MARKETSCOPE : Don’t Try To Catch a Falling Knife

April, 22 2024“A bend in the road is not the end of the road…Unless you fail to make the turn.”

— Helen Keller

As ever, the pendulum swings with traders’ hopes and fears, and struggles to remain measured.

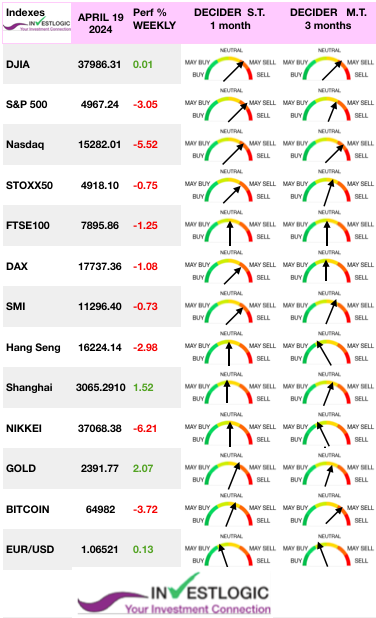

Stocks recorded broad losses, as concerns over tensions in the Middle East and the possibility of U.S. interest rates remaining “higher for longer” appeared to weigh on sentiment. Mega-cap technology shares lagged as rising rates placed a higher theoretical discount on future earnings.

Indeed, some strong economic data (e.g retail sales +0.7% vs. 0.3% expected) appeared to increase worries that the Fed would push back any interest rate cuts to the fall and pushed the yield on the 10-year U.S. Treasury note to its highest intraday level since early November.

Indeed, some strong economic data (e.g retail sales +0.7% vs. 0.3% expected) appeared to increase worries that the Fed would push back any interest rate cuts to the fall and pushed the yield on the 10-year U.S. Treasury note to its highest intraday level since early November.

Disappointing quarterly reports from Dutch semiconductor equipment maker ASML and the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing, pulled down chip stocks, dragging down the technology sector.

Nvidia, Wall Street’s darling designer of artificial intelligence (AI) chips, also fell sharply, dropping 10% to $762.

Other semiconductor and microprocessor manufacturers also fell out of favor, including server and storage solutions maker Super Micro Computer (SMCI), much sought-after for the AI sector, which slumped 23.14%.

All in all, the “Magnificent Seven” – the big names in tech, from Microsoft to Nvidia, Apple, Amazon, Meta, Alphabet and Tesla – returned over $900 billion in capitalization to Wall Street this week.

On the Nasdaq, technology took a beating, dragged down by disappointing Netflix results. Tesla, at its lowest level in over a year ($147), lost a further 1.92%.

This correction in technology stocks comes as investors anxiously position themselves ahead of next week’s earnings announcements. (see AHEAD below).

STOXX Europe 600 Index ended 1.18% lower as tensions rose in the Middle East, while European inflation confirms its decline.

The Nikkei 225 Index was down 6.2%. The week was also marked by the publication of a contrasting Chinese GDP for Q1 2024. “Contrasting” is a term that has been applied to the Chinese economy for some time: growth was stronger than expected at the start of the year, but production and household consumption remained sluggish.

Ahead

All eyes this week will be on the latest U.S. personal income and outlays report, due Friday. The data will also contain readings on the Federal Reserve’s preferred inflation gauge – the personal consumption expenditures price index. Also, Thursday will see the publication of the first estimate of U.S. GDP growth in Q1. April’s leading PMI indicators (Tuesday) will complete the picture.

The market will also be interested in the Bank of Japan’s rate decision (Thursday ), with rates expected to remain steady, but an updated inflation outlook.

Corporate results will be coming in thick and fast, with some fifty groups weighing in at over $100 billion.

It’s going to get interesting from here, 42% of S&P 500 companies will report earnings next week. So far, 64 of 499 companies have reported earnings growth of 9.5% year-over-year.

In the USA, The biggest names set to report include “Magnificent 7” club members Microsoft, Alphabet, Meta Platforms, Tesla, IBM, Qualcomm, Boeing, and Intel will unveil their results, to name but a few.

