MARKETSCOPE : Don’t Sell the Bear’s Skin Before Killing It

July, 05 2022

From Rates Fear To Recession Fear

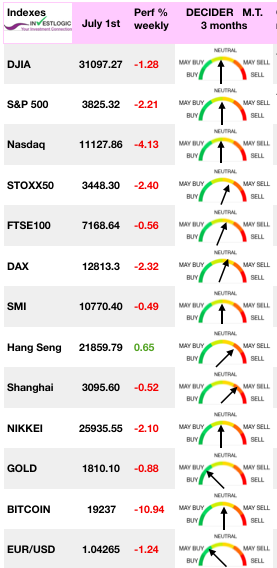

Despite Wall Street rebounded to close sharply higher Friday in light trading ahead of the holiday weekend, the S&P 500 posted its worst performance for the first half of any year since 1970.

Despite Wall Street rebounded to close sharply higher Friday in light trading ahead of the holiday weekend, the S&P 500 posted its worst performance for the first half of any year since 1970.

Financial markets experienced a new bout of weakness last week. Investors opted for further sell-offs, following weakening statistics that confirm the global economic slowdown while inflation remains sky-high and central bankers’ action on interest rates is leading to fears that economies are entering a recession.

Also, warning signs from several companies that lowered their profit guidance, added to investor concerns that persistent inflation at 40-year highs could continue to put pressure on stock prices.

Caution remains the order of the day as the first series of quarterly results are due to be published which will allow us to compare the targets set a few weeks ago with the current economic reality. Pending the start of earnings season in mid-July, volatility is likely to remain high.

In Europe, shares fell on fears that soaring inflation and rising interest rates could hit earnings and tip economies into a recession. In Asia, Japan equities declined while Chinese stocks advanced on the back of strong factory data and easing covid restrictions for travelers.

MARKETS

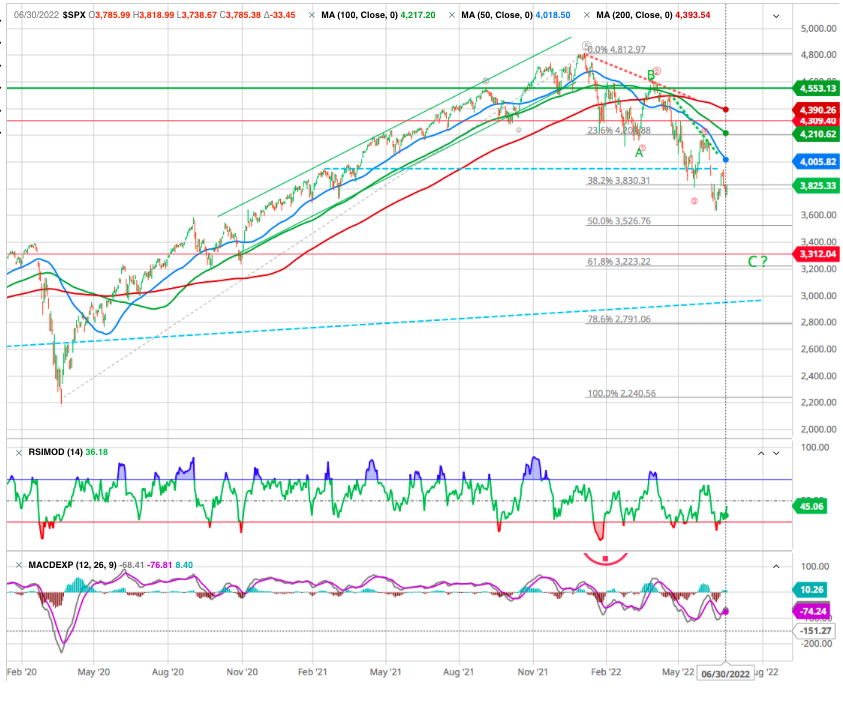

The market did rally on Friday, holding that minor support built over the last three trading days at 3800. While the bounce was certainly welcome, as noted, rallies are quickly met by “trapped longs” looking for an exit.

