MARKETSCOPE : Don’t Fight the FED

June, 20 2022A Market of Devastating Confusion

Nothing is permanent except change. – Heraclitus

Indeed “Change is always and everywhere at work; it strikes through causes and effects, and leaves nothing fixed and permanent.” wrote the stoic philosopher.

Signs are everywhere

In the decades since the last great inflation, investors came to rely on an inexorable trend toward rising equity and bond prices. In times of economic stress, the two tended to move in opposite directions, and this rewarded portfolios that were leveraged long. Amplifying this dynamic was a mega macro trend toward globalization, which encouraged investors to structure businesses and portfolios to optimize for higher returns. But all choices incur costs, and the price was an increase in economic and market fragility. It now appears that these mega macro trends are reversing. This is utterly unfamiliar territory.

Clouds multiplied in the past couple of weeks over stock markets: while the World Bank and the OECD lowered their growth forecasts and US inflation reached a 40-year high in May at 8.6% year-over-year and UK inflation remain at 40-year high levels.

The Federal Reserve has implemented its largest interest rate hike since 1994, taking the threat of inflation seriously by intensifying its campaign against surging prices. A flurry of central banks have decided to raise rates drastically (Fed +0.75%, BoE +0.25%, Swiss National Bank +0.50%).

In terms of the stock market things will largely depend on whether investors believe the Fed will be successful in pulling off a “soft landing,” by stabilizing inflation without denting economic growth.

In terms of the stock market things will largely depend on whether investors believe the Fed will be successful in pulling off a “soft landing,” by stabilizing inflation without denting economic growth.

Investors will strap in the week for more interest rate reality, with Federal Reserve Chairman Jerome Powell due to testify before Congress and expected to reiterate the need to combat inflation through aggressive rate hikes.

The S&P 500 Index recorded its worst weekly decline since March 2020 and entered a bear market, ending the week nearly 24% below its January peak. Meanwhile, the Dow Jones has now had 11 down weeks out of the last 12. This has never happened before. While US stocks rallied after the FOMC rate decision, the mood on Wall Street worsened on Thursday on the back of weak macro numbers. Indeed, several reports (housing starts, building permits) indicated that the US housing sector was already feeling the impact of Fed tightening and the surge in mortgage rates. Moreover, US retail sales were lower than expected while weekly jobless claims came in higher than expected. Inflation and rate fears pushed the yield on the 10-year US Treasury briefly to 3.49% on Tuesday (highest in more than a decade) before retreating to 3.24% by the end of the week.

SEE our report Bonds warning: Raise interest rates or we’ll do it for you

Shares in Europe fell sharply on concerns that economic growth may stall after several central banks announced rate increases. The SNB unexpectedly raised interest rates for the 1st time in 15 years, by 50bps to -0.25%. The BoE raised rates to 1.25% (+25bps). Meanwhile, The ECB held an unscheduled meeting and indicated it would take action to stem the widening yield spreads between member states’ sovereign bonds.

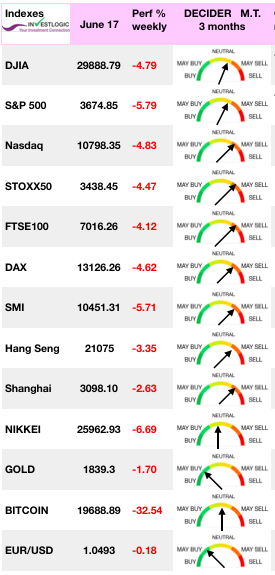

MARKETS

There is no shortage of reasons to justify the debacle of financial markets over the past few sessions. The appetite for risk has faded very quickly, leading to a clear sell-off in most sectors. Only energy stocks are surviving, as oil prices remain at their recent highs.

