Not a bad cursory review of what will drive the price of money over the next decade, something we have been focused on for years. The video is steeped in the old economic orthodoxy but provides just a faint shadow of the reality to come — think Plato’s Allegory of the Cave.

Outlook 2024

January, 15 2024FOMO : Everyone Is On Board

“By failing to prepare, you are preparing to fail.” – Ben Franklin

It is that time of the year again. Investors are taking out their crystal balls to set up their portfolios for 2024, but many are wary after the unexpected turn of events that materialized over the past year.

Most economists and analysts on Wall Street got things wrong in 2023, ranging from recession predictions and a down year for the market to the last mile of inflation would be the hardest to conquer. Is this going to be another strong year for equities or such a bad year that one might as well sell all equities at once?

Time then to take another look at the usefulness of these forecasts.

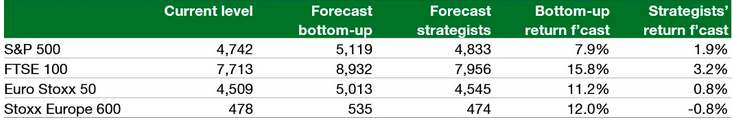

As reported in a recent article by J. Klement, Bloomberg asks a bunch of strategists every month where they expect major stock market indices to end at the end of the calendar year. At the same time, stock analysts submit their target prices for the stocks they cover to Bloomberg which allows Bloomberg to aggregate these individual share price targets into a bottom-up aggregate for an index.

The table below shows the latest forecasts for the major US and European indices both by analysts (bottom-up) and strategists (top-down). Bottom-up and top-down index forecasts for 2024

Source Bloomberg

The first thing to notice is the glaring difference in opinion between bottom-up analyst forecasts and strategists.

If you believe equity analysts, the S&P 500 will rally 7.9% in 2024 (that is price appreciation ex dividends), while European markets are expected to provide double-digit returns. That would mean we have another good year ahead of us. Not as good as 2023, but still a very good year and no reader would be angry at the end of this year if these returns materialise.

But if you believe strategists who look at the world from the top down you should strap in for a really bad year. On average, strategists expect the European market to move sideways, and both the S&P 500 and the FTSE 100 to rise in the low single-digits, essentially matching inflation but not more. That would mean you would probably be holding a ton of cash or bonds which provide returns that are likely to be higher than the equity returns expected by strategists.

If you don’t care about the actual level of returns but just want to get the direction (up or down) right, then

-

bottom-up analysts get the direction of the market right 73% of the time, compared to 70% for the simple 7.5% rule.

-

strategists get the direction right only 52% of the time, i.e. their forecasts are about as good as flipping a coin.

Conclusion : Don’t bother with share price or index targets. You are wasting your time because nobody knows where the index or individual share prices will be at the end of this year.

This is not what analyst and strategist research is about. Their analysis is about identifying the major driver of markets and then providing guidance on risks and opportunities, nothing more and nothing less.

Nevertheless, let’s review our outlook for the ongoing year 2024.

The base (consensus) scenario

Falling US inflation and prospects for easier Fed policy are increasing talk of a soft landing rather than a recession, hard landing and bear market. Leading indicators point to slowing growth but not a collapse. Select real estate, corporate and household delinquency rates are rising, but these are usually lagging indicators for investors.

In other words, equity markets normally bottom well before the peak in economic distress, with the dot-com cycle being the notable exception.

There’s still risk of recession next year; the important point is that even if it did occur it is likely to be a mild one, particularly with the Fed providing ample back-door liquidity to the banking system.

The consensus is pointing to :

Falling Global Inflation

As a result of lower energy prices, slower global growth and the delayed effects of the rate hike cycle.

Eurozone is also fighting rapidly falling inflation. The latest figures came in at 2.9%, below the expectations of 3%. Recently, the ECB issued a report which highlighted that supply chain issues were the largest contributors to inflation. If, indeed, the ECB believes that inflation is mostly caused by supply issues, then it makes sense not to keep monetary policy too restrictive for too long.

Lower Global Economic Growth.

It’s almost a certainty: it will slow down in 2024. What remains to be determined is the extent of the slowdown and how long it will last.

