MARKETSCOPE : Bull Trap or Christmas Rally ?

November, 13 2023Sky Is The Limit

“Whenever you find the key to the market, they change the locks.”

— Lucien Hooper

Risk appetite eased somewhat on the financial markets at the end of the week, following a rather hawkish speech by Jerome Powell. The Fed head hinted that the monetary tightening cycle in the US was not necessarily over.

Actually, the Fed faces a tricky balancing act of slowing demand without creating a recession, which, despite recent improvements in economic data, remains a risk in 2024.

On Thursday, Fed Chair Powell said that while the economy has made progress in the fight against inflation, he is “not confident” the Fed has done enough to address the issue. Despite these comments, the S&P 500 and Nasdaq Composite notched an 8-day and 9-day winning streak, respectively—both the longest string of consecutive up days since November 2021. Investors jumped back in, reclaiming the notion that U.S. rates have peaked which had sparked the rally in risky assets. Upside earnings surprises from some tech firms appeared to provide support to growth stocks.

On Thursday, Fed Chair Powell said that while the economy has made progress in the fight against inflation, he is “not confident” the Fed has done enough to address the issue. Despite these comments, the S&P 500 and Nasdaq Composite notched an 8-day and 9-day winning streak, respectively—both the longest string of consecutive up days since November 2021. Investors jumped back in, reclaiming the notion that U.S. rates have peaked which had sparked the rally in risky assets. Upside earnings surprises from some tech firms appeared to provide support to growth stocks.

In Europe, the STOXX Europe 600 Index ended 0.2% lower as optimism about a peak in interest rates dimmed.

Japan’s stock markets rose over the week, with the Nikkei 225 Index up 1.9% and the broader TOPIX Index gaining 0.6%, supported by strong corporate earnings, the government’s commitment to additional economic stimulus, and continued currency tailwinds.

Meanwhile, in China, statistics remained hopelessly lackluster. Consumer prices even fell in October, hardly consistent with the long-awaited economic rebound in the world’s second-largest economy.

Ahead the consumer price index report for October will be a key event (Tuesday) as investors look for direction with interest rates.

If all goes according to plan, prices should have risen by just 0.1% between September and October, not only because inflation is easing, but also for technical reasons (a sharp rise in the rent component in Septembedr).

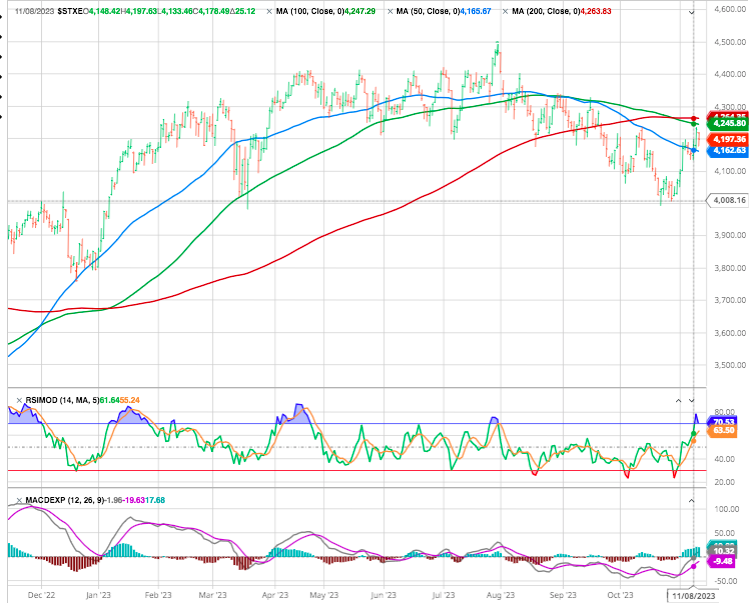

MARKETS : Taking out the downtrend

If it looks like a duck, swims like a duck and quacks like a duck, then it probably is a duck.