While we correctly warned in early 2022 that we will see a developing Bear Market, we clearly did set a first market target on the S&P 500 at 3800.

In the near term, 3620-60 is support in the market per our calculations. A break-down below that level will point us to the 3300-3200 region (61.8 % correction), from which a major bottom could develop.

But, for now, as long as we hold the 3620 support, we are looking for a rally to develop over the coming weeks to take us north of 4050. But, we will warn you that such rally will be quite volatile, as we have no “impulsive” structure which has clearly developed off the recent low.

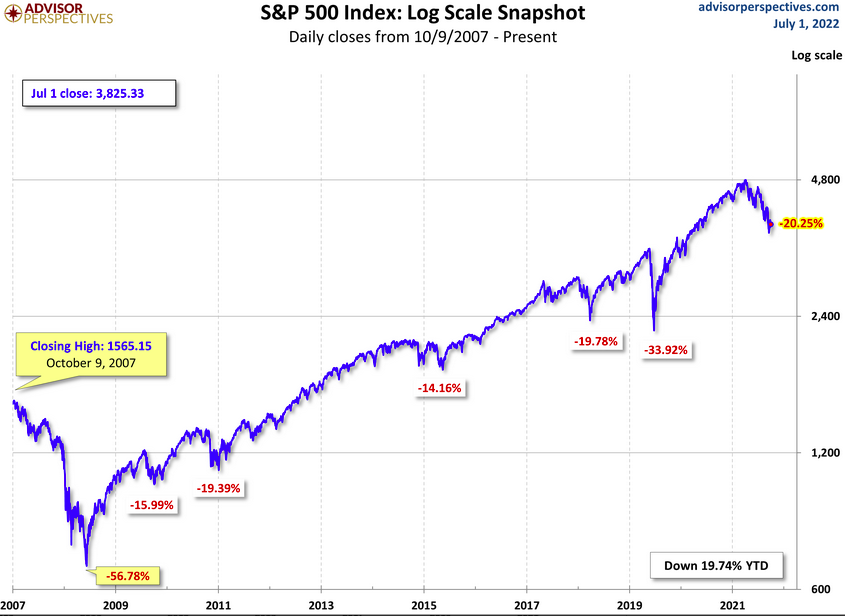

An interesting log chart from Market advisor shows that there is still some room on the downside

Same can be apply to the SWISS MARKET with a major support close to 10’000.

A new era for markets

The prevailing feverishness reminds the veterans of the sector of some of the complicated episodes of the last twenty years. The newcomers have only evolved in a bull market for years, and they are confronted with the kind of crisis they only know from economics books. Central banks remain more than ever at the centre of the game, with several controversies at stake.

EARNINGS SEASON

Investors are likely to see some more early warnings shots next week on Q2 earnings reports and back-half guidance revisions to follow on the recent updates.