The global economy has the capacity to avoid a severe recession. But are we therefore heading for an approaching soft landing that may last longer than most think.

Recession Is Delayed Not Cancelled

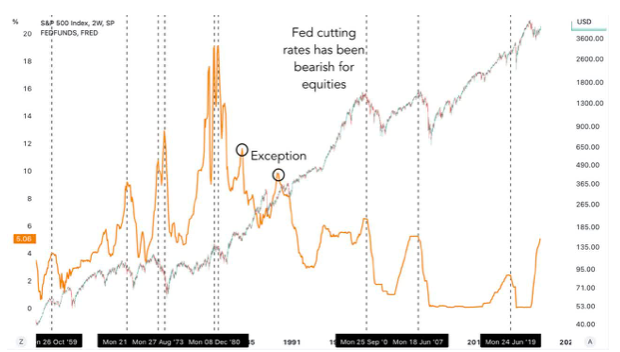

The most widely received comment recently is the certainty of a recession in 2024. However, at the same time, an increasing proportion of Wall Street analysts and economists suggest just an economic slowdown or a mild recession at worst. The hope is a repeat of 1995. This is the elusive “soft landing” scenario where the Fed hikes interest rates and cools economic growth and inflation but avoids a recession.

See the interesting paper by DB’s Jim Reid “The History (and Future) of Recessions”

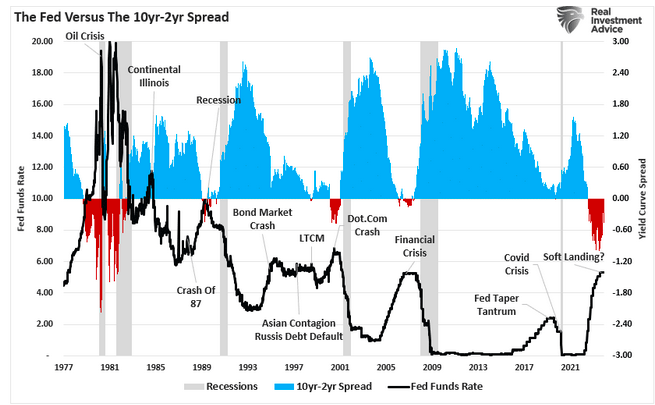

Notably, while the Fed hiked rates and the economy avoided a recession, it was not without consequence. That process caused a bond market crash, a debt default, and the failure of Long-Term Capital Management.

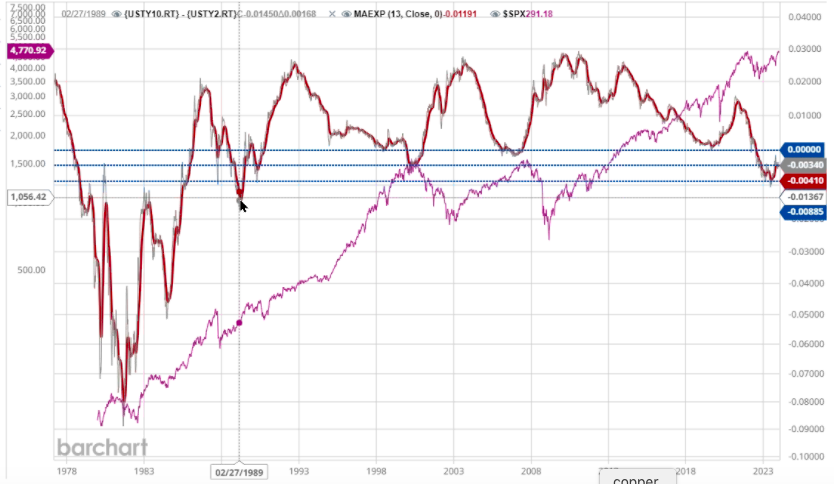

It is worth noting that recessions appears AFTER the inverted yield curve AND the start of rate cuts and market crashes.

Rate cuts have historically been bearish for equities.

Inverted Yield curve (Right) and S&P (left)

In the US, consumer resilience could be sorely tested by a rising unemployment rate, a persistently high cost of living and a relatively high interest burden. The likelihood of a recession is high, as tighter credit conditions eventually weigh on activity, while fiscal policy is unlikely to provide the same kind of support as seen in 2023.

