Oil Prices and Energy : WTF What’s the Future?

September, 18 2023- After an incredible run in 2022, energy stocks have slowed slightly this year, with oil prices softening on fears of an economic downturn.

- However, with energy demand continuing to recover and with OPEC likely to keep a tight rein on supplies, prices could stay well supported from here.

- After years of low investment, I believe we’re still in the early stages of a major cycle of new investment in international and offshore production.

- These factors are contributing to a positive outlook for the sector in general, and for energy equipment and services stocks in particular.

Gains among energy stocks have slowed this year, after their breakaway performance in 2023. But historically high energy prices—supported by constrained supply and rebounding demand—could set up a positive backdrop for the sector over the near-to-intermediate-term future. An uptick in investment could bode well for one segment in particular: energy services and equipment stocks.

Energy stocks take a breather

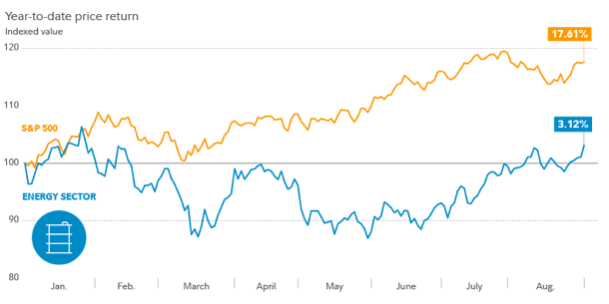

After leading the market by an enormous margin in 2022, when energy was the top-performing sector, these stocks have taken a breather so far in 2023. The sector was up 3.1% as of the end of August, compared with the 17.5% gain for the S&P 500.

Source Fidelity

In part, that slower performance has been due simply to a shift in investor preferences—with investors favoring tech stocks and other high-growth sectors this year (sectors that are seen as benefiting from slowing inflation and slowing interest-rate hikes).

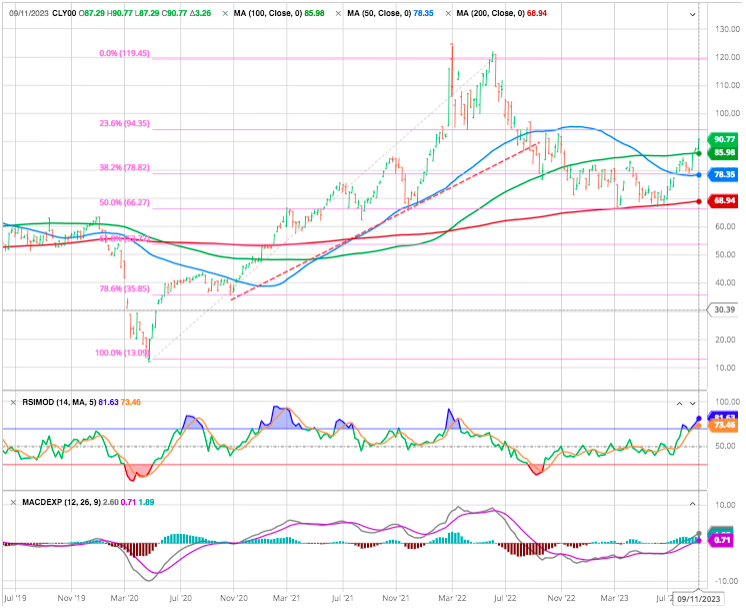

And in part, it’s been due to softening oil prices. After spiking in 2022 at the start of the Russian invasion of Ukraine, oil prices weakened earlier this year on concerns about the possibility of an economic slowdown.

Plenty of support for oil prices

That said, I think the outlook for energy stocks is promising. That’s in no small part due to favorable supply-and-demand conditions, which should help support oil prices.

Global demand for oil is solid, and may continue to rebound and grow during the remainder of 2023 and 2024, thanks to China’s reopening and thanks to the worldwide continued recovery in air travel. Looking out beyond 2024, economic growth in developing markets is likely to drive further growth in oil demand.

That strong demand is likely to be met with constrained supply. Although spare capacity had recently increased—due to the US’s unprecedented release of oil from its strategic reserves in 2022, and due to an unusually warm 2022–23 winter in the Northern Hemisphere—supply should be constrained for the near-to-intermediate term by recent production cuts by the Organization of the Petroleum Exporting Countries (OPEC).

The cartel of leading oil-producing countries agreed last spring to reduce output through 2024. And member nations Saudi Arabia and Russia announced that they were voluntarily cutting production by even more than what the cartel had agreed to.

In our opinion, OPEC is likely to keep oil supplies in check as it seeks to maintain per-barrel oil prices in the $80 to $100 range, which is considered the sweet spot that delivers strong profitability to oil producers without hurting oil demand.

Overall, steady global demand and constrained supply suggest oil prices are likely to remain elevated for some time.

What to watch: Equipment and services stocks

The supply-demand profile for oil is favorable, oil prices are likely to remain elevated for the near-to-intermediate term, many companies are generating strong positive cash flow, and stock valuations look attractive.

One area in which stock valuations are particularly compelling is energy equipment and services. These are the companies that provide the essential equipment and services to produce oil and gas, such as the rigs, crews, and technology needed to drill and complete a well. After years of low investment in new oil and gas production, particularly in international and offshore markets, this trend is now beginning to reverse course.

New production can take a long time to ramp up, and so it typically takes several years for international and offshore spending to recover. I believe the industry is still in the early innings of a significant investment cycle in international and offshore production. Corporate spending has been increasing and could continue to grow. The more recent rebound in prices we saw this summer could also boost onshore US production activity.

Why focus on energy equipment and services providers? There’s an old saying in investing that during a gold rush, your best bet is to start selling picks and shovels. Similarly, it takes equipment and services to extract energy from the ground. As oil producers seek to boost production, they boost spending on energy equipment and services.

Outlook remains bright

During the past decade, the energy sector has matured. It is a competitive, capital-intensive sector that tends to rise and fall with the broader economy. But many companies now generate positive cash flow and allocate capital back to shareholders through dividends and share buybacks.

Until next time !