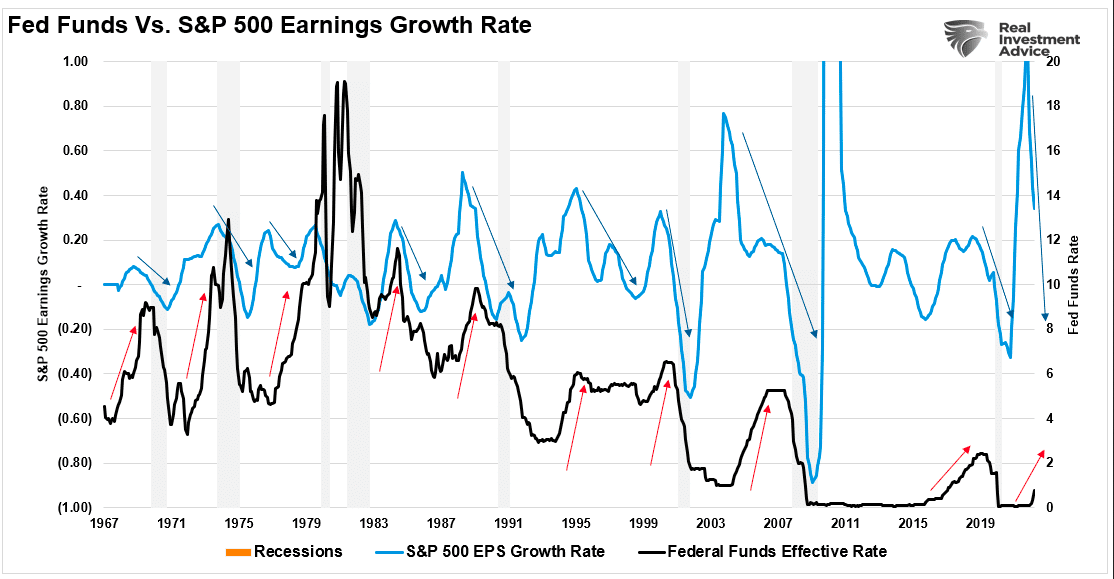

As the Fed hikes rates to slow economic growth, thereby reducing inflation, they risk pushing the economy into a contraction. Of course, since earnings are highly correlated to economic growth, earnings don’t survive rate hikes. As the arrows show in the following chart from Lance Roberts (RIA), Fed rate increases consistently lead to an earnings recession.

The market is also confirming the same. Historically, the stock market leads economic recessions by 6 to 9 months. When the National Bureau of Economic Research announces a recession, it is much too late to matter.

If a recession is coming, earnings have yet to be revised to compensate for weaker economic growth. If that is the case, then most likely, the market will have to reprice assets lower to adjust valuations for those reduced earnings.

Notably, while forward P/E ratios have declined, much of that is due to the decline in the “P” and not the “E.” Therefore, if an earnings recession is coming, as the data suggests, then the current “bear market” cycle still has more work to do.

We are just starting the negative revision phase which makes risk management in portfolios a key priority for now. However, the reversal of those earnings trends will be key in identifying the bear market end and the beginning of the next investible bull market cycle.

GOLD

Macroeconomic headwinds are weighing on base metal prices. In the face of this price purge, gold holders can take some comfort in the fact that the gold metal (denominated in dollars) has limited its loss to nearly 2% since January 1. In terms of prices, an ounce of gold is trading around USD 1,800.

Goldman Sachs has recently raised its year-end 2022, gold price target to $2500/oz, signaling a strong 2022 after gold prices ended 2021 down approximately 4%. Last year’s strong economic recovery and growth created conditions for the decline in gold, as investors moved to riskier assets. However, the coming year could bring increased concerns of a US recession, which would lead to higher gold prices.

We will note that I a bottoming structure seems to develop which, when completed, has the potential to begin a very strong rally in the complex which can take us well into the 2023 time-frame, and potentially beyond.

