MARKETSCOPE : Good Buy Until It’s Good Bye !

December, 11 2023The market (as measured by the S&P 500) has lately not seen a move over one percent in either direction and, as the old Wall Street adage goes:

“NEVER SHORT A DULL MARKET”.

Stocks closed higher last week following a strong monthly jobs report to clinch a sixth straight week of gains, with the S&P 500 and Nasdaq Composite hitting their highest closing levels since early 2022.

For the week, the Nasdaq climbed 0.7%, the S&P added 0.2% and the Dow Jones average finished flat. The market (as measured by the S&P 500) has this week not seen a move over one percent in either direction and, as the old Wall Street adage goes: Never Short A Dull Market ! The small-cap Russell 2000 Index outperformed the S&P 500 Index for the third time in the past four weeks, helping narrow its significant underperformance.

For the week, the Nasdaq climbed 0.7%, the S&P added 0.2% and the Dow Jones average finished flat. The market (as measured by the S&P 500) has this week not seen a move over one percent in either direction and, as the old Wall Street adage goes: Never Short A Dull Market ! The small-cap Russell 2000 Index outperformed the S&P 500 Index for the third time in the past four weeks, helping narrow its significant underperformance.

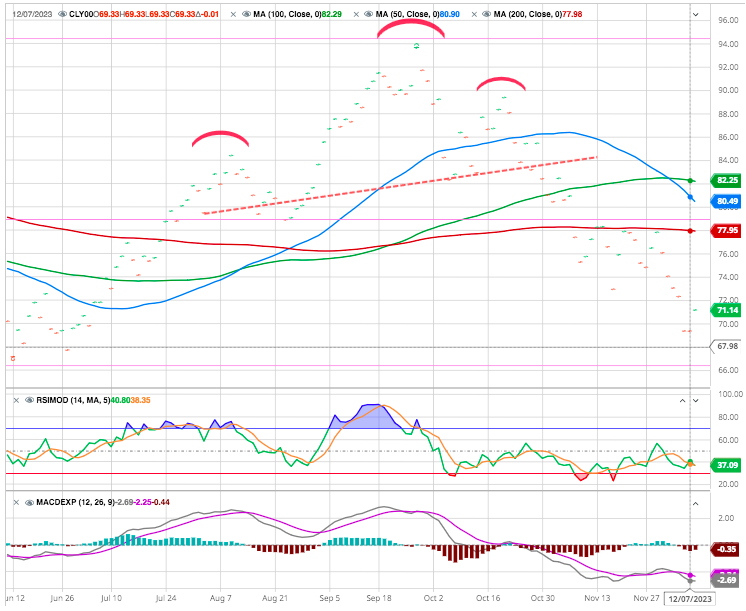

Spot gold prices climbed to a fresh record of $2,100 on Monday, while bitcoin breached $44,000 on Tuesday to reach its highest level since April 2022. Within the S&P 500, energy stocks lagged as domestic oil prices fell below USD 70 per barrel for the first time since June. See below.

The US job market remains stubbornly resilient. In any case, with 199,000 jobs created in November, against expectations of 185,000, and the unemployment rate dropping from 3.9% to 3.7%, the Fed has one more reason to keep rates permanently high. In any case, longer than the equity market expects.

STOXX Europe 600 Index advanced for a fourth consecutive week, ending 1.30% higher. Japan’s Nikkei 225 Index fell 3.4% over the week as comments by BoJ officials stoked speculation that the central bank may abandon its policy of negative interest rates earlier than anticipated, weighing on riskier assets. Meanwhile, Chinese indicators are still blowing hot and cold, with the services PMI slightly higher than expected, but import figures still weak. Beijing is still struggling to get its economy moving again.

The focus now turns to the Federal Reserve’s last monetary policy committee meeting of the year next week. Markets are widely anticipating the central bank to hold steady on rates. The Fed (Wednesday) and ECB (Thursday) will make their final monetary policy decisions of 2023. These meetings, coupled with the week’s expected statistics (inflation and producer prices in the US, PMI indicators, etc.), will enable the market to test its hypothesis of a reduction in key rates as early as the first half of 2024.

