Matrix Reloaded

August, 10 2022Investlogic Allocation Business Cycle System Matrix

It is for us the opportunity to share with you one of our strategic tool for our asset allocation : Allocation Business Cycle System -ABS-.

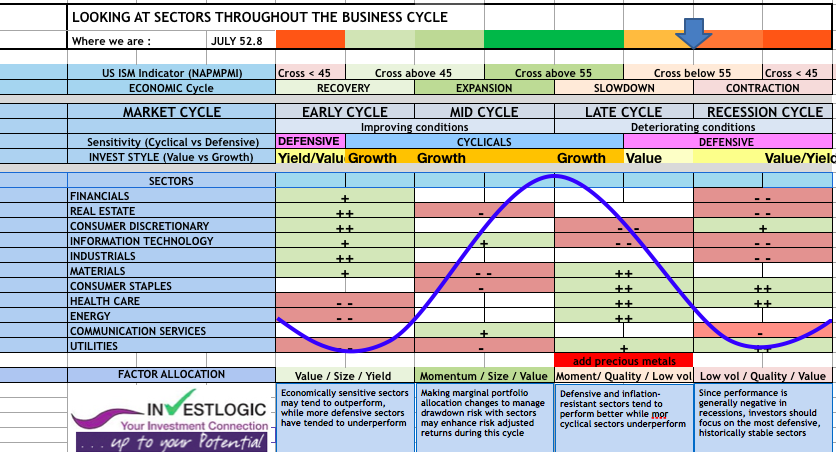

This proprietary ABS matrix to guide us to the optimum investment opportunities in the prevailing economic environment tracking the recorded US ISM indicator published each month. Accordingly we review our investment recommendations to various investment approaches based on style or sensitivity.

Over the intermediate term, asset performance is often driven largely by cyclical factors tied to the state of the economy, such as corporate earnings, interest rates, and inflation. The business cycle, which encompasses the cyclical fluctuations in an economy over many months or a few years, can therefore be a critical determinant of equity market returns and the performance of equity sectors.

Also check our Multi Time Frame Indicators

In July of 2022 the ISM Manufacturing PMI edged lower to 52.8 from 53 in June, beating market forecasts of 52. The reading pointed to a 26th straight month of rising factory activity but the weakest rate since June of 2020, as new order rates continue to contract although supplier deliveries improved and prices softened to levels not seen in two years.

According to our ABS Matrix we are going more defensive

During a recession, investors need to act cautiously but remain vigilant in monitoring the market landscape for opportunities to pick up high-quality assets at discounted prices. These are difficult environments, but they also coincide with the best opportunities.

In a recessionary environment, the worst-performing assets are highly leveraged, cyclical, and speculative. Companies that fall into any of these categories can be risky for investors because of the potential they could go bankrupt.

Conversely, investors who want to survive and thrive during a recession will invest in high-quality companies that have strong balance sheets, low debt, good cash flow, and are in industries that historically do well during tough economic times.

Third Quarter 2022 : Investing Strategy to Have During a Recession?

- While all sectors fell during the second quarter, defensive sectors held up the best, with consumer staples, utilities, and energy stocks suffering the smallest losses.

- Energy stocks have strong momentum and could continue to outperform even if oil prices fall from here.

- Although consumer discretionary stocks fared poorly in the second quarter, they could outperform this quarter if negative consumer sentiment turns out to be overdone.

Energy and Health Care Look Appealing

Relative strength and a solid combination of valuations and fundamentals have made the energy sector look appealing, while cheap valuations support the outlook for health care. High valuations may challenge the backdrop for consumer discretionary; however, some contrarian indicators appear increasingly more constructive

for the sector.

Momentum in energy, utilities, and materials

The energy, utilities, and materials sectors exhibited the greatest relative strength over the past 6 months. Information technology was the weakest, followed by consumer discretionary and communication services.

Europe : the eurozone is heading toward a recession.

Yet, consensusearnings forecasts for the region do not seem to have taken this into account. We strongly suspect that the economic outlook will turn out to be closer to reality and that earnings expectations will need to adjust markedly lower. Why?

The eurozone is facing persistent headwinds that likely will push the economy into a recession. These headwinds are stiff and plentiful and include an energy crisis, soaring inflation, a slowing global economy, and a central bank increasing rates and tightening financial conditions for the first time in over a decade. The region’s energy crisis in particular is at risk of escalating materially if Russia decides to restrict the flow of natural gas. Additionally, producer price increases are far outpacing consumer price increases, which suggests company margins will deteriorate at a time when overall demand is softening. In this environment earnings will not defy gravity.

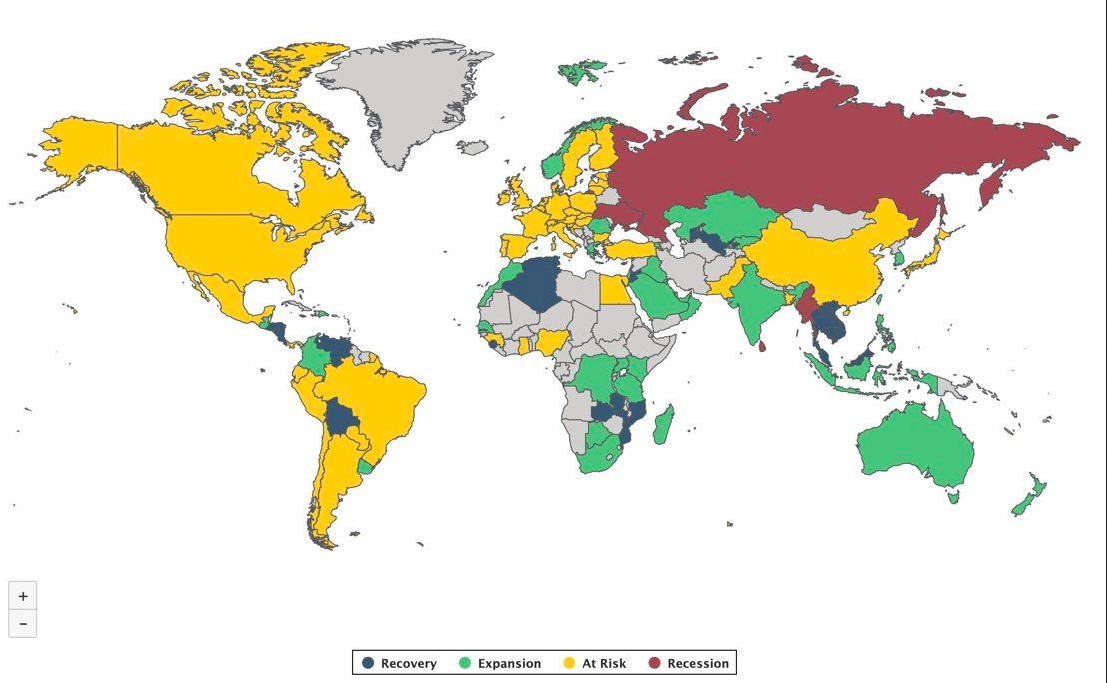

Business cycles around the world… not looking pretty overall. But you can diversifies into the right cycle in the right place.