Q2 Investment Strategy Update

April, 23 2024Up to now our well-diversified positioning since the start of the year has been playing out rather well with our favourite equity markets (US and Japan) outperforming.

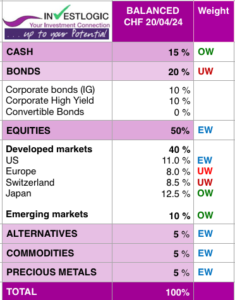

Following the recent market developments we are adjusting our Strategy and Asset Allocation for Q2 2024.

Keynotes

- We are adjusting our portfolio to the new environment we want to adjust our allocation to a more neutral Asset Allocation. We shall not add more exposure to equities at this stage. We recommend taking profits from the growth stock-dominated US equity market, and investing in global value stocks instead.

- Within non-US markets, we are keeping our preference for Japan and staying neutral on Europe. As momentum in Emerging countries is on the rise, we are keeping our over weight exposure c in this region. However we are not increasing our investments in Chinese equities.

- We are cutting our fixed income allocation from neutral to negative by reducing our stance on government bonds and corporate investment grade. Proceeds are reinvested into cash.

- Within commodities, we remain positive on gold, which continues to exhibit low volatility with other asset classes and should be a beneficiary of any tail risk event. We note it is supported by a heavy demand stemming from central banks, especially in emerging markets.

Positive performance on the financial markets has helped to significantly increase the value of our portfolios despite the challenging global economic climate and geopolitical tensions.

Economy : Contrasting economic cycles

Economic performance at regional level continues to vary widely. Growth remains weak in Europe and China, and the recovery is proving sluggish. In contrast, the US economy continues to perform very well, although inflation rates remain persistently high. Contrasting economic cycles are not unusual from an historical perspective.

The global economy usually only moves in sync in phases of crisis or recession, such as at the start of the COVID-19 pandemic, when economic activity slumped in almost all industrial nations at the same time. As can be seen at the moment, economic cycles do diverge during upturns.

Source Fidelity April 2024

Momentum on equity markets worldwide began to falter in April. How long a series of triumphs can be sustained on the financial markets ?

- A cautious stance over growth stocks have grown in recent weeks and months. Firstly, the valuations of these shares have now reached very elevated levels. For many companies, high expectations of future earnings growth have already been priced.

- Concerns over stubborn US inflation have been borne out. There’s a risk of core inflation becoming entrenched at just under 4 percent, which is twice the US Federal Reserve’s target.

- In this climate, substantial policy rate cuts look an increasingly distant prospect. The markets responded this year by raising long-term interest rates considerably. They may even go up again unless more progress is made on combating inflation. Above all, this will have an adverse impact on equities anticipating strong earnings growth as a rise in interest rates would lead to greater discounting of future profits.

Markets : Faltering momentum

This development led to disillusionment on the global financial markets. Bond markets fell significantly in value, while equity markets also began to falter.

Equity markets made gains again last month. Strikingly, it isn’t just tech stocks, previously the driving force behind the equity market rally, that have continued to rise, but prices in other sectors too. That means market development is now more broad-based. In particular, the energy sector, boosted by higher energy prices, gained momentum last month.

The central banks’ approach of “higher for longer” looks set to continue this year, at least in the USA. led to disillusionment on the global financial markets. Bond markets fell significantly in value, while equity markets also began to falter. This will adversely impact growth stocks, in particular.

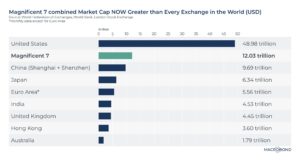

The market capitalization of the ‘magnificent seven’ exceeds that of other equity markets.

That’s why we recommend taking profits from the growth stock-dominated US equity market, and investing in global value stocks instead.

“Rotation is the lifeblood of every bull market.” – Ralph Acampora

High or rising interest rates have a particularly adverse effect on the valuation of these Interest-sensitive growth stocks as they reduce the present value of future profits and reduce the valuation of these firms. By contrast, value stocks are less hard hit as they traditionally offer high current profits and low growth.

This creates downside potential for interest rate-sensitive stocks such as technology stocks in the US equity market in particular.

We’re recommending to take the gains on US shares with a high proportion of these securities and reducing their allocation in the portfolio.

Instead, we are building up our positions in global value stocks. They have a more defensive character, lower valuations and are less sensitive to high interest rates in the USA due to their relatively high profits already – and lower predicted earnings growth.

At the moment, the US equity market is dominated by growth stocks, specifically by the ‘magnificent seven’, which currently account for around 30 percent of the US stock market. These shares contributed significantly to the strong performance of the US stock market past 12 months.

While they’re still performing strongly, they increasingly look to have little upside potential left. That’s why we recommend taking profits from the growth stock-dominated US equity market, and investing in global value stocks instead.

In contrast, value stocks have proven to be more resilient in the past in an environment of higher interest rates. We therefore recommend buying global value stocks at the expense of the technology-dominated US equity market.

Global Value/Global Growth

The chart illustrates the enormous performance difference of value and growth over the past ten years as a ratio, i.e. global value stocks divided by global growth stocks.

The best argument that can be made for value stocks is they may have found a technical bottom, which coincides with the fundamental factor of rising rates environment.

Emerging

More positive economic data is currently coming from other large emerging markets such as the Philippines, Indonesia and Vietnam. These countries have achieved growth of 5 percent or more in the past year.

The recovery in China, the biggest emerging market economy and the second largest in the world, has been sluggish, but shows some signs of recovery. Sentiment data collected from companies by the state did improve considerably last month and inflation moved away from its lows.

However, the sentiment indices produced by the private sector do not point to any significant trend reversal. The Chinese central bank’s first tentative interest rate hikes have not created any sustained impetus yet. This is reflected in the growth rates of bank loans and the overall financing of the economy, which continue to fall.

Stay tuned