MARKETS : Year-End Rally or not Rally

The Tide Turns

Europe has taken the lead for once. Markets worldwide are positioning themselves for rate cuts in the new year, creating sharp falls in yields and a boom for risk assets. But nowhere has that shift been more dramatic than in the eurozone.

One of the most surprising performances comes from no other than our one European equity market. Dovish comments by normally more hawkish ECB member Isabel Schnabel last week reaccelerated the uptrend. The Euro STOXX 50 index closed at a new … drumroll … all-time high.

Even the SMI, one of Europe’s lagging markets this year is recovering. Especially one of the index’s heavy-weights, Roche, has helped to push the index up.

What lies behind this?

Europe is differentiated from virtually everyone else by the intensity of the energy price crisis it suffered last year due to Russia’s invasion of Ukraine. Prices have abated. This means that headline inflation — most important in politics and in moving consumer behavior — has collapsed after peaking in double figures.

This provides space for the ECB to be far more lenient. The reason they might have more urgency to cut now stems from opinion surveys, which show both businesses and consumers growing more negative in a combination that normally prefigures a disinflationary slowdown.

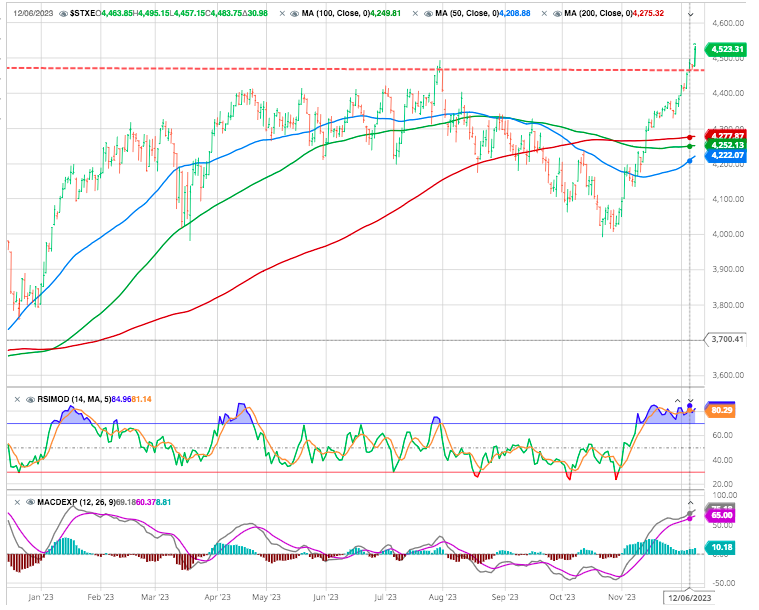

Market rotation

While the market struggled to advance early in the week, at the end markets climbed to set new closing highs for the year, as shown. However, the combination of overbought conditions and excess bullish sentiment limited gains from weaker-than-expected economic reports that should keep the Federal Reserve at bay.

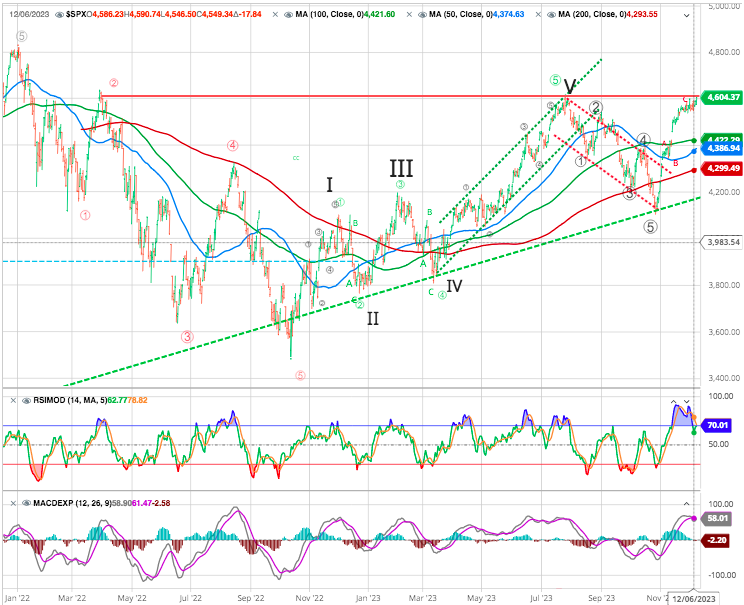

The equity market (and most other parts of the financial universe) has been in rally mode for about five weeks now, and while it would be greedy to think that the S&P 500 could rally the 4% needed between now and year-end to get back to its prior highs from the start of 2022.

