Investment Strategy and Asset Allocation: Gloomy outlook

April, 27 2023

Stormy waters

After a hawkish start to the first quarter, volatility especially in bonds, surged during March, following the collapse of Silicon Valley Bank. That led to fears about broader contagion across the banking system. The financial stability that has been receiving heavier focus from the central banks generated relief among market participants.

We share the investment conclusions of our latest Investment strategy committee and our asset allocation below .

STRATEGY : Sell in May and Go Away ?

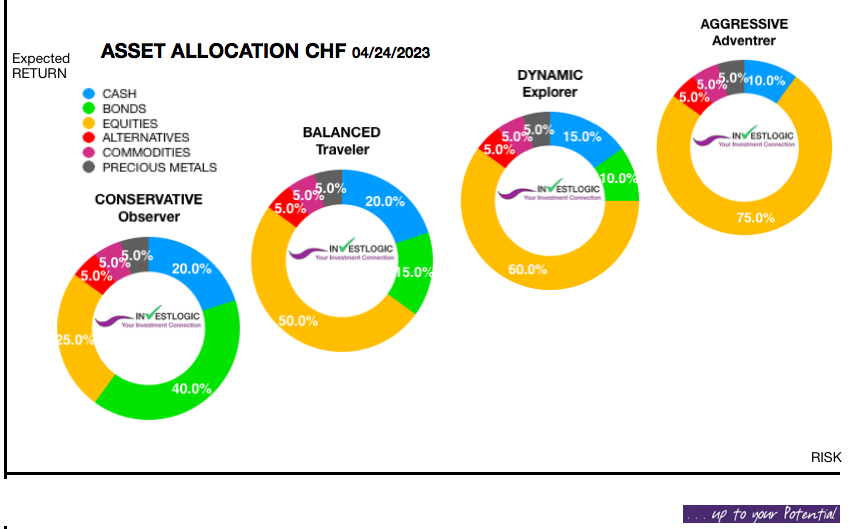

The deteriorating economic outlook and continued high core inflation rates are creating a challenging economic environment. We are retaining our defensive positioning underweighted positions in equities and global bonds and see potential in emerging market -particularly in Asia.

Our view remains that the aftershock of the Fed’s policy tightening is starting to be felt in the financial system and the wider economy. We believe that the macro-economic context is starting to deteriorate and that we have entered yet another period of uncertainty which should lead to an Equity Risk Premium re-rating.

For these reasons, we keep a high cash level and reduced equity risk in portfolios as we head into the seasonally weak summer months. Could we be wrong to “sell May” and go away until later? It is certainly possible, and if such is indeed the case, we will add exposure accordingly when needed.

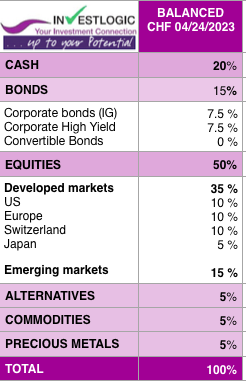

Other changes include a downgrade of our view on commodities and still favouring Gold. The CHF is also upgraded against dollar. Last but not least, we are increasing the share of emerging markets in all risk profiles.

Find YOUR INVESTMENT STYLE here

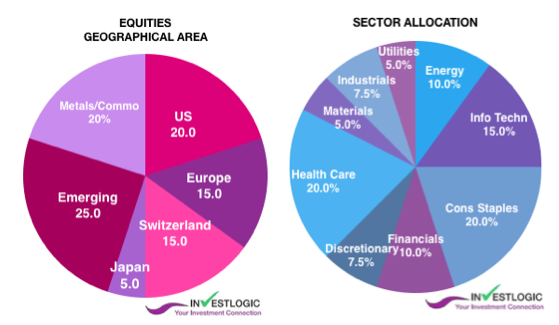

From a geographical standpoint, we remain positive on the US, Europe ex-UK, UK and Switzerland. We are keeping our positive view on Japan. This view is made from a total return (local currency return + forex) point of view. We believe that Japanese equities can perform reasonably well despite the strength of the yen. Some domestic sectors are benefiting from higher nominal growth (due to higher inflation) while the export sector is exposed to the reopening of the Chinese economy.

We increased our exposure on Emerging markets and Emerging bonds in USD. We keep an attractive view on China & EM Asia as Emerging markets are currently providing attractive diversification options. We keep a cautious stance on EM Latam and other EMs.

In terms of sectors, size and style, we continue to favor defensive over cyclicals, large caps over small caps and keep a balance between growth and value.

Our asset allocation in CHF for a Balanced strrategy :

Economy : Challenging environment

The key economic indicators have declined again. The industrial sector in particular is being hit hard by a significant fall in orders. Economic development is being supported only by private consumption, which is being boosted by the very tight situation on the labour market and the high level of savings built up during the pandemic, and is achieving strong figures in the services sector in particular. High core inflation rates remain a cause for concern in the USA declined once again, and consumer confidence remains at alow level, despite the recent increase.

But core inflation remains uncomfortably high, at 5.6 percent. It seems only a recession can really ease the situation. In Europe, the inflation situation is even more fraught. Core inflation rates, which stood at 5.7 percent in March, may not even have peaked yet. The services sector in particular remains upbeat thanks to the catch-up effects of the COVID-19 pandemic. This means that inflationary pressure is much higher in Europe than in the USA, despite weakening economic data. The European Central Bank will therefore have to take further interest rate measures.

Emerging markets are currently providing attractive diversification options.

