Midyear Strategy : Climbing a Wall of Worry

July, 03 2023

The mood on the financial markets is better than the situation in the economy.

S+P500 Index /Market Cap/ Performance YTD % ( Tradingview)

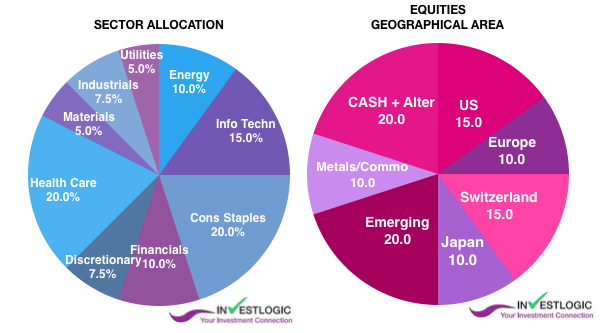

Our positioning

Although the economy continues to deteriorate, core inflation rates remain stubbornly high. Consumer and industrial sentiment also continues to paint a pessimistic picture. The economic outlook thus remains difficult. This does not yet seem to worry the financial markets too much. On the contrary, individual stock markets even rose again last month climbing a wall of worry. The air towards the top is thus getting thinner.

Risk assets are off to a very decent start of the year. We believe that volatility could pick-up in the second half of the year as central banks might have to maintain restrictive financial conditions while economic growth is slowing down.

In such an environment, low-risk asset classes are becoming increasingly attractive. At present, for example, almost 2 percent can be earned with a money market fund.

Find YOUR INVESTMENT STYLE here

STRATEGY and ASSET ALLOCATION

We are maintaining our baseline economic scenario of recession and slowing inflation for this year. Also, commodities have probably seen their best days yet.

We believe that the current context favors a still defensive overall portfolio strategy through a diversified exposure to developed equities, with a bias to emerging (see below ) with a tilt towards opportunistic investments such as the technology sector, as it provides regular cash flows and an attractive exposure to the AI theme.

The European equity markets, which have performed well so far, suffered losses in particular. The Swiss equity market, which was robust in the previous month, endured sharp losses and was among the major losers. The US market actually only rose so sharply due to a few tech stocks, known as MAMAA (Microsoft, Alphabet, Meta, Amazon and Apple). By contrast, the broad-based equity market indices have remained practically unchanged since year-opening. As a result, the US stock market has rarely been so concentrated.

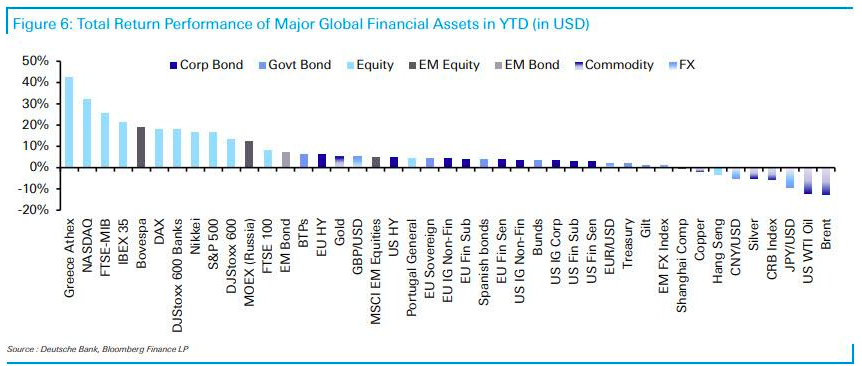

US global markets have ended the first part of the year on a strong note.

By surpassing a 20% gain from the October low, the S&P 500 is technically in a new bull market. The gains have been mainly driven by a limited number of mega-caps tech stocks driven by the Artificial Intelligence boom.

