MARKETSCOPE : The Law of Gravity

February, 27 2023

To Land or Not to Land ? !

Hard or soft, this metaphorical plane will land, and it remains our view that the risks facing today’s equity market remain more substantial and consequential than any tailwinds that are suppose to support it. A no landing scenario is simply a delayed landing.

Despite robust corporate results, the week ended on a bearish note, with the latest macroeconomic data confirming the robustness of the US economy, the job market and the resilience of inflationary pressures. Fears of further monetary tightening over an extended period of time prompted some profit taking.

Global markets correlated as theory would predict: interest rates higher, the dollar stronger, and stocks and commodities lower. Ten-year yields were up across the globe as the U.S. Treasury note yield approaches 4 percent on sticky inflation data. Consequently, world stocks fell across the board.

Global markets correlated as theory would predict: interest rates higher, the dollar stronger, and stocks and commodities lower. Ten-year yields were up across the globe as the U.S. Treasury note yield approaches 4 percent on sticky inflation data. Consequently, world stocks fell across the board.

Wall Street’s main indexes posted their biggest weekly drop of 2023 after sharp losses on Friday to wrap up their worst week so far this year, as the Federal Reserve’s preferred inflation gauge unexpectedly accelerated in January and consumer spending surged.

Shares in Europe fell as better-than-expected economic data and corporate earnings raised the prospect that central banks might persist with interest rate increases. Chinese stocks advanced after three weeks of losses.

The flow of macroeconomic news supporting a moderation of central bank rate hikes seems to be drying up. Several pieces of data in the US and Europe have reignited concerns about the trajectory of prices.

The core PCE price index jumped 0.6% in January and 4.7% from a year ago, coming in above economist estimates. Meanwhile, consumer spending surged 1.8% last month, the biggest increase in nearly two years. Investors worry the figures will add pressure on Fed policymakers to keep ratcheting up interest rates. U.S. Treasury yields rose in response, with the two-year note climbing nine basis points to 4.78% and the benchmark 10-year yield adding seven basis points to 3.95%.

The 5-day heat map of the S&P 500 gives a similar picture:

Investors braced for the possibility of more aggressive rate hikes from the U.S. Federal Reserve as U.S. economic data pointed to resilient consumers.

The results season is coming to an end with more than 90% of companies having already published their annual figures for 2022. The vast majority seem to be weathering the macro-economic storm better than expected despite the first visible signs of a recession that is currently rather mild.

All eyes will be on the ISM Manufacturing PMI on Wednesday and the Services PMI on Friday.

MARKETS : No Bull Case for Stocks

As the recession countdown begins, the market finally took notice of rising yields and the continued talk of higher rates, the market was beginning to question the no recession scenario bet.

