t follow our weekly comments. Just consider the following YTD performance numbers for the largest asset classes:

As DeutscheBank’s Henry Allen puts it succinctly, “2022 was an awful year for financial markets, with the S&P 500 seeing its worst annual performance since 2008, just as global bonds fell into a bear market for the first time in 70 years.”

Which assets saw the biggest gains of 2022?

- Commodities: In a rough year more broadly, commodities were one of the few asset classes to post consistent gains in 2022. A big factor in that was Russia’s invasion of Ukraine, which led to a major spike in energy and food prices in Q1, which then unwound somewhat as the year went on. Nevertheless, Brent Crude (+10.5%) and WTI (+6.7%) still posted gains for the year, as did corn (+14.4%) and wheat (+2.8%) prices. For metals there was a more mixed performance however. Some such as platinum (+10.9%) performed very strongly, but gold (-0.3%) saw little movement and copper (-14.6%) posted its first annual decline since 2018.

- US Dollar: With the Fed hiking rates and moving faster than other central banks, the US Dollar was a major outperformer in 2022. The dollar index (+8.2%) posted its biggest annual advance since 2015, and the dollar itself strengthened against every other G10 currency over the year.

Which assets saw the biggest losses of 2022?

- Equities: An aggressive campaign of rate hikes and growing fears of a recession meant it was a rough year for equities. The S&P 500 (-18.1%) saw its biggest annual decline in total return terms since 2008, despite a +7.5% gain in Q4. Over in Europe, the STOXX 600 fell -9.9% over the year, and there was little respite in emerging markets either, with the MSCI EM index down -19.9%.

- Sovereign Bonds: After a multi-decade bull run, 2022 was an incredibly bad year for sovereign bonds. For instance, Bloomberg’s index of US Treasuries (-12.5%) posted its worst annual performance since data begins in 1973. Longer-term data showed that it was the worst year for 10yr Treasuries on a total return basis since 1788. Euro sovereign bonds saw even larger declines, with a -18.4% decline thanks to losses in every single quarter, whilst gilts fell -25.0% amidst the turmoil in the UK.

- Cryptocurrencies: The risk-off moves more broadly proved bad news for cryptocurrencies, with Bitcoin down -64.3% to close the year at $16,540, having started the year at $46,334. This pattern was echoed among other cryptocurrencies, with Ethereum down -67.5%, Litecoin down -52.0%, and XRP down -58.7%.

Our subscribers, as for our clients, will note that short U.S. equities and crypto along with long the U.S. Dollar has been among our Macro team’s big calls since the beginning of 2022.

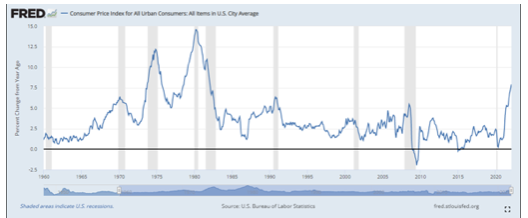

Setting aside investors for a second, it’s been a challenging year for consumers around the world. Inflation is near 40-year highs. Meanwhile, growth has been slowing globally… and will continue into 2023. We estimate that 83% of central banks are raising rates into this in order to quell inflation but also exacerbating the growth slowdown. As strategists publish their predictions for the US economy next year, it’s clear that recession-positioning is regarded as more of a when than an if.

Make no mistake: Inflation is still a major concern. But rates are becoming just as pressing.

Given Chairman Jerome Powell’s recent comments regarding more rate hikes on the way, hopes for a Fed “pivot” are fading and expectations of “higher rates for longer” are growing.

So, buckle in. Rising rates will be a key investor and consumer theme in 2023. And we’ll be watching closely.

The publication’s preview of 2023 for the stock market includes a warning the selling pressure could continue if the Fed’s interest rate hikes push the economy into a recession. “Call it a soft landing, call it a rolling recession, a growth recession, whatever the case. It will be the most widely anticipated recession of all time,” chimed in economist Ed Yardeni. The positive spin is that a more modest economic slowdown might be enough to reduce price growth to a level near the central bank’s annual target of 2% and set the stage for a strong second half rally.

We think all of the aforementioned market and economic dynamics continue in 2023. If you want to get ahead of these trends that will impact your portfolio for many months to come, now is as good a time as ever to read our reports and to review your portfolio.

