2024 New Year, Old Focus !

January, 08 20242023 yearly market performances

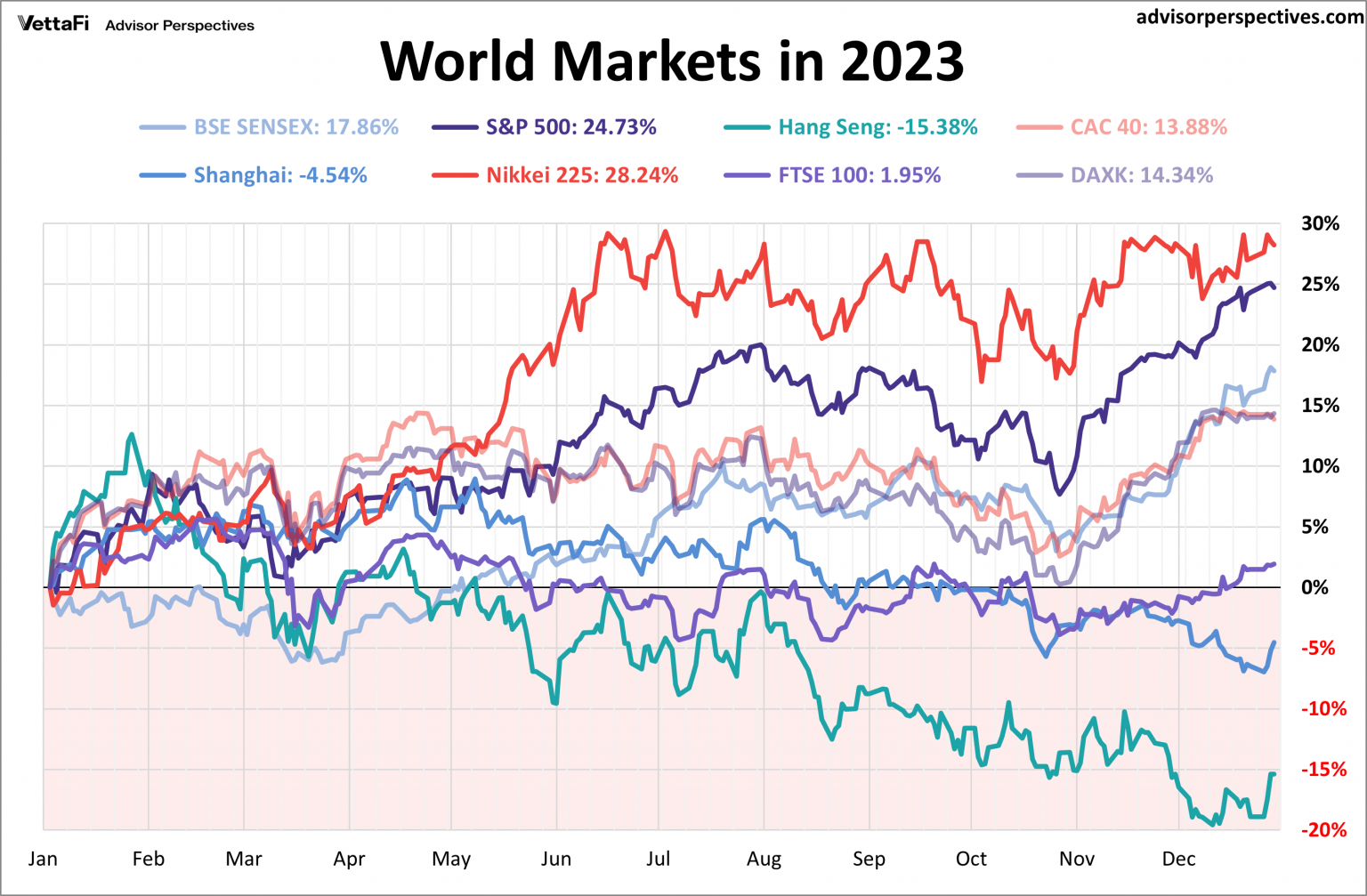

The 2023 stock market vintage was marked by a rebound, after a difficult 2022. Tech stocks bounced back spectacularly, while most Western and Asian financial markets enjoyed a substantial rebound. China was the only market to lag. The Hong Kong stock market even recorded a fourth year of decline, to the point of being overtaken by the Indian stock market in terms of capitalization.