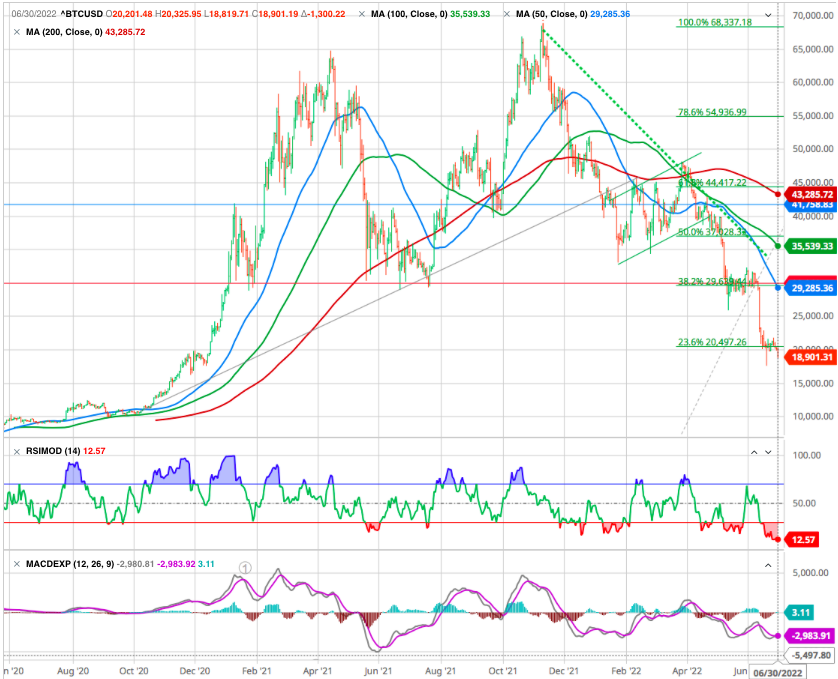

CRYPTO CRASH

Bitcoin just closed June with a -37% underperformance, recording its worst quarter since 2011. The digital currency continues its fall that began in November 2021 and is now sailing at the $19,000 level as of this writing. Bitcoin is still not out of the woods in this still very deteriorated macroeconomic environment and may yet put the nerves of crypto-investors to the test during this summer season.

Things are looking pretty shaky in the cryptoverse as a continuous flow of damaging headlines continues to rock the sector. The failure of the TerraUSD “stablecoin” project in May sent shockwaves through the crypto market, while the Celsius Network froze accounts and now is preparing for a possible bankruptcy.

The staunch believers are calling it a “crypto winter” before things heat up again, while the naysayers are pointing to the final demise of “tulip mania” they have been warning about for years. Those in between are acknowledging that a shakeout is underway, but feel that only the strongest players will survive in a similar fashion to the aftermath of the dot-com crash.

The Ugly Word : Recession

Fear of a recession could be the final straw that actually tips the economy into that recession, some analysts say.

The fear of a recession and its consequences remains at the top of the risk pile. In the weeks to come, the strength of the U.S. consumer will need to be closely monitored. The consumer is part of the Fed’s current bet: if he can keep spending until rate hikes – or threats of rate hikes, you guessed it – have calmed inflation, the bet for a soft landing could be won. Still a lot of conditional in there.

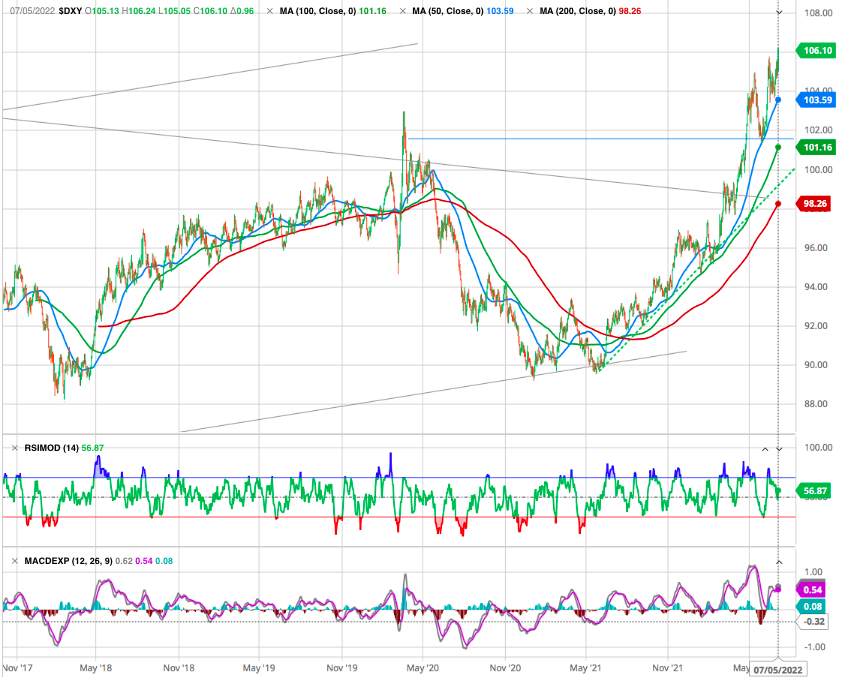

USD

Powell seemed to acknowledge the US was lucky to have a relatively closed economy. He was looking at Lagarde as if to say he had secret sympathy for the restraints they are working under.

