China : The Wooden Dragon Year : Predictions

February, 06 2024

Chinese New Year is upon us, and on February 10, 2024, we shall enter the Year of the Dragon ! Leaving the Hopping Rabbit . The Dragon sits in the 5th position in the Chinese Zodiac and is one of the most revered signs in China. The Dragon represents lively, intellectual problem solvers who are dignified and persistent.

In fact, ancient Chinese Emperors called themselves “the Dragon,” and used the dragon’s power to reign over their empires and personify their divine power. Dragons are also well known for their arrogance and impatience, and so when you put it all together, we must wonder what the Year of the Dragon holds for financial markets?

The Dragon is a majestic and lucky creature in Chinese folklore, symbolizing bravery, creativity, and innovation.

Based on the Oriental horoscope, most of the predictions revealed that the “Year of the Dragon”–particularly 2024, the Wooden Dragon year–will bring prosperity, authority and favorable outcomes.

According to the Chinese zodiac, the Dragon is the most powerful and auspicious animals. It represents strength, wisdom, luck and prosperity. 2024 would be a year full of potential and opportunities for personal growth, professional success, and social impact.

The Year of the Wood Dragon 2024 is also known as Yang Wood on Dragon, or Jia Chen 甲辰 in Chinese. The fixed element of the Dragon (Chen) is Earth (Wu 戊), which represents stability, honesty and loyalty. The variable element of the Dragon in 2024 is Yang Wood, or Jia 甲, representing growth, creativity and flexibility.

The Wood Dragon is the most creative and visionary of the dragons. They are optimistic, ambitious and adventurous. They like to explore new ideas and challenge themselves. They are also generous, compassionate and loyal to their friends.

Therefore, the Year of the Dragon in 2024 is expected to be a time of visionary leaders, innovators and problem solvers. 2024 is also predicted to be a great year to start new projects, explore new opportunities and create value for yourself and others.

The year of the Wood Dragon 2024 is special because it is a rare combination of the dragon’s power and the wood’s creativity. It is a year of innovation, vision and growth. It is a year to pursue your dreams, express your ideas and expand your horizons. It is also a year to be generous, compassionate and loyal to your friends.

Investing in Promising Industries during the Year of the Dragon

The word for “Dragon,” in Chinese is spelled “Lóng.” Automatically that is a good sign for markets, as we are always hopeful for long markets and lots of profit. Some of the most promising sectors for business growth in the Dragon Year 2024 are fintech, AI, cybersecurity, blockchain, and solar energy.

The well-positioned industries during this transformative period include digital media, AI technology and computer-related sectors, as well as social morals and beauty/cosmetics areas with a focus on digital finance.

These industries are driven by innovation and demand for cutting-edge solutions. To succeed in these competitive markets, businesses need to embrac

As businesses adapt to the changing energy landscape , where Fire is the dominant element, it becomes increasingly important for them to identify potential investment opportunities.e new technologies and communicate their value proposition effectively.

In the Year of the Dragon, the zodiac predicts that markets will hesitate until Summer. Predominant elements this year are fire and water, the later could douse any fire in the markets, and is expected to temper the fire heat in February and March. Then a huge surge will take place and a “Lóng” market takes us well into the next Chinese New Year.

Adaptability is key as we explore this energetic terrain. By welcoming change with open arms, we are more likely to create brighter futures full of plentiful rewards.

To compose with the Dragon it is important for investors to remain tactically constructive and nimble.

So welcome to the Year of the Dragon ! Good luck, and as they say in China, “Gung Hay Fat Choy.” (Best wishes and congratulations. We wish you a good and prosperous Dragon Year!)

