MARKETSCOPE : A Dead Cat Bounce ?

June, 27 2022

The main purpose of the stock market is to make fools of as many people as possible.

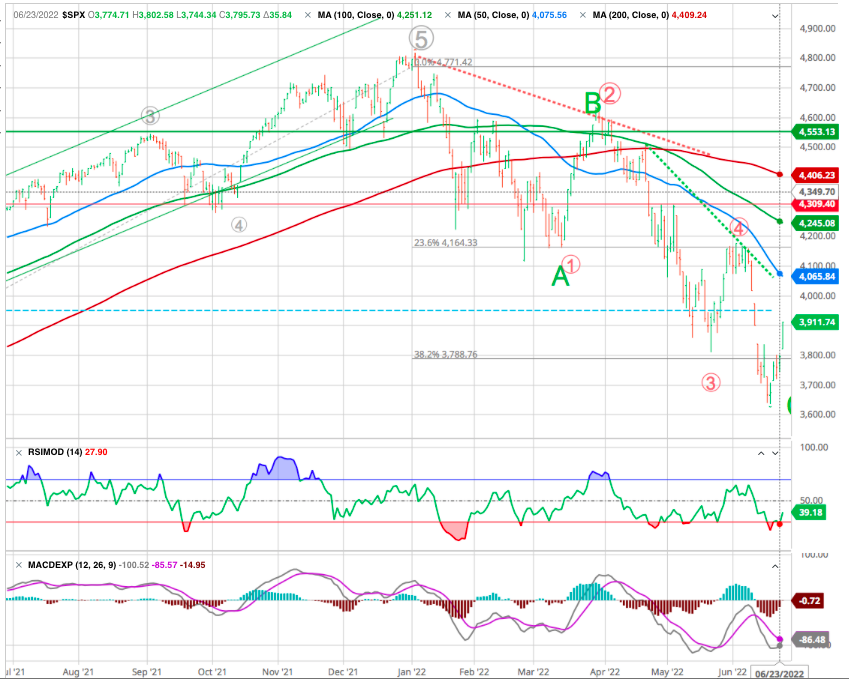

Markets look like they will bounce back from their stabilization at the beginning of the last week. A fragile stock market rebound that gained strength throughout the week. The context has not changed, but some of the fears about the possible upcoming recession seem to have been partially incorporated into prices. The question now is whether the markets have found a bottom or starting a bear market rally off oversold conditions.

SEE our research Finding the Market Bottom

Investor hopes were raised Friday by economic data that included better than expected new home sales for May and a slight improvement in inflation expectations from the latest University of Michigan survey of consumer sentiment, which was seen as potentially reducing the urgency for steeper interest rate hikes by the Federal Reserve.

Investor hopes were raised Friday by economic data that included better than expected new home sales for May and a slight improvement in inflation expectations from the latest University of Michigan survey of consumer sentiment, which was seen as potentially reducing the urgency for steeper interest rate hikes by the Federal Reserve.

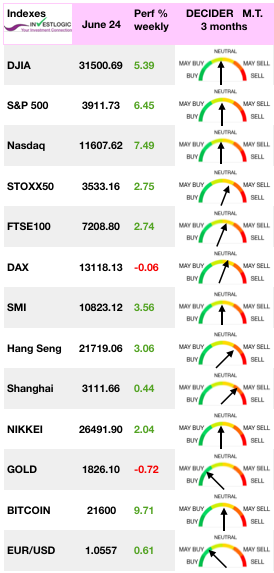

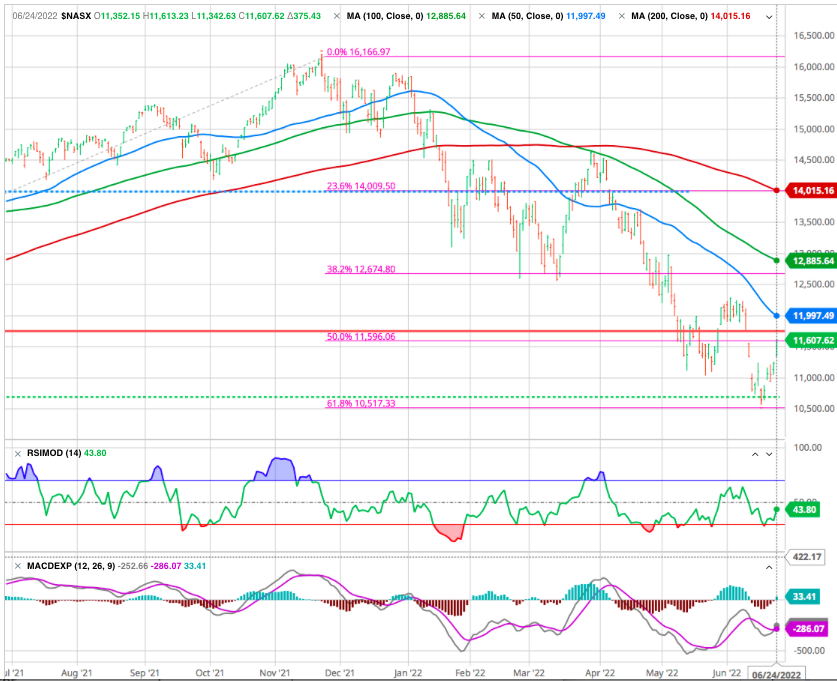

Of course, with a market solely dependent on the Federal Reserve for price support, it was not surprising to see a fairly sharp rally in anticipation of a return of “zero rates” and “Q.E.” After all three major indexes snapped three-week losing streaks — with the S&P rising 6.5%, the Dow Jones average gaining 5.4% and the Nasdaq Composite surging 7.5% — .

