Behind The Crypto Scam

November, 23 2022“Complete Absence Of Trustworthy Financial Information”

We have been in awe lately about the stupidity of the people who had invested in the crypto-‘exchange’ FTX. We are likewise in awe that anyone would have ‘parked’ their ‘money’ in an account of that unregulated entity. How stupid can one be?

Yves Smith of Naked Capitalism, who called everything crypto ‘prosecution futures’, provides the latest FTX bankruptcy filing:

John J. Ray III, the newly appointed CEO of bankrupt crypto player FTX’s sprawling empire who played the same role in the then-biggest-evah Enron bankruptcy and other big corporate implosions, filed his formal initial assessment with the Delaware bankruptcy court in the form of declaration.

See report

As expected the FTX and the companies related to it are a huge criminal mess.

In point 5 of his filing the new CEO is not holding back:

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented. …

At the stage of this filing, Ray could only make an approximate description of the business, putting operations into four “silos” and describing the major legal entities and activities in each.

Let us look at the things FTX did not have:

- Balance sheets that showed crypto customer funds as liabilities. The only customer holding on the consolidated balance sheets are fiat currencies!

- Digital asset controls: “The FTX Group did not keep appropriate books and records, or security controls, with respect to its digital assets.”

- An accounting department

- Audited financials for all businesses. Only one “silo” used a recognized audit firm.

- The biggest customer-facing silo had its books prepared by a no-name flake (office in the Metaverse, you cannot make this up), two had no audited statements

- Record of bank accounts and signers on those accounts

- Centralized cash management

- Record of employees and their employment terms

- Meaningful disbursement controls

- Board meetings and/or “audited by flaky auditor” financials for many FTX entities

- Records of most decisions

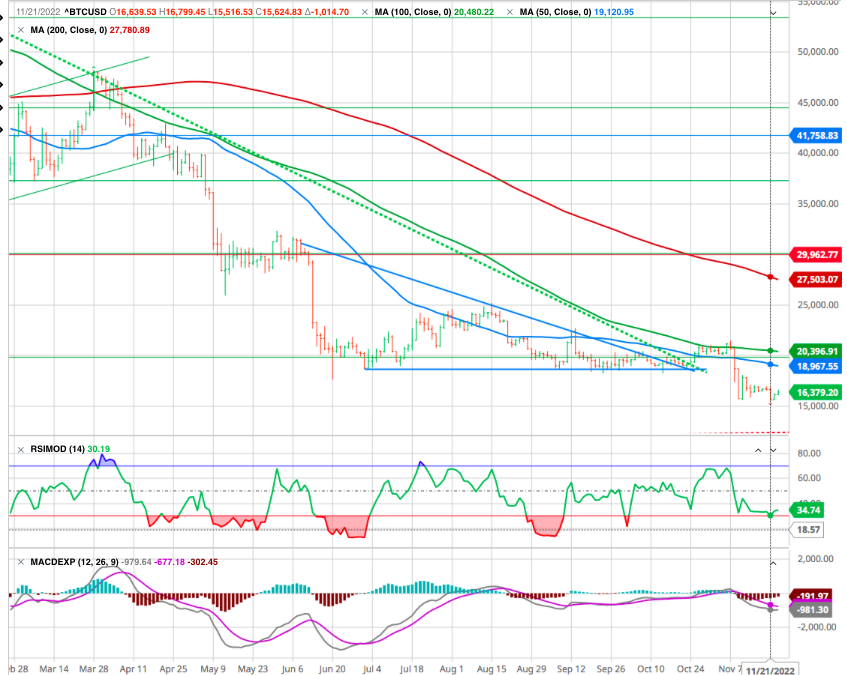

So far, Ray has found only $564 million of cash and have moved $760 million of crypto to cold wallets. That’s only $564 million of real money in an ‘exchange’ that just months ago was valued at $32 billion and cashed in hundreds of millions as new capital.

Several billions of the customer funds the company was supposed to hold had been ‘lent out’ to Sam Bankman-Fried, the main owner and CEO, for ‘personal use’.