China’s Struggling Economy …

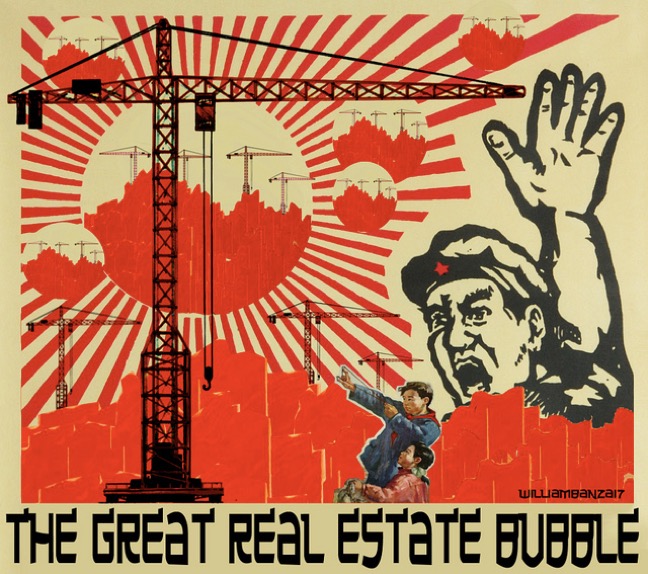

The world’s second-largest economy is experiencing a bumpy recovery from the Covid pandemic. As third-quarter GDP data confirmed, consumer spending is relatively healthy. The property market, on the other hand, remains in a state of turmoil. Then you have a depreciating currency in the yuan, which has ramped up pressure on China’s government to stimulate growth.

China is struggling to revive investor confidence after a particularly tough year for the world’s second-largest economy. But the negative headlines mask a more nuanced picture of an economy in transition, offering select opportunities in fixed-income and equity markets.

The good news is that China is on pace to meet its 5% growth target, albeit a conservative one. With the emerging market expected to deliver extra special growth this decade, stimulus measures have been effective but not enough to appease investors.

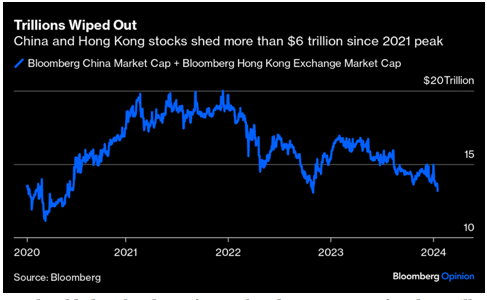

The past 3 years have been a very challenging period for Chinese equities. The CSI 300 is down some 46% from 2021 highs. You basically need to double your money to break even if you bought the highs…

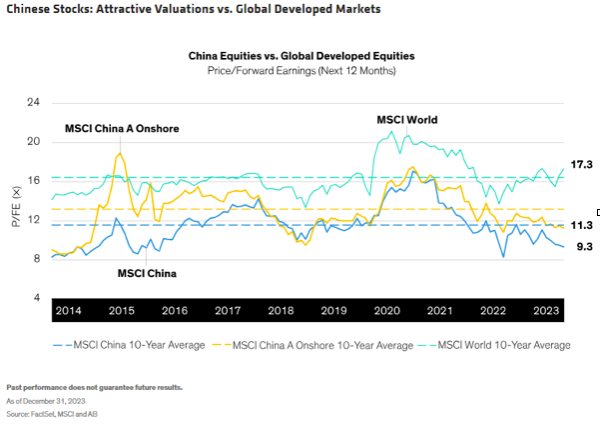

Given the sharp performance disparity between U.S. and China stocks, a rotation to the Far East may be a good portfolio strategy at the start start of the Chinese New Year.

The value of China’s equity market has never been this far behind the US.

After all, the Shanghai Composite is trading at just 12x trailing earnings compared to the S&P 500 at 21x. If China’s housing crisis improves and economic growth accelerates, investors could be in for some fiery gains in the Year of the Dragon.

On the other hand, MSCI’s indexes for the other emerging markets have tracked China’s almost perfectly for 20 years — but now the bet is that other EMs can prosper whatever happens in Beijing and Shanghai.

