Weekly Market Review as of September 23 :

September, 25 2013The “No-Fed-Taper Festival”

Hegel remarks somewhere that all great, world-historical facts and personages occur, as it were, twice. He has forgotten to add: the first time as tragedy, the second as farce.

– Karl Marx

(Let it play to hear the music as you read)

Since our last letter, equity markets have risen further, propelled higher by the so-far peaceful U.S. reaction to chemical weapon usage in Syria, by Larry Summers’ withdrawal as a possible Fed Chair, and most important, by the Federal Reserve’s decision to not yet lighten its level of policy accommodation.

Since our last letter, equity markets have risen further, propelled higher by the so-far peaceful U.S. reaction to chemical weapon usage in Syria, by Larry Summers’ withdrawal as a possible Fed Chair, and most important, by the Federal Reserve’s decision to not yet lighten its level of policy accommodation.

Everyone was sure there would be some type of tapering. That message had been clearly communicated to the markets. When the announcement came, the telephones went off and everyone erupted with various forms of surprise. I fully admit to being speechless as I discovered it. I kept waiting for some kind of explanation, and none came. The more we talked about it and the more I thought about it later, the more convinced I became that this was one of the more ham-handed policy announcements from the Fed in a very long time. Why would you go to the trouble of getting the market all ready for the onset of tapering, build expectations, and then jerk out the rug? What in the wide, wide world of sports is going on?

The Fed defied widely-held expectations that it would begin tapering its pace of QE this week. Now to be clear, we think the decision to delay tapering was the correct one based on our reading of the data. However, notwithstanding the data, the Fed was sending unmistakable signals tapering was imminent. Thus, markets were clearly caught off guard and were force into an abrupt revaluation of asset values. But perhaps this is what the Fed intended—surprising markets and causing some pain (particularly those shorting Treasuries).

Indeed, this could be the Fed’s way to rein in markets and keep them from again getting too far ahead in pricing-in any tightening of monetary policy. And perhaps this is better than the alternative that Bernanke and the Fed are simply tone-deaf to market expectations. Either way, this means we may see more volatility because investors are surely now far less certain of the Fed’s intentions.

The delay on tapering is one factor leading us to believe the Fed is more dovish than we have assumed. The other is the FOMC’s frankly puzzling Summary of Economic Projections for 2016 added this week. These projections suggest that the Fed is at risk—admittedly well down the road—of keep rates too low for too long. Economic theory suggests the policy rate should be at neutral, or at least quickly approaching neutral, when the economy hits full employment. Otherwise, the continued unwarranted monetary stimulus risks an overheated economy, inflation well above target, and the possible return of asset bubbles. This in turn raises the specter of significant economic and financial instability in the longer term.

Equities: The Fed’s decision to pass on tapering, along with Summers’ decision to step away from a possible Fed Chairmanship, improved risk appetites, sending equities broadly higher. Emerging markets (EM) were notably well bid. Interestingly, the index most closely associated with Fed policy, the S&P 500, finished the week in sixth place with its 1.30% gain. Of the seven indexes open all week, only the UK’s FTSE fared worse with its fractional 0.19% advance. The big weekly winners were the three Asia-Pacific indexes

Bonds: Government bonds rallied on the Fed’s surprise decision to pass on tapering. The Summers withdrawal also helped. Gilts lagged other markets as investors continue to challenge the BoE’s extreme low-for-long guidance.

Currencies: USD was broadly weaker after the Fed’s surprise no-taper announcement. Notably, EUR soared to its highest since February, and AUD to its highest since June. Key EM currencies are also better bid.

Commodities: Gold caught a bid after the surprise Fed announcement. Oil was still lower on the week.

Surprise !

Everyone is searching for an answer on the FOMC’s move. A good friend, one of the largest bond manager here, came up with a conspiracy theory. He thinks Obama is quite upset that he can’t have Summers as Fed chair and that his staff is crossways with Yellen. Reports suggest she has not even been interviewed yet. Really? we can question if Summers had maybe communicated through back channels to Bernanke that he wanted to end the tapering, and Bernanke was helping him out; but then when he was no longer in the running for Fed chair, Janet Yellen came and said, “Ben, I’m not ready to end tapering yet,” so Bernanke took one for the team.

Can we trust the Fed now? Years of work building transparency and a confidence in the narrative, and then they blow it on a meaningless non-taper?

One of the important things a Central Bank provides when there is a crisis is that sense that “daddy’s home.” A Central Banker has to deliver his message speaking confidently as the man who knows.

Whether or not you personally believe the Fed has any significant power to actually do anything, the general market does believe it, and that’s the important thing. Now the Fed is at significant risk of damaging its reputation for decisiveness and clarity. We can only hope there is not another crisis coming out of Asia or Europe in the next few months that would require Federal Reserve action. What could they do now that would actually be credible? And while I don’t see a crisis developing in a short timeframe, it is the things that we don’t see, the Lions in the Grass, that create so many problems. Just saying…

Fed To Stick With Stimulus For Now Citing Tough Economy… What Does it Mean for Investors ?

There are, however, two events that kept the Fed from lowering its monthly purchases: the impacts of “federal fiscal retrenchment” and, as Fed Chairman Bernanke noted, a “tightening of financial conditions observed in recent months.”

According to the Fed, fiscal policy in the U.S. has been suboptimal. During times of weak growth and low inflation, the Fed would prefer the Government to act with the Keynesian response of stimulus in the form of tax cuts and increased spending. Congress and the President have instead delivered tax increases and a sequestration, both of which have softened the strength of the recovery. House Republicans are also threatening another debt ceiling fight that could limit the Treasury’s ability to pay its obligations.

