MARKETSCOPE : Japan : ¥ Blossom Season

March, 18 2024The stock market frenzy to “buy anything that is going up” has spread from just a handful of stocks related to artificial intelligence to gold and digital currencies. Intoxicated by the rise in equity markets and promises of future rate cuts.

US stocks were slightly lower for the week. Energy shares outperformed on the back of higher oil prices, while technology shares lagged due to weakness in NVIDIA and other chipmakers. Investors weighed upside surprises in inflation data and signs of moderating consumer spending.

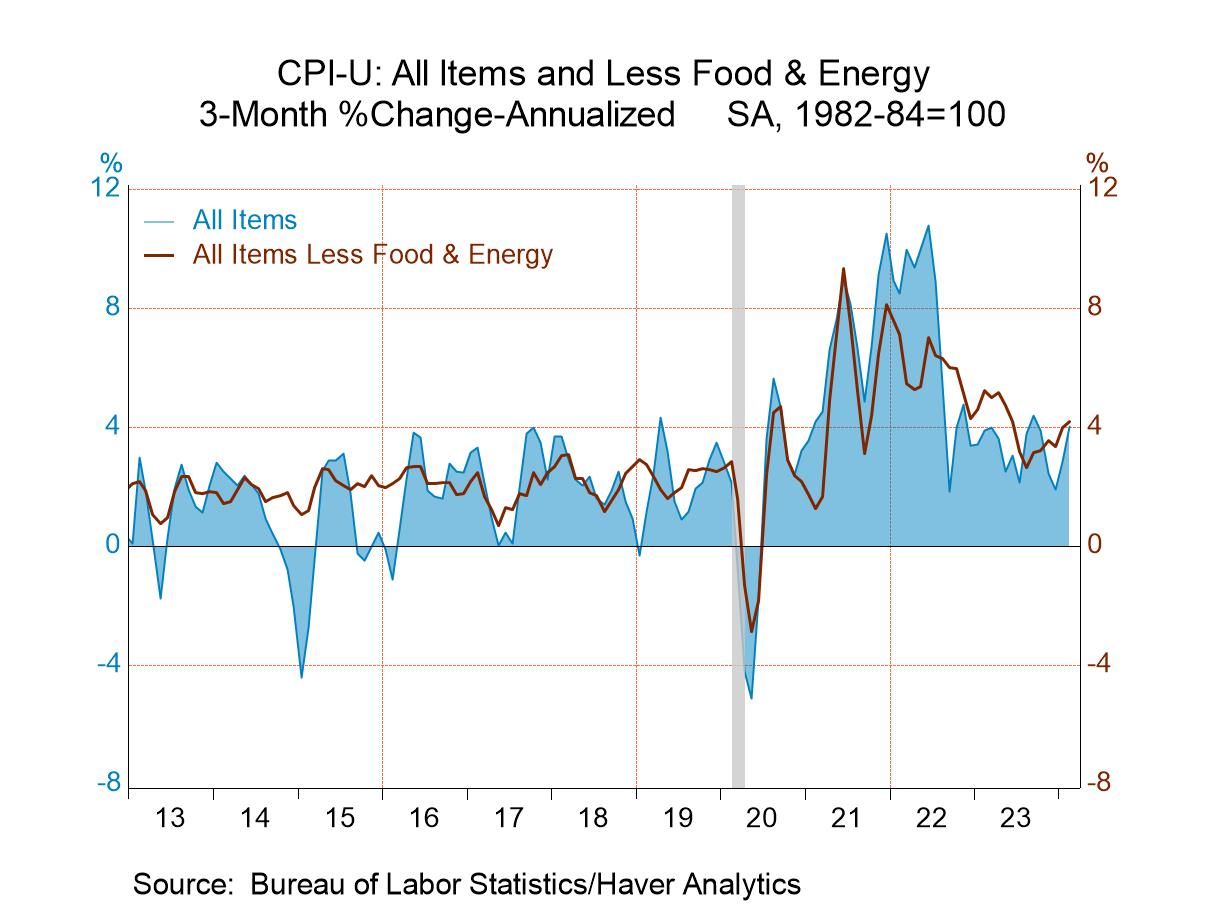

Investor concerns rose after a raft of data showed inflation rising more than economists expected.