Could the rest of the emerging world conceivably continue to flourish if China’s corporate sector crashes in the way the market now seems to expect? It’s at least worth asking the question. A lot of optimism about a range of countries that have spent two decades growing by serving China’s insatiable appetite seems to be embedded in current assumptions (such as India).

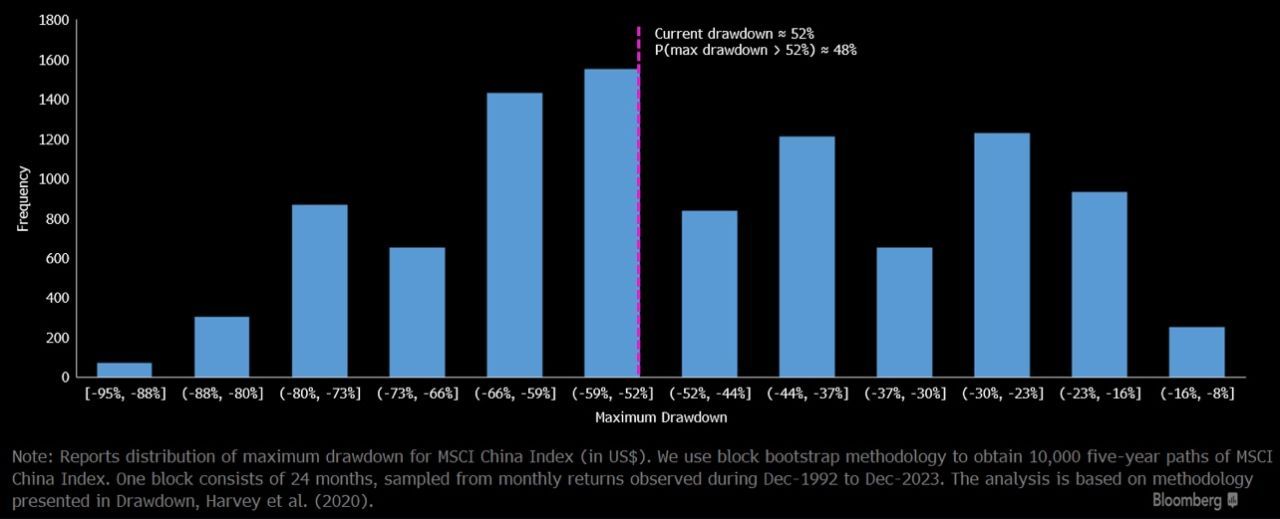

The probability of the MSCI China Index experiencing a 50%-plus maximum drawdown over a five-year period is 51%, during which the index can remain below its previous peak (aka time-under-water) for an average of 35 months. The probability of a 75%-plus maximum drawdown is lower but still significant at 12%, with average time-under-water of 36 months. -BI-

MSCI China Maximum Drawdown Distribution is below:

China saw a “dual-track” growth dynamics in China following the end of the pandemic. Services and industrial growth have taken the lead, while the property sector has been a drag on growth. This reflects the government’s concerted effort to focus on ‘high-quality growth’ instead of achieving numerical growth targets at any cost.

Chinese markets suffered because of government efforts to unwind the debt-laden property sector and the resumption of an anti-corruption campaign targeting various sectors.

During this economic transition, policymakers were reluctant to provide substantial support for growth, which can be viewed as an attempt to move away from China’s leverage-dependent growth model. As a result, corporate earnings were weak and investor sentiment soured.

China’s real GDP grew by 5.2% in 2023, according to official data released in January. While that’s a marked improvement from the 3.0% growth rate in 2022, it’s still a far cry from the pre-pandemic era, when annual growth averaged 7.4% in the decade through 2019.