Nevertheless, the hypothetical Chinese awakening will remain one of the major themes of 2024, along with the start of the central banks’ monetary easing cycle and the countdown to the US presidential election in November.

After two months of strong gains and a year-end close to record highs, the atmosphere seems to have darkened somewhat since January 1st, with profit-taking on the main financial markets. Volatility has resurfaced against a backdrop of caution and uncertainty about the timing of rate cuts.

Stock prices fell, so did bond prices, and a miserable time has been had by all. That is the story of 2024 so far. As two of the worst years for US stock market history, 2008 and 2022, both started with a really bad first week of January, that’s already unleashed concerns that another horror year lies ahead.

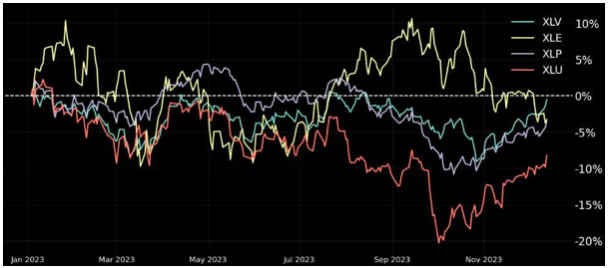

In the beginning of the new year stocks gave back a portion of the past several weeks’ solid gains as investors appeared to rotate into sectors that lagged in 2023, including utilities, energy, consumer staples, and health care.

The yield on the benchmark 10-year U.S. Treasury note ended higher for the week and moved above the 4% threshold for the first time since mid-December.

EuroSTOXX 600 Index ended the week 0.6% lower, after reaching almost two-year high at the end of 2023, and snapped seven consecutive weekly gains, as optimism for an early cut in interest rates waned. Stocks in China retreated amid persistent concerns about its economy.

Macro data offered mixed evidence about the economy’s momentum heading into the new year. US labor market data generally surprised on the upside, although underlying trends were more mixed. Indeed, investors are on the lookout for any sign of a soft landing for the US economy, which would de facto allow to return to the joys of easy money.

Treasury Secretary Janet Yellen declared last Friday the US economy had achieved a long-sought soft landing, a historically unusual event in which high inflation is tamed without significantly damaging the labor market.

In the shorter term, the first full trading week of 2024 will see some major conferences keep investors on their toes. The biggest release on the economic calendar will be the U.S. inflation report on Tuesday, as markets continue to factor in the likelihood and timing of monetary policy easing.

Leading indicators point to slowing economic growth but not a collapse. While odds of a soft landing have increased, markets are already pricing that in at a time of single digit earnings growth and single digit returns on the median stock.

Cautious optimism is the play here. A recession is as likely to happen as it has been for the past year. The question is how deep it will be and whether the Fed will navigate it well providing ample back-door liquidity to the banking system.

Will the coming figures confirm slowing inflation, a soft landing for the US economy and rate cuts to come in 2024?

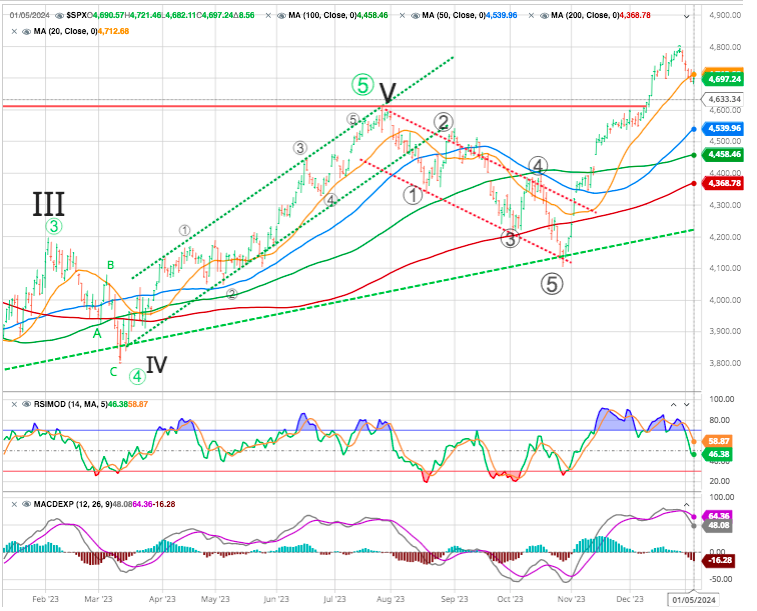

Markets : Embrace Corrections, Reject Euphoria

The beginning of 2024 started with a sell-off that wiped out all of the gains from the last five days of December. While the price action this past week reduced some of the overbought conditions, as represented by the Relative Strength Index (RSI), more work is still ahead. Given the overbought condition, further upside may remain limited.