With the substantial November advance, the question is whether anyone is “left to buy?” The S&P 500 rallied nearly 9% fin November. Notably, this rally followed a 10% decline from August to October, which sent investor sentiment to bearish levels. The resurgence in bullish sentiment is quite astonishing.

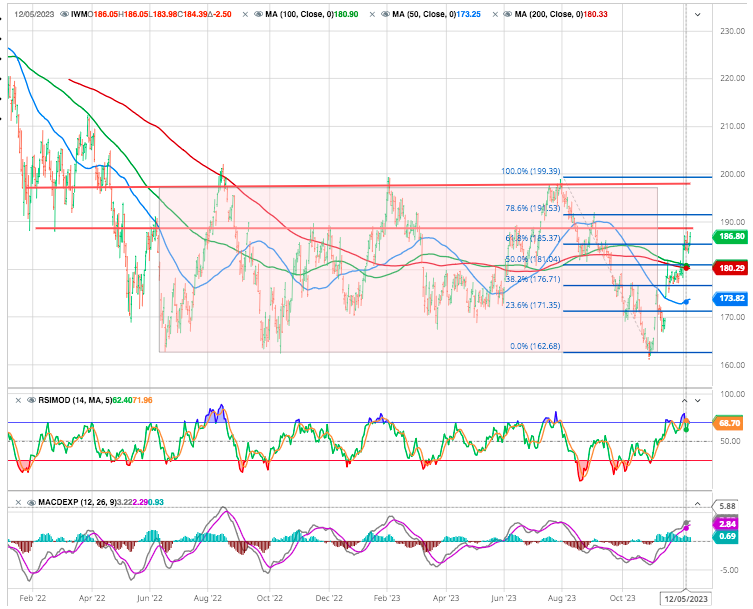

Russell 2000 is up by nearly 14% since its late-October low, but only 4% of members are at a new 52-week high. US small-cap stocks, as measured by the Russell 2000, have moved into the upper half of their nearly 1 1/2-year range.

It then back Fibo above 61.8% of the last wave down and facing a major resistance at 189.

The equity market (and most other parts of the financial universe) has been in rally mode for about five weeks now, but it would be greedy to think that the S&P 500 could rally the 4% needed between now and year-end to get back to its prior highs from the start of 2022.

On a total return basis, the market is knocking on the door of new all-time highs. As shown in the chart below, the total return index is within 1.1% of its prior all-time high from 1/3/22. In addition to nearing its prior highs, the pattern of the S&P 500 looks a lot like a cup and handle, which technicians consider to be a bullish formation.

Source Bespoke

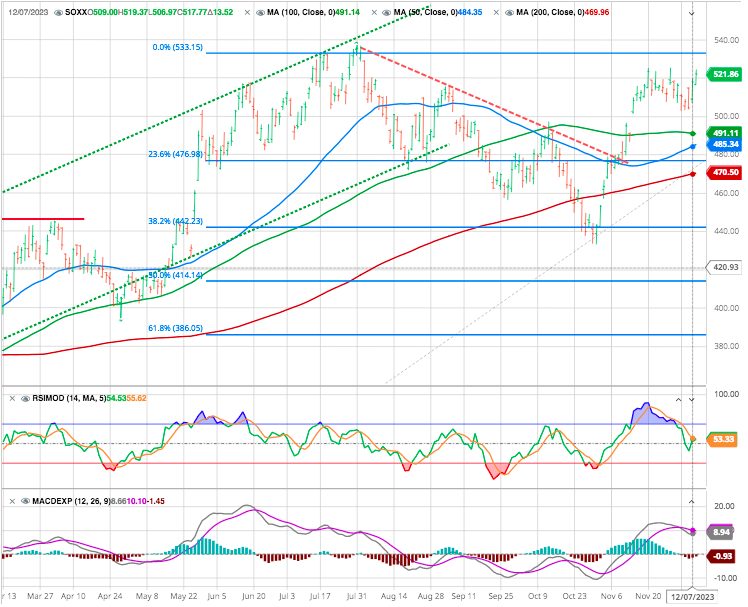

Never the less, looking at the semi sector which has been the leading indicator in the past years we would remain very cautious as it still miss a new high .

