MARKETSCOPE : Beware of a Schizophrenic Market

December, 05 2022There’s a Light Side, There’s a Dark side…And There’s the FED .

“The market can stay irrational a lot longer than you can stay solvent.”

John Maynard Keynes.

Markets continue to overreact to news that could tip U.S. monetary policy one way or the other, Never the less stocks maintained weekly gains, after the monthly U.S. jobs report showed the Federal Reserve’s aggressive interest rate increases have not yet cooled the strong labor market. The data revealed non-farm payrolls rose by a greater than expected 263,000 and the unemployment rate held steady at 3.7% in November. But investors were able to shake off the report, leaning on Fed Chairman Jerome Powell’s mid-week remarks that suggested a slower pace of rate hikes.

Markets continue to overreact to news that could tip U.S. monetary policy one way or the other, Never the less stocks maintained weekly gains, after the monthly U.S. jobs report showed the Federal Reserve’s aggressive interest rate increases have not yet cooled the strong labor market. The data revealed non-farm payrolls rose by a greater than expected 263,000 and the unemployment rate held steady at 3.7% in November. But investors were able to shake off the report, leaning on Fed Chairman Jerome Powell’s mid-week remarks that suggested a slower pace of rate hikes.

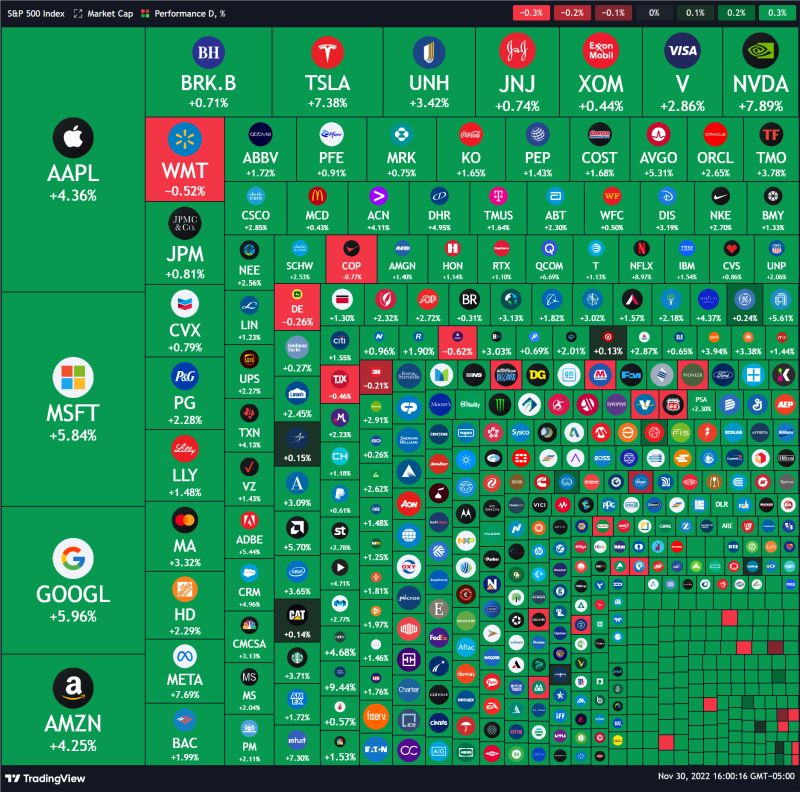

Growth stocks outperformed their value counterparts. Meanwhile, the Dow Jones Industrial Average Index did enter bull market territory on the final day of November, when it closed more than 20% above the low it hit in September 2022.

The dollar and U.S. Treasury yields also reversed from initial gains to finish lower and risk assets rebounded.

In Europe Indexes rose for a seventh week in a row, as lower inflation spurred hopes that central banks could slow the pace at which they are tightening monetary policy.

Chinese stocks rose amid signs that the Fed would slow the pace of interest rate hikes and that Beijing was moving closer to fully reopening the economy after months of pandemic controls.