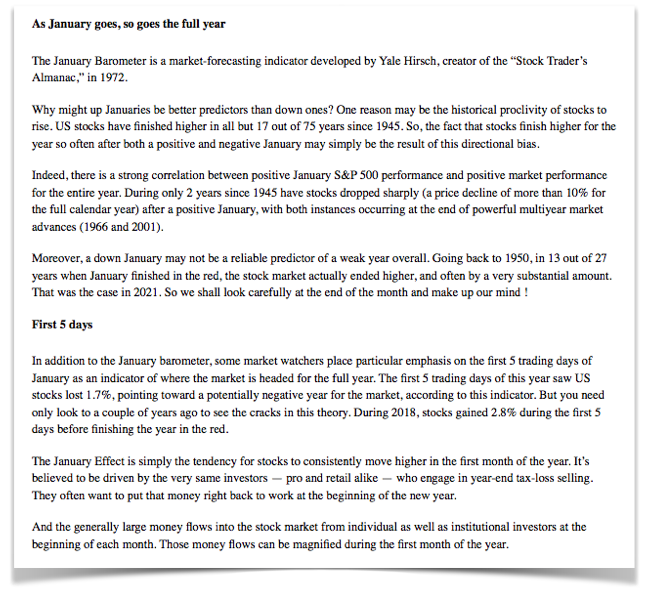

January Effect

The old Wall Street axiom says, “So goes the first five days of January, so goes the month, so goes the year.” The lack of a rally can be a preliminary indicator of tough times to come. This was certainly the case in 2022, 2008 and 2000.

This week, we shall know how the first five days turn out. For now, let’s return our focus on navigating a sell-off to start the year.

Earnings season is here.

Earnings reports regularly provide big stock-price moves in either direction – overnight gaps with enough volatility to add zeroes to a position faster than you think. The heavy hitters don’t report for a couple more weeks. But we do have the big banks reporting a week from today… And tit is a sector that stands to benefit greatly from imminent interest-rate cuts.

Safe to say, these reports will be fascinating

2023: Best of Times, Worst of Times

2023 was a positive year for most financial assets, but in several cases the gains were almost entirely driven by the final two months. If we’d have stopped in late-October, then bonds would still have been on track for a third consecutive annual loss.

A majority of experts were convinced at the start of the year that there would be a recession and interest rates would be higher for longer, but the irony is that those expectations were worse than what has transpired, and that is what has helped support the rally in markets.