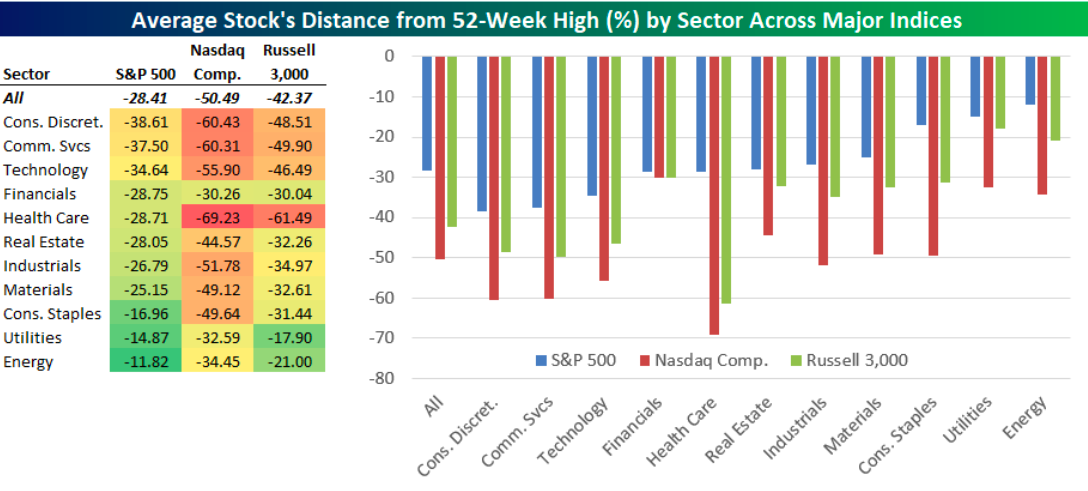

The average stock’s drawdown by index: S&P 500: -28.4% Russell 3,000: -42.4% Nasdaq Composite: -50.5% (courtesy of Bespoke).

It is not surprising that we are getting many questions inquiring whether we are near the “bottom” of the current selloff. Picking the bottom of a “bear market” is always more luck than skill. However, some technical signals and supports suggest we may be closer to a bottom than not.

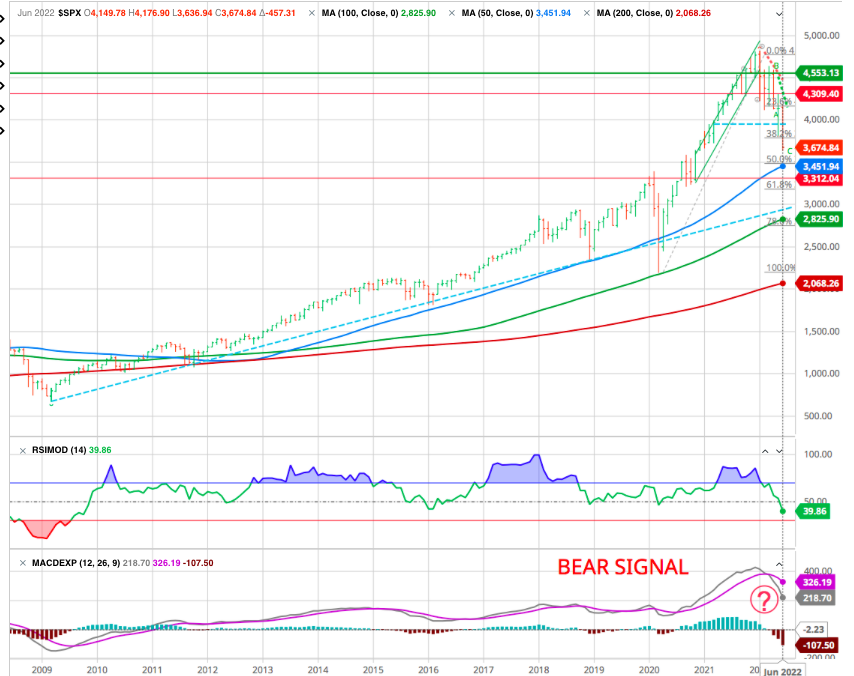

Those who have been our readers for a while has already seen some iteration of this chart, but we bring it up again today because it has proven to be one of the most reliable charts to date. It is essential to understand when we are looking at charts, sometimes it is not about the actual chart itself but rather what the data means and the implications.

The secular uptrend (doted blue line)is still intact but the market has still some wa to move lower before testing the trend line (approximately 3000). A oscillating process could take place during summertime with ups and downs before stabilizing.

The indices have reached our downside targets in this first downward movement.

With the market completing a topping process and violating important support at the 38.2% Fibonacci retracement level, the next logical support is 3500. Such a correction would wipe out all the gains since the 2020 peak.

If the market fails to find support at 3485 (50%), 61.8 % becomes the next logical level- 3180.

Same is true for other indexes. On the NASDAQ we are close to our 61.8% correction at 10250 with a small support at 10800.