With bullish optimism quickly returning to the market, the pressure to chase performance from the “Fear Of Missing Out” will continue to provide a “bid” under stocks. We note that the rally has been broadening lately to other areas of the market, for example, value or small caps, which is a positive. Finally, we are closely monitoring the evolution of earnings growth momentum and the magnitude of the expected US recession, in the second half of the year.

Momentum on the European and Swiss equity markets has weakened again due to the gloomy economic outlook.

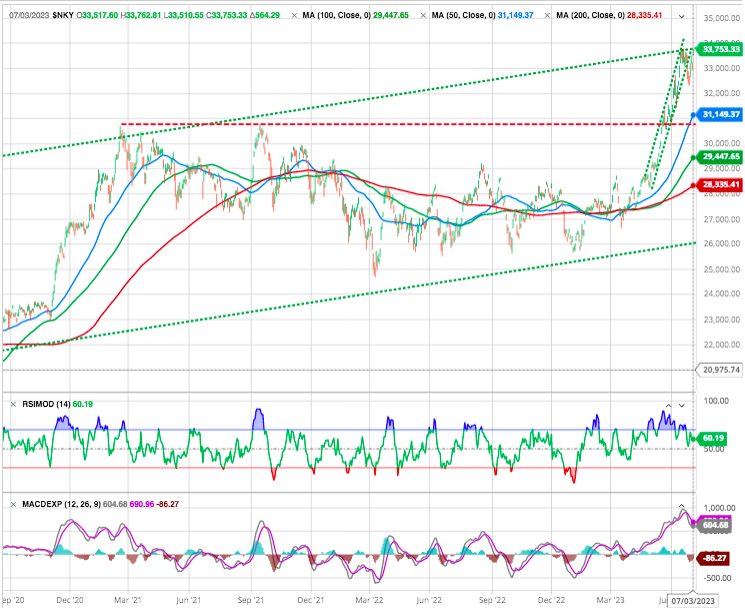

By contrast, the Japanese stock market performed impressively again -See BELOW- , making gains of over 12 percent. We expect Japan to continue to outperform thanks to Asia’s better macro dynamics, but also thanks to the country’s new corporate governance reform, which encourages companies to increase dividends and start buybacks programs. Japan, more precisely the Nikkei, has also benefited from the semiconductor sector sharp increase.

We are maintaining our exposure to emerging markets. Equity markets in the emerging economies, such as Brazil and India, are seeing rising growth rates again. The positive growth signals are a major factor in this development. We are reducing again commodities as the economic recovery in China is much weaker than anticipated and geopolitics weigh on the general sentiment of foreign investors.

Finally, in terms of decorrelated positions, we maintain an exposure to real assets, such as gold and hedge funds to bring diversification to the portfolios.

We are slightly overweight Gold, as it remains a benchmark safe-haven asset. It recorded an impressive rally in 2023, despite the last month correction. Among the reasons for this are the persistent fear of recession, the banking crisis in the United States and the persistently tense geopolitical situation. They are all favourable long-term factors for gold, a potentially attractive asset.

Our basic economic scenario for 2023 (US recession, higher interest rates) that we established at the end of 2022 has to be confirmed. We never the less maintain our convictions regarding asset classes and sub-categories.

