Beijing’s Bazooka

February, 28 2024Our greatest glory is not in never falling, but in rising every time we fall. — Confucius

TAKEAWAYS

- Chinese banks cut a key reference rate for mortgages by a record amount. The five-year loan prime rate (LPR) was lowered by 25 bps to 3.95%, the first cut since June and the largest reduction since a revamp of the rate was rolled out in 2019.

- Lower mortgage rates can hopefully stimulate more home demand, but it will likely only narrow new home sales decline and property investment will still face severe pressure.

- The early and larger-than-expected RRR rate cut (Feb 5) shows that economic pressure pushes China to adopt a laxer monetary policy, especially in a temporary deflationary environment. The 1-year LPR rate has stayed unchanged.

- As such, the combination of policies in the upcoming months will be key to see if China’s outlook should be upgraded.

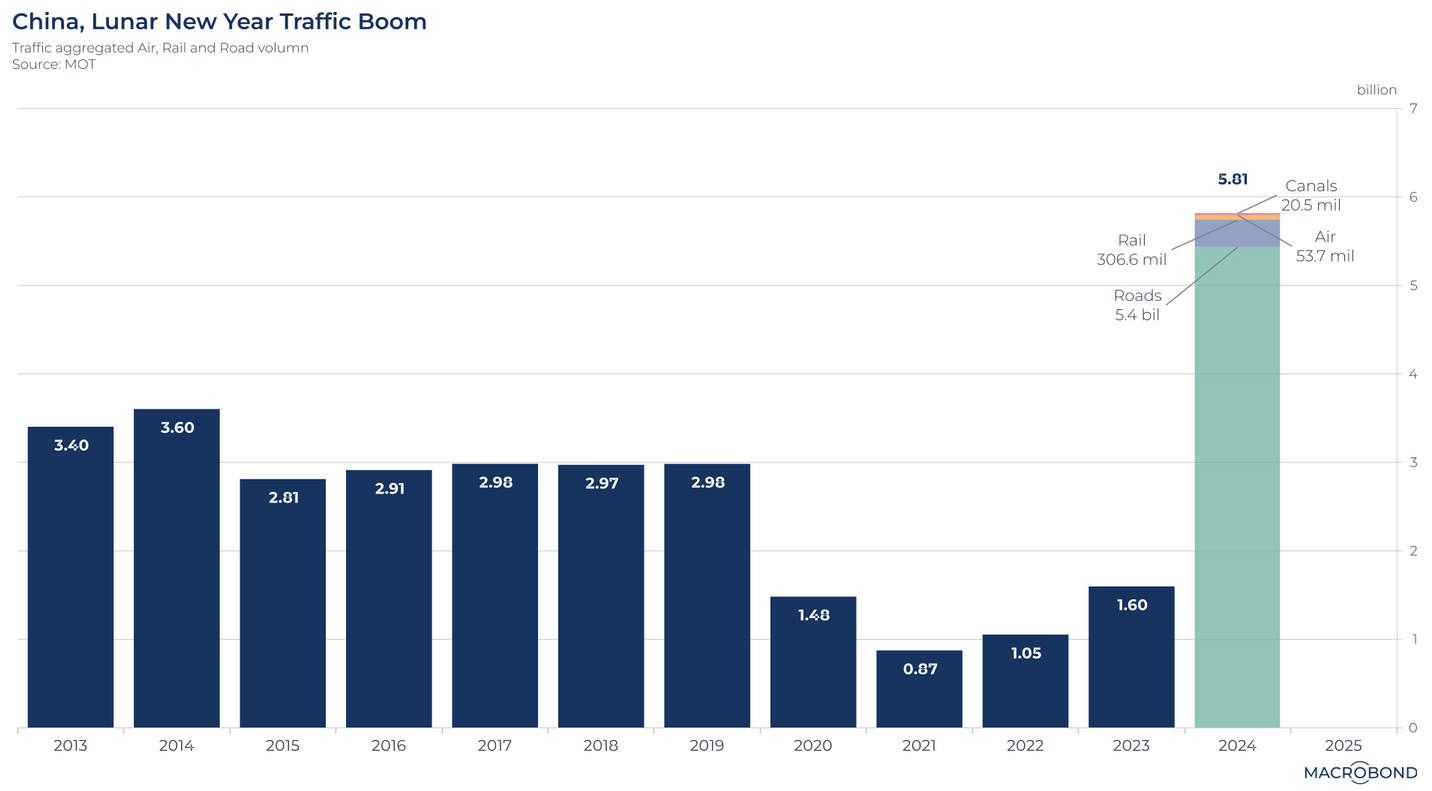

- Despite the looming pressure from the real estate industry, Chinese consumers remain resilient. Could domestic consumption become the new driver of economic growth as the government pushes forward to the service industry?