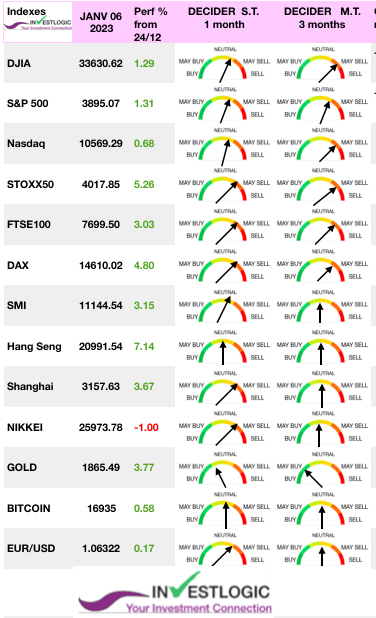

A Bumpy Start To The New Year

The start of 2023 shows a mixed start. European indexes rose on the back of good news about slowing inflation in Europe. It surged the prospect of a less aggressive ECB on rates, while in parallel, the sharp drop in the price of gas has reduced the risk weighing on companies in the Europe.

In the US , after a poor start of the week, Friday’s official payrolls report from the Labor Department appeared to turn sentiment back in a positive direction by raising hopes that the economy could be on its way to a “soft landing”.

Nonfarm payrolls rose by 223,000 in December, the smallest increase in two years but above expectations. The separate household survey showed that unemployment fell back to its post-pandemic low of 3.5%.

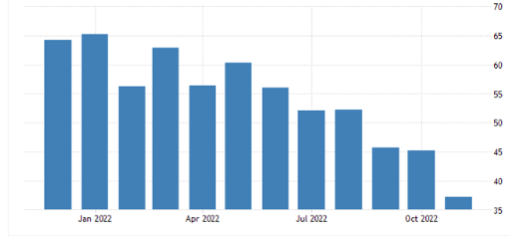

Friday also brought news that the Institute for Supply Management’s index of services sector activity fell to 49.6, well below consensus and into contraction territory (below 50) for the first time since May 2020, as new orders slowed sharply.

This batch of softening data brought one of the biggest falls in two-year Treasury yields — a critically important measure and a barometer of where the market thinks rates are moving in the short term — since the Federal Reserve began its current aggressive tightening campaign a year ago. That’s because a soft landing looks more likely.

Both short- and longer-term U.S. Treasury yields sharply lower on Friday, leaving the yield on the 10-year note down over 30 basis points for the week.

Investors seemed to hold on to it as a sign that the Fed’s efforts are starting to pay off. Once again, and having failed to learn their lesson, the bulls piled into stocks hoping for a “Fed pivot.” And again this week, the focus will be on Jerome Powell’s speech and the publication of US inflation data.

Meanwhile easing restrictions in China also sent Chinese stock markets soaring. Chinese equities rose amid reports that Hong Kong would reopen its border to mainland China and that Beijing was considering relaxing curbs on borrowing for the ailing property sector.