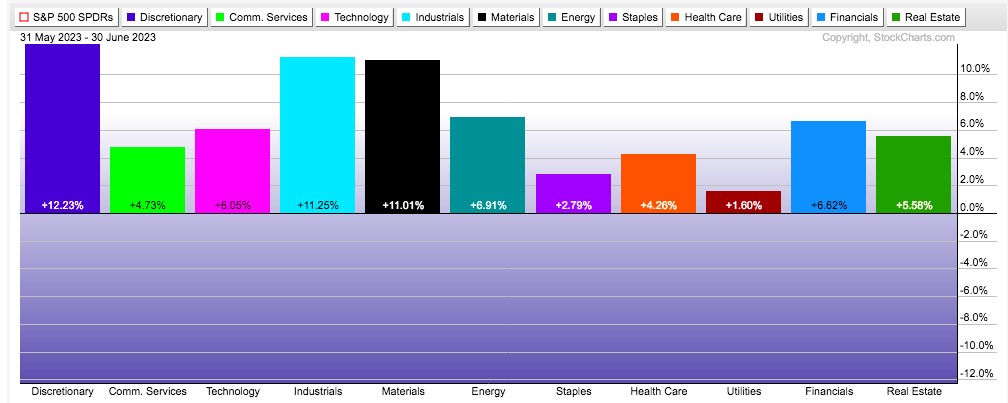

Sectors over last month

The economic slowdown prompts us to favor defensive stocks and sectors. In particular, we see opportunities in

- Healthcare: a combination of short-term resilience and long-term growth prospects.

- Consumer: the focus will be on a more favorable cost base and the ability to take advantage of the pivot in monetary and fiscal policies (when they occur), but sector rotation from non-cyclical consumer companies to discretionary spending still seems a distant prospect.

- Technology: advances in Artificial Intelligence and the shift towards cost control are strengthening the appeal of the sector, which tends to perform well against a backdrop of falling long-term interest rates and economic slowdown.

There are plenty of reasons to be very concerned about the markets over the next few months. However, markets can often defy logic in the short term despite the apparent weight of evidence to the contrary. Don’t forget that any unexpected macroeconomic development or monetary policy decision could trigger a volatility spike. !

After reviewing the risks to markets, we consider our asset allocation and portfolios well positioned. This entails, among other things, an underweight on high-yield bonds, which would see spreads widening and default rates spiking in the event of a recession, as well as a continued exposure on emerging-market equities, which benefit from a more dynamic macroeconomic backdrop and cheap valuations.

4 Steps Plan to Bulletproofing Your Portfolio

- Reducing risk exposure – Reasonably, we don’t mean sell everything, but taking some profits on stocks that have appreciated by 100%-200% in short time frames makes sense around here. Furthermore, we can rebuy at lower levels as the market undergoes a healthy correction process.

- Taking profits around appropriate levels, like the peaks in significantly overbought stocks, and adding to badly beaten-down positions around the troughs is crucial in improving portfolio returns.

- Raising dry powder reserves before a correction strikes. we are considering raising cash position if price action worsens, and we plan to deploy some dry powder to buy quality companies at lower levels.

- Rotating away from some ultra-high flying stocks into some undervalued stocks and underappreciated sectors. Also, it’s vital to stay well-diversified.

NASDAQ US

At the sectoral level, tech stocks were the big outperformer once again, with the NASDAQ up +13.1%, and the FANG+ index of megacap tech stocks up +25.2%. That was thanks to strong excitement about the potential of AI to improve productivity and boost economic growth.

Indeed, one of the standout company performances over Q2 was Nvidia (+52.3%). Their share price surged in late May after they reported earnings with an outlook far above expectations, thanks to demand for AI processors. And on a YTD basis, Nvidia has now risen by +189.5%.

However, with tech stocks having outperformed so strongly in recent months, it’s worth noting that the equal-weighted S&P 500 hasn’t done as well as its standard counterpart, rising by a smaller +4.0% over Q2.

Emerging Markets

Marketwise early this year, we decided to upgrade emerging market equities from “neutral” to “overweight”.

Recent Chinese economic data have proved disappointing, as for Asia, China’s “reopening” growth has been disappointing so far.

Chinese consumers remain cautious, which is particularly reflected in weak import figures and low demand for credit. Foreign demand for Chinese goods also declined sharply. Year-on-year, exports fell dramatically by 8.0 percent in May. This led China’s central bank to relax its monetary policy conditions recently and to cut one of its main policy rates.

Expectations are for the introduction of measures aimed at supporting economic activity and more specifically the real estate sector. An improving outlook for the Chinese economy, should also support the whole region

In contrast, economic performance in other developing markets, such as India and Indonesia, is far stronger.