Europe should gradually emerge from the mild recession it is currently experiencing. Unlike the United States, the old continent did not abuse the fiscal stimulus in 2023. Things could change in 2024.

As for China, it has entered a new era of weaker but better growth, driven by the expansion of domestic demand. And, of course, China is well ahead of the curve, having already issued a few rate cuts as a response to their real estate crisis.

Reversing Monetary Policy Cycle in the G7 Countries.

The Fed could start lowering its key rates (“pivoting”) as early as the first half of the year. Other central banks (e.g., ECB, SNB, BoE, etc.) are likely to follow suit.

Liquidity is expected to be a driving force for markets in 2024, with rate cuts by central banks and possibly the end of quantitative tightening.

From QE (Quantitative Easing) to QT (Quantitative Tightening) to QB (Quantitative Balancing) to QE Light.

Something needs to be done to preserve QB / liquidity.

This is why the Fed is now thinking about slowing down the pace of QT. Over the last week-end, Dallas Fed chief Logan said the Fed should slow Asset runoff as Reverse Repo dwindles.

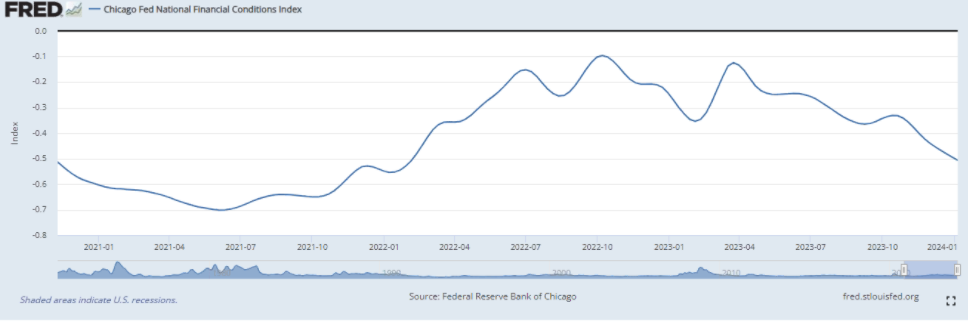

Looking at the Chicago Fed’s National Financial Conditions (Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average) the trend is to easier monetary conditions.

However it is hard to see how the Fed can start cuts as early as March, with disinflation stalled and inflation still above target. Yet federal funds futures barely moved. They still discount five cuts this year, while the chance of a 25 basis-point cut in March is still put as high as 63%.

BUT 2024 is an election year and we expect net liquidity to be supportive next fall for the economy, bond markets and risk assets.

If the central bank is really happy to start cutting with inflation still above 2% to avoid overshooting, and if it’s truly in the tank for Joe Biden in an attempt to boost the economy before November’s election, then December’s report needn’t stop them from cutting in March.

If this happens, such a liquidity injection might be a massive tailwind for risk assets…

