MARKETSCOPE : Irrational Exuberances

July, 24 2023Market timing has become mission impossible.

There is simply less adhesion to the trends of the past given the growth of computer based trading versus decisions made by people on the fundamentals displayed through a prism of emotions (fear & greed).

Amidst the intensifying quarterly earnings season and the pending rate decisions by the Fed and ECB, financial markets traded in a mixed manner throughout the week.

U.S. equity indexes advanced on hopes that the tight labor market and moderating inflation would help the economy avoid a hard landing. The Dow Jones is up 10 days in a row, which is the longest winning streak since February 2017. The Nasdaq, which posted last Thursday its worst session since March, suffered a modest pullback on the week on the back of Tesla and Netflix earnings.

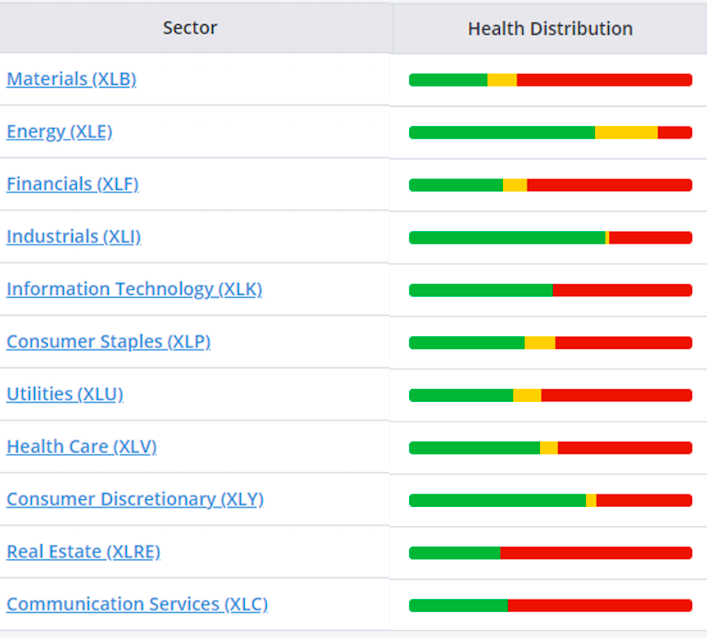

Of the 11 S&P sectors, six ended trading in the green, led by Utilities and Health Care. Communication Services and Industrials topped the losers. Value stocks outperformed their growth counterparts.

Chart of the 11 sectors’ YTD performance and against the S&P 500

Quarterly earnings will largely dominate the spotlight.

Perhaps the most eagerly anticipated results were from Netflix and Tesla, with both household names turning in a disappointing showing. The streaming giant missed on revenue expectations and issued underwhelming guidance, while the electric vehicle leader slumped on profitability and margin concerns.

While the bulls are hopeful that the end of rate hikes will support the bullish rally, the disinflation in both CPI and PPI suggests earnings will be weaker than analysts’ current expectations.

Treasury yields stabilized after surging in Thursday’s session, partly due to economic data that showed a continued fall in initial jobless claims. The longer-end 10-year yield was down 1 basis point to 3.84%, while the more rate-sensitive 2-year yield was up 1 basis point to 4.85%, leading to a further inversion of the yield curve as investors appeared to price in a near certainty of another Federal Reserve rate hike at the central bank’s July 25–26 policy meeting.

Investors continued to celebrate the end of monetary tightening a little early. At the same time, US macroeconomic indicators looked bleak during the week, with retail sales and industrial production at half-mast. The same was true of the housing market and building permits. This deterioration in statistics is rather in line with investors’ beliefs that the US central bank will complete its rate hike cycle next week.

Investors continued to celebrate the end of monetary tightening a little early. At the same time, US macroeconomic indicators looked bleak during the week, with retail sales and industrial production at half-mast. The same was true of the housing market and building permits. This deterioration in statistics is rather in line with investors’ beliefs that the US central bank will complete its rate hike cycle next week.

STOXX Europe 600 Index ended the week 0.95% higher despite the news that Eurozone economy skirts recession (based on revised figures). Two of the leading hawks in the ECB appeared to moderate their stance on future interest rate increases.

The week will be dominated by central bank meetings, with the Federal Reserve and the European Central Bank both poised to deliver rate hikes, while the Bank of Japan stands pat.

The key question is how strongly Fed Chair Jerome]Powell will nod toward the ‘careful pace’ of tightening he advocated in June, which we and others have taken to imply an every-other-meeting approach. A rally in U.S. equities markets faces an inflection point investors are focusing their attention on whether this is likely to be the final hike of its tightening cycle.