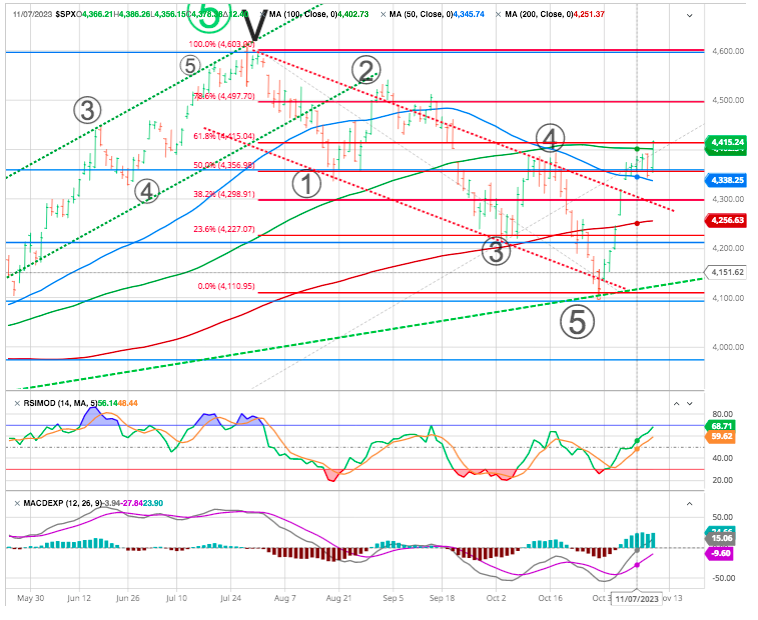

SPX is taking out the big trend line and is closing in on the 100 day moving average (green line ). A pullback to 61.8 % fibo retracement of last down wave. Another massive up candle is creating even more frustration as the crowd is waiting to buy the dip still. After regaining the 200-DMA, the market surged through the 20- and 50-DMA.

With the upper-band of the downtrend channel from the July highs now broken, there is a much stronger bullish case for stocks through year-end. It will likely not be a straight move higher, so adjusting exposure accordingly.

However, there is not yet any sign of a reversal and the strong close does project further upside early this week. Ideally this is a failed gap higher or a quick spike and fade into a week close and breaking 4334 (50 DMA) would confirm a down wave is underway.

