MARKETSCOPE : The Sum of All Fears

October, 23 2023Be ready for the «Unknown unknowns» ie another Black Swan

With the latest geopolitical developments, the global situation is very bleak at present. Things are very tense and the situation on the financial markets is unclear. Another tough week as markets tried to get a clearer view.

Check our Investment Strategy and Asset Allocation Update for more details

Financial markets have just endured another turbulent week, with bond yields continuing to rise and geopolitical tensions gaining momentum. Corporate results were mixed, prompting traders to adopt a cautious approach.

Jerome Powell further dampened the mood, declaring that further monetary tightening may be warranted if US growth remains stronger than expected and the job market remains tight. The Fed Chaiman declared

“Given the uncertainties and risks, and how far we have come, the committee is proceeding carefully. We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks.”

But as it stands it looks very likely that Powell and his colleagues will skip hiking rates for two consecutive meetings, for the first time in their 19-month tightening campaign.

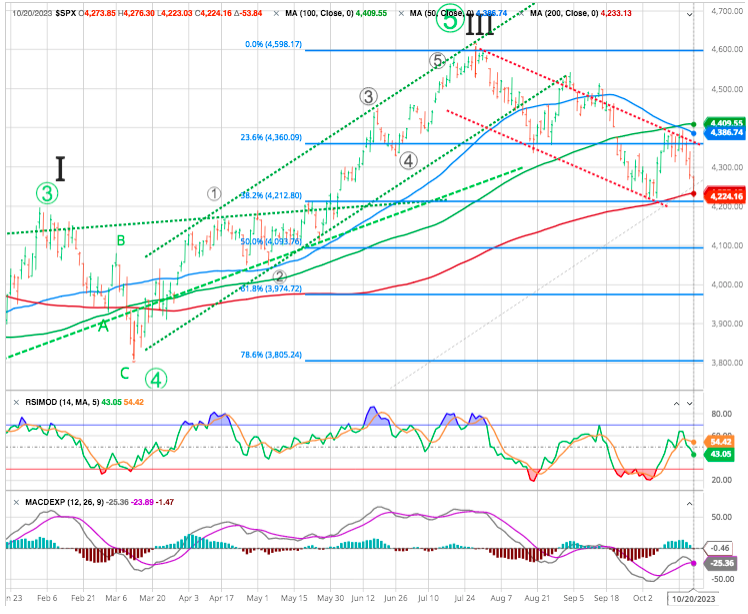

Geopolitical concerns, tough talk from Fed officials, and a rise in long-term bond yields to 16-year highs appeared to weigh on sentiment and drove the S&P 500 Index to its biggest weekly decline in a month. The Nasdaq fared worst among the major benchmark. Growth stocks lagged their value counterparts.

Geopolitical concerns, tough talk from Fed officials, and a rise in long-term bond yields to 16-year highs appeared to weigh on sentiment and drove the S&P 500 Index to its biggest weekly decline in a month. The Nasdaq fared worst among the major benchmark. Growth stocks lagged their value counterparts.

The yield on the benchmark 10-year Treasury crossed 5% for the first time in 16 years on Thursday, a level that could ripple through the economy in higher rates on mortgages, credit cards, auto loans and more – plus, it offers an attractive alternative to investing in stocks. See below

Europe, Japan and China equities dropped sharply over the week.

Rising U.S. Treasury yields will continue to weigh on stock markets at the start of a week .

The European Central Bank will announce its interest rate decision on October 26. The ECB is expected to hold rates steady after firing off 450 points of rate hikes since July 2022. As for the Federal Reserve, members will be in a blackout period ahead of the next FOMC meeting in November, but the “higher for how much longer” guessing game will go on.

There’s a lot on the plate for investors this week as they continue to work their way through earnings season.

Headlines are now shifting from the big banks to mega-cap tech, with Tesla (TSLA) already kicking things off last week for the “Magnificent 7.”

The major tech players have already witnessed big gains in 2023 from the artificial intelligence frenzy and their quarterly results could spark outsized impacts on the broader market. Without the mega-cap tech group, earnings on average for S&P 500 companies would be down 5%.

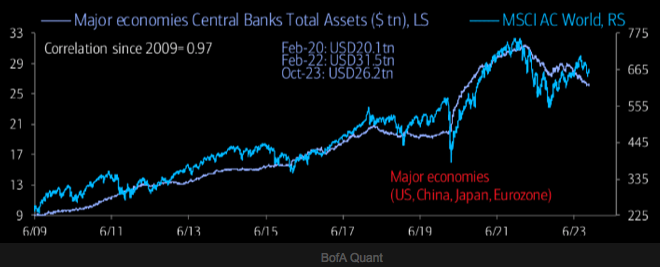

MARKETS : QT still in play

Quantitative tightening may have taken a backseat in recent months, but is still very much in vogue.

Obviously in time it will weigh on markets and we remain very cautious and defensive in our positions.

The S&P 500 is just struggling the 200 dma which might help to refrain the downtrend. We keep our first target a minimum of 3980 (the 50% retrace of the 2022-2023 rally), and potentially below 3491.

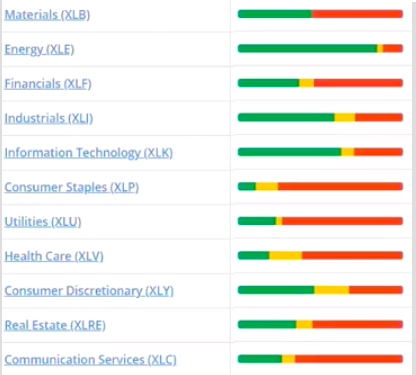

Looking at our oscillator DECIDER system (check here) for the US sectors only Energy, IT, Discretionary and Industrials look attractive. We recommend to stay with the defensive.

When do we end this bear market ?

Unknown and unknowable at this time. Yet we sense that once investors see rates level out or pull back…then stocks will be back in fashion once again.

Do not expect a roaring bull market. Higher rates will lead to a lower earnings growth environment which mutes stock returns. Gladly those with an advantage will be able to easily top the modest returns of the S&P 500.

While this time may seem different in the short term, the unintended consequences of monetary polices have always manifested themselves in the long term.

US 10 year going parabolic

The trend lines are getting steeper and steeper. This move is going parabolic. The golden cross from mid July has been truly golden…

SG strategist Albert Edwards noted “As US bond yields surge ever higher, do you feel like you are in a car you just know is about to crash but are powerless to stop? All you can do is brace yourself and hope for the best. Meanwhile, the ‘maddest chart’ just got even madder.”

However, we can take comfort in the fact that the 10-year is close to 2006-2007 horizontal resistance around 5.30%.

Happy trades