… Masks a Promising Investing Landscape

Policymakers have shifted priorities from urbanisation-related investments that were largely dominated by property and infrastructure in the early 2000s, including residential buildings, logistics hubs, road, railway and bridges. The new focus aims at efficiently utilising the existing infrastructure to facilitate manufacture upgrade and the building of new infrastructure, such as 5G networks, EV charging facilities and innovation hubs.

These new forms of investment will foster more sustainable growth as China enters the next phase of development, leading more households to middle- and high-income classes

Growth rate may normalise this year as low base effects fade, but consumption — especially services consumption — to emerge as one of the key growth drivers in coming years.

Bloomberg has reported a potential $280bn rescue package for the Chinese stock market end of January. Apparently offshore accounts of state owned enterprises could be mobilised to prop up share prices.

Marvin Chen, a strategist at Bloomberg Intelligence noted that the potential support package should be able to stem declines in the short term and stabilize markets into the Lunar New Year. But state buying alone has historically had limited success in turning around market sentiment if not followed up by further measures.

Despite continued growth of more than 5% in China’s gross domestic product last year, the loss of confidence is palpable. It’s nowhere near so clear exactly what has undermined it. One view attributes this to Beijing’s attempt to rein in the financial sector, fulfilling a longstanding preoccupation to avert a potential Minsky Moment. Putting serious money into the stock market will tend to vitiate this effort by funding more financial speculation.

Other suggests that the plunge in sentiment stems from alarm that the government won’t in fact have the guts to head off a financial crisis. The latest selloff has come despite a surprisingly calm response to the Taiwan election.

As China’s economy transitions, policymakers have pivoted to nurture new engines of growth, including focusing on green investments, high-end manufacturing and the digital economy. We can expect more resources to be deployed into these sectors, contributing to positive long-term growth and partially offsetting some shorter-term structural headwinds.

The Chinese government has pledged a concerted policy effort to build a “Beautiful China”, which includes the adoption of a low-carbon development model to reduce pollution and pave the way for its long-term carbon neutrality goal.

One beneficiary of this is China’s electric vehicles (EV) market, says Liu, as policymakers have pledged to achieve 45% of EV adoption in newly-purchased vehicles in China by 2027, with accompanying measures to support the transition.

Equity investors shouldn’t be deterred by the housing sector’s woes, in our view. As the housing crisis fades further in the rear-view mirror over the next year or two, we believe the quality of China’s economic growth will improve. Targeted economic reforms could help China derive more economic growth from innovation in consumption, services, technology and higher-value-add manufacturing.

Turning The Dragon Into A Bull

Of course, the Shanghai Composite’s valuation is where it is because it has been assigned a ‘risk discount.’ But as the volatile market inevitably gets de-risked, these three stocks could benefit from having strong risk-reward profiles.

- An expanding market share in China’s massive e-commerce opportunity has Wall Street thinking 2024 could be the year of the bull for delivery company ZTO.

- Analysts are unanimously bullish on online gaming and services provider NetEase with a perfect 10 out of 10 firms calling the stock a buy.

- BYD zoomed past Nissan by selling more than 300,000 new energy vehicles during November while also taking market share from Tesla in China.

The long-term outlook for Chinese equities is promising, Chinese equity valuations are cheap compared with the last decade, and relative to the MSCI World Index of developed-market stocks.

It’s true that corporate earnings are currently depressed. But that also means there is real potential for an earnings rebound later in 2024, in our view. Earnings of Chinese onshore stocks are expected to grow by 16% this year, compared with 9% for global developed stocks, according to consensus estimates. A potential earnings recovery combined with today’s low valuations create attractive conditions for investors to initiate positions in Chinese equities.

As we enter a new era of lower growth, we think a value-oriented approach can be rewarding for equity investors. That means targeting select companies with attractive valuations that are aligned with the government’s commercial and policy objectives; for example, in businesses focusing on technology security and domestic decarbonization.

There are also opportunities in industrial cyclical firms, such as bus makers and forklift manufacturers with a strong international footprint.