Overall, the growth momentum of emerging countries remains much stronger.

We therefore believe that a slightly positive assessment of emerging market equities remains justified.

Moreover, emerging market debt in local currencies offers both a high carry, given the level of nominal yields, and significant capital appreciation potential, given the level of real yields should economic growth disappoint.

Look Toward the Rising Sun

Kabuto-Cho could well be experiencing a bright new dawn.

For over thirty years, Japan has endured a long stock market winter. While there have been periods of recovery, they have been insufficient to bring investors back en masse. It was therefore easy to ignore this market, and most international investors have since desinvested from the Japanese market altogether.

Japan has endured a long period of deadly deflation and has thus been the most disadvantaged market over the last two decades. Now, Japan is in the midst of a major transformation, and this should bring about structural changes in favor of equity investors. This could be the time to turn to the Japanese market once again. It’s never as cold as just before dawn, and the Land of the Rising Sun could well present a resplendent dawn.

Japan has enacted a new corporate governance code that promotes the maximization of shareholder value. The arrival of activist investors and private equity funds has made it possible to revitalize certain companies whose capital returns were insufficient, and to unwind many cross-shareholdings, an endemic evil in Japan. At the same time, dividend programs and share buybacks were introduced to support equity market valuations.

The need to increase productivity has led to substantial technological investment, and mergers and acquisitions are now beginning the necessary process of consolidation in an economy that is still too fragmented. All these measures should lead to a significant improvement in corporate liquidity, and the medium-term outlook for the stock markets seems excellent to us.

The most important change – and one that has gone almost unnoticed – is the change in listing rules on the Tokyo Stock Exchange. All companies listed on the First Market (the most prestigious part of the stock exchange) are now required to implement a growth strategy designed to improve their return on capital.

Companies with a price-to-book ratio of less than 1 over the long term (i.e. a market value lower than their book value) would be forced out of the Prime index and relegated to a less important segment of the stock market. The requirement for companies to publish their corporate governance policies and improve transparency for investors is thus one of the most significant changes to corporate culture in Japan, and should bear fruit in the long term.

Performances

Remaining Uncertainties

On the companies side is the fact that earnings growth expectations look too optimistic at a time when valuations are expensive. This combination means that there is little room for disappointment. Especially if we take into account the fact

that markets seem very complacent at this stage.

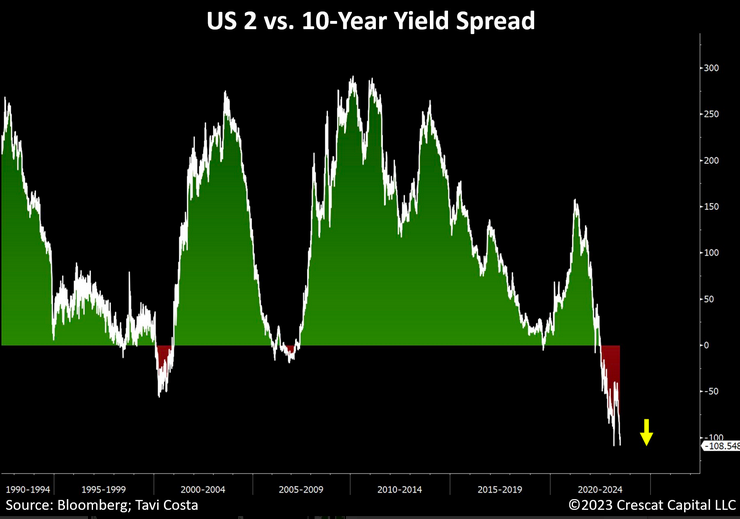

On the macro side, we might very well enter the stage where the most aggressive rate hike cycle since the 80s start to impact economic growth.

Furthermore, central banks seem reluctant to pause or cut rates, as inflation remains well above target. Resulting in a situation where the Fed, and other central banks, are not our friends when the weakest parts of the economy start to tank.