Recovery Road In the Year Of The Dragon

Beijing lately has been emphasising ‘high-quality growth’, which is a subtle way to acknowledge the reality of slower growth.

After decades of go-go growth fade in the rear-view mirror, Xi’s China may settle into a curious new phase. Even as it emerges as a technological superpower, its people feel that their quality of life is slipping into reverse.

For years, the great hope for China has been that it will be goaded into a “shock and awe” stimulus that will rally the rest of the world. Some strategists have openly rooted for things to deteriorate so that everyone else can enjoy some Chinese money.

The big move, announced on Monday Feb 19 , saw the People’s Bank of China slash the prime five-year fixed mortgage rate by 25 basis points, to just below 4%. Mortgage rates have never been cut by so much before.

This follows an aggressive move to reduce the reserve ratio (RRR) that banks need to keep when making loans, another direct stimulus to lending.

The currency is also a big part of the problem. Twenty years ago, China deliberately held its currency too cheap in a successful effort to flood the world with exports. Those days are long over.

The currency is also a big part of the problem. Twenty years ago, China deliberately held its currency too cheap in a successful effort to flood the world with exports. Those days are long over.

At this point, its problem is to avoid the yuan growing too weak. That makes it easier to sell stuff, but in the worsening trade environment it’s more important to maintain buying power.

That colored the way authorities chose to administer their stimulus. The mortgage rate doesn’t directly affect bond yields and has minimal impact on foreign exchange, so it was cut sharply.

Once the Federal Reserve will reduce interest rates in response to falling inflation, expected in summertime, the PBOC will be able to ease monetary policy more aggressively as Fed rate cuts will reduce downward pressure on the CNY.

But lower interest rates alone in China will be unlikely to revive confidence in the subdued economy. Instead, further fiscal stimulus and property measures will be needed.

But with the exception of a relatively small stimulus for property, such strenuous fiscal interventions are no longer in Beijing’s preferred playbook, nor do they fit with a Xi mindset that elevates security and self-sufficiency above all.

It is unlikely to do debt-fuelled stimulus, which would exacerbate the structural imbalances, impair China’s credit rating outlook and constrain long-term growth.

Even after this not-so-shocking, less-than-awe-inspiring move, China will need to do more to re-energize its economy and stock market.

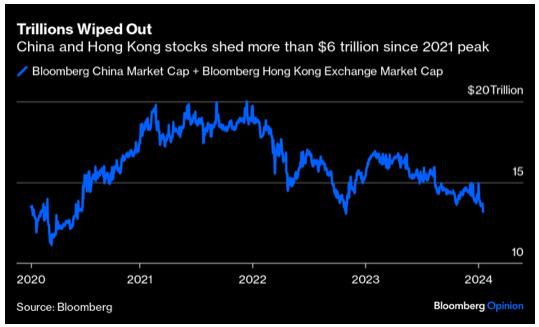

The benchmark CSI 300 index plummeted to a five-year low last January, with Chinese and Hong Kong stocks in aggregate erasing more than $6 trillion in market value since their peak in 2021. That’s roughly equivalent to the entire market capitalization of Japan.

The PBOC’s move can be taken as an unequivocal signal that Chinese authorities are now all-in on supporting the housing market. These factors, coupled with a rapidly ageing population and intensifying trade friction with both the US and EU, feed into a growing consensus:

China’s troubles are not transitory but rather long term and structural in nature.

The dragon is not turning into a bull yet !

Any rally like the one seen since the end of the lunar holidays needs to be taken seriously. It shows people have an appetite to buy, and that the government wants to prod them in that direction. However, none of the measures causing excitement gives any good reason to believe that China can stage a prolonged bull market.

For the longer term, investors might want to ponder whether they really wish to invest in a market that appears wholly beholden to help from regulators, and leaps at the first suggestion that the government will be propping it up.

Then, if China continues to ward off a major economic recession, the rest of the world can enjoy the Year of the Dragon. But until this moment, none of the measures causing excitement gives any good reason to believe that China can stage a prolonged bull market.

For the longer term, investors might want to ponder whether they really wish to invest in a market that appears wholly beholden to help from regulators, and leaps at the first suggestion that the government will be propping it up.

There is no proof yet that this market is the Wooden Dragon spreading its wings, or just a dead cat bouncing.

See our Chinese horoscope predictions