MACD signals caution for stocks

August, 21 2023MACD gave a sell signal most recently.

The possibility of more rate hikes. Fitch’s US credit rating downgrade (plus a warning on some bank ratings). China growth worries. Relatively expensive stock prices. The list of reasons why investors could think stocks might head lower over the short term appears substantial. Yet stocks remain within striking distance of their all-time highs (although the trend has been bearish this August).

What do the charts say? Investors that use indicators to help figure out which direction stocks may go over the short term can find that MACD is registering a bearish signal for US stocks.

How MACD works

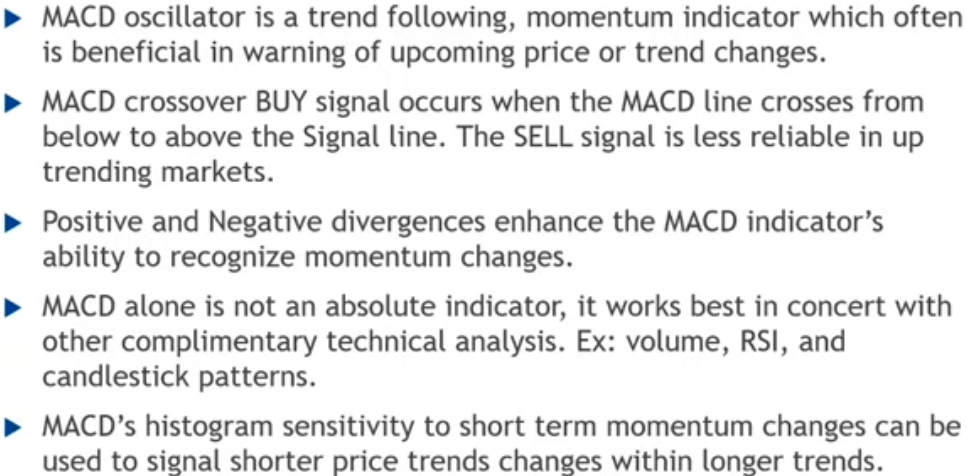

The Moving Average Convergence-Divergence indicator, commonly known as MACD, is a technical indicator consisting of 2 lines—the MACD line and the signal line—as well as a bar chart.1 It is used to generate buy-and-sell signals, and to determine whether an investment or index may be overbought (i.e., potentially expensive) or oversold (i.e., potentially cheap). See the bottom section of the chart below for a sense of what MACD looks like.

MACD is a momentum oscillator that is generally best employed in trending markets—where prices are trending in a particular direction. If you are considering MACD, you might first consider determining the trend of the market. As the top section showing the S&P 500 price in the chart below shows, the market has marched higher for much of 2023, but has trended a bit lower in August. Left daily, right weekly.

Using MACD

See more in our previous highlights The Decider : The Market is always Right

Short-term buy-and-sell signals are generated by the MACD line and the signal line. If the MACD line crosses above the signal line, this may be interpreted as a buy signal.

Alternatively, if the MACD line crosses below the signal line, this may be interpreted as a sell signal. In late July, the MACD line crossed below the signal line, generating a sell signal.

These 2 lines fluctuate around the zero line. A sell signal is given when the signal line or the MACD line crosses below the zero line, and a buy signal is given when either cross above the zero line. The MACD line recently crossed below the zero line, generating a sell signal. The zero line is also significant because it can act as support and resistance.

Some chart users think oscillators like MACD are most valuable when they reach their boundary’s extreme levels (i.e., the MACD and signal lines are relatively far away from the zero line). The signals using this interpretation would be as follows: When the MACD line is well below the zero line in extremely negative territory, it can suggest an investment may be oversold (i.e., a buy signal). Alternatively, when MACD is well above the zero line in extremely positive territory, it can suggest an investment may be overbought (i.e., a sell signal).

Currently, neither line is near what might generally be considered an extreme level. It’s worth noting that MACD can theoretically rise or fall indefinitely.

The difference line, represented in the chart by the blue bars, is typically presented as a bar chart around the zero line. This bar chart represents the difference between the MACD line and the signal line. It helps depict when a crossover may take place. Recall that a crossover generates buy-and-sell signals. A narrowing of the difference line (i.e., when the bars decrease) illustrates the potential for a crossover. The difference line has widened in recent weeks, suggesting a crossover is not imminent.

As usual we use several Oscillators and as we like the traditional business cycle we use the reliable weekly prices (right chart). We can see that be the end of the month we might well see another cross sell signal.

Confirming the trend

One technique that technical analysts may use to confirm the direction of the trend is to determine whether the MACD indicator is making higher highs or lower lows in conjunction with the price. Some traders that utilize this strategy wait for a “trigger,” or some sort of confirmation of the divergence. Both the S&P 500 and MACD have been making lower lows in recent weeks, which suggests that the downtrend may continue.

In sum, the various signals generated by MACD appear to have been bearish over the past several weeks, suggesting the short-term trend may continue to be down. Of course, fundamental factors could quickly change this outlook. Keep an eye on the latest market developments, both in the charts and in other data, to stay ahead of the trend.

Stay tuned