See our review Foreign Markets Strike Back here

Emerging Market ETF

The current situation in the emerging markets is refreshingly different. While the industrial nations face severe weather condi- tions and further volatility on the stock markets, the outlook for the emerging markets is brighter, with the headwind dying down. Above all, the situation in China appears to have improved significantly in recent weeks. A clear recovery in business sentiment and a sharp uptick in exports, which have been weak for months, suggest that China has managed to reverse the trend after the COVID-19 crisis.

The emerging markets may also have contributed to the reversal of the upward trend experienced by the US dollar over recent years. On a trade-weighted basis, the value of the greenback has fallen by over 10 percent since last autumn. The banking crisis has accelerated this development still further. As many emerging markets have directly or indirectly tied their currencies to the US dollar, this is creating a boost for exporters and improving financing conditions for states and large companies. For this reason, we believe that investments in emerging markets provide opportunities again.

Markets Is there a canary in the coal mine?

So far, the markets have weathered the rate increase much better than expected. However, most of those rate hikes have not worked through the economic system. Furthermore, the economy has remained buoyed by the massive increase in money supply, which still supports economic activity. But that support is also fading as the last vestiges of pandemic support programs end.

The collapse of the Silicon Valley Bank preoccupied the financial markets last month. The upheaval in the financial system resulted in investors take flight to safe havens. Bonds and gold made gains, while equity prices fell worldwide. But the slump in higher-risk investments proved only brief. The financial stability that has been receiving heavier focus from the central banks generated relief among market participants.

Lately First Republic Bank reported dramatic slump in deposits of more than $100 billion in the first quarter following the biggest banking crisis since 2008 last month. People are trying to figure out the health of the regional banks in general.

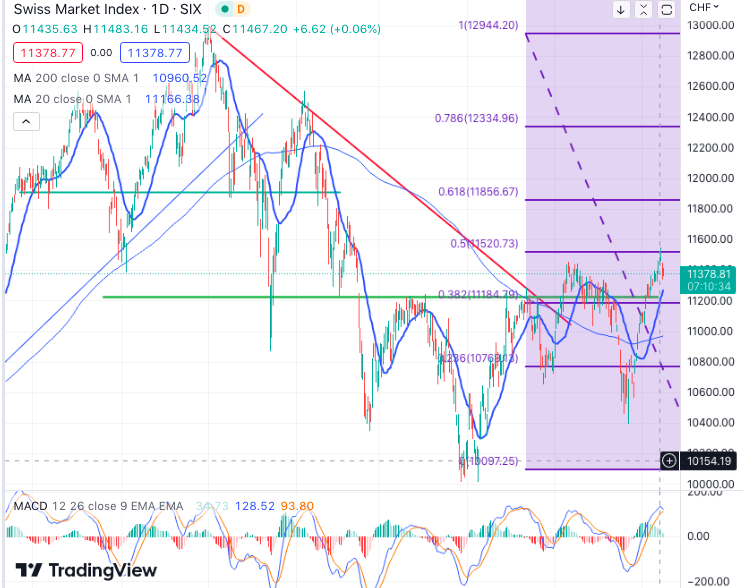

Europe’s equity markets have performed particularly well since year-opening, making gains of over 10 percent. The strong Swiss franc dampened performance for Swiss investors, where currency fluctuations were not hedged.

The Swiss Market recovered from its March low and set back to 50 % of its downtrend and we can target Fibo 61.8% art11850.

There was also positive momentum on the Asian markets. However, the Chinese stock market’s stronger growth rate is more due to the equity market’s low point last autumn than the recent market upturn. China’s equity market remains subdued despite the recent rise in sentiment in industry and the services sector.

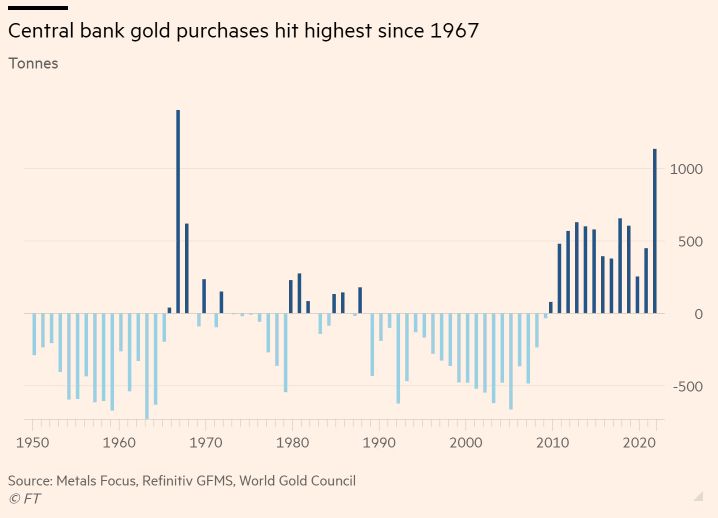

Gold

The price of gold has risen sharply owing to greater uncertainty in the financial system due to the banking crisis and the broad-based depreciation of the US dollar. This means the precious metal’s performance is well into positive territory since the start of the year

The gold price made significant gains over the course of Marc and is now at a much higher level than at year-opening. The price of a troy ounce of gold now stands at over 2,000 US dollars again.

The flight to this asset class, which is seen as a safe haven, was largely due to the turmoil in the banking sector and related uncertainty in the financial system. The depreciation of the US dollar and the cut in output recently agreed by OPEC+ also boosted the gold price.

Global central bank gold purchases have soared of late (at rate not seen since late-1960s).

Until next time !