Couple that lack of concern with continuing intention to keep hiking rates and that added up to another rally for the dollar when compared to other major currencies in the widely followed dollar index. It’s almost regained the two-decade highs set in the aftermath of the ECB meeting and the May inflation print.

As you can see below, the dollar has strengthened significantly against these currencies over the past year.

There are a few reasons for this.

If you’re not familiar, the DXY compares the value of the U.S. dollar to a basket of six other major currencies:

Euro (EUR), 57.6% weight

Japanese yen (JPY), 13.6% weight

British pound sterling (GBP), 11.9% weight

Canadian dollar (CAD), 9.1% weight

Swedish krona (SEK), 4.2% weight

Swiss franc (CHF), 3.6% weight

Monetary Policy

In the U.S., pundits have criticized the Federal Reserve for being too slow to respond to rising inflation. However, central banks in those other economies mentioned earlier – particularly the Eurozone and Japan, which have the heaviest weightings in the DXY – have been even slower.

Given these policy differences, it makes sense that the dollar is strengthening versus those currencies.

World’s Reserve Currency

Due to this role, most global trade – including energy – is conducted in dollars. Many countries borrow in dollars as well. In fact, significantly more dollar-denominated debt exists outside of the U.S. than within it.

Foreign demand for dollars tends to rise while the available supply tends to fall. This pushes the dollar’s value higher versus other currencies, further increasing demand and reducing supply.

Unfortunately, this kind of vertical move in the DXY may not stop until something breaks. “Something” has traditionally meant one or more emerging market economies, the fallout of which slowly ripples across the globe. However, given the poor fiscal health of many developed economies mentioned earlier, there’s no telling where the trouble may appear.

A Silver Lining

If there’s , it’s that none of this changes the longer-term outlook.

The U.S. economy is in no position to weather even a run-of-the-mill recession, let alone a global financial crisis. And other major economies are even worse off today. Especially with the Mid-term elections coming next September

If this scenario plays out, it will simply hasten the moment when the Federal Reserve and other central banks must resume easing, inflation be damned.

This should generally be positive for stocks and most other assets besides bonds. We believe a handful of specific assets – including energy and gold — are likely to lead the way higher.

Happy trades

BONUS:

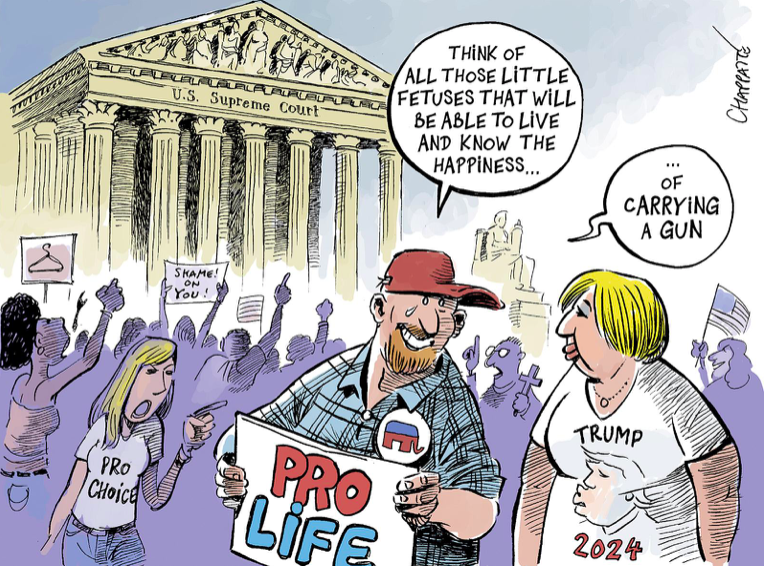

America goes backward for its 246th birthday

By Chappatte in NZZ am Sonntag, Zürich