Shares in Europe also snapped three weeks of losses as signs that the economy is slowing cast doubt on whether central banks would seek to increase interest rates aggressively.

Chinese stock markets advanced on stimulus hopes after President Xi Jinping pledged to roll out more measures to support the economy and minimize the impact of COVID-19.

How should one interpret a positive day for stocks like Friday if we are in the midst of a bear market?

Consider this…does a bull market go straight up?

Of course not. There are extended bull runs followed by pullbacks and corrections. Yet as you look back over time the gains of the bull are undeniable.

Bear markets are no different. They don’t go straight down either. It is an ongoing process of bear runs to new lows followed by bounces and then another leg lower so on and so forth til bottom is found.

NOTHING about this bear, or any other, will go according to a preset pattern. That means we need to be flexible to adjust our plan according to the realities on the ground.

MARKETS

The first half of what has been an exceptionally turbulent year in markets is ending, with investors wondering whether the next six months could bring some respite and volatility is expected to continue with the start of the second quarter earnings season.

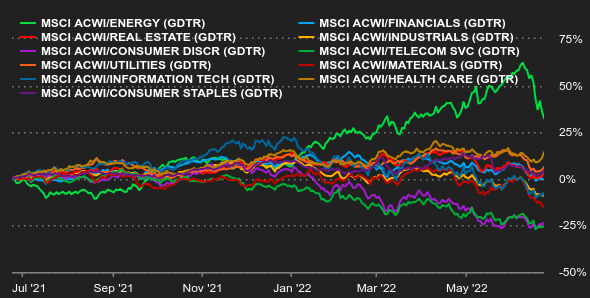

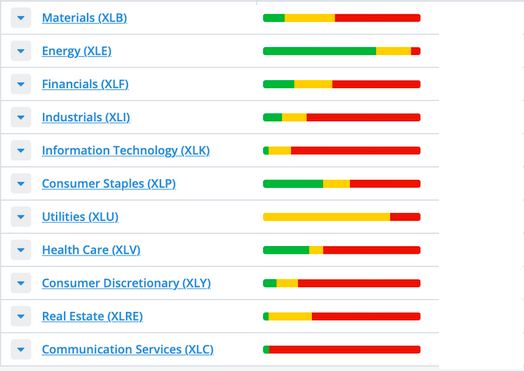

All sectors apart Energy went up last week :

While the rally was strong on Friday, the volume was light, but it did fill the gap of the previous breakdown in price. Furthermore, as shown, a series of gaps will provide stiff resistance to a rally over the next few days, although this week is the end-of-the-quarter rebalancing which could support a continued rally with many managers underexposed to equities.

Looking at our DECIDER table last week we can see that Energy remains the only standout.

It is further evidences that this is indeed a bear market, and not just a severe correction like we’ve seen many times in recent years. It also suggests the overall market could fall to significant new lows in the months ahead (even if we should see a temporary bear-market rally in the meantime).

For now, caution is still warranted. That means holding plenty of cash, sticking to healthy sectors and stocks if you choose to remain long stocks, and selling immediately if and when any of your remaining stop losses are triggered.

Any rally to the 3900-4000 range on the S&P index will likely move the markets back into overbought territory.

With recession risk rising, and earnings estimates on the decline, we suggest using that rally to reduce risk and rebalance allocations accordingly.

There will be tremendous opportunities on the other side of this bear market, but only for investors who have the capital available to take advantage of them.

The odds that a bear market bottom is “in” remain low.

Earnings Season

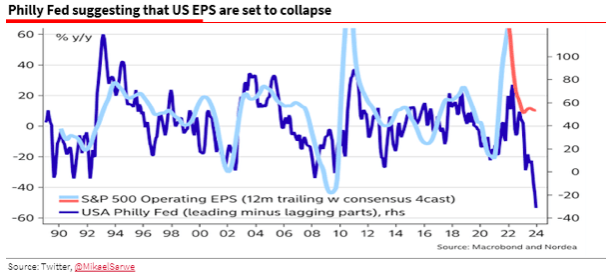

With the coming earning season they are strong headwinds in preparation.

Earnings are one of, if not the best, recession signs for investors. Given that earnings estimates remain elevated, the eventual downward revisions will require a further repricing of assets to compensate. As noted by SG strategist Albert Edwards : @MikaelSarwe, head of Market Strategy at Nordea, was flagging that ‘The problem with (current) lower P/E ratios is that while the P has moved, the E is on thin ice — and the cracks are starting to show.”