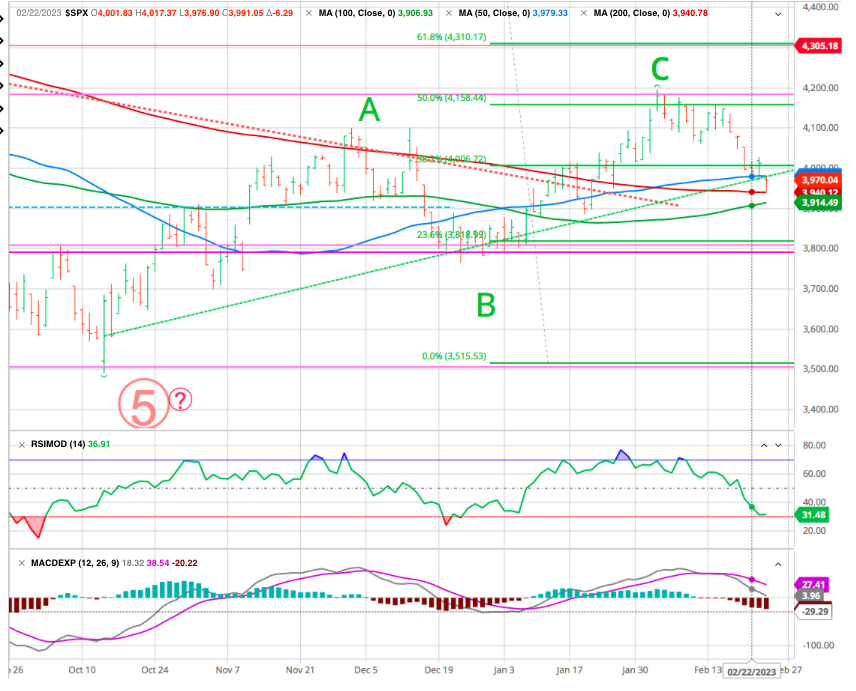

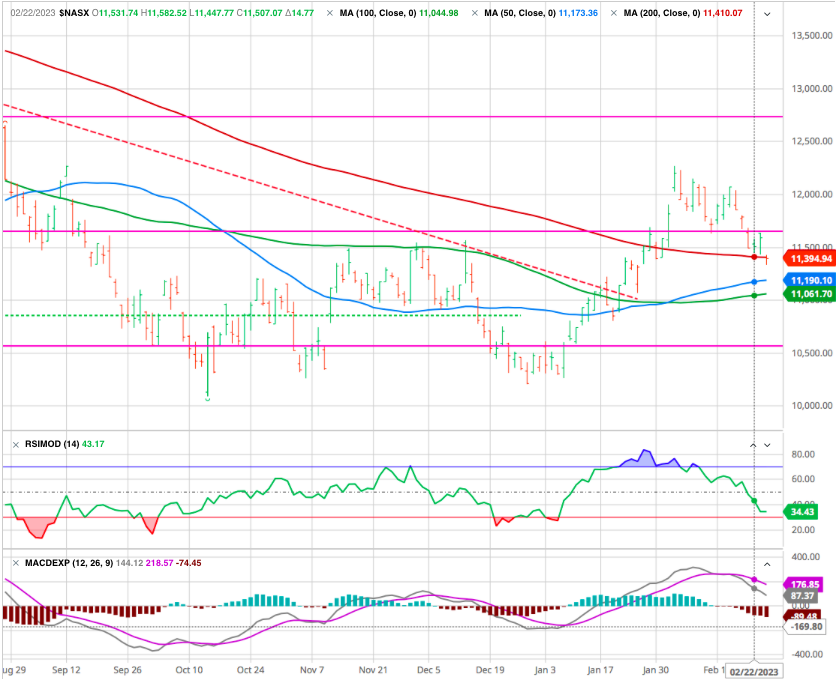

The sell-off took out support at the 50-DMA. Critical support at the rising trend line from the October lows and finally the S&P 500 recovered precisely at its own 200-day moving average (red line). The 200-DMA is now getting tested. A failure of those levels next week will put the bears back in charge of the market near term.

We are now testing the bottom of the rising trend channel from October and failed at the June high resistance.

Nevertheless, the chart does not look overly encouraging for bulls, with the target at 3,770 we set a few weeks becoming more likely to be visited over the coming weeks.

We would like to see most indexes successfully “test” these support levels – holding above them or quickly recapturing them if they dip below – as sentiment falls back to neutral or even falls into “fear” territory. On the other hand, if the major indexes fall back below DMA support and accelerate lower and RSI begin to weaken, it would suggest that the bear market would resume again.

Equity sector performance and given that inflationary pressures dominated the investment narrative throughout the week, it should follow that longer-duration sectors such as tech and consumer discretionary are amongst the worst performers.

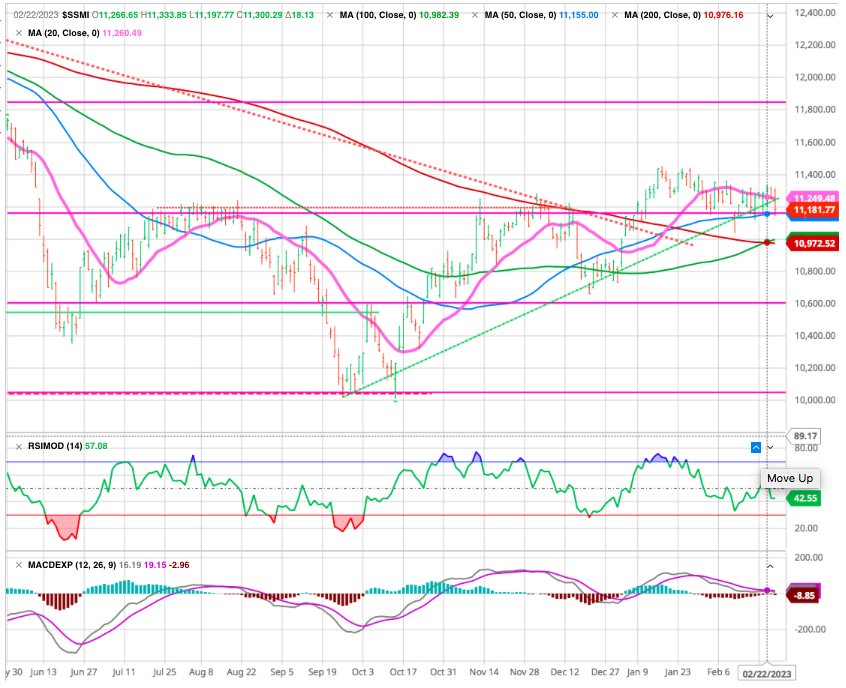

The Swiss Markets is challenging is support at 11180 (horizontal red line) and its uptrend (dotted green) as the 20 DMA (purple), our short term trend direction, is now going south.

Cryptos

Bitcoin is down 2% this week and is back below $24,000. Still waiting for strong positive catalysts, digital currencies are stalling in a macroeconomic environment that still doesn’t check all the boxes to support risky assets.

Clearly, the good news about cryptocurrency adoption is not enough to entice investors. The monetary policy pivot of central bankers is therefore expected like the messiah to give crypto-assets a boost.