MARKETS : Dr Jekyll and Mr Hyde

The main event last week was Chairman Powell’s speech on Wednesday when stocks went from modest red arrows earlier in the session to a +3% heart pounding, end of day rally. The S&P 500 (SPY) quickly dispensed with 2 key levels of resistance on Wednesday following statements by Fed Chairman Powell.

Now more people are contemplating that the 2022 bear market may be over and time to get more bullish.

The short version is to say…this rally makes no FREAKIN’ sense! Let’s look at it :

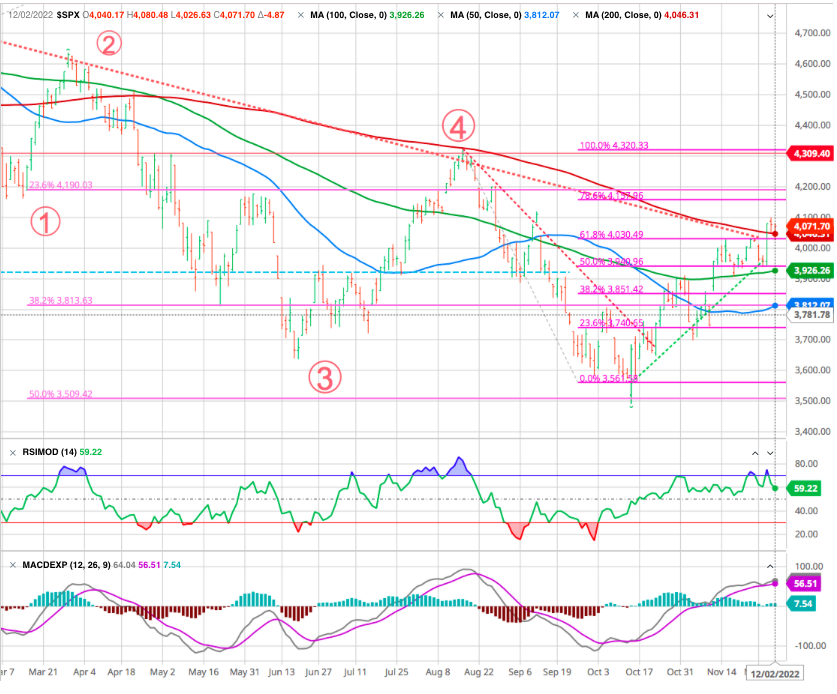

The S&P 500 closed above the 200-day MA last week for first time in more than 7 months.

As you can see from the S&P 500 year to date chart there have been a few times we broke back above the 200 day only for it to fail. Thus, hard to appreciate why right now would be different with the economy on the verge of recession.

Although, as noted by Ryan Detrick, over the previous 13 times (since ’50) it was beneath this trendline for 6 months or more and closed above showed only once did it move back to new lows. Up avg 18.8% year later and higher 12/13 times.

Regardless, the market rally sent the volatility index below 20, which has historically denoted market peaks rather than the beginning of a bullish rally. With the market breaking above the 200-dma, investors are starting to ask the obvious question.

“Is the bearish market over? Is now the time to jump back in?”

It is an interesting psychological phenomenon because investors continue to choose whatever narrative they need to support the bullish or defy the bearish case. The reality is that as asset prices increase, individuals quickly find “rationalizations” for buying stocks.

Despite the Fed continuing to hike rates, which is bearish from a valuation standpoint, investors continue to chase stocks in hopes the Fed will reverse monetary tightening. Instead, investors continue to “fight” the Fed hoping for a pivot. Such is due to the F.O.M.O. (Fear of Missing Out) of missing the bottom of the market.

As noted above, Powell’s comments on Wednesday sent the markets screaming above the 200-dma, which excited the bulls. But is the bull market back, or is this another “bearish” setup waiting to maul overly enthusiastic investors?