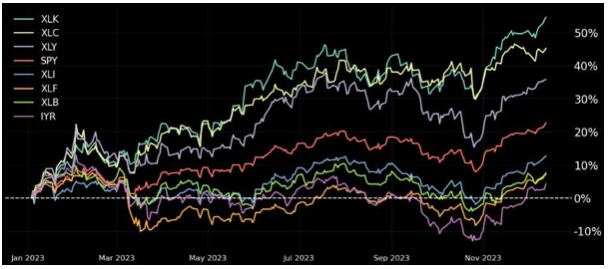

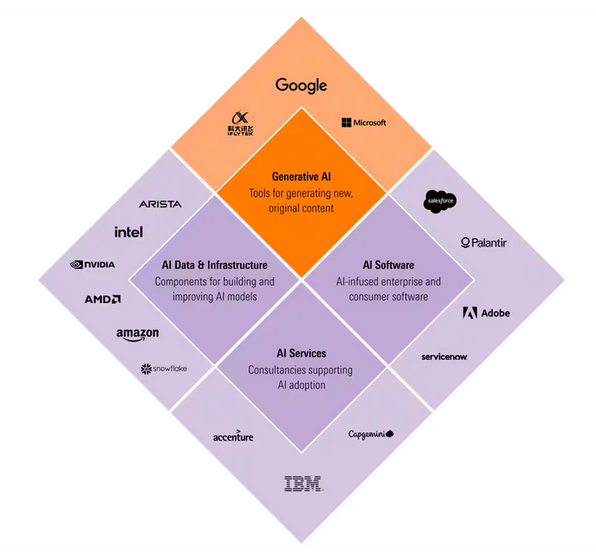

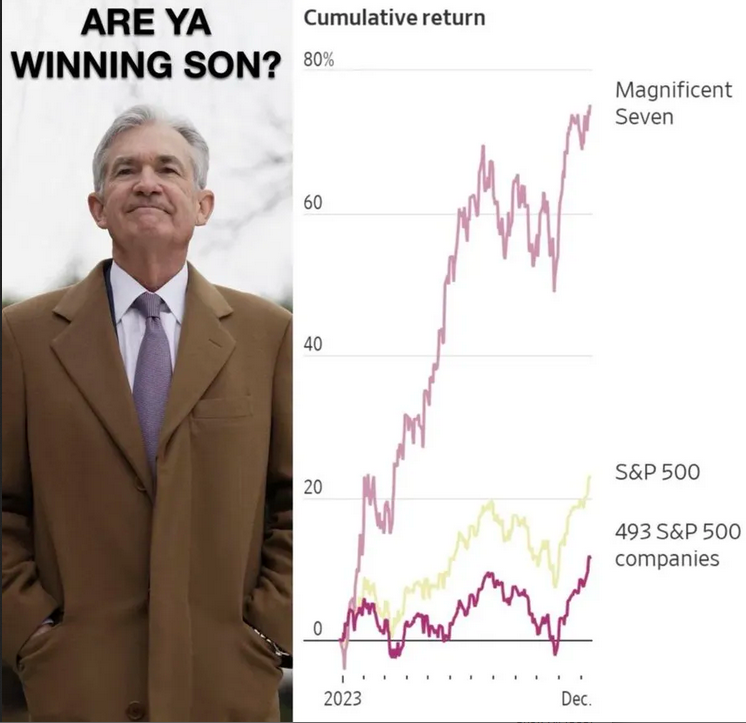

The year largely saw a concentrated tech stock rally, with the Nasdaq up 55% from 2022. A market-wide rally since November also supported tech and led the equal-weighted S&P 500 to eke out roughly 25% last year, a near mirror image of their downtrodden 2022 performance. That was partly driven by excitement over AI lifting tech stocks and carrying the broader market.

The rally in the final two months of the year was fueled by favorable “seasonals” as well as investors’ rising hopes for a “soft landing” and interest-rate cuts in 2024.

Risk appetite turned more positive in the final two months of the year and participation within the US market (and more widely) broadened. Cyclical sectors and smaller stocks started to outperform and the gulf between the leaders and laggards started to narrow – by year-end the average US stock concluded the year up 14%.

Bonds rebounded to finish 2023 in positive territory while the S&P 500 surged 26.3% last year on a total return basis. Meanwhile, the 10-year Treasury yield ended the year where it started.

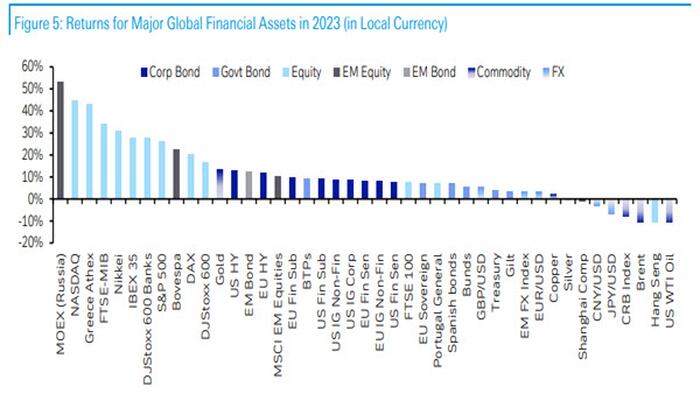

Here’s what happened across assets in the markets :