CPI Core (US core inflation) came in slightly above forecasts at +3.8% y/y. Unfortunately, the second effect came two days later with the PPI (US producer prices). On an annual basis, it showed a rise of 1.60%, against a forecast of 1.2%.

Statistics pushed the benchmark 10-year Treasury yield to its highest intraday level (4.32%) last week, raising questions about whether inflation has cooled enough for the Fed to cut interest rates this June.

The S&P 500 has reached record highs 17 times this year, with artificial intelligence darling Nvidia soaring more than 80%. And Bitcoin hit an all-time high for the fourth time in six days past week, bolstered by massive inflows into US exchange-traded funds tied to the cryptocurrency. That’s a lot of froth.

The S&P 500 has reached record highs 17 times this year, with artificial intelligence darling Nvidia soaring more than 80%. And Bitcoin hit an all-time high for the fourth time in six days past week, bolstered by massive inflows into US exchange-traded funds tied to the cryptocurrency. That’s a lot of froth.

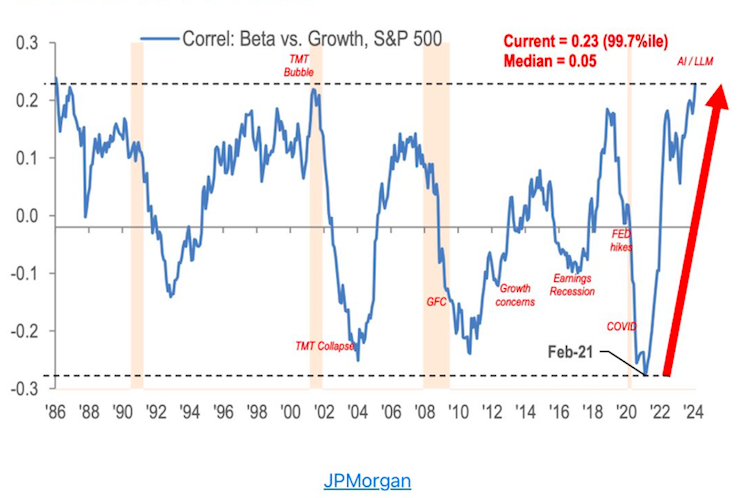

Markets are showing the characteristics of a bubble, given the record-setting surge by the technology sector’s so-called Magnificent Seven stocks and the all-time highs in cryptocurrencies.

STOXX Europe 600 Index added 0.3%, notching an eighth consecutive weekly gain. Japan’s Nikkei 225 Index lost 2.5% as the Bank of Japan (BoJ) might soon end its negative interest rate policy.

This Week : Five central banks for the price of one

It’s all about the central banks this week, even if no rate changes are expected. The Bank of Japan will take the lead on Tuesday, with a slight possibility of a rate hike (see below). The Bank of Australia will follow, but it is of course the Fed that will capture the attention on Wednesday. Fed funds futures say there is a 99% chance that the Federal Open Market Committee keeps interest rates on hold. The Swiss National Bank and the Bank of England will take over on Thursday.

Sicky Inflation ! Supercore To The Rescue

The composition of the overall CPI over time, shows that inflation is now almost exclusively about services. A big chunk of services comes from the cost of housing, which is difficult to measure.

Sticky inflation is what the Fed has complained about the most keeping them on pause with hawkish rates. The main components are wage inflation and housing which have stayed elevated far too long and not going away as quickly as hoped for.

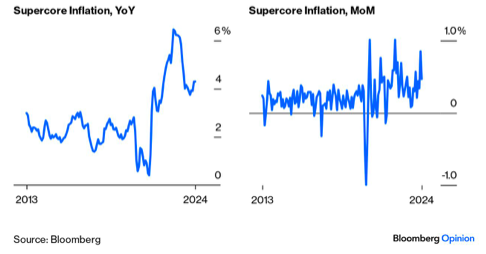

This is when the relatively good news begins. We discovered that Fed Chair Jerome Powell has long focused on the “Supercore” rate of services inflation excluding shelter. This is particularly driven by wages and at least in theory can be most directly moved by monetary policy.