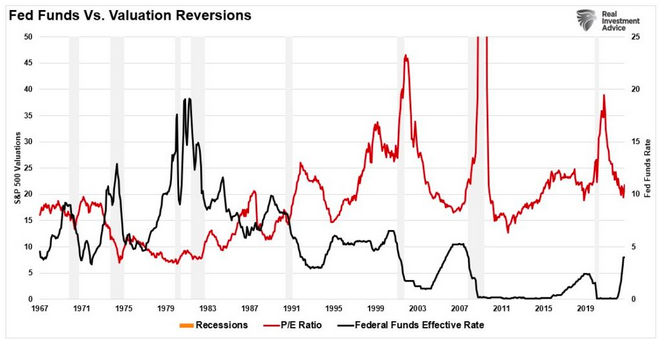

IF the Fed will maintain a higher level of interest rates for longer, the discount rate applied to forward earnings is not conducive to keeping valuations at current levels. As higher interest rates slow economic activity, to reduce inflationary pressures, earnings must decline. If such is the case, prices must also fall to revalue the markets for lower earnings. Valuations tend to complete their respective “mean reversion” following the reversal of monetary tightening.

Source courtesy of RIA

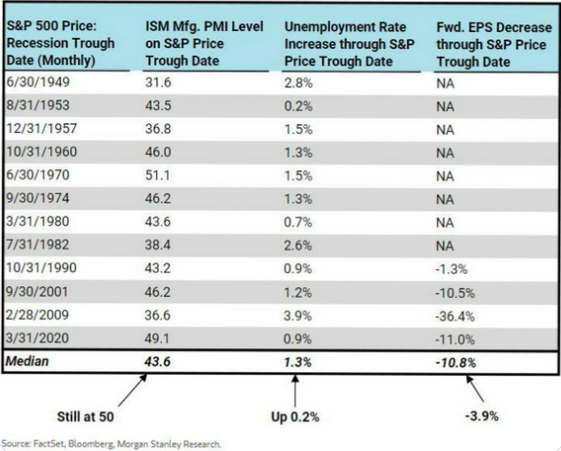

Below the excellent table showing how recessionary bear markets tend to bottom when:

- PMIs are well below 50

- Unemployment rate has already risen by 1.3pps

- Future expected EPS have been revised down 10%+

None of the conditions are met today, and unlikely to be met until Q1/Q2 2023.

Last things for investors to worry about in recent months.

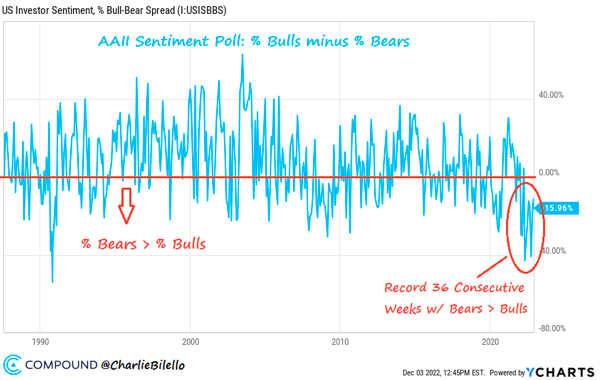

And worry they have, as evidenced by the longest streak of negativity that we’ve ever seen in the AAII sentiment poll (36 weeks and counting).

Only 24.5% of investors reported as bullish this week; down from 28.9% last week and a recent high of 33.5% the week before that. That nine percentage point decline in the past couple of weeks is not a particularly large drop and only brings the reading into the middle of this year’s range; however, it marks a distinct turnaround from what had been one of the most optimistic readings of the year only two weeks ago.

Bearish sentiment has gone into hibernation and done a whole lot of nothing. After being unchanged at 40.2% last week, bearish sentiment rose modestly to 40.4%.

In terms of what it means for the S&P 500 when bearish sentiment moves so little as it has recently, near-term performance does not tend to be particularly favorable.

Then you have the idea that there could easily be a FOMO rally to close out the week followed by a hangover and pullback next week as investors wise up to the reality of the situation. Thus, we will find it hard to join any rally that does not extend into the following week as this action may be the last gas of a sucker’s rally before the next leg lower. Again, see the chart above and appreciate how often this has happened earlier this year…and could easily be the case this time around as well.

