RISING SUN

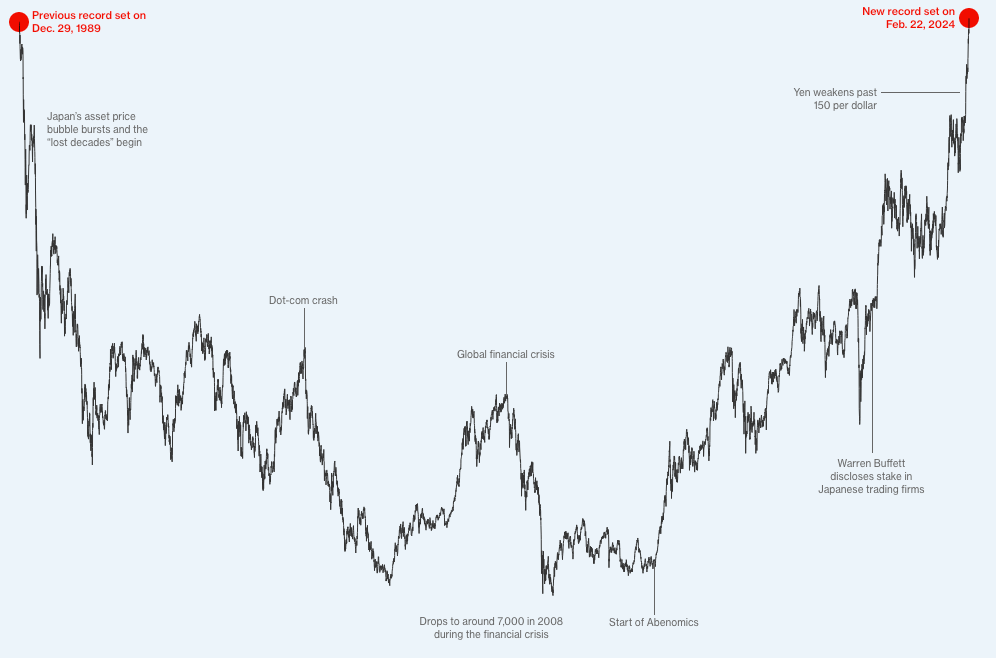

February, 24 2024Japanese stocks have reclaimed the historic peak reached over 34 years ago as global investors pour money into a country they’re betting has finally escaped deflation and is headed on a path of sustainable growth.

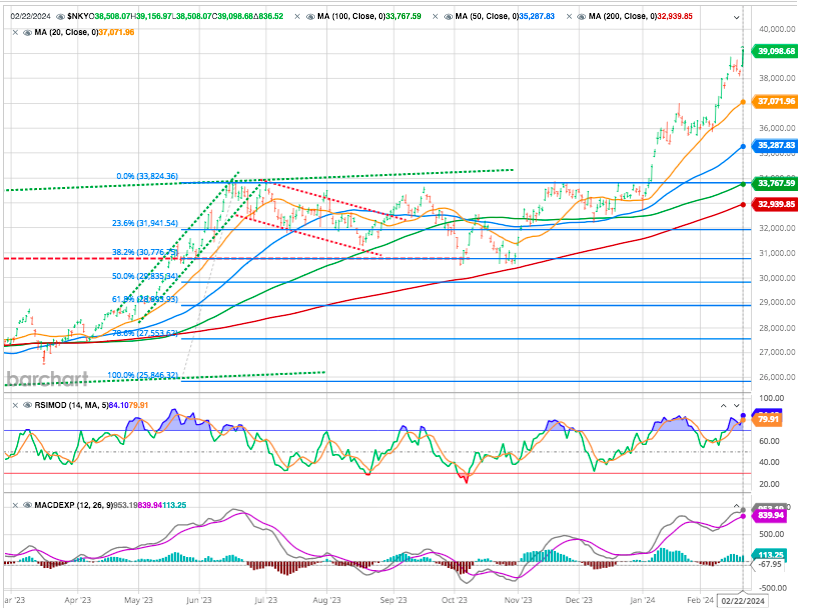

Last week, the Nikkei 225 closed at 39,098.68, finally breaching the previous record. The leap was driven by gains in technology shares and chip-gear producers after Nvidia’s blowout sales forecast. The epic come-back — it took even longer than Wall Street’s recovery from the crash that sparked the Great Depression — marks a rebirth for Japan’s share market.

