MARKETSCOPE : Market Doldrums

May, 14 2024

This week had the 1st, 2nd and 4th lightest notional volume days of the year. This is the reverse of “when there is yellin’ you should be sellin’…

Stock indexes returned to their record levels at the end of the week, driven by hopes of monetary easing in the coming weeks. The S&P 500 Index is moving back towards its all-time high and recorded its third consecutive week of gains. The other major indexes also advanced, with value stocks generally outperforming growth shares. Market volumes were especially low over much of the week.

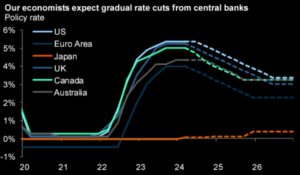

In the United States, the latest deteriorating statistics on the job market and economic activity suggest that the Fed will have the leeway necessary to cut its rates in September.

In the United States, the latest deteriorating statistics on the job market and economic activity suggest that the Fed will have the leeway necessary to cut its rates in September.

Friday brought another sign that the labor market and broader economy might be cooling: the University of Michigan reported that its preliminary index of consumer sentiment in May tumbled unexpectedly to 67.4, down from a final reading of 77.2 in April and marking its lowest level in six months.

Europa First. Unusually, it was the Bank of England that led the way this week, paving the path for a more relaxed monetary policy. The May meeting ended with a status quo on rates, but the tone was less austere than before. The rest of Europe quickly took this as a positive signal for an initial rate cut by the ECB in June.

STOXX Europe 600 Index ended 3.01% higher on better-than-expected corporate earnings and increased optimism that major central banks would soon start cutting interest rates.

In Asia Japan’s Nikkei 225 Index and the broader TOPIX Index registered marginal weekly losses. Meanwhile, China is finally showing some signs of recovery.

AHEAD

Next week’s economic score promises a notable crescendo following the quiet of recent days. A first clap of thunder will resound on Tuesday with the release of the US Producer Price Index for April, before the anticipated solo by Jerome Powell. On Wednesday, another thunder detonation with the US Consumer Price Index for April.

In the grand auditorium of results, Chinese tech tenors Tencent, Alibaba, and JD.com will share the stage with the American retail duo (Home Depot, Walmart) and a few international virtuosos (Allianz, Sony, Siemens AG, Richemont).

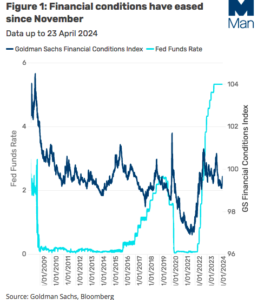

Source Goldman Sachs

MARKET : Volatility view: Absolutely No Yellin’

All in all, too quiet and calm to short into and we do wonder if this is the calm before the melt-up storm…?

VIX Benjamin Button:ed out of teen-age years and closed at its lowest level since January 23.

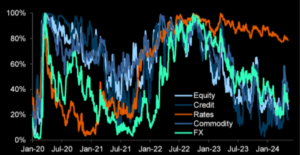

Aggregate cross-asset volatility – chart shows percentile of 3-month implied volatility since 2010. Rates the only odd one out.

Even more stunning is the the volatility of volatility (VVIX) has dropped to its lowest level since … 2015!!

Equities Bounce Back Ending April Correction

April saw the US stock market witness a nearly 6% sell-off, which is still considered mild compared to the historical average non-recession year selloff of 13%. During this period, the volatility index peaked at 21.36, compared to the current 13.60.

The upside is limited by concerns over valuation, the market history of contentious election years, and persistent inflation. On the other hand, the downside remains cushioned by a surprisingly strong earnings season.

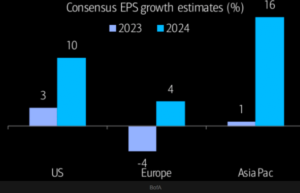

Overall there is an upbeat outlook for global earnings :

Chart shows 2023-24 consensus EPS growth estimates: US, Europe, Asia Pacific. (Source BofA).

This past week, the S&P 50 broke above the 50-DMA. A pullback to retest the 50-DMA would turn it from previous resistance into support and reduce some overbought conditions. Overall our oscillator system still point to a continuing consolidation/correction, but a new short term buy signal may come into place.