In the Fed’s view, Congress is forcing its hand and leaves it no other choice but to pick up the slack of their fiscal tightening. A showdown in Congress over the debt limit and the Affordable Care Act is possible, but would do unnecessary harm to the recovery. This fact is no doubt known by both sides of the aisle of Congress and therefore a full-blown government shutdown isn’t likely. Though we can say that we do not trust the wisdom of this Congress, it appears the Fed doesn’t either. Recent softening in housing is likely the main culprit of the Fed’s steady posture.

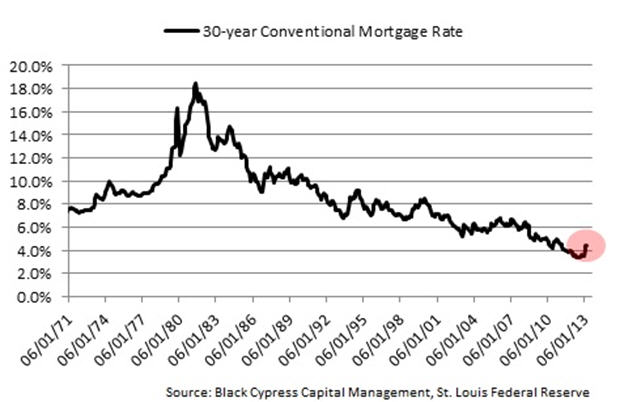

Typically, ‘tightening’ refers to both increases in credit spreads and increases in nominal interest rates. Since Chairman Bernanke’s testimony before the House of Representatives’ Committee on Financial Services back in July, the 10-year Treasury yield has increased 34 basis points, the 30-year conventional mortgage yield rose 20 basis points, all while credit spreads on corporate debt remained largely unchanged. By historical standards, this is hardly a “tightening of financial conditions.”

When you expand the time frame from the last couple of months to last November, the month with the lowest mortgage rate on record, however, you do see a greater increase in interest rates. Since November 2012, the 30-year conventional mortgage rate has increased 126 basis points to 4.57%. Credit spreads, on the other hand, actually improved over 100 basis points during that period.

This increase in interest rates has thus far had a limited impact on most of the economy. Manufacturing continues to expand, robustly so over the last few months, auto sales reached a new high for this economic recovery in August, unemployment claims are at the lowest level since 2007, hours worked and weekly wages are increasing, corporate profits are the highest ever, stocks are at all-time highs, and the outlook for economic growth remains positive.

So why then did the Fed hold steady on its current level of purchases? We suspect it is due primarily to that little red section on the graph above. Since mortgage rates bottomed in November of last year, building permits and housing starts have been stuck at the same seasonally-adjusted level. Applications for refinancing and applications for purchasing homes both peaked in May of this year and have since fallen 65% and 13%, respectively. So it appears that the Fed maintained its level of monthly purchases to support the housing market.

If there were any doubt that ultra-low rates are, in the Fed’s view, critical to both the ongoing housing recovery and more broadly, this economic expansion, the last four months should put that to rest. While mortgage rates today are lower than they have been for all but a few months in history, the mere 126 basis point increase in rates slowed the housing market’s advance enough for the Fed to abandon the start of its widely-expected process of ending its unprecedented monetary stimulus. Is the recovery really so fragile?

see Hufftington in English and Complete report in French

How Should Investors React?

In our view, investors should stay focused on the economic data, maintain their investment thesis and ignore any of the “body language” from the Fed. Markets react to economic data. We saw that yesterday with a sell-off, in light of the strong data released. In May, Treasury rates had already begun to rise prior to the Fed’s comments.

With that said, the economy continues to expand, whether Fed-induced or not, and combined with accommodative monetary policy, this bodes well for equities. More important, we hold a portfolio of companies priced to generate solid returns despite the broadly overpriced opportunity set. Our portfolio has an implied double-digit, 3-year average annual expected return — baring another economic downturn — far in excess of what we believe investors can earn owning a stock index fund.

A “Green Light “ for Risk-on Investing?

We think this decision prolongs the positive market environment we have seen in both equities and fixed income. With the Fed seemingly a distance away from tapering and raising rates, this could bode well for the risk sectors, where we could see further tightening in credit spreads on both high yield and investment-grade corporate bonds. We could see a reach for yield in securities that have suffered since the Fed’s comments in May. In reality, riskier markets have been only modestly affected by all of this talk of tapering. In fact , high yield and investment-grade corporate spreads are very close to where they were in early May, suggesting that the markets have recaptured almost all of the spread tightening and frothiness that occurred in the U.S. credit markets.

Equity markets, on the other hand, have shown no such sign of pause. Our estimate of expected broad equity market returns is a 3% to 5% average annual increase over the next decade. To view future returns more favorably is to assume record high profit margins do not normalize and the economy avoids recession for an additional ten years. Put simply, one must believe that it is different this time. We think it is not

In its quest for returns, a strategy’s capability to manage risk and preserve capital is far more important than its ability to chase the market higher at lofty levels. This is of particular importance to remember at this stage of a market cycle. Stocks are no longer inexpensive and the case can be made quite easily that as a group they are in fact overvalued. Their continued desirability today is in many respects a function of poor alternatives due to historically low interest rates.

We suspect many investors would be more than content to hold cash or bonds in lieu of stocks if short rates covered inflation and offered a reasonable real return. As the Fed would have it, capturing mid-to-high-single-digit yields isn’t possible today without taking poorly compensated credit risk further out on the yield curve. As such, stocks remain the best asset class as well as investors’ seemingly only decent choice.

In this environment of more moderate future returns that favors security selection and, in time, actual risk management practices, we expect to flourish.

Globally, this should help alleviate stress in the Asian markets and some of the emerging markets in particular by taking some of the heat off the dollar. The dollar had been appreciating against these currencies and many of those investors were moving money out of those markets to the U.S.

TaperLess