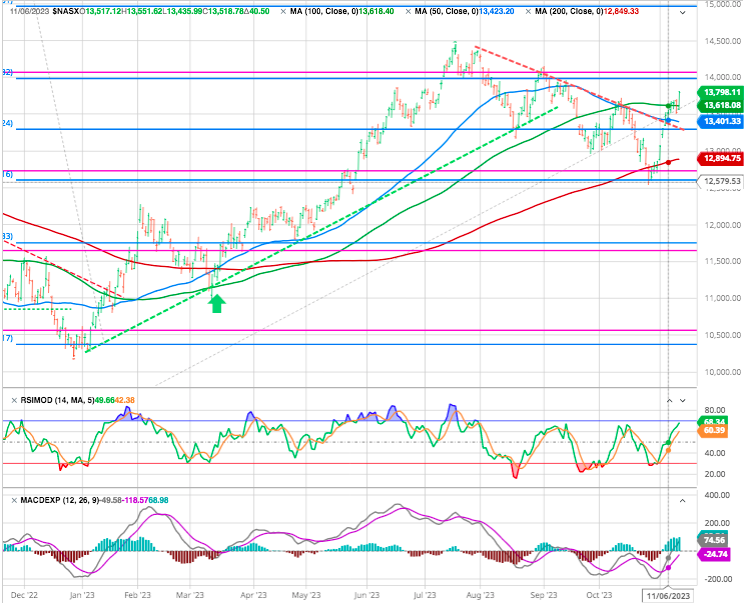

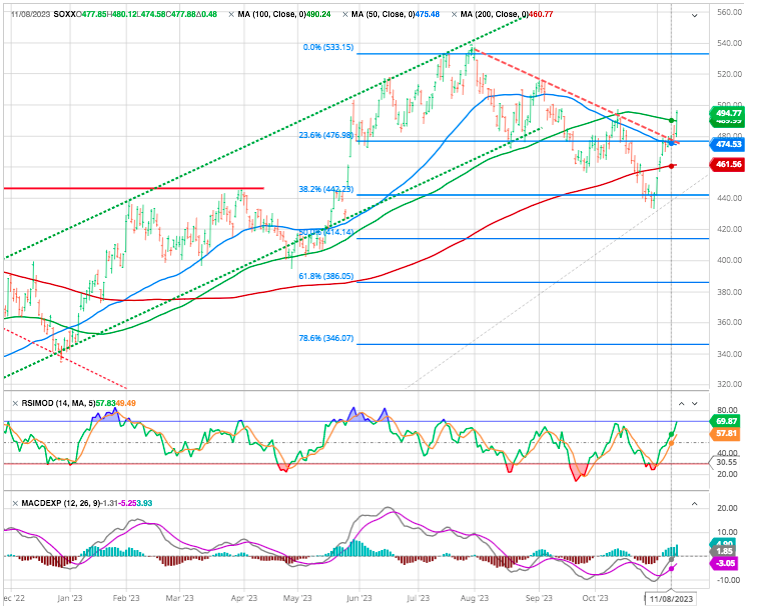

We would stay with the leaders of this move. As a matter of fact, the entire semiconductor sector, in the following chart depicted via the Philadelphia Semiconductor Index (SOX) is showing a bullish constellation, and could be closing in on the 2021 all-time high soon.

Don’t Catch A Falling Knife

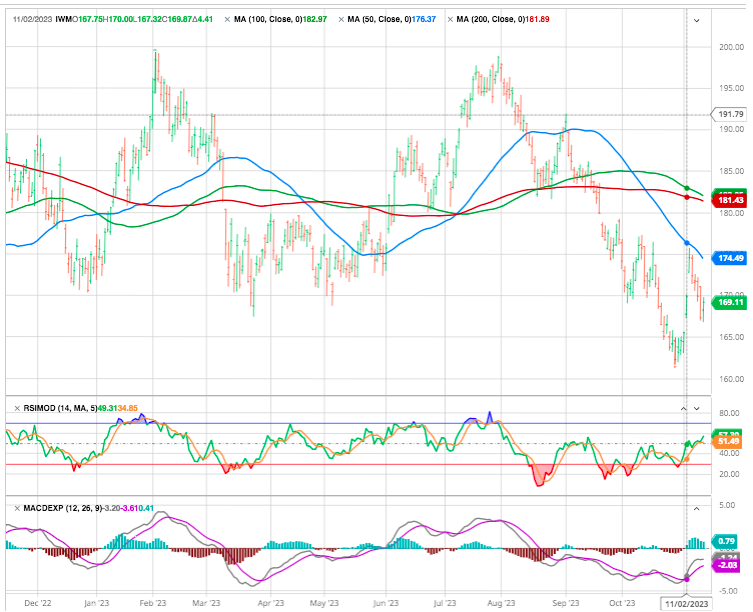

As we can see that small cap (as of the Russell 2000) are still lagging strongly.

We know that the small caps may look like a bargain, but it’s like buying brown bananas at the supermarket If there’s a reason that the market Nicola banana, their brown bananas, they’re not getting any better.

We don’t like seeing something that’s going underwater and getting worse. Yes, DO NOT try to bottom fish that “Small-Caps-will-outperform-Leader-peers-because-they-are-much-cheaper” fad. The cemetery is full of ‘smart’ investors who have tried just that.

Now, the only good thing is the risk reward is tight.

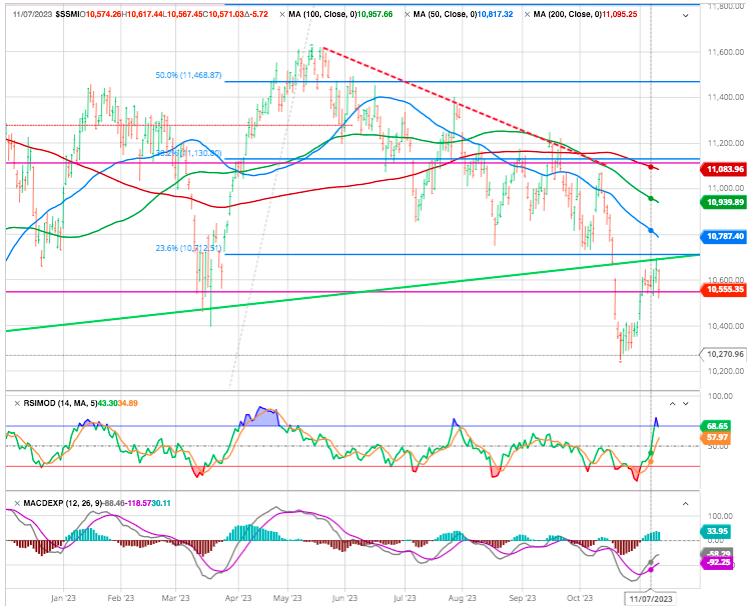

Euro SOXX

European equities missed most of Friday’s late Wall Street rally, but the chart remains overall constructive too.

