MARKETSCOPE : Too Early to Cut, Too Late to Hike

May, 06 2024

The stock markets, which had been in the doldrums for part of the week, found reason for hope on Friday.

Markets were eagerly awaiting Jerome Powell’s speech, but he settled for a half-hearted one. In essence, the Fed Chairman was focusing on inflation and the job market, which is still too resilient for his liking to allow himself an initial easing of rates. Fortunately, the latest data on job creation in the US came in below expectations at 175k vs. 240k forecast.

This was all it took to push indices higher and bond yields lower. The US 10-year is now within touching distance of an important support zone to watch around 4.42/33%.

Aside from the central bank, this week also saw one of the busiest stretches of the first quarter earnings season, with Amazon and Apple. Both tech giants delivered, and Apple in particular shook markets with the unveiling of record USD 110 billion buyback.

In Europe, it was the first estimate of April inflation that took center stage: slightly more robust than expected, it did not, however, call into question prospects of an ECB rate cut in June.

The pan-European STOXX Europe 600 Index ended the week 0.48% lower. In Asia, the Nikkei 225 Index rose 0.8% while the Shanghai Composite Index gained 0.52%.

AHEAD

Wall Street will get a slight amount of relief this week as both the economic calendar and the first quarter earnings season will lighten up somewhat. Also in focus will be Friday’s University of Michigan preliminary consumer sentiment data for May.

Zurich will be closed for a public holiday on Thursday. Two central banks will release their decisions: Australia’s RBA on Tuesday and the UK’s BoE on Thursday.

Many major companies including members of the “Magnificent 7” have already reported their results. Still, next week has a few notable names on tap, Walt Disney, BP Plc, UBS, Toyota, AB Inbev and Bouygues will spice up the week.

April was a rough month. May might be milder!

After a strong start to the year, April was a much tougher month in financial markets, with losses across several asset classes. In fact, the S&P 500 fell back after a run of 5 consecutive monthly gains, whilst US Treasuries had their worst month of 2024 so far. That was partly thanks to growing evidence of sticky US inflation, which led to questions about whether the Fed would be able to cut rates at all this year. But there were also fears about #geopolitical tensions in the Middle East, meaning that Brent crude oil prices rose for a 4th consecutive month, and haven assets such as gold and the US Dollar also moved higher.

Which assets saw the biggest gains in April?

Commodities: The geopolitical tensions supported commodity prices, with Brent #Crude #oil (+0.4%) and gold (+2.5%) both posting gains in April. There were also very strong gains for copper (+13.9%), which had its best monthly performance since February 2021.

US Dollar: The US Dollar index (+1.7%) moved higher for a 4th consecutive month, supported by the prospect of the Fed keeping rates higher for longer.

Which assets saw the biggest losses in April?

Equities: After a very strong run since November, the S&P 500 (-4.1%) and the STOXX 600 (-0.8%) both lost ground after a run of 5 consecutive monthly gains.

Sovereign Bonds: The prospect of rates staying higher for longer hurt sovereign bonds, and there were losses for US Treasuries (-2.4%), gilts (-3.2%) and #bunds (-1.8%).

Cryptocurrencies: After a very strong performance over February and March, #Bitcoin (-15.5%) had its worst month in April since November 2022.

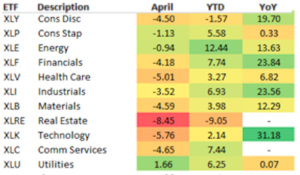

At the sector level, Real Estate , Technology, and Health Care ( all fell more than 5%, while Utilities was the only sector that was up.

Source : Bespoke

Even after the latest market reversal, major developed tech sectors continue to exhibit high valuation premiums relative to their local markets vs. prior to the pandemic, putting them at a greater risk for further de-rating.

Source :Gina Martins @Bloomberg Intelligence

MARKETS : April’s Thread

The market surged higher on Thursday and Friday, supported by Apple’s massive $110 billion stock buyback program. A push above resistance at the 50-DMA should allow the bulls an opportunity to retest 5200 in May. However, while the bullish market setup is intact in the near term, we continue to expect another decline as our medium term indicator is still bearish.

Given the above, we continue to not see much of a case for serious stock upside until the certainty of a Fed rate cut is greatly increased. That points to a trading range or more market downside as the more likely outcome in the months ahead.

Any bad news on inflation, earnings, banks, middle east, or (fill in the blank) could easily have us breaking below to test the 200 day moving average. I suspect any such move would be fairly short lived as I don’t see anything pushing us towards recession at this time…and thus no reason to truly be bearish either.

We expect the S&P 500 between 4600 and 5100 in near term.