Supercore has risen for the last couple of months, and jolted sharply upward in January. This was really bad news for anyone hoping for rate cuts.

But the latest numbers suggest that January was an outlier. Supercore overall remains above 4%, an uncomfortable level for the Fed, but it’s not picking up in a big way again.

As that had seemed a real possibility after the January data, this should come as a big relief.

The Fed is between a rock and a hard place with a slowing economy and a brewing speculative mania in stocks. They’ll have the opportunity to push back on market rate cut expectations this week and retake control of the narrative.

Members of the Fed should be steadfastly prudent and signal unequivocally that they will maintain rates at current levels until Core Services Ex Housing inflation falls below 3.5% and is decisively decelerating – or until evidence of a recession is absolutely unmistakable.

The Fed is set to update its summary of economic projections (“the dot plot”), and if they intend to drop the hammer on traders Fed pivot hopes, they’re likely to do so there and in Jerome Powell’s press conference.

As for the prospects of a cut at the Federal Open Market Committee meeting in June, which now seems the most realistic time to start, fed funds futures currently give that an 80% chance. Two months ago, they were confident of three cuts by June, but the readjustment has already been made.

MARKETS : A Mature Bull Market ?

After a rally to all-time highs, the market again traded lower on Thursday and Friday to finish at the 20-DMA.

While the 20-DMA continues to act as short term support, as well as the support at 15’950, a violation of that level could well trigger additional selling. Momentum and relative strength have also shown continued weakness, and both registered “sell signals” on Friday.

Nasdaq 100 is showing the same signal (bearish divergence) as last summer before the downward correction back towards the 20 and 50-week moving averages.

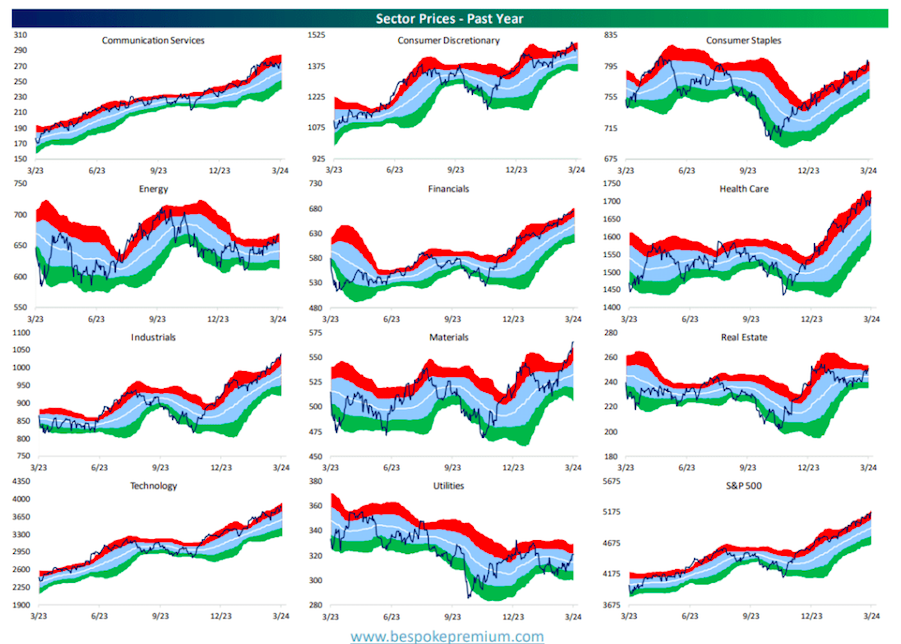

Looking at the sector snapshot from last weekend’s Bespoke Report, we see that everything is overbought. And everything is in an uptrend, only Energy and Utilities are moving sideways.

The S&P 500 has surged 25% since October despite stagnant earnings, driven by Fed pivot hopes and investor interest in AI, weight loss drugs, and high P/E blue-chip stocks.

AI has not caused corporate profits to increase significantly, with negative earnings guidance outweighing positive guidance in Q1 for the S&P 500.