OIL

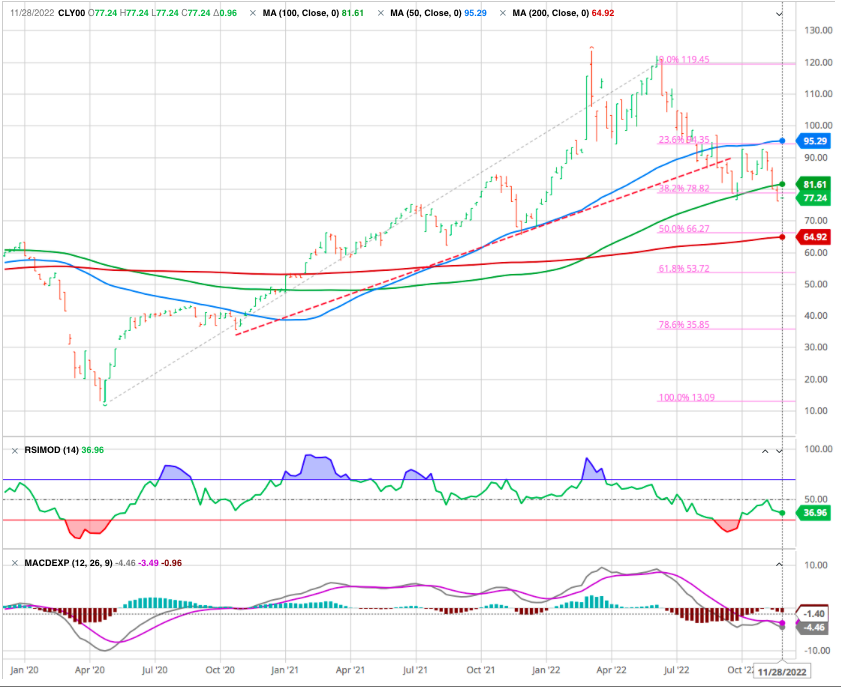

Oil prices are poised to end the week higher, buoyed by speculation trading at USD 87.7 for European Brent and USD 82 for US WTI. The momentum remains weak .

Following the failed attempt to move back above the 200-day SMA, the negative momentum gained traction and the price of WTI has fallen below the prior low. This negative price action has paved the way for a decline towards last year’s low at around 66.5.

GOLD

The Economist Why central banks are stockpiling gold

CRYPTOS

Bitcoin is up 3.15% on the week and is back flirting with $17,000. A timid and soft rebound that is still far from erasing the terrible week of early November that saw bitcoin sink 22% in the wake of the FTX collapse. Ether, on the other hand, is clearly outperforming the leader by registering +7% on the week and is back to hovering around $1300.

Despite all this, confidence in the crypto ecosystem is still very fragile and it will probably be a long way to win back the hearts of the crypto-skeptics.

“Bitcoin is being artificially propped up and should not be legitimised by regulators or financial companies as it is more akin to gambling, ” the European Central Bank said… “Bitcoin and other cryptocurrencies have been variously presented as an alternative form of money and a shield from the inflationary policies pursued by major central banks such as the ECB in recent years. But a 75% fall over the past year, just as inflation reared its head, and a string of scandals including the collapse of the FTX exchange this month have given critics among central bankers and regulators ammunition to fight back.”

Several US firms told the Financial Times that they had elevated some or all of their crypto-related clients to the status of ‘high risk’, triggering a more thorough audit that will take longer and lead to higher bills. Some clients could ultimately be dropped altogether.”

USD

The currency market that the sharpest shift can be seen. King Dollar is in ill health. If we look at the popular dollar index, we find that after an extraordinary rally it is now below its 200-day moving average. Differentials in bond yields between the US and other major economies have not moved enough to explain the decline, just as they didn’t explain the ascent:

This selloff looks overdone and has little obvious trigger, but then much the same was true of the rally that preceded it. It’s primarily driven, it would appear, by an attempt to get out of positions betting on the dollar. Plenty of people who had decided to shelter in the dollar in the years after the pandemic are deciding that now is a good time to exit (and plenty of them will be realizing good profits). That puts pressure on exporters to do something about their own buildup of dollars.