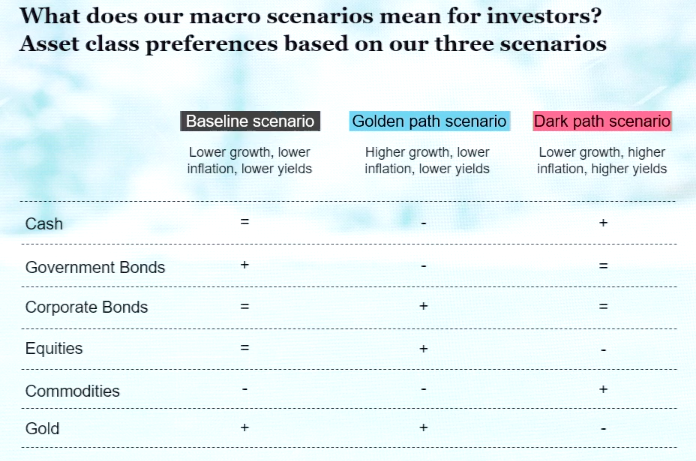

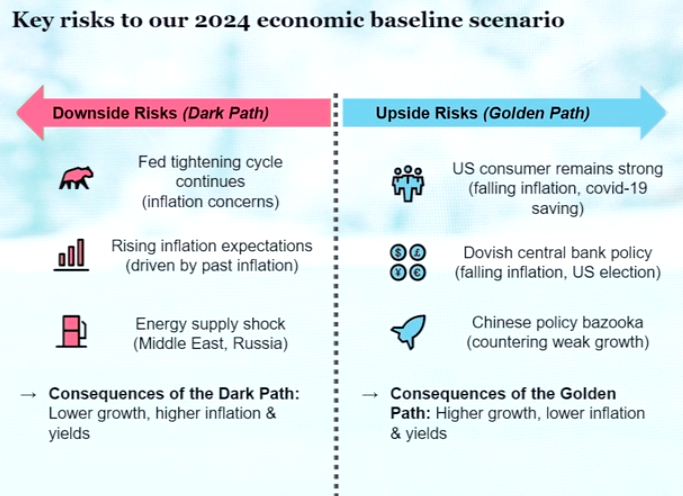

Scenario risks

Barring a return of inflation or any geopolitical disruptive or black swan-like event :

- The disinflationary process is likely to end in June, at which point the baseline scenario will have to be reevaluated.

- The probability of a summer “slump” is high if inflation remains sticky and growth slows more than expected.

- USD stronger with stable interest rates (SPX blue) as the correlation with market expectations (revenues).

A secular upward in the greenback could be a harbinger of a global economic recession—and a headwind for equities.

Navigating the Market Uncertainty

The considerable risk to any outlook for 2024 is what happens with Federal Reserve policy, interest rates, inflation, and, importantly, the avoidance or impact of a recession.

Many conflicting indicators suggest a recession is possible and likely as we move forward. Other indicators suggest the opposite.

Aside of the consensus we are taking a cautious tilt for the year. It won’t be a straight line lower, but in terms of handicapping odds. It may take several quarters to play out, with rising volatility being the story going forward.

We are forecasting rather dull year with a better start and a more difficult second part as the recession is taking its share.

There is a higher chance that something goes wrong in an environment filled with risks. What bulls need is for a lot more things to go right.

Bear of the bears

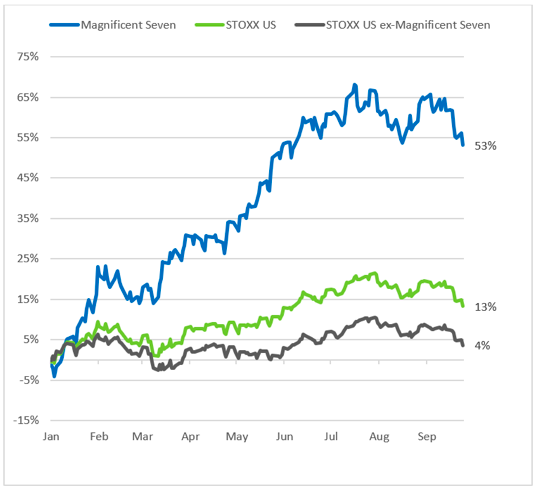

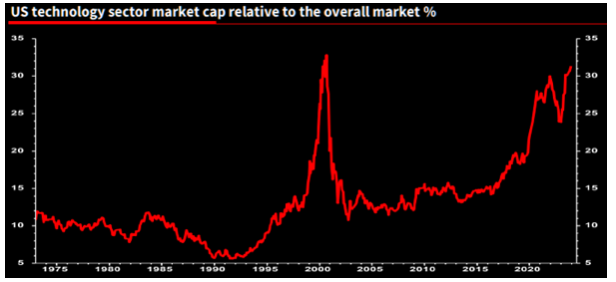

The one and only, Albert Edwards from SG noted “the biggest surprise that could send a shockwave through portfolios is the US IT market cap bubble bursting and tipping the entire US market into a slump.”

Actually, at the end of 2023, the U.S. tech sector’s weight in the broad market index equals that observed during a brief period of exuberance in the summer of 2000, a time associated with the dot-com bubble.

The current 7x IT premium is as high as it ever has been, apart from the madness of the 2000 Nasdaq bubble.

Value Vs Growth Stocks: Which Ones To Favor In 2024 ?