Source Deutsche Bank

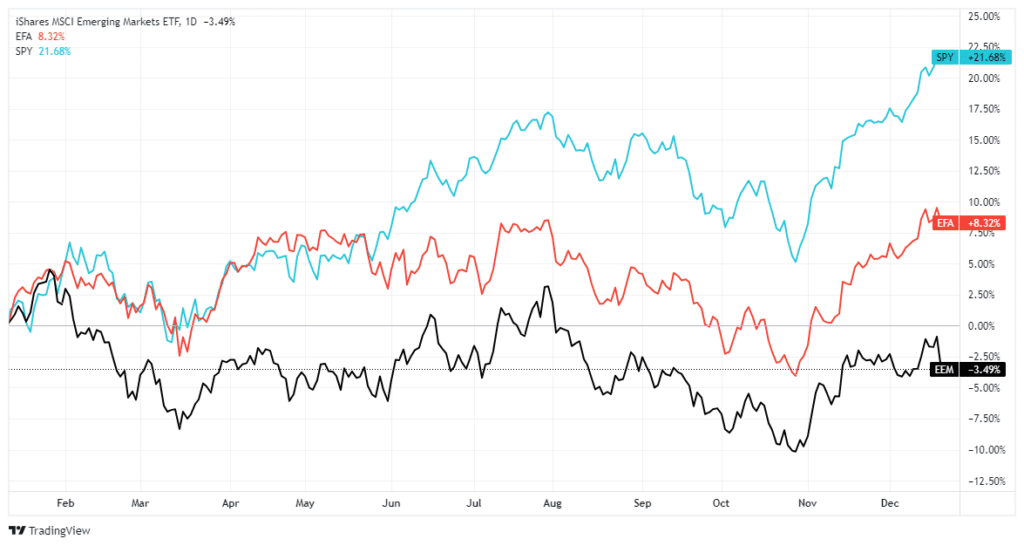

On a global scale there has been a clear divide between developed and emerging markets this year. The MSCI Emerging Markets index has delivered 1.9pc this year, but if you exclude Chinese shares then it would have risen by 11.2pc.

Overall the Emerging and Developed Internal Indexes has been lagging. There has been a perennial hope that these markets would significantly begin to outperform the United States; however, that has yet to be the case. Those two markets underperformed the S&P 500 considerably in 2023.

Source RIA

Black : Emerging, Red :EAFE :large and mid-cap securities across 21 developed markets, Blue : S&P

Heading into 2024, it is likely that we will continue to see a rotation of capital into domestic markets over international markets as Federal Reserve policy shifts to a more accommodating stance.

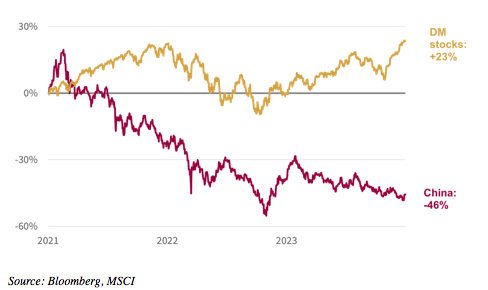

MSCI World vs MSCI China cumulative total return: Jan 2021 to Dec 2023 (% change in USD)

The Chinese market has had another difficult year, despite investors hoping that the delayed end to lockdown would help stocks recover. China’s economic prospects are encouraging. Despite property sector related woes, growth is on track to hit Beijing’s 5% target in 2023 – and a similar target is pencilled-in for 2024. Its stock market is cheap on most valuation measures – now the long-awaited revival in sentiment needs to follow

Lower inflation has helped the bond market rally late in the year. In the US, the benchmark 10 year Treasury yield fell to 3.85pc, its lowest level since July. Yields fall when prices rise.

Gold prices in dollar terms hit an all-time high at the end of the year, boosted by a fall in the US dollar as the market starts to price in interest rate cuts next year. The metal – which is treated as a safe haven asset – rallied to $2,135 an ounce, a new record.

Commodities retreated in 2023 – mostly driven by the big falls in energy prices. Bitcoin was one of the best performing assets, up 150%, but is still languishing at two thirds of its 2021 all-time high.