A bullish counter trend rally could be confirmed with a target to 11700 (S&P500 at 4000) also closing the panic selling gaps .

Furthermore, the market selling as of late has been brutal. As noted by BofA:

“More than 90% of stocks in the S&P 500 declined today. It’s the 5th time in the past 7 days. Since 1928, there have been exactly 0 precedents. This is the most overwhelming display of selling in history.”

Number of stock above 200 DMA

While none of this data “guarantees” a market bottom is near, history suggests the odds of a counter trend rally remain.

BUT the biggest near term concern might be earnings

Companies are likely to be far more worried on their next conference calls in the kind of abrupt pivot that has not occurred since 2007.

Given that valuations remain elevated by historical measures, realizing economic recession risks requires further repricing for a coming earnings recession. (Fed rate hikes precede economic slowdowns, recessions, and earnings reversions.)

Corporate outlooks will shift dramatically as earnings are revealed.

For now patience is paramount.

The same is true for the other markets ie : Switzerland

The Swiss National Bank (SNB) raised its key interest rates on Thursday from -0.75 to -0.25%. In recent weeks, Swiss bonds have lost more than 5%, while the equity markets have undergone an even stronger correction.

The SNB’s interest rate hike does not change our outlook for the overall market development. As long as the economic situation remains intact, we can expect further interest rate hikes and a further increase in capital market interest rates. This could continue to put pressure on the bond and equity markets. We were already prepared for this scenario by positioning our portfolios.

Achieving a 50% correction at 10450 we could go back to the new resistance at 11500 before finishing the 61.8 % correction at 9800.

For traders with an appetite for risk an opportunity in oversold stocks could arise. For the investor, however, it would be better to remain cautious.

Globally, the risks of an international recession have increased and could also increase in Switzerland due to higher inflation, rising interest rates and a stronger exchange rate. While a new recession could lead to a reversal in the bond market, equity markets would probably also suffer in such a scenario. Therefore, we maintain our recommendation to remain patient and keep the risk in portfolios low for the time being.

GOLD

The precious metal has delivered what it is supposed to do: it has outperformed most asset classes this year when others have plunged, although the Federal Reserve’s more aggressive tightening of monetary policy has weighed on the gold price, which is trading around USD 1,840.

CRYPTOS

Cryptocurrencies: had their worst week since March 2020. Bitcoin had a difficult week. The digital currency is shedding 20% of its capitalization this week and is now back to hovering around $20,000. A price zone that represents the peak of bitcoin’s price during its 2017 bullish rally. After losing 70% of its capitalization since its all-time high of $69,000 last November, the fall could be extended further in this hyperinflationary environment unseen in the digital asset’s short history.

See our analysis Tulipmania Meets the Real Economy

Not helping the situation was an announcement from Celsius, which is one of the largest crypto lending platforms (topping $20B in assets last August). The DeFi giant paused all withdrawals due to “extreme market conditions,” as its CEL digital token went into freefall, plunging over 50% to $0.20 in less than 24 hours.

From the next cycle’s view, we are probably near the bottom but that doesn’t mean that price can nuke 50% further.

FED Bluff

Jerome Powell decided that a “Fed bluff” was the right call to assuage the markets in light of the increase.

“There is no sign of a broader slowdown in the economy that I can see.”

Combine this with 50 Year High Inflation , War, FED hiking into a slowing economy, QT, Supply Chain shocks, Sanctions/Embargoes, Energy soaring, and Gas at $4-5 in every state in America for the first time in history.

Ask yourself this, if this recipe isn’t enough for concern, what exactly is?

Eventually we are in unprecedented times. The FED is behind the curve and now they are trying to gain back control of the Inflation Train but there is only one problem; the train has already left the station.

“Don’t fight the Fed.”

This phrase was reportedly coined by renowned investor Marty Zweig decades ago. But it took on new life following the financial crisis, when billionaire investor David Tepper referenced it in a now-classic CNBC interview on Sept. 24, 2010.

At that time, the Federal Reserve was doing everything in its power to juice the economy and push stock prices higher. Stocks were up significantly from their 2009 lows, yet many investors were still shell-shocked and hesitant to get back into the market.