China is changing, and transition often creates uncertainty in financial markets. But dislocations can also create opportunity for investors who don’t succumb to negative short-term sentiment and take a longer view of China’s economic journey toward healthier and more sustainable growth.

The Biggest Long Trade On The Planet

“A crisis is an opportunity riding the dangerous wind.”

Investor sentiment toward China has soured after a tough year for the economy and stock market. But the painful economic transition is also creating real opportunity. For stocks in the world’s second-largest economy, next year could be the year of the bull, as some major global banks are forecasting a resurgence by China equities.

In 2024, a potential pivot by the US Federal Reserve toward lower rates could help improve sentiment toward Chinese assets, though additional policies to stabilize the property market and support growth will be essential to bolster confidence.

According to BofA China led witnessed the largest inflow in equity funds since July 2015, amounting to $11.9 billion – the second-highest ever recorded. Epic deflation of property stocks makes China the world’s most enticing contrarian long “trade” (no-one believes it’s an “investment”).

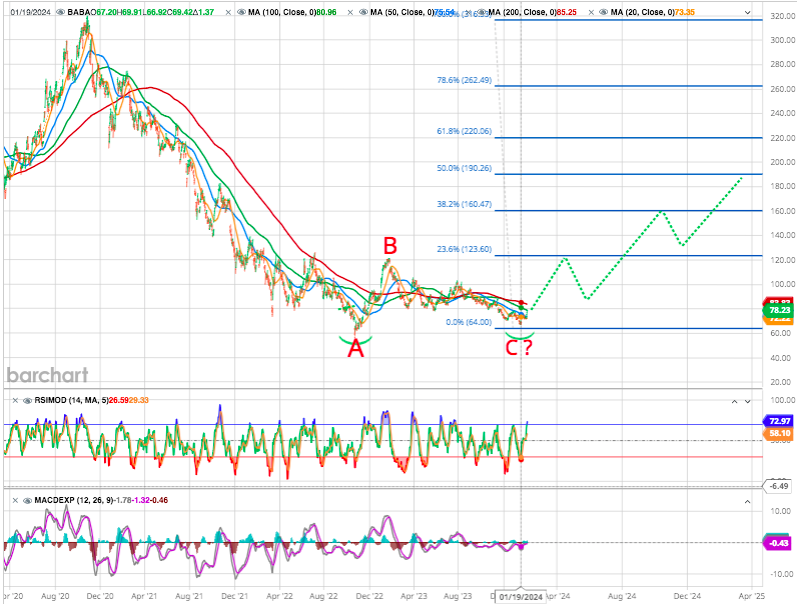

ALIBABA : The Fundamentals Are Talking

Alibaba founders Jack Ma and Joe Tsai are buying back stock, acquiring nearly $200 million worth in recent weeks. BABA might bet his kind of good contrarian play due to its low valuation and potential for a bullish move

From a stock-specific perspective, noted Lyn Alden, Alibaba is cheap and a likely good contrarian play on the long side at this point.

The main risk is geopolitical, and from multiple directions. China’s government aggressively cracked down on its tech companies including BABA in recent years, which turned foreign investors away from the stock market and resulted in the first negative flow of foreign direct investment in over 25 years.

As mentioned, China’s domestic population and government are showing signs of concern about the country’s bad stock market performance. The government is now turning toward stimulus that is specifically geared toward propping up the stock market.

This provides fertile ground for a significant bull market in BABA and similar stocks, but there are still a lot of nonlinear risks to the downside that have little or nothing to do with the companies themselves.

A bottoming process ?

Price has now made a higher high compared to the high that was made at the end of January. It’s still below the high that was made at the start of January, but certainly improving the probability that a bottom has been struck. It’s not completely confirmed yet.

Waiting for a larger 5 up as the wave successfully broke above the high struck earlier in January also improves that likelihood even more. We overlay Fibonacci retracements for objective purposes.

Stay tuned & Happy trades

China distorsion