MARKETS : Hope Lives On

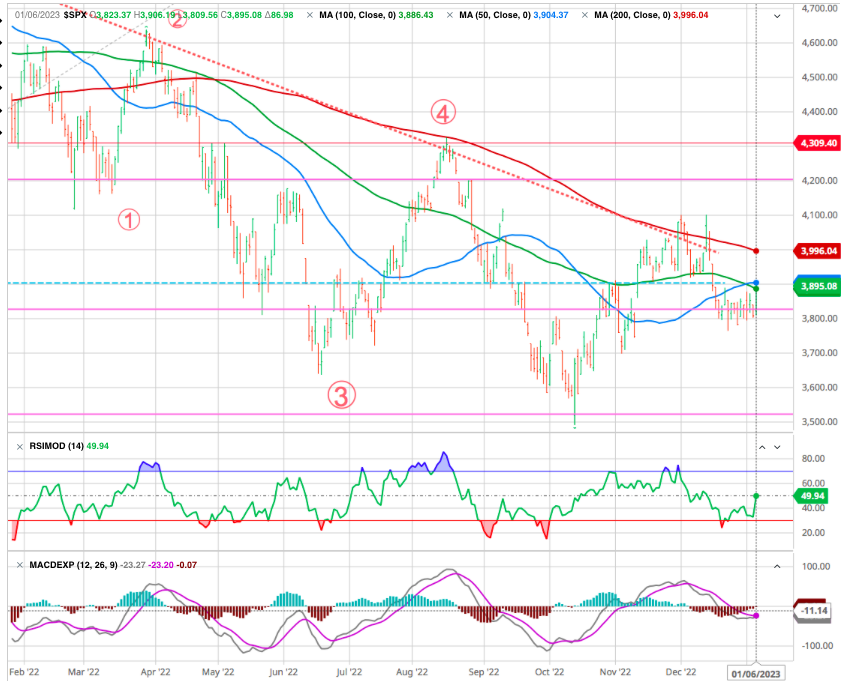

Markets just had a great start into 2023, it is too bad that the earnings season starts this week. Last Friday’s more robust rally broke the market out of the recent consolidation range from the last half of December and pushed prices into the cluster of resistance around 3900. Notably, the market held support at the rising trend line from the October lows. While the market has surged into short-term overbought territory, a counter trend rally toward the 200-DMA is possible as the MACD “buy signal” crosses higher.

While we might have a tradeable rally, it remains worth selling into and trading accordingly.

For now, trade accordingly as we drift from one “pivot hope” report to the next, even though the Fed remains clear that no “pivot” is coming.

The Nasdaq looks like it is now searching out a bottom and may be finding one just above 10,000. Never the less we shall be very carefull as we do expect some further disillusions. Going out further on the high PE (or in a lot of cases no PE) and longer duration curve, the greater the damage.

The people who couldn’t afford to lose got pounded first, in crypto and Tesla. Now we’re moving to where the wealthy are in leveraged loans, private equity and venture. Cathie Wood’s ARK Innovation fund (ARKK) was down a whopping 67% in 2022. Long-duration stocks were the worst place to be in last year. They and bitcoin (-66%) were the biggest losers for the year. Will they be the biggest winners in 2023? Don’t count on it.

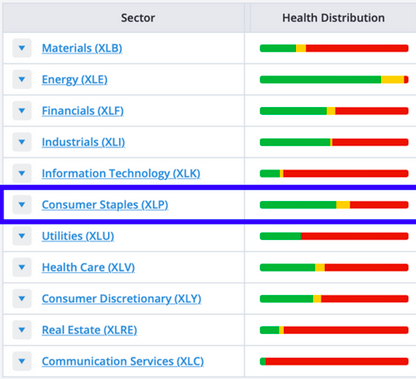

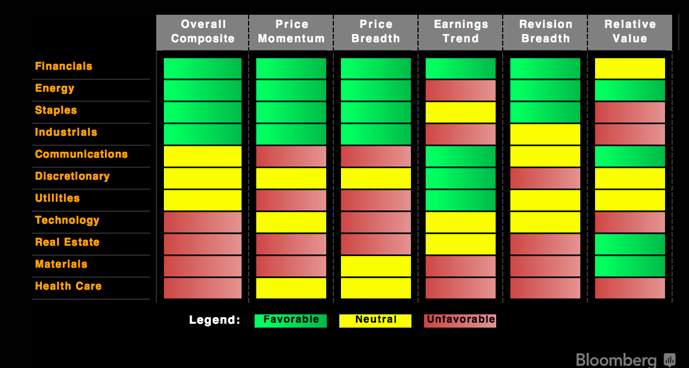

Considering our Decider, our technical oscillator system, we note that, apart from the strong energy sector (below) and Financials, we have a new positive candidate in the “Consumer Staples”.

Consumer Staples is traditionally considered a “defensive” sector. It includes a lot of steady, “boring” stocks that tend to outperform the market when the economy hits a rough patch.

So, this signal isn’t necessarily a bullish omen for the broad market. However, it does present a welcome opportunity for conservative investors – who haven’t had many great options recently outside of cash and energy-related investments – while we wait for bullish or bearish confirmation from the major indexes.

The strong Energy seems to bring a powerful new tailwind for this year.

The combination of higher energy prices and conservative management has allowed companies to do two things they haven’t been able to do in years: pay down debt and return cash to shareholders.