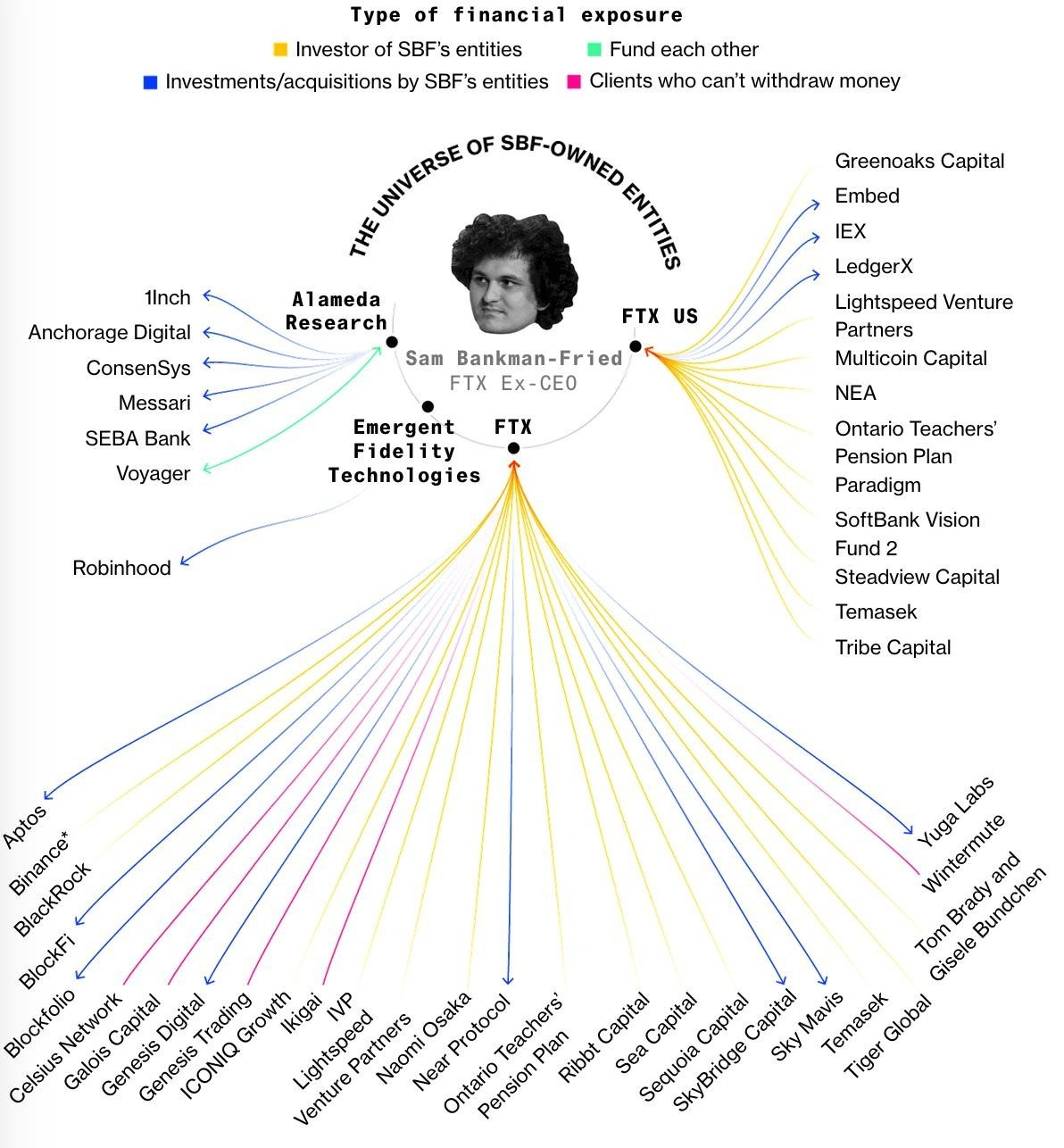

Keep in mind, [FTX & Co] are the entities into which some of the smartest and best known venture capital firms on the planet threw billions of dollars. These are the entities around which countless journalists fawningly editorialized, spilling untold gallons of digital ink in the service of lionizing a would-be messiah. These are the entities that were glorified on a weekly basis by the most widely-followed mainstream financial media outlets on Earth.

