Be a Successful Investor

May, 03 2022Investing is not about “getting rich” or “playing the market.” It’s an essential part of achieving financial wellness. That means being able to meet your needs and the needs of those who depend on you as well as being able to set and achieve goals that go beyond merely being able to pay your bills and manage debts like mortgages, credit cards, and student loans.

Think back to the last great investment or trade you made…

Feels good, right?

In hindsight, the idea probably seems obvious. But on a consistent basis, you’re probably left wondering why you can’t reproduce those results to keep your winning trade streak alive.

The chances are that you fall into one of the three pitfalls that cause most investors and traders to fail:

- You lack an appropriate strategy.

- You take too much risk.

- You invest and trade on emotion.

You can think of these as the deadly sins of finance, and so long as you know them and watch out for them, you can make sure they don’t rule your decision-making process :

You Lack an Appropriate Strategy

Markets are more volatile than ever, but investors aren’t changing with the times. Regardless of whether you invest or trade, your strategy needs to match the market conditions and match your long term objectives ie. your investing personality.

You Invest and Trade on Emotion

We do it. You do it.Everyone does it. We’re human.

So what CAN we do?

First, recognize when and where emotions creep into the picture. This happens a lot when markets make huge swings and it’s exacerbated by commentary from financial pundits, friends, and family.

While we all experience these moments differently, no one can avoid them. Instead, we need to bring out our second weapon – an investment strategy.

You may downplay this idea, but mark our words, there is nothing better than releasing yourself from the burden of making a decision when emotions run high. A well-crafted investment strategy tells you exactly what to do and when.

It also means you do not need to continuously worried about the market erratic moves. You will only need to monitor the framework and adapt your investment strategy accordingly. Once you create a strategy, it’s easy to maintain and it brings you a peace of mind.

Defining a long term strategy, even in challenging times, can help you now and in the future.

We propose you the following steps to help you to increase your investing success and achieve financial wellness, even when financial markets seem unfriendly.

1. Start with a strategy

Creating an investing strategy can provide the foundation for investment success. The financial planning process can help you take stock of your situation, define your goals and figure out practical steps to get there.

An asset management strategy doesn’t have to be fancy or expensive. You can do it with the help of a financial professional, or an online tool like Investlogic platform. Either way, making a plan based on sound financial planning principles is an important step.

Defining an investment strategy is one service that financial professionals frequently offer their clients. There is some evidence that families who work with financial professionals are better prepared to meet long-term financial goals.

2. Stick with your long term objective, even when markets look unfriendly

When the value of your investments falls, it’s only human to want to run for shelter. But the best investors don’t. Instead, they maintain an allocation to stocks they can live with in good markets and bad.

The financial crisis of late 2008 and early 2009 when stocks dropped nearly 50% might have seemed a good time to run for safety in cash. But on the log run those who stayed invested in the stock market during that time were far better off than those who headed for the sidelines.

If you get anxious when the stock market drops, remember that’s a normal response to volatility. It’s important to stick with your long-term investment mix and to have enough growth potential to achieve your goals.

If you can’t tolerate the ups and downs of your portfolio, consider a less volatile mix of investments that you can stick with.

3. Be diverse

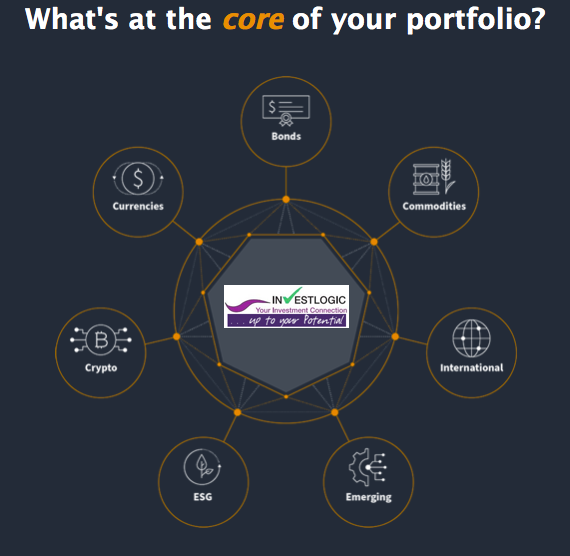

One key foundation of successful investing is diversification (owning a variety of stocks, bonds and other assets), which can help control risk.

Having an appropriate investment mix, giving you a portfolio that delivers growth potential with a level of risk that makes sense for your situation, may make it easier to stick with your plan through the ups and downs of the market.

Diversification cannot guarantee gains, or that you won’t experience a loss, but it does aim to provide a reasonable trade-off between risk and reward. You can not only diversify among stocks, bonds, and cash, but also within those categories. Consider diversifying your stock exposure across regions, sectors, investment styles (value, blend, and growth), and size (small-, mid-, and large-cap stocks). For bonds, consider diversifying across different credit qualities, maturities, and issuers.

The bottom line

Investing can be complex, but some of the most important habits of successful investors are pretty simple. If you build a smart long term strategy and stick with it, review it from time to time, you will have adopted some of the key traits that may lead to success.

What Kind of Investor Are You ?

To that purpose we propose a quick test to define your investing personality and your risk profile here.

Ready for the next step? The team at Investlogic is ready to discuss your goals and risk tolerance and provide you with a custom recommendation.