Energy stocks are currently trading at a forward price-to-earnings (P/E) ratio of around 9. That’s nearly 40% below their long-term average P/E of 14, and it’s roughly half the SPX’s forward P/E of 16.

In short, the Energy sector — and the Oil and Gas Exploration & Production (E&P) sub-industry, in particular — is generating huge cash flows for the first time in years.

The sector would have to rally another 40% just to return to its long-term average valuation. But of course, it’s still possible we could see further near-term — and potentially severe — weakness in energy prices if the economy falls into recession this year.

Sector Scorecard/ New Leadership

For more details see our What are the charts telling us?

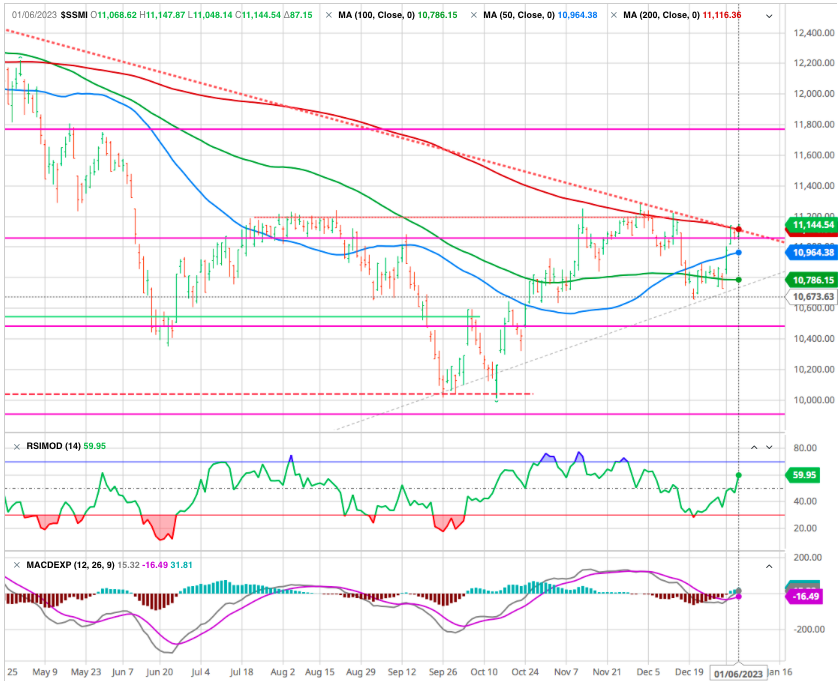

Europe : Mild Winter

In Europe, as for the Swiss Stock Market the trend switch more positive challenging its 200 DMA and the downtrend line. Our indicator is also flirting with a “buy signal”.

Buy China ?

A call for 2023, could be “buy China” — not just its bonds, but even its beleaguered stocks. On any simple what-goes-down-must-come-up model, this makes ample sense. Chinese American Depositary Receipts, as measured by the Bank of New York’s index, and Hong Kong-quoted shares covered by the MSCI China Index have more or less caught up with the MSCI All-World index. An epochal 46% fall for the ADRs at one point is now a more manageable 18% drop for the year.

Christopher Wood, a veteran analyst of Asian markets suggests that it’s now safe to enter the water. But it’s important than he is more confident about relative performance (because he sees US earnings and the dollar as challenged), than about absolute performance in an environment that is confronted to a big public health crisis for the next few months.

BETTER RETURN OUTSIDE THE US.

Some strategists see a better set-up for foreign stocks than their U.S. peers in 2023. This marks a departure from the pattern in recent years when investors were rewarded for staying close to home.

Last year global stocks fell 18% compared with 20% for the S&P 500. Current forecasts suggest global stocks could extend that lead this year. For example, Vanguard estimates annualized 10-year returns at 7.2% to 9.2% for developed markets, 7% to 9% for emerging markets, and 5% to 6.7% for U.S. stocks.

Some reasons behind the rosier view of global stocks include that stocks in Europe and emerging markets are cheap compared to those in the U.S. Also, the odds of a recession in the U.S. are increasing by the day, and there’s the risk that higher labor costs for companies could eat into high-profit margins.

A portfolio of U.S. stocks bought in 2012 is worth double on a cumulative return basis than an international stock portfolio. But Vanguard sees emerging markets as attractively valued for the first time since the pandemic. Interest rate increases in the emerging world have also slowed, whereas U.S. rates keep climbing.