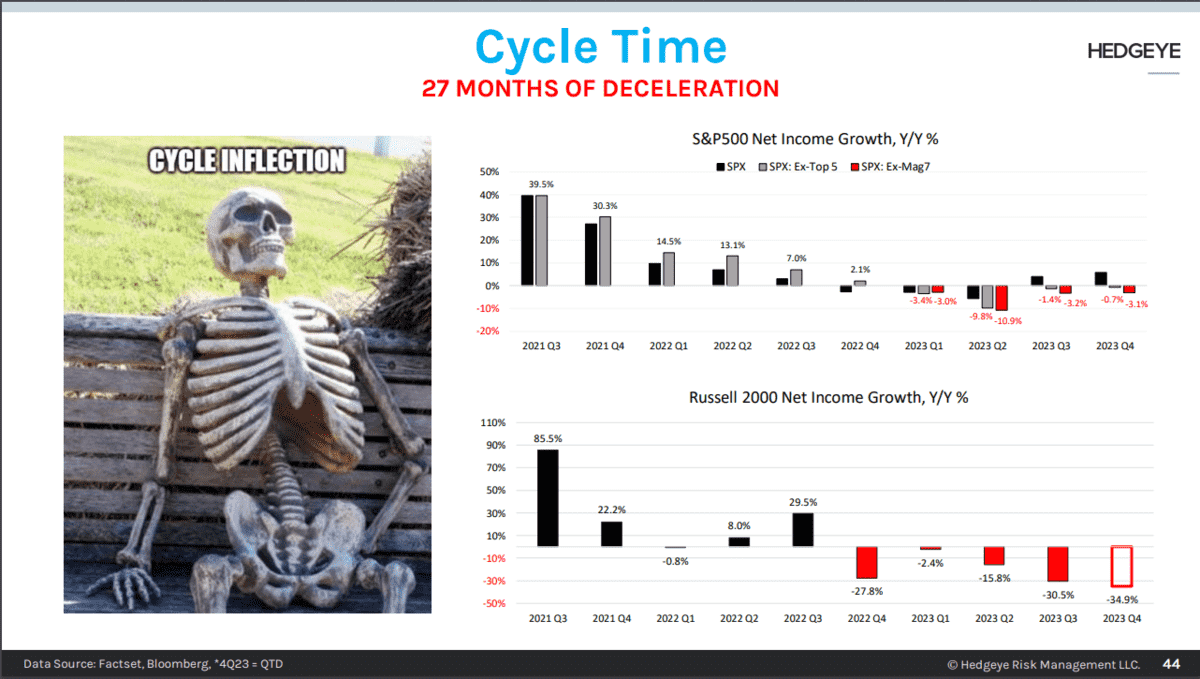

This chart from this weekend’s Early Look by Keith McCullough from Hedgeye shows the 27-month slowdown in S&P 500 and Russell 2000 net income growth.

Based on the fundamentals (like tepid earnings growth and rising valuations) this market is pretty fully valued. Thus, a sustained, broad based bull rally above current levels cannot be envisioned UNTIL the Fed starts lowering rates.

The current consensus is that the U.S. economy will avoid a recession following the aggressive rate-hiking campaign in history. While it certainly seems that such will be the case given the relatively strong economic growth rates over the last few quarters, important indicators still suggest recession risks remain.

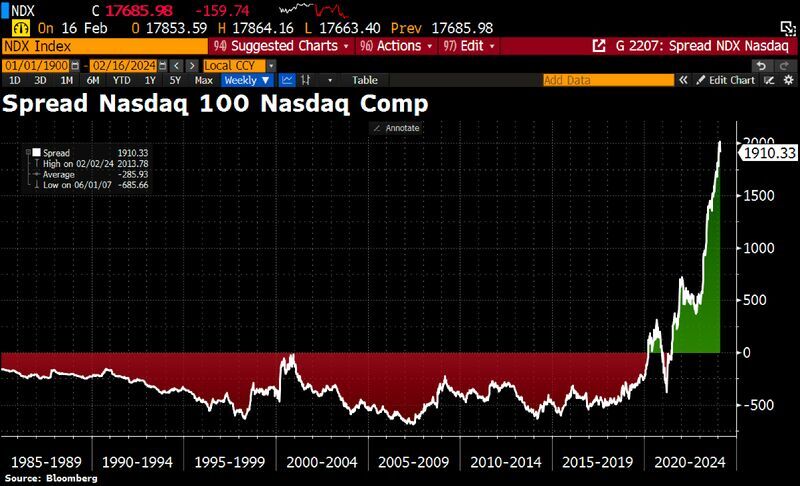

Price discrepancy between the Nasdaq 100 and Nasdaq Composite indices.