A break of resistance should allow the bulls an opportunity to retest 5200 over the next month.

Ultimately, the market could test the 200-DMA iwhich currently hovers just above 4720. This suggests that the S&P 500 may see the 4,700-4,800 zone.

China

Lat’s have a quick look at the Chinese market which is up more than 38.2 % since the bottom on January 22nd! Zooming out we can see that the next step is the 50 % retracement level and more probably 61.8% (3325).

After this massively bullish breakout, it seems not a lot of people have been speaking about this. Couple that with the “uninvestability” of anything Chinese and we have a pretty decent case for a strong contrarian play.

See our Feb 06 article The Biggest Long Trade On The Planet

Crypto

Meanwhile cryptocurrencies continue to be in some very volatile (after all, we are talking crypto here) consolidation period.

Bitcoin has struggled to find an upward path for over a month. April was particularly painful with a 15% decrease in its valuation – a counterperformance that contrasts with the seven consecutive months of gains from September 2023 to March 2024 – above $70,000-. This movement was mainly driven by the marketing of Bitcoin Spot ETFs at the beginning of the year across the Atlantic. But the enthusiasm seems to be fading. Currently, BTC is trading around 61’000.

The correction of the last wave at 61.8% -51’000- would be a crucial zone for this trend to continue.

Otherwise it could drive the price to the next Fibo retracement level (50%) of the main wave at 44’500.

Taking Bitcoin as a proxy, the technical analysis textbook would suggest a price target of anywhere between $90,000 and $100,000 on a break above 66,000, depending on how aggressive you want to be. We wouldn’t bet on it !

FED Conundrum ?

Some analysts suggest that the Fed is “politically motivated to stay behind the curve” and that the pivot was a move to help Joe Biden.

The Fed, they argue, pivoted towards leniency. The FED is willing to see inflation be sticky, perhaps for a pretty long time. It has kind of abandoned that for the 12 months ahead of the election. That’s the political nature of the FED.

So they interpreted the December pivot as a new “Fed put” :

It is a situation where the monetary policy authority would “have the market’s back,” and investors would know that at any sign of market weakness, a big easing would be around the corner. But when the economy or inflation accelerated, the Fed wouldn’t react hawkishly but rather “let the economy run hot.” It was originally known as the “Greenspan Put” after the federal funds rate seemed to be rising and falling in response to the stock market during Alan Greenspan’s last decade as Fed chairman.

So, how hawkish will the Federal Reserve go?

Even the more traditionally dovish Fed members have had little choice but to pivot away from rate cut rhetoric as inflation data shows few signs of returning to the 2% target any time soon.

Even with the economy growing at a less than expected 1.6% annualised rate in the first quarter, policy makers’ focus should be firmly on prices.

The pivot from the Fed closely follows a trend of higher-than-expected core inflation rates. This development is concurrent with the easing of financial conditions since November 1 when the Fed signalled it was done hiking, as suggested by the Goldman Sachs Financial Conditions Index -below-. Looser financial conditions have boosted economic activity which is stalling any disinflationary trends.

The Fed now finds itself in a conundrum. It cannot easily revert to a strategy of cutting rates due to the dwindling impetus that had energised the recent rally in risk assets and rates since the November 1 pivot away from raising rates. The factors that fuelled this rally, such as the extension of Money Market fund durations, cannot be replicated given the increasingly two-sided nature of rate risk, and the Fed reverse repo has been exhausted.

Moreover, any attempts to support risk asset markets for electoral purposes by reducing issuance duration could prove problematic, as such a move would need to be fully reversed post-election, potentially during a period of tightening fiscal stance.

Happy trades

BONUS

USD/YEN

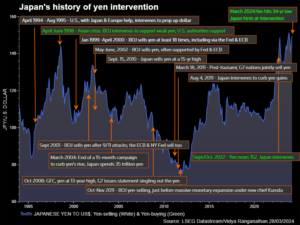

Be careful when betting against one of the world’s greatest currency trader ever – the MoF. The last time the BoJ/MoF intervened in currency markets was to sell JPY in the Fall of 2011.

Here’s some more history of currency intervention by the BoJ/MoF.