Gavekal Research sees the next bull market in Asia and emerging markets. They expect the Fed to pause interest rate hikes this year; if the Fed blinks, the dollar could weaken, unlocking a wave of investments in global stocks.

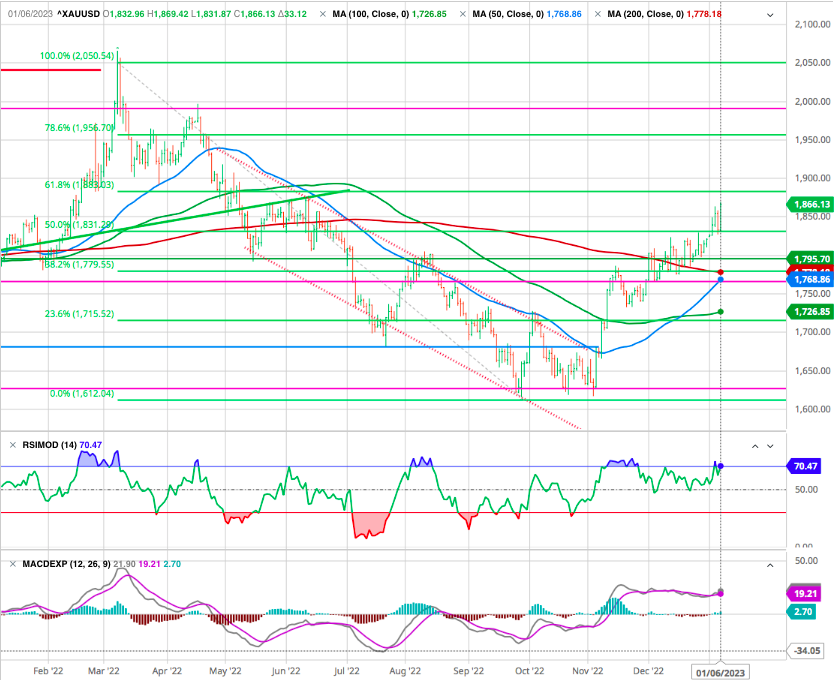

GOLD : The Rally May Last

After we called the break at USD 1700

Gold has appreciated by about $200/Oz in the last three months as the US dollar started to weaken and the FED rate hike expectations started to moderate.

Gold usually rises during a recession, high inflation or economic uncertainty. Looking ahead, the US dollar will be key to gold’s performance. If the dollar has peaked, the gold price should be above $2,000 again this year. Gold has nothing to fear from interest rates hikes. It is the impact of rate increases on the value of the dollar that is important.

Cryptos

In line with the end of 2022, bitcoin is showing relatively low volatility in this first week of 2023, still stuck around $17’000. So investor appetite for bitcoin still remains low for now. For the first time in its short history, bitcoin is expected to post four quarterly closes in the red in 2022. The cryptocurrency market leader will have shed 62% of its valuation by 2022, falling from $46,000 at the start of the year to $16,500.

In line with the end of 2022, bitcoin is showing relatively low volatility in this first week of 2023, still stuck around $17’000. So investor appetite for bitcoin still remains low for now. For the first time in its short history, bitcoin is expected to post four quarterly closes in the red in 2022. The cryptocurrency market leader will have shed 62% of its valuation by 2022, falling from $46,000 at the start of the year to $16,500.

Ether, the second largest crypto in terms of valuation, is clearly outperforming the leader by registering a rise of more than 4% over the past week but is still far from reversing the trend after a catastrophic 2022.

Meanwhile, the total valuation of all digital assets has fallen from $2.2 trillion to $750 billion, down 66% this year.

The Fed is in Collision Course with Investors

While the markets continue to defy the FOMC, hoping for a pivot, there is no reason outside of a financial event, a deep recession, or both.