Via Jonathan Baird

The spread is truly historic, before the recent FAANG+ and Magnificent 7 driven markets the only time the Nasdaq 100 threatened to eclipse the entire Nasdaq Composite was at the top of the Internet Bubble. All major market moves have historically been led by a minority of stocks, but the narrowness of the current advance is without parallel with the top 5 stocks currently comprising about 32% of the Nasdaq 100 at the time of writing!

Interest Rates : Higher for longer trying a comeback

The 10 year yield is making a massive up candle as we take out the 4.2% resistance. Note that we are now above the 200 day moving average and that we are closing in on a potential golden cross.

Tech has been immune to rates lately, but rates are still in the driving seat for most other equities.

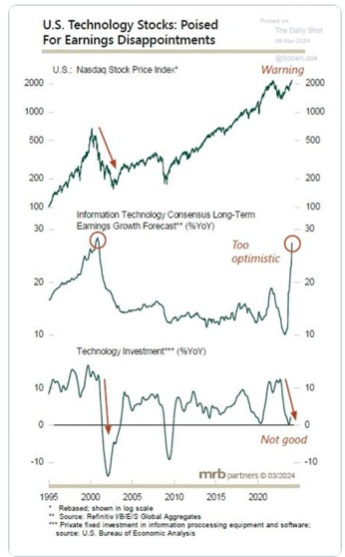

Analysts are very optimistic about US tech sector earnings growth. But record valuations built upon record profit margins represent a “double jeopardy” for investors.

source dailyshot via @SoberLook

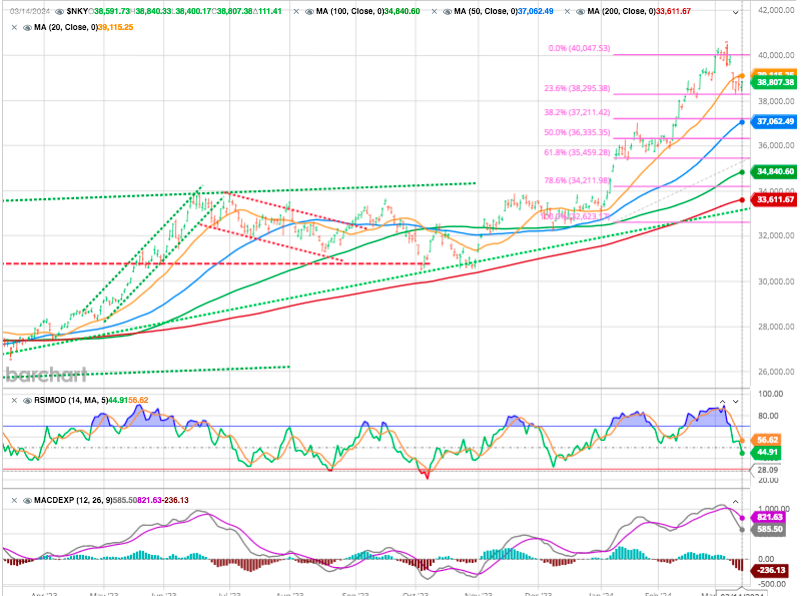

NIKKEI

As the BOJ will probably hike the interest rates for the first time in 17 years, and should support the economy.

The market should continue its trend, supports are 38170 and 37400.

HANG SENG

A double bottom in the air ?

A Bubble ?

MEME is back, trading at “delicate” levels again, beating the SPX once again over the past year (chart in %).