In Europe, we have SAP, Novartis, Roche, Air Liquide, Hermès, Nestlé, Sanofi, Schneider and TotalEnergies. So there’ll be plenty to do.

Markets : Buy The Rumor, Sell The News !

See our investment strategy & asset allocation update

The S&P 500 is currently in an unprecedented situation where three major fundamental events are colliding with overextended technicals and a bubble-like valuation multiple.

- The Fed has just made a major hawkish turn, dialing back on the signaled interest rate cuts, and even suggesting a possible hike.

- The geopolitical situation has escalated significantly, and we are facing the possibility of a worst-case scenario – a direct war between Israel and Iran.

- The mega-cap tech firms will report their earnings over the next 2-3 weeks, and a slight miss in guidance could burst the AI-bubble.

JPM’s excellent Positioning Intelligence team suggests that this correction process is just a normal correction within an ongoing bullish trend. You will note very similar actions to the dynamics of August last year, during the decline last summer.

1. A market pull-back post almost 30% gains

2. A similar magnitude of declines by this point MTD

3. Rising yields / resurfacing inflation concerns

4. HFs starting to add shorts

5. Positioning declines as highlighted by their TPM.(see red arrows)

Blue line : average of full history z-score positioning level – is the number of standard deviations an observation x is above or below the mean. Z-scores are used to compare placement of a value compared to the mean. If the z-score is negative, x is less than the mean. If the z-score is positive, x is greater than the mean-

We can add many more reasons why it feels like this sell-off still has legs.

Now that we’ve had our first glimpse of real selling pressure since November, investors have quickly become fearful, or at least much less optimistic. When sentiment normalizes after a prolonged period of extremes, it has historically never resulted in an immediate bear market, or even a correction. Of course, this is just a recounting of history, since human behavior means that it tends to repeat itself.

A couple of weeks we signaled a short and a medium term coincident sell signals therefore that a correction process was imminent (red vertical bar).

That correction process arrived last week and continued earnestly, with the market falling below the 100-DMA. We fixed the main support at around 4700 whic is the 200 DMA as well as the 50% Fibo retracement of the last wave up (Oct 2023) and 38.2% retracement of the uptrend from Oct 2022.

Despite, the market short-term oversold, such as a reflexive rally in the next week is likely, we shall not buying Tech in a FOMO reflex as an asset makes a lower high, then it breaks the trade momentum line and then it breaks down below trend. When these thresholds break – trade and trend lines – it perpetuates a directional behavior. That’s when assets have the highest potential to collapse.

Down 5.5 % in the week for the Nasdaq 100, it’s starting to look like correction.

This term has a fairly consensual definition: a correction occurs when an index loses 10% from its highs. This has happened some thirty times over the last forty years for the broad US S&P500 index, with an average drop of 13%. We’re not there yet, but the S&P500 and the Nasdaq are getting closer from their April 1 highs, so it’s something to watch.

For the first time in six months, Smart Money (professional investors, who are supposed to know how finance works) and Dumb Money (private investors, who are supposed to be totally off the mark and considered superb contrarian indicators by Dumb Money) are at the same level of confidence when it comes to equities.

Source Bloomberg opinion

Last autumn, equities held up well, even after sentiment had initially reached extreme optimism.

The Russell is down -9% from where it made a lower high in April. Now the Russell is down -20% from where it peaked in November 2021.

STRATEGY

What’s changed in the portfolio over the past weeks ? Basically, we keep increasing commodities (metals/ energy) and reduced crypto and momentum-based equity exposures and significantly growth oriented down. We also chose to add selected Emerging Markets.

FED : It Is the Destination Not the Journey !

Powell signals higher for longer rates as inflation data dent confidence on cuts

The much-awaited Fed pivot has materialized, but it’s not what investors had been expecting. The change was supposed to signal that the central bank finally reversed course on its contractionary monetary policy path, which has been in place since March 2022.

Unfortunately Federal Reserve Chair Jerome Powell indicated last week that the central bank can stand pat for “as long as needed.”

“The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence.”

Many had predicted that the last mile of the inflation fight would be the hardest, and the latest comments didn’t rock equities too hard as the central bank has been clear that incoming data would determine its path forward.

Suffice it to say that things will be higher for longer, but for the time being.

Happy trades