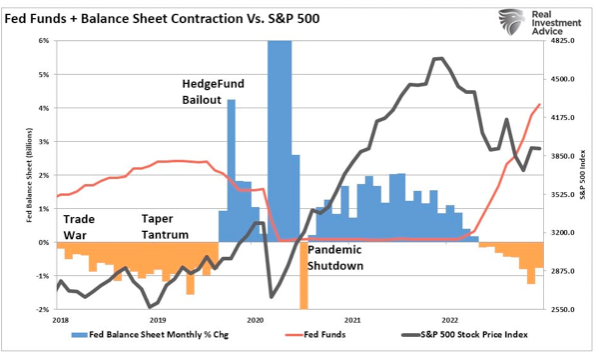

The headwinds of higher rates, quantitative tightening, and a drain of “stimulus” from the economy have not changed. If it wasn’t a good idea to “fight the Fed” during QE, it probably remains a good idea not to do so during QT.

Everyone is looking for a Fed pivot, but Quantitative Tightening is not dovish, M2 going negative and it being the worst it’s ever been is not dovish.

The Fed is removing liquidity by reducing its balance sheet twice as fast as in 2018. For those who don’t remember, the last QT ended in a 20% market plunge over three months. Today, even with weaker inflation, QT is not ending anytime soon.

Here is the Dilemna : The FED Dot plot are at 5.1% by 2023 year end yet FED funds futures call for 4.5%-4.75% roughly 50bps below the FED’s projections. Investors see or hope enough cooling is come through to slow down the FED moves.

The consensus outlook for investors is for the economy to slow down in 1H23 and rebound in 2H powered by the FED pivot. While the markets continue to defy the FOMC, hoping for a pivot, there is no reason outside of a financial event, a deep recession, or both. Also the exact opposite may happen: the market under-estimate how persistent the US economy really is notably the unspent fiscal stimulus…..eventually the FED tightening will catch up and hit later in the year.

The minutes from the latest FOMC meeting in December. were unsurprising, at least to us, as they reiterated the same message the FOMC delivered in all of 2022. To wit:

“No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time. In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy.”

There are a couple of important points made in that statement.

- The FOMC isn’t looking to have inflation at 2% before changing its policy stance. They want to see a clear and sustained pathway to 2%.

- The FOMC fears inflation will come down and then reaccelerate, as seen in the 70s.

The FOMC wants a “controlled burn” of asset prices lower, not higher. We would suspect that at some point, market participants will realize that the FOMC is serious about its mission.

The more bullish market participants should be aware the Fed is ultimately pushing for lower stock prices.