Taking out the 200-day MA at 4,265 on the EuroSTOXX 50 would be a major win for the Bulls.

SMI

Unfortunately we are far from this situation for the Swiss Market as we broke the March low (as we anticipated it). The major resistance is now at 10’700.

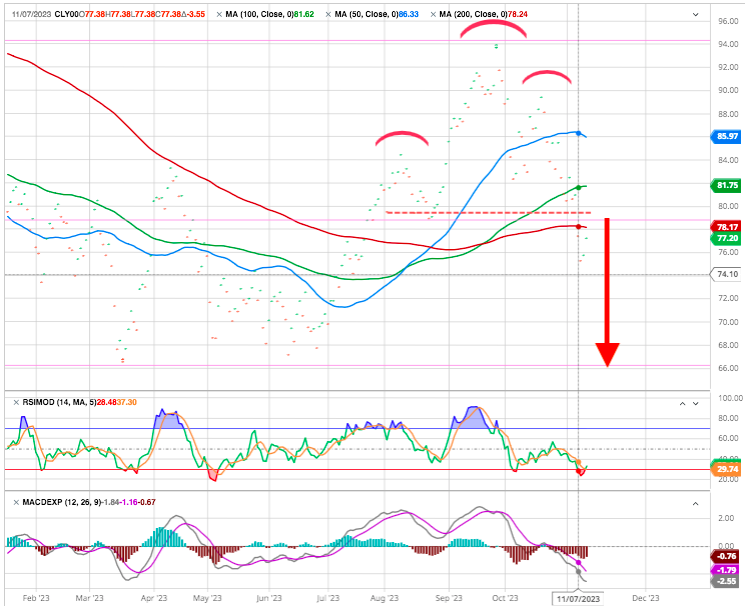

OIL

Oil (WTI) saw the shoulder-head-shoulder pattern triggered $66.60 (devilish!) must hold, otherwise, we will have to put our long oil stocks on the back burner.

CRYPTOS

Fourth consecutive week of gains for bitcoin, which has climbed almost 6% since Monday and is back above $37,000. The same is true of the market’s second-largest cryptocurrency, ether, which has outperformed the leader since the start of the week, rising 10%.

The main reason for ether’s surge was BlackRock’s application to the SEC for a spot ETF based on the ETH cryptocurrency. This was enough to trigger a tidal wave of optimism in the market. Although no ETF of this type has yet been accepted by the SEC, the enthusiasm of the players in this ecosystem is palpable, and is reflected in the valuation of the main cryptocurrencies.

STRATEGY: Increasing Equity Exposure into Year-End

Check our Investment Strategy and Asset Allocation Update for more details

We are tactically increasing equity exposure to slightly underweight to take advantage of seasonal tailwind after having reduced sharply our equity exposure last summer.

Whilst we remain cautious regarding 2024, with a landing (soft/hard/trampoline?) finally in sight for Q1/Q2, we also think that seasonal tailwinds will be strong enough to lift equities into year-end/early January.