Bond…. The Name is Bond

Ever since the FOMC last hike three weeks ago, where Powell failed to push back on easing financial conditions, economic data has been coming in “hotter” than expected.

As the popular iShares 20+ Year Treasury Bond ETF (TLT) as proxy for the overall bond market, we take note that bonds are about on the verge of giving back all year-to-date gains.

Further along the term structure the 10-year yield has not yet hit a new cycle high, but the fractal pattern we looked at a few weeks ago remains in force and continues to point to a 5% yield target for the current leg underway. and if the following chart of the 10-year US treasury yield were a stock, we would be super-bullish on it …

Notably, when psychology changes, for whatever reason, the rotation from “risk-on” to “risk-off” will find Treasury bonds as a “store of safety.” Historically, such is always the case during crisis events in markets.

Once again, it is pretty likely we should not dismiss the message from the bond market. Bonds are essential for their predictive qualities, so we pay enormous attention to U.S. government bonds, specifically the difference in their interest rates.

Also check our research “What are the charts telling us ?”

FED : How slow can you go?

That was the question at last month’s FOMC meeting, with monetary policymakers debating how much tightening would be needed to rein in inflation without shocking the economy.

The minutes showed that “almost all” officials agreed it was appropriate to raise rates by 25 basis points, but there were “a few” that could have supported a larger 50 basis-point hike.

As investors debated the hawkish/dovish signals, stocks rose and then fell, with equity futures climbing again overnight. Several other topics that were also discussed included financial stability, the labor market and even crypto, while Fed Chair Jerome Powell warned against complacency following the meeting.

As we have explained before, for many decades the Federal Reserve was a friend to the stock market. That condition persisted because inflation was low and wage pressures were nonexistent — conditions that allowed the Fed to step in and be accommodative whenever the economy showed signs of slowing or stalling.

Now we are in the opposite environment: The Federal Reserve is an enemy of the stock market because inflation is high and wage pressures are significant.

In this reversed condition, the Federal Reserve is going to remain hawkish (the “higher for longer” thing) until the job is done of getting inflation down, and that simple reality will force equities into a bear market.

The pain for stocks will not be over, meanwhile, until the Fed has gotten inflation much closer to its 2% inflation target, which is still far away.

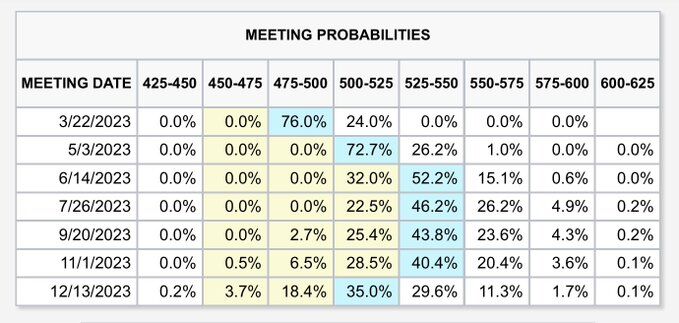

Hotter-than-expected inflation could encourage the Fed to keep interest rates higher for longer. The market expects the central bank to raise rates by a quarter of a percentage point in March and again in May. The policy rate is expected to reach 5.36% by mid-summer and could remain elevated for the rest of 2023. The market slowly waking up from the dream and pricing in reality.

And by the way, if the U.S. actually does avoid recession — a scenario that some are touting as bullish — that is even more bearish for stocks, because in the absence of meaningful economic slowdown, the Fed will have to hike even higher (which will hammer the rate-sensitive tech and financials sectors in particular) in order to try to put a lid on services inflation.

Then, too, the lagged impact of rising interest rates hasn’t walloped corporate profits yet — but it will. This will be a factor in significant earnings deterioration in the months ahead.

Investors are trying to see these factors in a different light because, simply put, they don’t want to be halfway through a bear market. They want the bear to be over already. But it is nowhere near done, because general conditions indicate we are only in the middle of this pain.

As a final note, numerous Wall Street bulls are still anticipating interest rate cuts in the latter half of 2023 — and they are trying to make an optimistic case from that expectation.

This makes no sense at all: Even if the Federal Reserve chooses to pause at some higher level, it will hold rather than cut — the equivalent of keeping the economy in a chokehold — and refuse to back down unless the economy deteriorates suddenly and dramatically.

There are scenarios where a sudden and rapid deterioration can happen, certainly — but those scenarios are the opposite of bullish for stocks.

January’s much stronger than expected US jobs and retail sales data quickly transformed market sentiment. Investors who had in any case been shifting away from a hard-landing outcome towards a soft-landing, suddenly lurched to a ‘no-landing’ scenario.

No landing scenario does not make any sense because it means is that if the economy is not slowing sufficiently to reduce inflation back towards the 2% target. Doesn’t it entails that interest rates will need to go higher for longer than even the hawks at the Fed had previously been threatening ? And doesn’t that increase the risk of a hard landing?” That is why markets got into a flap on.

Happy trades

BONUS