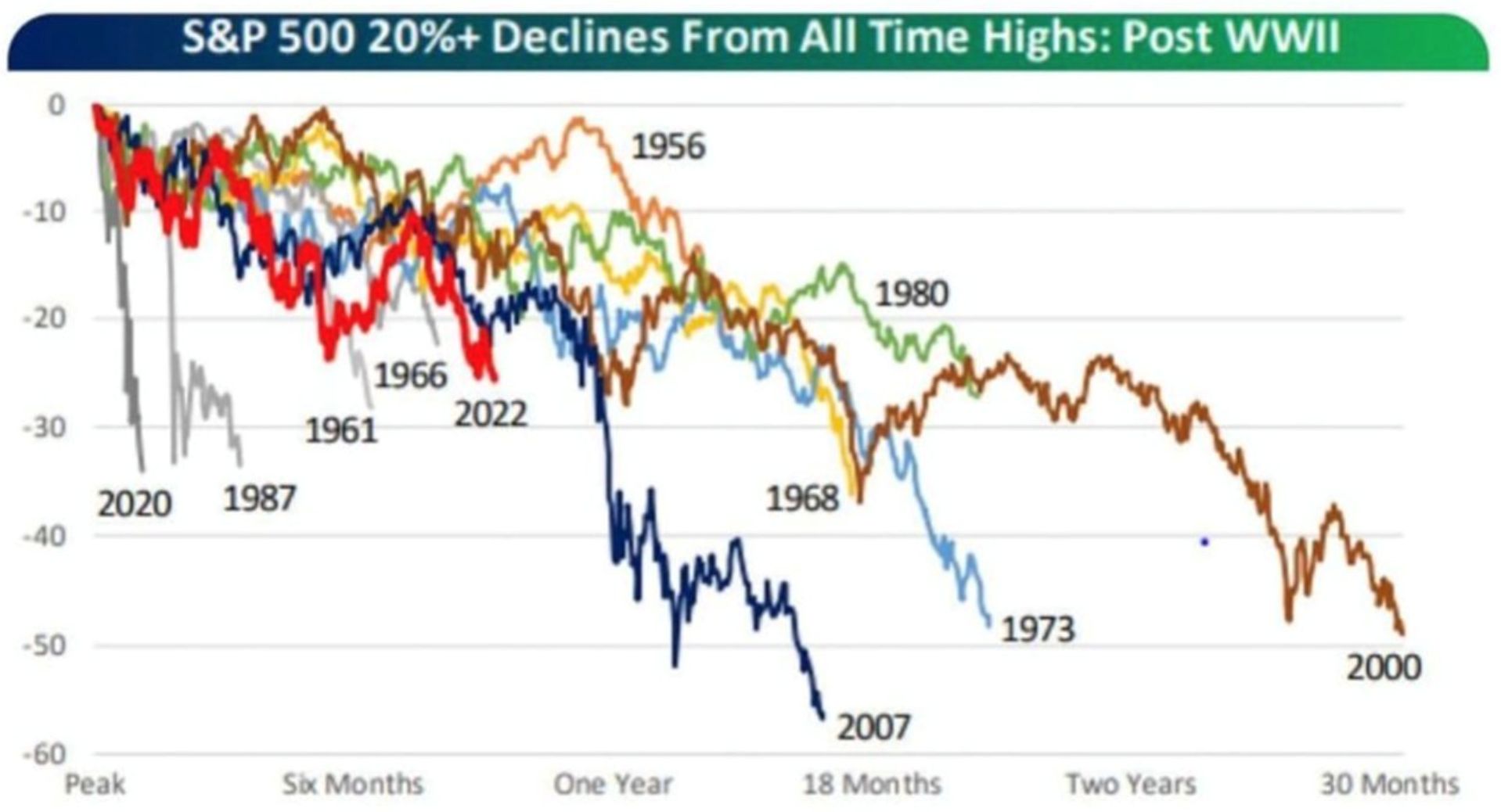

Risks Of A Recession Are Elevated

The financial markets have yet to adjust to accommodate for a substantially weaker, if not recessionary, economy. As discussed previously, earnings estimates remain highly optimistic and deviated from their long-term growth trend despite the recent cuts. Even in a “soft landing” environment, earnings should weaken, which makes current valuations at 22x earnings more challenging to sustain.

In the short term, there is almost no connection at all. Investors try to adjust the multiple they pay for those profits to take account of other changing variables, such as interest rates, geopolitical risks, or prospects for the macro-economy. Every so often, they will be taken over by irrational exuberance or equally irrational discouragement.