According to Web3 is Going Great some 12 other crypto ‘exchanges’ and ‘funds’ have so far closed down or halted all withdrawals of customer funds as a consequence of the downfall of the FTX scam.

Binance, the largest crypto ‘exchange’, who’s owner had pulled the rug on FTX, is still holding out.

The small crypto traders who use Binance as ‘exchange’ and who have ‘wallets’ with crypto ‘coins’ at Binance do not have custodial agreements with it. They are thereby unsecured creditors, the last in line who will not even receive pennies for dollars when the bankruptcy curtains come down.

Nouriel Roubini @Nouriel – 8:48 UTC · Nov 16, 2022

To be precise I literally said that Crypto is 7 C’s:

- Concealed

- Corrupt

- Crooks

- Criminals

- Con men

- Carnival barkers

- @cz_binance

Yves Smith described how the shockingly amateurish FTX customer agreement, the so-called Terms of Service, was the investment version of a Nigerian scam letter, designed to sort for marks.

A key thing to understand is that organizations like FTX are for the most part running unregulated mutual funds (aside from the provisions related to the handing of conventional currencies). Unless the contract very clearly says so, your coins are comingled in an omnibus account. The crypto players that do have what amount to separate accounts typically have different terms for their mingled coin offering and segregated ones, with the segregated accounts costing more.2

This language from FTX is false on its face:

- Account Services. As part of your FTX.US Account, FTX.US provides qualifying users access to accounts for you to store, track, transfer, and manage your balances of cryptocurrency and/or dollars or other supported currency. All cryptocurrency or dollars (or other supported currencies) that are held in your account are held by FTX.US for your benefit….

- Title to cryptocurrency represented in your FTX.US Account shall at all times remain with you and shall not transfer to FTX.US. Your balances in your FTX.US Account are not segregated and cryptocurrency or cash are held in shared addresses or accounts, as applicable. A valid purchase of cryptocurrency that is accepted by FTX.US generally will initiate on the business day we receive your instructions.

“Title to cryptocurrency represented in your FTX.US Account shall at all times remain with you” is contracted by the fact that the cryptocurrency goes into a pooled account. All you have is FTX’s ledger entries of what you have and its promise to honor them. You do not have ownership of those coins any more, just a claim on FTX if things go badly…oh, which you waived by agreeing to their egregious indemnification terms.

As a lawyer summarized it: “We took your money and we’re keeping it and we’re not guaranteeing that you get it back.”

However, four entities appear to be solvent! And guess what, three were regulated ones: LedgerX LLC, d/b/a FTX US Derivatives, regulated by the CFTC; FTX

Capital Markets LLC, an SEC-registered broker-dealer; Embed Financial Technologies Inc., and its wholly-owned non-Debtor subsidiary Embed Clearing LLC, which are also SEC-registered broker-dealers. The fourth was “FTX Value Trust Company, a South Dakota Trust Company, which provides custodial services.” It appears that this custodian handled only fiat assets.

Oh, and as to that $1 billion loan to Bankman-Fried personally, it’s in a footnote, along with a $2.3 billion loan to a Bankman-Fried solely-owned entity:

Paper Bird is 100% owned by Bankman-Fried.

New filings in crypto exchange FTX’s bankruptcy case revealed that Alameda Research loaned co-founder Sam Bankman-Fried $3.3 billion. The $3.3 billion included a $1 billion loan to Bankman-Fried and $2.3 billion to Paper Bird Inc., a Delaware-based company owned entirely by Bankman-Fried, according to a Miami-Dade County resolution approving the naming rights to FTX Arena.

As Yves Smith closes:

I don’t see how Bankman-Fried does not wind up in jail. The US is very loath to prosecute white collar criminals, but this story has become way too visible, too many small fry lost money, and the conduct was too egregious for this not to be punished. Given the utter chaos of the financials, it may take a prosecutor who can argue jurisdiction and venue to master enough details to gin up a filing and get Bankman-Fried. If nothing else, there’s always mail and wire fraud to get discovery started. If no one else gets there first, expect a group of attorneys general from red states to saddle up.

Take care