The Santa Claus Rally Cometh

It certainly is related to an anticipated pivot. Although the Fed has not cut rates, they have signaled they are close to, or at, the end of its rate hiking campaign. This gave the bulls an early “Santa Claus” gift that “rate cuts will soon be here.” With such a surge in the market, the question is whether bullish investors front-ran the year-end rally.

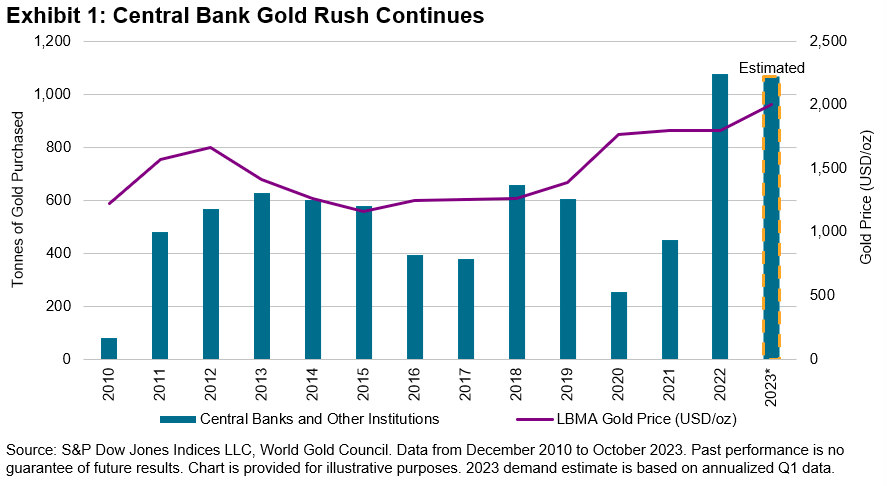

GOLD : Rock and Roll

Central banks continued to add 800 tons of gold to their portfolio in the first three quarters of the year, led by the People’s Bank of China. Purchases thus far drove gold to an all-time high, as inflation wreaks havoc on fiat currencies. Following a year of record gold purchases, central banks are on pace to nearly match 2022 levels. Investors appear to be fighting the U.S. Fed, however, as net redemptions in physical gold ETFs have seen USD 12 billion in outflows YTD.

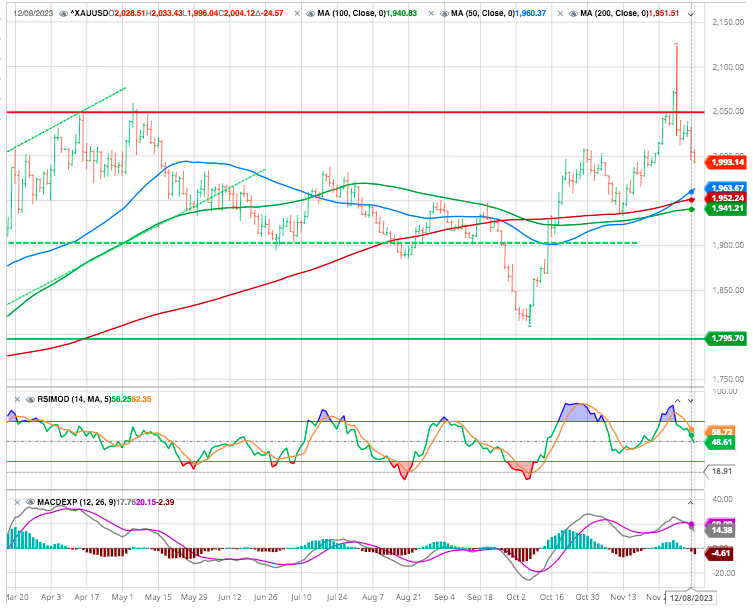

What was strange was the dive gold took after the landmark. Many were prepared to buy if it broke that level, but it would appear that many others had decided it would be an opportunity to sell into strength:

In the case of gold, it crashed through the $2,100 barrier for the first time very early in Monday trading. Peter van Dooijeweert of Man Group described the gold story now as “very much a bond story.” With rates falling, the argument against gold — that it has no yield — is less of a problem. “But I think there’s still an overarching conviction of things could break next year. So the people who are gold bugs got a little bit of relief from the punishing rate moves. And so now they have a bit of freedom to use gold as that defensive asset.” The fear surrounding politics gives a “defensive kicker.”