Some say that the S&P rally has broadened out recently beyond the M7. But as Bloomberg’s Simon White points out, the smaller cap half of the S&P 500 is not just lagging, it’s struggling.

The immediate price action following the Fed meeting does not accurately reflect the market’s longer-term direction.

This means that the outcome of those events is likely to be seen in the following weeks. The knee-jerk market reactions tell us nothing about the longer-term trends that are likely to develop, which is what most of us long-term investors care the most about.

We have seen large drawdowns in various hot “assets” this year. SOX was down around 17% from high to low and the brightest shining star NVDA close to 20% last month. Nothing is impossible in this market.

Hang Seng

China and Hong Kong actually bounced back while the rest of the world took a breather. Hong Kong’s benchmark Hang Seng Index surged more than 7% in April as the best-performing major index in the world. It’s now heading into a bull market, rebounding nearly 20% from its January low.

Improving economic landscape in China, cheaper valuations and a flurry of mainland investors putting money into Hong Kong to protect their portfolios from a weakening Chinese currency have combined to resuscitate the market.

In recent days, investors have been getting increasingly upbeat because of reports that Beijing would roll out a “real solution” for the crisis-ridden property sector.

See our Wooden Dragon Year Predictions and Beijing’s Bazooka

Meanwhile in Tokyo …

Japan intervened last Monday just as the dollar was challenging the level of Y160. Powell’s press conference on Wednesday helped the yen by not laying the way for more hikes, but didn’t change things enough to relieve the pressure, Japan intervened again, this time with greater effect.

The currency remains historically weak, but the news now supports it, and it is no longer crashing into the abyss. An over-mighty dollar isn’t as much of a threat as feared.

FT reports that the Bank of Japan has used $59 billion to save the Japanese Yen. But government interventions this week fail to ease concerns about plunging currency. check FT

On her side Treasury Secretary Janet Yellen says the Bank of Japan should consult with her before intervening to support Japanese Yen.

Using formal and informal mechanisms, Chinese officials have resisted the pressure on the yuan. As a low-yielder, and with low volatility, the offshore yuan, like the Japanese yen, is a popular funding currency.

If Chinese officials were to step back and market forces were allowed a freer hand, the yuan’s decline would accelerate.

However despite China’s mercantilist policies, it does not appear to be using the exchange rate to boost exports. The offshore yuan surged on the back of the yen’s (likely intervention-induced) rally, and broader dollar pullback. Assuming it is reflected in the onshore yuan, it may help to create more space for monetary policy.

The key factor is not the market for goods but for capital. The bond market is not attractive, and investors are cautious toward Chinese stocks. The PBOC’s continued gold purchases capture the imagination of many observers and journalists, but Chinese investors themselves also appear to be keen gold buyers as they seek alternatives to the property market and local equities under the capital control regime.

FED : Not Dovish Yet

Federal Open Market Committee gave one of the most calmly received monetary policy announcements on record. On balance, when it comes to interest rate policy, they truly changed nothing, and didn’t depart from what had been universally expected

The governors added a new sentence to their statement from the last meeting in March to acknowledge that “in recent months, there has been a lack of progress toward the Committee’s two percent objective.” That evidently makes it harder to cut rates imminently, so stating this baldly has some significance.

People see and hear what they want. While Powell spoke softly at Wednesday’s press conference, the message was that rate cuts will take longer to come by in 2024, and longer will mean fewer rate cuts.

Powell has never been one to speak with harsh words. On top of that, market mechanics give this often false optical view that he is being dovish. But in reality, that is not what has happened.

This is a pretty clear statement and not a dovish one.

There is also a focus on the Federal Reserve’s plans to slow quantitative tightening. In theory, as the Fed slows the pace of QT, they should exert less upward pressure on long-term interest rates, and those rates should be lower than if QT continued at the old, faster pace.

Source : John Auther, Blomberg Opinion

But in practice, other developments in the financial system are likely to outweigh the effect of QT’s taper. Interest rates on longer-maturity government bonds are exceptionally low relative to shorter-maturity bonds considering that the economy is growing solidly, so there is likely limited scope for longer-term interest rates to fall before the Fed gets closer to cutting short-term interest rates.

Happy trades

BONUS

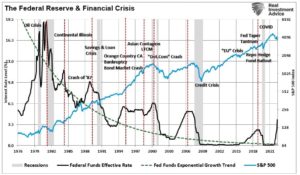

As a reminder do not forget that an interest rate cut is often linked to a Slowdown/ Receesion in the economy and that the Stock Market corrects at this time.

This year it might well collide with the Elections and we can count that the authorities will do whatever it takes (money supply) to avoid any collapse.

If the Fed embarks on a series of rate cuts without the appearance of a recession, then a resurgence of inflation becomes probable.