2023 was a perfect storm. The spring took a bite out of financial stocks, which are a major component of the value category, even though rising interest rates should have theoretically favored that segment. The fact that the Magnificent Seven ended up being that quality trade completely dwarfed any sort of trends underneath the hood.

The Magnificent Seven soared, lifting up the major indexes even if the rest of the market wasn’t faring nearly as well. Value stocks fell by the wayside once again. Large-cap value stocks hovered close to their fair values at the end of the year, while large-cap growth stocks carried a 15% premium.

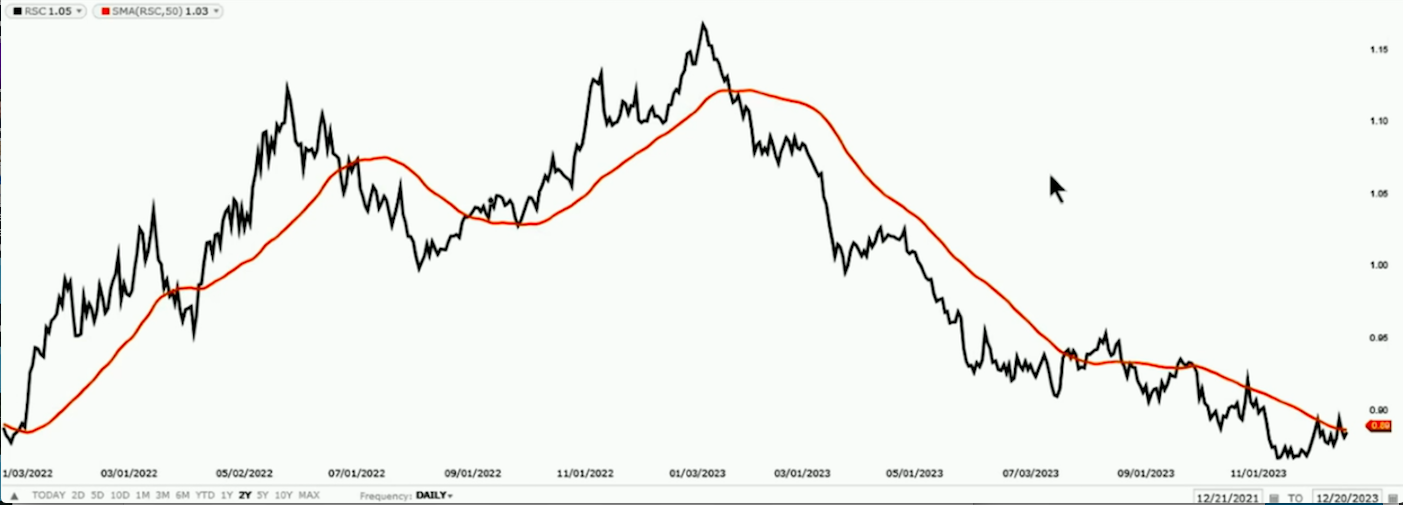

Relative Value to Growth stocks

After lagging last year, these stocks could rebound under the right conditions.But in the wake of 2023′s “everything rally,” there are hints (albeit small ones) that the tables could be turning. Value stocks are flat so far in 2024, while growth stocks have fallen 1.8%.

This valuation imbalance could be a tailwind for value stocks, especially as interest rates return to more normal levels.

This year, it may make perfect sense to have a bias toward value stocks rather than growth stocks, they’re not the sworn enemies you might think.

A period of slower growth could be good for defensive value stocks like utilities and consumer stables, while more cyclical stocks within the category, like financials and energy, would suffer. A major rally within the value universe would depend on the participation of financial stocks, which comprise the largest portion of the category.

Russell value components

But this time around it felt like value just couldn’t keep up because it wasn’t big tech. But in 2023, value stocks faced their own fundamental headwinds: Bank stocks were cheap because of concerns around interest rates and deposit risk, for instance, while utility stocks fell out of favor as Fed policy pivoted. Those headwinds opened up opportunities that could flip the narrative.

Will Laggards Become This Year’s Leaders

As we head into 2024, the big question is where to place my bets. Will market capitalization-weighted indexes lead the way again, or will we see a rotation to something else? At the beginning of 2023, no one thought the market would end on such a high note, with Technology pacing the gains.