Of course, for investors, these recession signs suggest the stock market has not fully accounted for the coming contraction in earnings.

In other words, this bear market cycle is likely not over yet. There is likely a few months’ worth of bear market to come. Scary drops…shocking bounces (rinse and repeat).

SEE our scenario in Finding the Market Bottom

Mr. Market will kind of work in and out in 2-3 phases before it is finally ready to explode off the bottom.

Consequently the current conditions call for investors to remain cautious in their choice of investment. They should pay particular attention to the quality of the companies in their portfolios, focusing on profitable companies with solid free cash flow, low financing needs, low debt, structural pricing power, and a certain recurrence of results over time, while showing little correlation with economic cycles.

OIL

Second week of decline for oil prices, which remain under pressure due to headwinds on the macroeconomic front. Fears are growing thanks to Fed policy, which could push the U.S. economy into recession to contain inflation.

GOLD

In precious metals, recession fears have not allowed gold to take its revenge. The price of the golden metal remains challenged by positive real yields in the bond markets, which weigh on gold, without offering any yields.

CRYPTOS

For its part, bitcoin is just about even on a week, around $21,000 at the time of writing. After losing nearly 35% of its capitalization since the beginning of June, the digital currency is back gravitating to a price area that represents the peak of the 2017 bull market. In a macroeconomic environment that remains unfavorable for risky assets, crypto-investors may still be in for a scare before they see bitcoin reverse its downward trend.

POWELL RELOADED

This past week, Federal Reserve Chairman Jerome Powell testified before senators as the central bank is under scrutiny for its efforts to combat soaring inflation with rising interest rates while not driving the economy into a recession. As Powell stated:

“We do understand the full scope of the problem, and we’re using our tools to address it pretty vigorously now. Price stability is really the bedrock of the economy. We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.”

As a reminder, the Fed has to fight inflation by raising its key rates. If rates are raises too high and the slowdown persists, it could lead to a decline in growth and therefore a possible recession. Some are even talking about stagflation.

Meanwhile, the New York Fed’s latest forecast puts the possibility of a recession or “hard landing” at 80%. Here is chapter and verse of how it predicts that disinflation is going to be achieved, with comparisons to its previous estimates in March:

This disinflation path is accompanied by a not-so-soft landing: the model predicts modestly negative GDP growth in both 2022 (-0.6 percent versus 0.9 percent in March) and 2023 (-0.5 percent versus 1.2 percent). According to the model, the probability of a soft landing—defined as four-quarter GDP growth staying positive over the next ten quarters—is only about 10 %.

Conversely, the chances of a hard landing—defined to include at least one quarter in the next ten in which four-quarter GDP growth dips below -1 percent, as occurred during the 1990 recession—are about 80 percent.

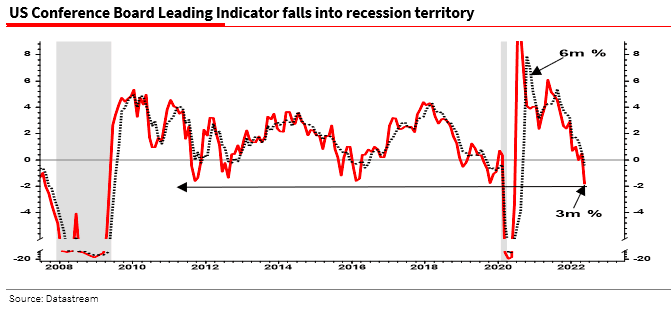

As Albert Edwards noted the U.S. Leading Economic Index is already testing recessionary levels.

The coming US ISM indicators will plunge too.

Elsewhere, the tightening of monetary policy around the world continued, with Norway’s central bank raising its key rate by 50 basis points to 1.25%, more than expected. The Philippines also raised, but only by 25 basis points, while Indonesia kept its key rate steady. The central banks of Egypt and Mexico are expected to hike by 50 and 75 basis points respectively when they meet later.

The ECB’s Emergency Meeting: “TO NIP IN THE BUD”

It could be the first time that a central bank confronted by the onset of a crisis has moved early and quickly. Concerns about the structural stability at the heart of the sovereign bond market in Europe have never been silenced.

The power to print money is the basis of the creation of benchmark risk-free assets in a financial system. Without the ECB’s backing, the eurozone has no such asset. But the ECB’s support for the sovereign bond market has always been conditional on consistency with its mandate of price stability.

Inflation in Europe is a game-changer, and markets know this.

“The European Central Bank is determined to nip ‘in the bud’ any fragmentation in borrowing costs between eurozone countries, its president Christine Lagarde said…, warning anyone doubting this was ‘making a big mistake’.

Magic Christine faces quite a challenge convincing the Germans, financial markets and most interested parties that another bout of rank inflationism at this point will lead to anything other than higher inflation and only more instability. Lagarde will be playing a game of chicken – feigning Draghi’s overused, abused and depleted instrument – against battalions of emboldened market operators.

Happy trades