Beta / Growth correlation in the 99.7th percentile implies Growth stocks now have the highest sensitivity to the market versus long term history. Beta Factor

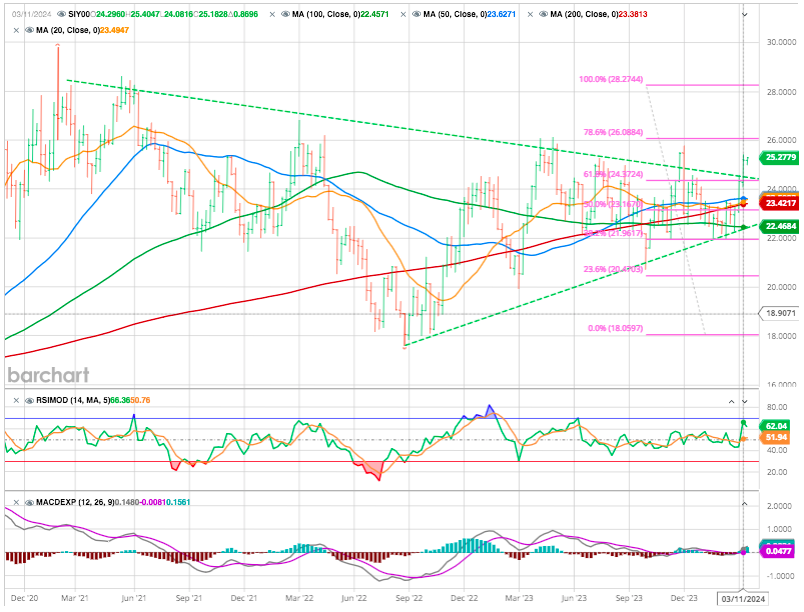

Gold

The precious metal took a breather after two strong weeks, trading at USD 2160. Copper continues to perform well in London, approaching the USD 9,000 per metric ton mark. The reason for this upturn is to be found on the supply side, as China plans to ease up on its copper production. Indeed, China’s largest smelters have agreed to reduce their output.