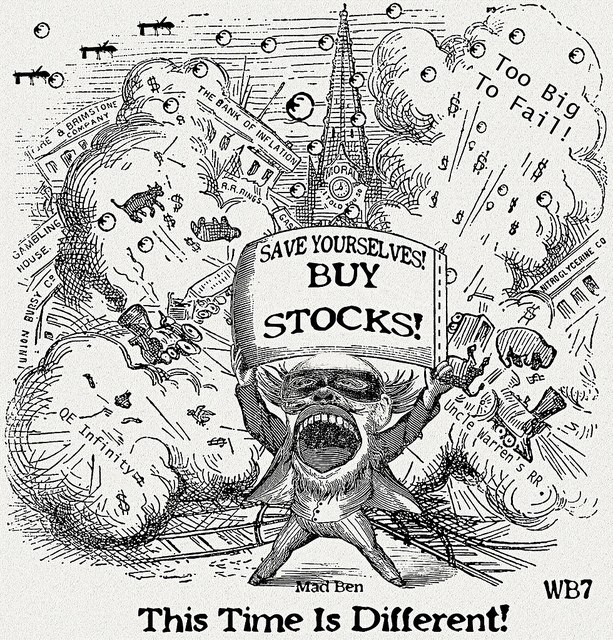

The Fed doesn’t want to let go !

The shift in monetary policy from full-throttle acceleration to cautious crawling doesn’t mean the Fed has become less concerned about inflation. Fed Chair Jerome Powell has said repeatedly that inflation threatens the financial well being of investors and consumers alike, and the Fed remains committed to slowing it, eventually down to around 2%.

The problem for the Fed is that increased liquidity, higher asset prices, and lower yields remove the pressure from consumers. If consumer confidence improves, then so does consumption. That increased demand then fosters higher prices, which is not what the Fed wants, at least not yet.

However, the Fed is also watching how tighter financial conditions caused in part by the Treasury selloff affects these economic indicators in the coming months. If the inflation-fighting force of higher yields ripples through the economy, further rate hikes may not only be unnecessary to achieve the Fed’s goal of getting inflation down into a range of just above 2%, they could also raise the risk of slowing the economy all the way into a recession.

The Fed’s challenge is potentially a trap of their own making. On the one hand, they want falling asset prices and weaker economic data to quell inflation. However, the Fed does NOT wish for an economic event to destabilize the financial system. Unfortunately, the Fed may soon face a difficult decision. Either allow a deeper recession to take hold, quelling inflation, or cut rates to keep a banking crisis from spreading.

We will likely know the answer sooner than later.

Happy trades

BONUS

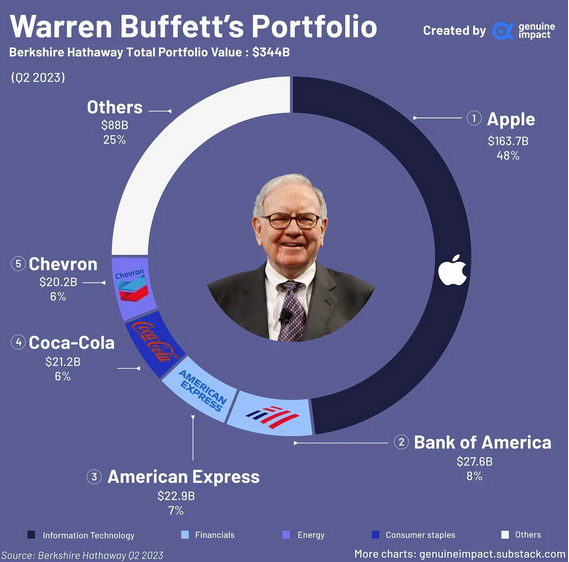

Warren Buffett’s decision to invest billions of dollars in Japan has paid off.

In the summer of 2020, Buffett’s investment conglomerate Berkshire Hathaway bought stakes of about 5% in each of Japan’s top five trading companies.

In the summer of 2020, Buffett’s investment conglomerate Berkshire Hathaway bought stakes of about 5% in each of Japan’s top five trading companies.

Berkshire invested $6.7 billion and told shareholders it could increase those holdings in the long run. This year, it doubled down as Japan’s Nikkei and Topix indexes rose over 20%. Berkshire’s stakes in each company now average 8.5%.

The firms backed by Berkshire include Itochu, Marubeni, Mitsubishi, Mitsui & Co., and Sumitomo. They deal in various industries, including energy, tech, and manufacturing. The stocks are up over 30% this year, with Marubeni shares rising by 62%. Marubeni has more than tripled in price since Buffett’s investment.

According to Buffett’s partner, Charlie Munger, Berkshire was able to pull off its biggest bet outside the U.S. because of Japan’s historically low-interest rates.

Buffett’s portfolio