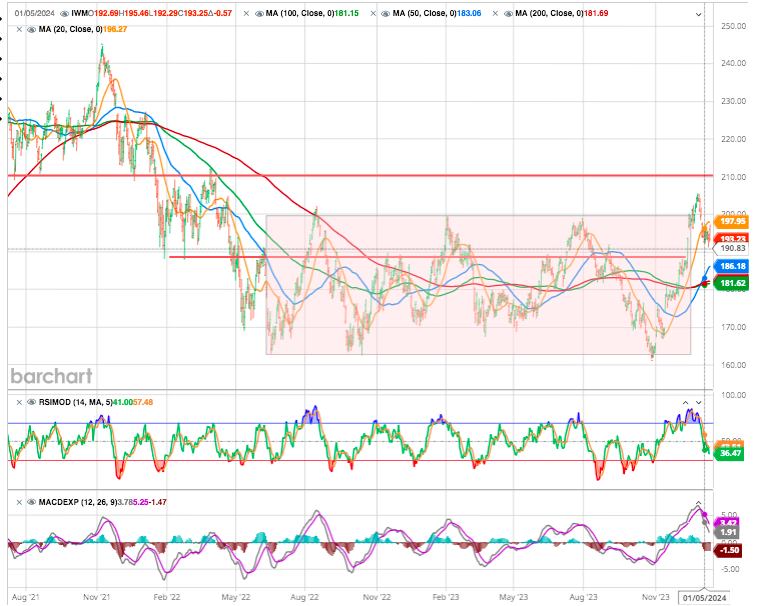

The small-cap Russell 2000, which largely sat out this year’s stock market rally, has outperformed the S&P 500 in the year end. But then it retreated early 2024.

Rotations are the lifeblood of a bull market, and would be constructive for the rally.

Could it signals that investors could be finally rotating into laggard stocks and pushing them higher ?

For the time being the one and half year rectangle has not been significantly broken.

We are therefore looking for large cap to form short-term distribution patterns into the early weeks of next year, or for signs that the laggards are starting to breakout. The latter is clearly the risk scenario for our base-case outlook and will leave us having to rethink the 2024 trajectory.

Small caps usually underperform both before and after the Federal Reserve cuts rates, which speaks to the notion that the Fed typically cuts rates as nominal growth is slowing and small caps tend to be quite economically sensitive.

But although rate cuts may not drive big small-cap outperformance in and of itself, an earlier anticipated transition to more comfortable monetary policy in the context of a still healthy economic backdrop, can drive a cyclical rebound in nominal growth in 2024.

We can make some educated guesses based on the thesis that the economy will slow due to more restrictive monetary policy and a continued reversal of monetary liquidity. A slower economic environment will contribute to a slower inflation growth pace, manifesting in a lower yield environment. In such an environment of disinflation and lower yields, earnings growth will become more challenging for many market areas.

Strategy

The combined effects of a moderate slowdown in growth, lower interest rates and positive corporate earnings momentum should lead to a moderate rise in equities in 2024.

It’s time to look at the stocks that are lagging, such as some small- and mid-caps, Swiss blue chips and value stocks. And a possible Chinese resurgence

Europe is expected to resume a mild expansionary trend after its 2023 recession when adjustments triggered by restrictive financing conditions and less government support have already happened.

The Chinese economy appears ready to stabilise after a multi-year slowdown caused by political decisions designed to strictly control a wide array of sectors (real estate being the most emblematic).

And of course, we continue to favour Japanese equities.

Conclusion

We haven’t seen the worst of the story yet. we expect more pain to come in 2024 as we will feel the full consequences of the numerous rate hikes.

In 2024, we believe the relative weight of the Magnificent Seven—more than most other considerations—could well determine the market trend.

The challenge for portfolio managers will be to nimbly calibrate the active weights of these stocks—no mean feat if volatility continues to persist.

Against this challenging backdrop, we continue to emphasize quality equity portfolios with low Beta and minimal sensitivity to the underlying business cycle.

In such an uncertain environment, making a firm commitment is difficult. We must adhere to our portfolio management discipline and investment rules. As the market dynamics change, for better or worse, we must be willing to adapt and change accordingly.

Stay tuned

Bonus