Central banks are going to have to hike further. Nobody any longer denies this. With fed funds futures contracts now offering the chance to hedge rates all the way through until the beginning of 2025, it’s startling to see how expectations have moved just in the last week. At the end of this year, the market believes, the fed funds rate will be higher than it is now. And it will still be above 4% by the end of next year.

Ultimately, whether the Fed is done raising rates for the cycle will come down to the usual suspects: inflation and employment.

Meanwhile, the economy seems to be showing neither positive nor negative momentum.

For the time being, investors don’t seem to think that these higher rates will inflict an economic downturn. One explanation would be that the economy is resilient. A perhaps more plausible one is that investors still don’t buy that Fed policy is that restrictive.

Is the long-awaited recession around the corner?

The course of monetary policy for the summer has been set. Current monetary policy is weighing on the economy and represents a risk for financial markets.

The economy continues to weaken without any significant fall in core inflation rates. The markets are still ignoring the risk of recession, which could leave them facing a correction over the summer.

The economic climate in the industrial nations has deteriorated further over the last three months. Sentiment data in industry continues to reflect an expected decline in production. Consumers are still very pessimistic. Only the services sector expects further growth, albeit at a lower rate. However, the resulting expectation of recession isn’t the core trading scenario on the financial markets for the moment. Prices on individual stock exchanges actually rose last month.

Inflation rates are continuing to fall in the western industrial nations. Inflation fell from 4.9 to 4.0 percent in the USA, while core inflation, adjusted for volatile prices, also decreased. There was a similar picture in the Eurozone. Encouragingly, Switzerland’s core inflation rate has dropped to just 1.9 percent.

The US Federal Reserve’s decision not to raise money market interest rates again in June was welcomed by the financial markets. The stock markets aren’t concerned that this may be due to an increasingly sceptical assessment of the economy. Risk premiums on corporate bonds fell across the board despite poorer economic data, while interest rates on long-term government bonds rose slightly again. None of this is consistent with an anticipated recession.

Yet, core inflation is unlikely to continue to fall without a recession. What’s more, another upturn would drive inflation rates higher again. A rise in energy prices alone could wipe out recent progress on bringing down the overall rate of inflation. We’re also seeing sharply rising wages and, in turn, higher prices for services in many industrial nations. Fresh growth would undoubtedly exacerbate the existing labour shortages. The central banks would inevitably have to raise interest rates again. The prospect of capital market interest rates remaining below money market rates would then be highly unlikely.

Today’s issue in the Treasury curve resembles prior stagflationary times with yields across all durations continuing to move higher.

Anyone who recalls the situation that rising capital market interest rates triggered on the financial markets in 2022 would not want to see a repeat of that scenario. This means there’s clearly no viable alternative to consistently bringing inflation down to meet central bank targets. Any other approach would lead to volatile conditions in the economy and on the financial markets for years to come.

The bearish view and the bullish view

The bearish outlook is that the much-anticipated recession is going to finally arrive, and that we are on the brink of an earnings washout that will trigger another down leg—in what will prove to be a prolonged bear market.

The bullish outlook is that interest rates have peaked, the Fed is done, the economy is holding up, and earnings will rebound later this year.

Your choice !

Happy trades

HAPPY SUMMER

BONUS

We believe that there are some golden rules practiced by the greatest investors in history. to follow during these uncertain times.

- Cut Losers Short And Let Winners Run.

- Investing Without Specific End Goals Is A Big Mistake.

- Emotional And Cognitive Biases Are Not Part Of The Process.

- Follow The Trend.

- Don’t Turn A Profit Into A Loss.

- Odds Of Success Improve Greatly When Technical Analysis Supports

- Fundamental Analysis.

- Try To Avoid Adding To Losing Positions.

- Invest First with Risk in Mind, Not Returns.A 70% Success Rate is a great

- The Goal Of Portfolio Management achievement .

Until next time