According to Bespoke Investment, the only time gold saw a bigger intraday decline after making a new all-time high was way back on Oct. 2, 1979, when it closed 5.29% below its high point. That was in the middle of the biggest melt-up the gold market has ever seen, and its price would more than double from the close that day until peaking the following January.

CRYPTOS

Bitcoin gets December off to a flying start. Following on from November, BTC has soared by more than 9.70% since Monday, returning to close to $44,000 at the time of writing. A peak last seen at the beginning of 2022.

OIL

Energy prices keep on slipping, with benchmark West Texas Intermediate so far down 22% in the fourth quarter. It comes as the U.S. continues to pump crude at a record rate, cranking out a record 13.2M barrels a day, which is more than oil-exporting heavyweights Russia and Saudi Arabia.

OPEC members have been forced to respond to record U.S. production, with tensions most apparent in the reactions from kingpin Saudi Arabia. So far the Kingdom’s strategy has been to slash more output, but the deeper cuts have not resonated with oil bulls and have even formed some cracks within the OPEC+ group. Economic weakness in China, Russia’s shadow fleet and the removal of fear premiums from the Israel-Hamas war have also helped contribute to oil’s decline,

Many have also been eyeing recent developments to see whether the U.S. will refill the Strategic Petroleum Reserve, which has fallen to its lowest level since the 1980s following the release of 180M barrels last year. At the time, the Biden administration said it would consider refills “at or below about $67 to $72 per barrel.

The price of crude oil is likely to continue falling from current levels before settling around $68 at the major support. see our previous oil prognostic in our marketsope– Despite the bearish outlook, we would not recommend shorting crude oil – the geopolitical situation could change in a moment.

Other Commo : Expensive Breakfast

Cocoa and coffee registered 12% and 13%, respectively, with the S&P GSCI Coffee hitting double-digit returns for the second consecutive month. Reduced production due to heavy rainfall in the Ivory Coast boosted the S&P GSCI Cocoa to 72% YTD; combined with the S&P GSCI Sugar, which was up over 50% YTD, the two will surely sweeten the holiday season.

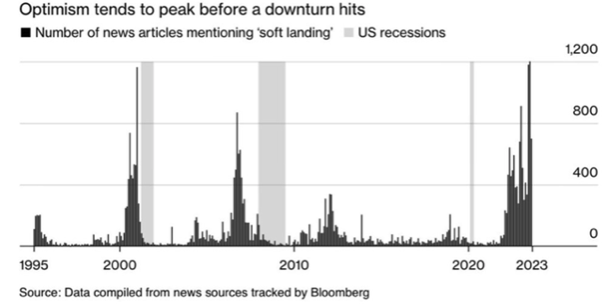

Soft Landing Hopes and Hard Landing Realities

Forecasting recessions is difficult, but the bond market has a very good track-record as it got it right in 1970, 1975, 1980, 1982, 1991, 2001, 2009 and 2020. Admittedly, most of us though the recession would have come by now, but the fact that it hasn’t, doesn’t mean that it won’t.

The most widely received comment recently is the certainty of a recession in 2024. However, at the same time, an increasing proportion of Wall Street analysts and economists suggest just an economic slowdown or a mild recession at worst. The hope is a repeat of 1995. This is the elusive “soft landing” scenario where the Fed hikes interest rates and cools economic growth and inflation but avoids a recession.

The yield curve inverts, on average, 24 months before the start of a recession. That would put the most likely start date of a recession to October 2024.

Although the economy is doing fine for now, don’t think this time will be different and something will break eventually as a result of monetary policy tightening. Consequently, we would expect a recession in the second half of 2024.

Happy trades