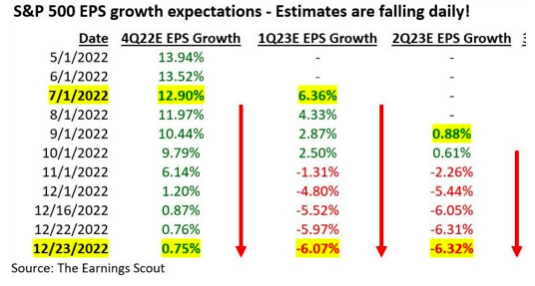

2023 Will Be About Earnings

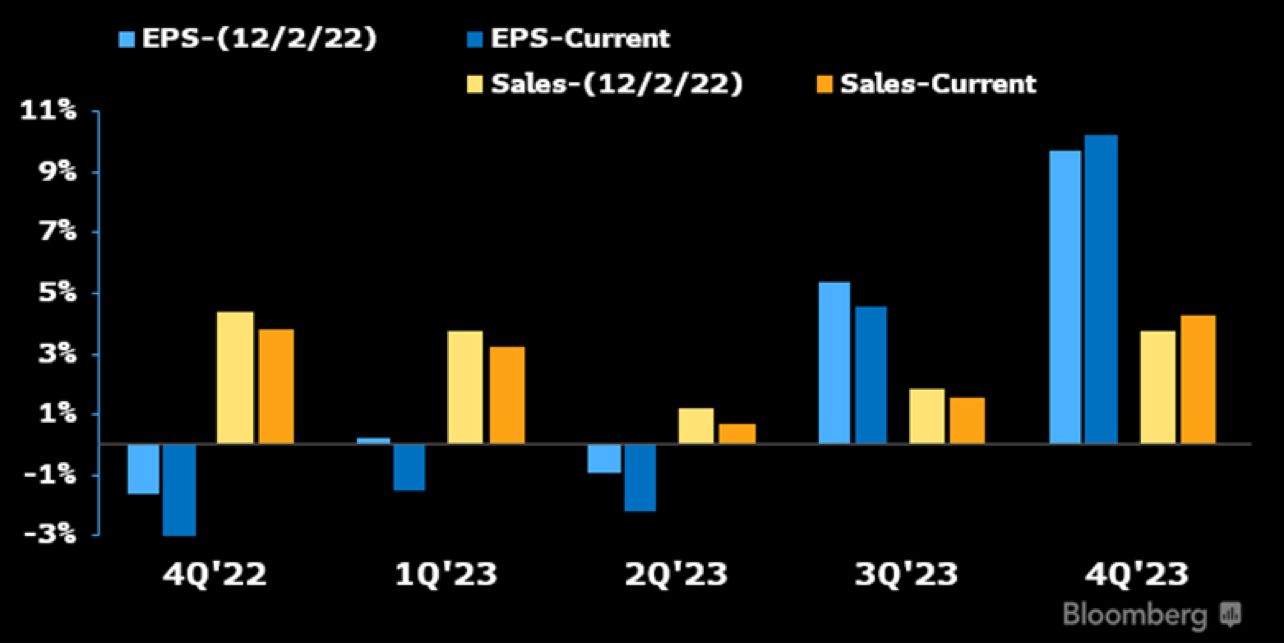

In 2023 the narrative is likely to shift from rate hikes and bad news being good news to bad news being bad news. Weaker economic data will not be positive because the market thinks the Fed will stop raising rates but will shift to the market demanding the Fed cut rates as corporate earnings decline.

The good news is that the Fed probably does bring inflation down in 2023. The bad news is that with falling inflation rates, nominal GDP growth will fall, and as a result, earnings will fall too.

How much earnings truly fall is anyone’s guess. But from the peak in September 2000 through December 2001, earnings estimates for the S&P 500 dropped by around 19%. That would equate to earnings in 2023 falling from around a peak of $238.96 in June 2022 to about $191.22 in 2023.

Investors will try to adapt to likely short-term changes in earnings, and even more importantly to longer-term changes. A graph of earnings over time is a steadily upward-sloping diagonal line, with very occasional slight dips during recessions.

A graph of multiples is very different. The following chart (source Bloomberg John Authers) shows the price-to-earnings ratio for the S&P 500 since 1970, based on both the last 12 months’ earnings and the average of 10-year earnings, developed and made popular by Professor Robert Shiller of Yale University for his CAPE (Cyclically Adjusted Price Earnings) multiple. Both are far more variable than earnings. The CAPE, designed to capture how the market is dealing with longer-term trends, is comfortably the more variable of the two.

Keep in mind that the forward PE ratio of the S&P 500 contracted from 23X to 17X during the rising rate cycle last year. That forward PE has probably stabilized in the 16-18 range for now, unless the Fed cannot get inflation under control.

The damage to the S&P 500 this past year was done by the aforementioned multiple contractions, not a big drop in earnings, which will happen.

5 Reasons to Still Be Bearish in Early 2023.

Think of a recession the same as opening “Pandoras Box”. Once these demons have been unleashed it will be harder than you think for the Fed to contain. Which explains why the lookout for recession is the key ingredient in making a bull/bear stock market prediction and trading plan.

The same thing will be true about the delayed effects when the Fed wants to revive the economy down the road. It is far from an “On” switch that immediately kicks the economy back into high gear.

- Inflation correlates with Recession

- Inverted Yield Curve predicts recession

- Chicago PMI Under 40

- Wall Street Earnings Outlook

- Wall Street analysts are already predicting negative earnings for the first 2 quarters of the new year.

- Don’t Fight the Fed!

- Putting it altogether “Don’t Fight the Fed” at this juncture means that they are manufacturing a recession and bear market. And the smart money knows they will make that outlook happen come hell or high water.

Most of the market outlook commentaries you have read in recent months likely cited at least one of these reasons as proof of a recession and bear market on the way. But when you stack all 5 of these accurate predictors on top of each other you get overwhelming odds of what is in store.

This is why we continue to be bearish to start 2023.

Happy trades

BONUS .