The earnings season hits full swing this week with 150 S&P companies due to report. The list of heavy hitters due up at the earnings plate includes Microsoft Meta Platforms, Boeing , and Coca-Cola .

MARKETS : Mind the Gaps

The return of big tech. HeatMap / YTD /Market Cap Ranked by 2023 performance:

1. NVIDIA +174%

2. Meta (Facebook) +129%

3. Tesla +117%

4. Amazon +49%

5. Apple +45%

6. Alphabet (Google) +32%

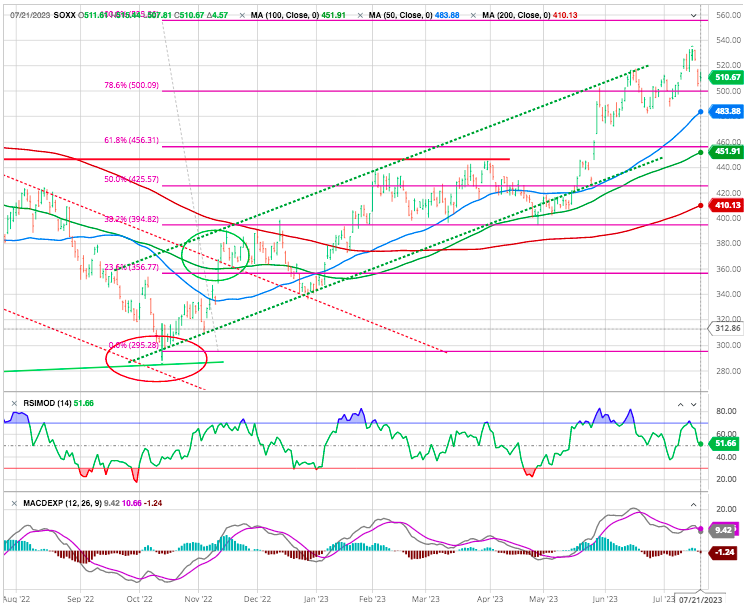

Looking at the Semis (closely related to Nasdaq) we note that we are at 78.6% Fibo retracement but moving lower. A drop to the 61.8 % is possible.

Is this the beginning of something bigger or not? Either way, global chip stocks had a poor week this week. Note that most names are trading at the same levels we traded at almost a month ago. Is the perceived AI bull stronger than the actual one?

Check how the latest developments in AI have been fueling the market.

NVidia (Blue) Tokyo Electron (orange) Taiwan Semi (purple) ASML (green)

Our Sector Oscillator Tool (see The Decider- The market is always right)

continues to point toward some Defensive sectors : Health care, Consumer Staples, as well as Discretionary. The favorable Industrials or IT point to this ambivalent market situation. Energy remains positive but would not recommend it yet.

Reality Check

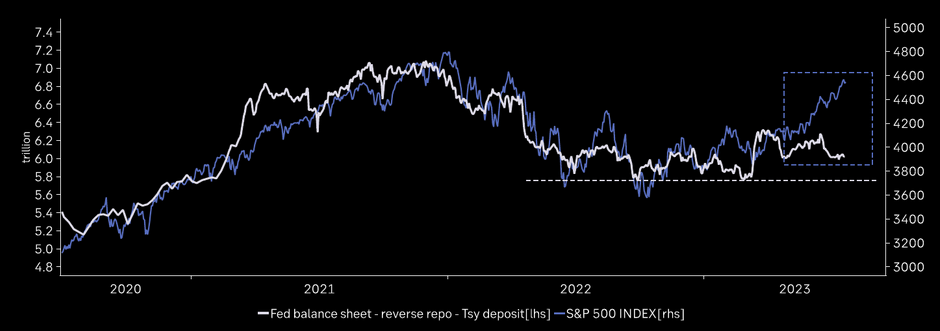

If you are wondering about the recent market action, then you can’t miss what’s happening with the most important indicator that drives stocks!… The liquidity.

The Central Bank liquidity is plunging at a record pace as TLTRO repayments pick up speed in Europe and Fed’s QT accelerates post the SVB expansion. Furthermore, the Fed wants tighter financial conditions to transpire so that the monetary policy effectively deals with inflation.

Do chase the liquidity before you make decisions about your hard-earned money.

Happy trades

BONUS Soundtrack

Market timing has become mission impossible.