Chinese markets are steadily positioning for economic revival.

On the economy, relaxing Covid Zero should stoke Chinese demand, which is a consummation devoutly to be wished by the rest of the world. It would also put extra upward pressure on inflation. And removing Covid policy as an excuse for poor performance should also tell us something about the true underlying strength of China’s economy.

It does look as though significant change is afoot in China, and markets are so far reacting positively. Certainly, plenty of positive scenarios look more plausible than they did a few weeks ago — but it’s worth maintaining caution.

The positive momentum in Chinese stock markets resumed after the Hang Seng Index managed to stabilize above 17,000. The next technical hurdle is at 18,865, the 200-day DMA.

Lost in Statistics

-SEE our ISM PMI ABS matrix update-

Please consider that for the majority of stock market history, the future outlook for the economy was the main signal of whether to be bullish or bearish. That is why there are so many economic reports covering things like manufacturing, services, employment, retail sales, industrial production, consumer sentiment etc, etc.

On that economic front, it was odd to see the stock market unmoved Wednesday by the truly horrifying Chicago PMI report which many see as the leading indicator of what will show up in the national ISM Manufacturing report. That came in at 37.2 versus 45.2 the previous month. Please remember that any reading under 50 = contraction. Therefore 37.2 is in the “holy s#*t” category.

Once more investors look beyond inflation and Fed rates…they will see that the economic rug has been pulled out. The normal trigger for bearish activity. Once the focus properly returns there it will be hard to keep hitting the buy button to push prices higher.

Thus, hard to appreciate why right now would be different with the economy on the verge of recession.

Two of the best mainstream market indicators of economic bearishness are the bond yield curve (if shorter-term yields are higher than longer-term ones, that implies a belief that the economy is due a fall) and the ratio between consumer discretionary and consumer staples stocks (when discretionary stocks underperform, it implies that bad times are coming).

On these simple measures, a recession looks ever more likely, and nothing much has changed in the last three weeks:

Don’t Fight the FED

Harry Truman once famously asked for a one-armed economist, one who couldn’t say “but on the other hand…” On this score, while there were no real surprises or new insights in FOMC members’ comments, starting with the FED Chair Powell.

While the Fed is suggesting their want to hold rates “higher for longer,” such has historically led to bearish market and economic outcomes. When the Fed reverses monetary accommodation, such is because they are combatting a recession, bear market, or worse.

Powell was determined to hold a balanced line Wednesday. And, to be sure, balanced Powell conflicts with press conference forthright hawkish Powell. And markets fancy balanced Powell. He’s a cautious team player.

That hawkish Powell can be a little scary: On occasion, he gets that intrepid look in his eyes that he might go rogue Volcker. Balanced Powell, giving a nod to his dovish vice chair and her contingent, refers to “monetary policy works with long and variable lags.” “I don’t want to overtighten. My colleagues and I do not want to overtighten…” Hawkish Powell, from his November press conference, “if we over tighten, then we have the ability with our tools, which are powerful, to… support economic activity strongly.”

Soft Powell leans on “risk management” to avoid breaking things. “So, we have a risk management balance to strike, and we think that slowing down at this point is a good way to balance the risks of over tightening.”

Dovish bias Powell, principled, bold and assertive, views the risk of things breaking as an inescapable facet of managing through a serious inflation threat. “And trying to make good decisions from a risk management standpoint, remembering of course that if we were to over-tighten, we could then use our tools strongly to support the economy.”

So far, the Fed has moved to normalize rates more rapidly than expected. Perhaps the more consequential surprise has been that financial conditions remain relatively loose. Securities market conditions tightened, yet bank and “non-bank” lending booms and ongoing enormous deficit spending sustained elevated system Credit growth.

Happy trades