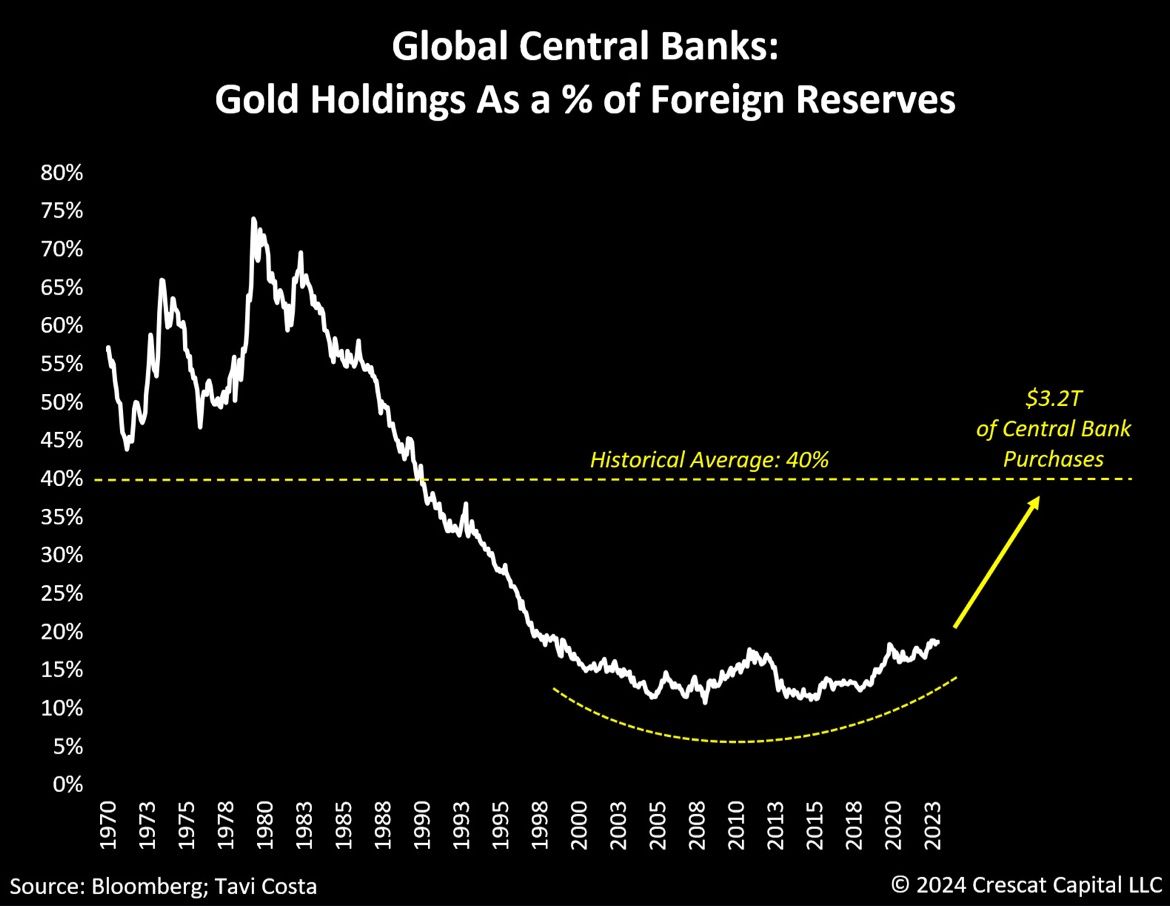

The recent surge in gold prices, despite a lack of corresponding growth in assets managed by related ETFs, suggests that central banks’ purchases have likely been the primary catalyst for the rally.

Although there’s been a record pace of metal accumulation, central banks currently hold a much smaller proportion of gold compared to historical levels. Back in the late 1970s and early 1980s, these institutions held around 80% of their balance sheet assets in gold, whereas today it’s less than 20%.

From Gold to Miners

If metals continue to display resilience, Gold mines could present some of the best distressed opportunities in recent memory. The lack of capital interest and the scarcity of geologists and other workers entering the mining industry is setting the stage for one of the most supply-constrained environments in history.

CRYPTOS

Crypto: Bitcoin (BTC) is down 1.40% around the $68,000 mark, after hitting a new all-time high of $73,830 on Thursday. Bitcoin Spot ETFs are still fuelling the rise, with a record day of net inflows into these exchange products on Wednesday. No less than $1.05 billion flowed into ETFs on a single day.

This Time Is Different

There are many narratives surrounding the markets, digital currency, and gold. However, in today’s market, more than in previous years, all assets are getting swept up into the investor-feeding frenzy.

Sure, this time could be different. (joking)

Banzai !

The Bank of Japan is about to end negative rates with its first hike since 2007. There are implications for carry traders, and for Japan’s giant neighbor, China.

The Carry Trade

The BOJ’s obdurately negative interest rates have been a boon to anyone operating a carry trade— the tactic of borrowing in a currency with low rates and parking in one where you can get a better return.

Typically, a carry trade is working well when the flow of funds from the low- to high-rate country tends to strengthen the latter’s currency, thus making the trade all the more profitable. Such trades prosper when volatility is low and currencies and interest rates are stable.

Since the beginning of 2020, remarkably, a carry trade of borrowing in yen and parking in the Mexican peso has made a far bigger profit even than an investment in the S&P 500.

China

If there is any beneficiary from higher Japanese rates, it stands to be China.

As we noted in our Beijing’s Bazookas and The Wooden Dragon Year Xi Jinping’s flagship policy is to replace real estate as the main driver of growth with industry and technology. For China, the obvious market for its wares — cars, trains, turbines, solar panels, power plants — has to be other emerging markets. And China’s biggest competitor in this endeavor is Japan.

Notoriously, China wanted a weak currency after entering the World Trade Organization in 2001. As it grew, this helped undercut other countries’ export prices. Now, according to Gavekal it seems that China has an interest in maintaining a strong currency. That way, it’s easier to persuade others to “de-dollarize,” or use the yuan rather than the US dollar.

If the yen began to rise, the outlook for China would improve substancially. At that point, policy, geopolitics and financial markets would all point toward a stronger yuan and stronger Chinese capital markets. Positive rates in Japan would definitely be good news for China.

Happy trades