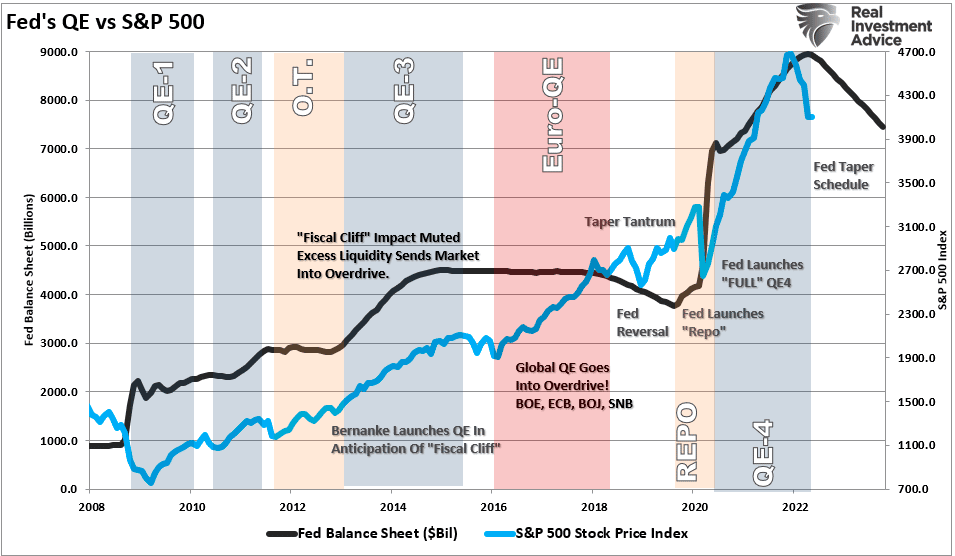

At previous market bottoms, the Fed was cutting rates to zero, introducing QE programs, or providing other measures of monetary liquidity.

Today that is not the case, as the Fed is just starting to reduce its balance sheet and hike interest rates aggressively. The reversal of liquidity suggests that any short-term bottom in stocks may not be “the” bottom, particularly as the economy approaches.

When the Fed reduced its balance sheet in 2018, it ran at a pace of $30 billion monthly with very low inflation. Starting this month, the Fed will be ramping up that reduction to 3-times the previous run rate, with inflation at nearly 9%.

While they believe they can achieve this reduction without disrupting the equity markets or causing an economic contraction, history suggests otherwise.

Because of the combination of surging inflation, high debt levels, and inflated stock valuations, one of two things is likely to happen.

High inflation will peak and reverse on its own, the economy will begin to slow, and corporate earnings will fall. Or inflation will remain elevated and the Fed will continue to jack up interest rates until it creates a similar result through monetary policy.

Either way, the overall stock market is likely to continue to struggle until valuations reach bargain levels or the Fed stops tightening.

In other words, folks who are rushing to “buy the dip” today are arguably making the same mistake as those who were afraid to buy stocks back in 2010.

The Fed is literally telling us they’re willing to sacrifice the stock market to kill inflation. Until that changes, we’d be foolish not to believe them.

In any case, sooner or later, economic reality (there’s that word again) will require the U.S. and other Western governments to reverse these policies.

The determination of the world’s big money makers to turn off the liquidity tap is raising fears of a recession, as the demand shock looms (the latest indicators in the US and Europe are hardly encouraging).

There simply isn’t any alternative unless we’re willing to return to the Stone Age. The only question is how bad things must get – and how many of the world’s most susceptible people have to freeze or starve – before that happens.

In the days and weeks ahead, investors will be keeping their fingers crossed that the fight against inflation does not turn sour. They will also be looking for the inflection point at which central banks will feel that their policies are too restrictive and will start to ease again.

But clearly, we are not quite there yet.

The Russia/Ukraine conflict, rising interest rates, and soaring commodity costs exacerbate the collapse in confidence. Such has already significantly tightened monetary policy, elevating the risk that the Fed will again make another “policy mistake.“

STRATEGY COMMENT

The reality is, we can’t be certain how bad things could get before the Fed resumes easing. And given its relatively poor track record in the past, it’s possible the Fed could misjudge the risks and respond more slowly than we expect.

So we urge you to continue to be conservative with your investments for now. That means holding primarily healthy stocks in healthy sectors, avoiding most high-risk, speculative assets, and holding plenty of cash. And please, whatever you do, don’t hesitate to sell if your stops are hit.

If we are right about the Fed’s eventual response, we’ll have plenty of opportunities to profit when the time is right, even if we do get stopped out in the meantime.

Happy trades