Back then, the nation’s equities had risen so far and so fast that there really was only one way to go: down. 1989 was very likely the biggest bubble in human history.

Today, despite some lingering concerns the rally may be a false dawn, most analysts and investors believe that the stock market is on much firmer ground.

We recommended the Japanese Stock Market in our Strategy &Asset allocation on July 2023.

A more shareholder-friendly corporate culture has taken hold and steady gains in Japan look appealing to funds that have been burned by turmoil in markets like China.

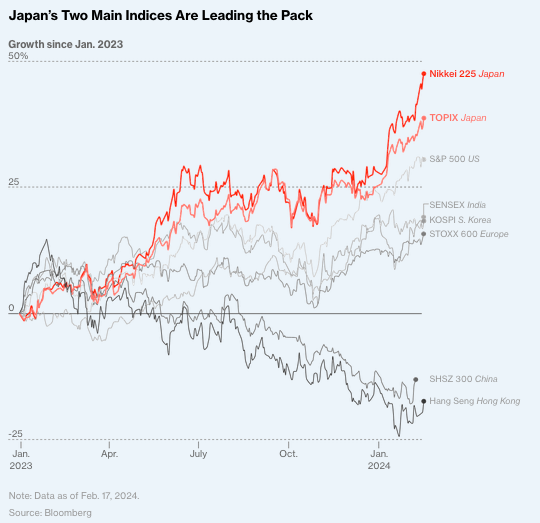

Outpacing Rival Global Markets

One of the key catalysts for the rebound is that signs of inflation — and the country’s anticipated exit from negative rates later this year — are encouraging companies to put their piles of cash to work on expanding and improving their business.

Luminary investor Warren Buffett boosted his holdings in Japan’s biggest companies, an endorsement that’s further increased the allure of Tokyo stocks. Since the start of 2024, the Nikkei has surged over 16%, beating most other major markets.

The outperformance is even more striking over the past 12-months or so.

Foreign Flows

While there are still reasons to be cautious about the rebound — skeptics suggest that funds could rapidly flow back to China if sentiment shifts and worry that the Nikkei has become a momentum play — overseas investors have mostly put these aside.

They are the driving force behind the rally, accounting for almost 70% of trading in the broader Topix Prime Index of stocks, while domestic buyers have largely sat on the sidelines. Institutional investors have pared their portfolios and individual Japanese investors are flocking to the US and other markets abroad following the expansion of special tax-free accounts in January.

All the while, global buyers have absorbed the selling, with their holdings rising to 30%, from less than 5% in 1989.

It took a long time for global investors to accept that Japan had changed. Now, after consistent corporate earnings growth and profitability improvements, there is greater agreement overseas that “Japan is in a secular bull market.”

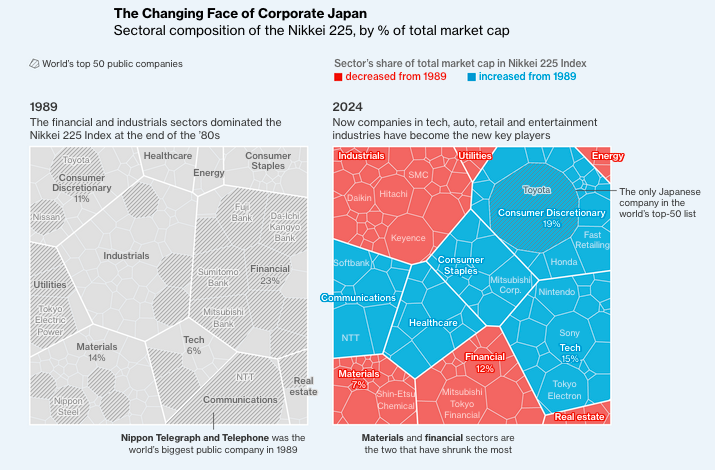

The Changing Face of Corporate Japan

In another sign of the great changes over the past three-plus decades, in 1989 Japanese companies accounted for 32 of the top 50 companies by global market capitalization. Today only one Japanese company, Toyota Motor Corp., makes the global top-50 list.