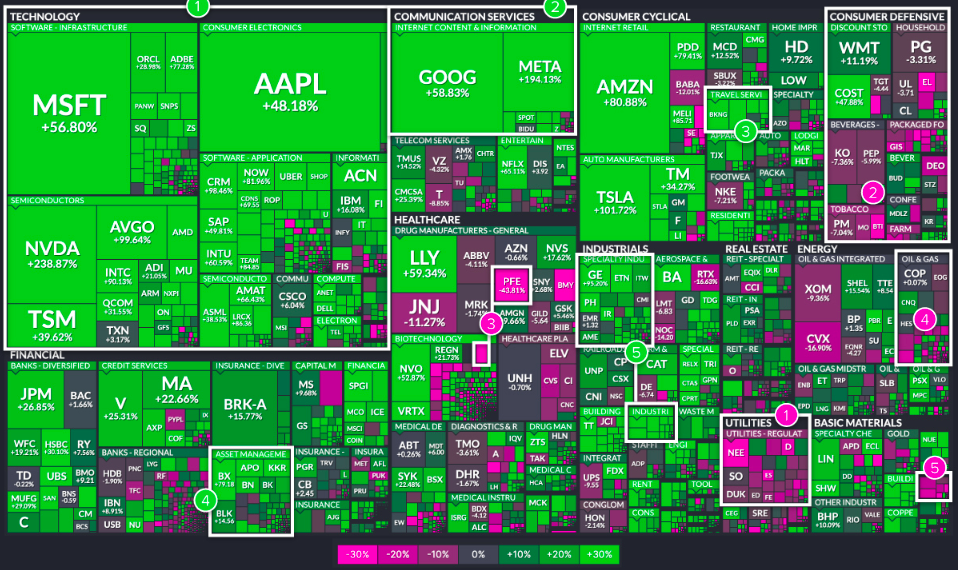

Sectors : Technology Ruled

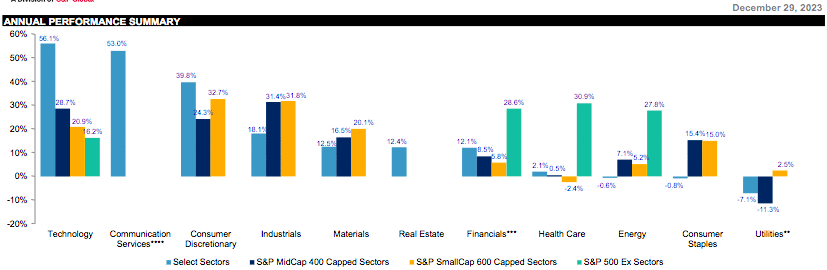

The chart below highlights the yearly performance of each sector’s

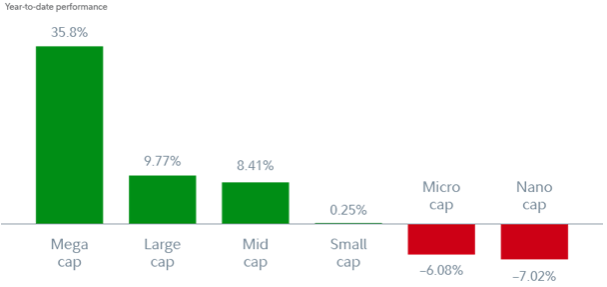

The Bigger The Better

In 2023, investors continued to love the biggest stocks on the market, the mega-cap tech companies known as the “Magnificent Seven.” After climbing steadily in the first half of the year, the group stumbled in August as bond yields soared, then recovered as the market rallied in November.

See our comment on the Equal Weight Index and Return to the Mean

Bullish sectors

Bearish sectors

Strategists agree AI is not going anywhere, and everyone is wondering what the next big breakthrough will be. So far, the AI story has been just Nvidia, Microsoft, and OpenAi. But a more diverse landscape is just around the corner as other firms get in on the action, and points to semiconductor companies like Advanced Micro Devices is potential beneficiaries.

Stock and sector heat map

source VisualCapitalist

The top five stocks of 2023 benefited from the AI boom in the technology sector and an expansion of digital offerings, as well as hopes that the Federal Reserve will curtail its interest rate hikes in the near term.

The year’s bottom five stocks, however, struggled because of a combination of internal challenges and external market pressures. The five bottom performers faced factors that potentially reflect broader industry trends and economic shifts, which significantly affected their market performance last year.

Plenty of tech giants took off in 2023 with the artificial intelligence craze, but a few surprises made the notable performance list for the S&P 500.

As you might imagine, there were a handful of products that took a nose-dive during 2023. Covid vaccine products are near the top of the list. Here are the top gainers and the worst performers ranked by gains, losses:

Next our review What’s Next in 2024 ?

Happy Trades

BONUS