Back in the late 1980s, Japanese banks were the true heavyweights in the market, thanks to inflated asset prices. The market is more balanced and diverse now, with major companies including Sony Group Corp., casual clothing chain operator Fast Retailing Co., the parent company of Uniqlo, and companies that hold key positions in the vast semiconductor supply chain, such as Tokyo Electron Ltd., which has benefited from a surge in orders from China.

Growth Potential

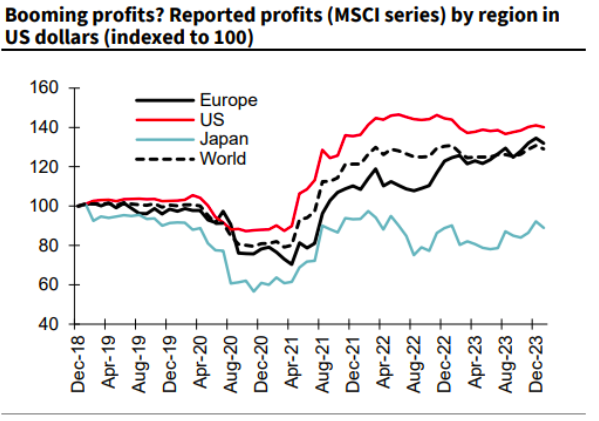

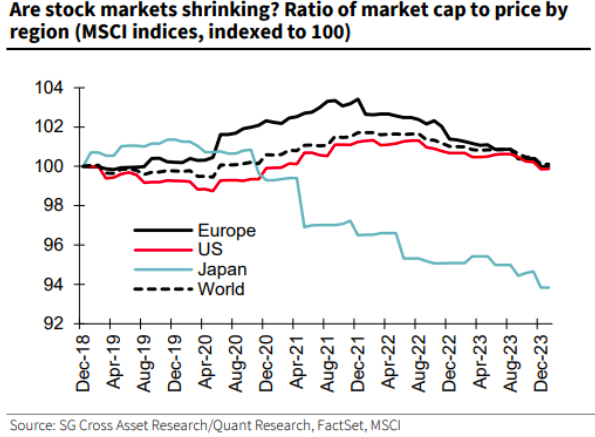

There’s plenty of room for growth because, as SocGen explains, profits are still below their pre-pandemic level, while market cap as a proportion of GDP is falling. Again, this differentiates Japan sharply from other markets and suggests there’s value to be had.

Source : SG Cross Asset Research / Factset / MSCI

Even after this year’s rally, many Japanese stocks are still at depressed levels, with 37% of Nikkei members trading below their book value.

In theory, this means investors could make more money by selling off all the company’s assets than keeping it as a going concern. This is tantamount to vote of no confidence in management, but it also suggests upside potential if the business is run right.

Only 3% of stocks in the S&P 500 trade below book value. For the Euro Stoxx 600, just one-fifth fall under this category. The low valuations in Japan now are a stark contrast to 1989, when asset prices were at the other extreme.

After the bubble economy burst in the early 1990s, Japanese equities went through a nearly 20-year correction period — a downtrend — when looking at the correlation between stock price levels and corporate profits.

Japan is re-emerging from its multi-decade long hibernation with multiple government initiatives that have held back share valuations starting to reverse course, for both Japanese shares and the yen.

Japanese stocks are not experiencing a bubble. The situation is completely different from the situation in 1989. If there are actions that go one step further in terms of business performance, structural reforms, corporate governance, and corporate reforms … they will be going up to higher levels.

When the Nikkei average hit the previous high in December 1989, the price-to-earnings ratio — a major valuation measure — for shares in the TSE’s top section was 61. The ratios for Nikkei stocks have been around 15 recently. For Japanese firms, a ratio of below 15 is often considered undervalued.

Unless something extraordinary occurs to hinder the growth of Japanese firms, stock prices will likely rise in line with profit growth to be in an overall uptrend from now on.

The biggest risk is that the government bodies start to lose confidence in the policy pivots for reasons that include wage inflation not taking hold like it is currently anticipated.

All this means that some fund managers now see the possibility of substantial gains to come for the Nikkei-225. Getting back to the previous historic record must have “an enormous psychological impact on Japanese investors.

Until next time

*Source Bloomberg