Weekly Market Review as of July 7

July, 08 2013A thought experiment…

Our base case forecast is that the global economy is poised for improvement as tailwinds dissipate and the recovery broadens. However, we have become more guarded about near term prospects, even conceding in our latest forecast that improvement is now likely delayed until 2014. Moreover, there have been important reminders over the last week that risks to this outlook remain skewed to the downside.

Our base case forecast is that the global economy is poised for improvement as tailwinds dissipate and the recovery broadens. However, we have become more guarded about near term prospects, even conceding in our latest forecast that improvement is now likely delayed until 2014. Moreover, there have been important reminders over the last week that risks to this outlook remain skewed to the downside.

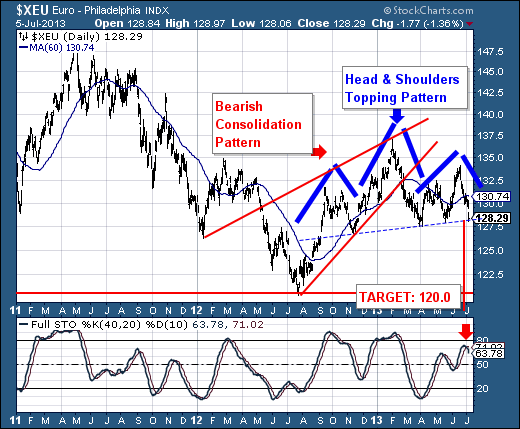

The Bank of England and the European Central Bank have re-affirmed their old positions since the Fed has changed tacks. The initial reactions will be a spike in equities and a fall-off in the valuations of the Pound and the Euro to the Dollar.

These, however, are first blush reactions as the color fades from the bloom. Whatever the actual reasons, the European statements have certainly sounded the trumpet that the “Currency Wars” have reignited.

In Europe, the tail risk of a eurozone breakup has abated over the last year, but the crisis certainly has not been solved and the monetary union remains highly vulnerable to negative shocks and backsliding on structural reforms. Alas, there have been both recently. First, austerity fatigue has splintered the coalition government in Portugal, leading to a sharp jump in borrowing costs for the country, threatening to set back its fiscal and economic reforms, and raising the risk of contagion. Second, the critically important move towards a European banking union appears to have stalled—the single supervisory mechanism is taking longer than expected to set up; the single resolution mechanism is proving extremely difficult (and contentious) to establish; and a single deposit insurance appears to be delayed indefinitely.

In China, the data flow suggests economic growth is little more than stabilizing. Indeed, economists have been widely downgrading growth expectations for China as the data have failed to improve, and policymakers appear increasingly willing to tolerate slower growth in order to continue rebalancing the economy more toward private domestic demand, especially consumption. Of course, because growth in the advanced economies remains anemic, a real disappointment in China suggests that the global economy could actually slow for a third consecutive year in 2013.

In the Middle East, the Egyptian military has ousted President Mursi (elected last year) and suspended the constitution. Along with the continuing civil war in Syria, the crisis in Egypt highlights the fragility of the region’s geopolitics and thus the vulnerability of OPEC production.

Equities: Equities were mixed.The week’s leading piece of good news was the June jobs report, which showed that employers had created 195,000 jobs in June, somewhat in excess of consensus estimates. The German DAX fell following a disappointing orders print. In contrast, Japan’s Nikkei continued its rebound from the spring swoon as business confidence improved.

Just about everyone expects a short term correction at this point, but what about the long term? We might get some idea by looking at where the market is today in relation to its long term trend. As you can see in the chart below, the S&P is 65% above the 140 year mean. For it to revert just to the mean would require a drop to approximately 1000. However, when any system is thrown out of balance it first compensates in the opposite direction before settling back to equilibrium. This means that we could see a far greater drop as the S&P falls from its high in 2000.

Remember that the S&P crashed to “just” 666 in 2009. Since the 2000 high was the all time extreme variance from the trend at 153% it is not unreasonable to imagine an extreme over-compensation to the 400 estimate, as unpleasant as that would be. These scenarios seem much more likely than the S&P gently landing on and following the mean line, let alone suddenly making a u-turn and taking off into a multi-year bull

Bonds: Government bonds across the rest of the G7 were generally better bid as policymakers (in Europe most notably) reassured markets that policy rates will remain extremely low for a considerable period yet. US Treasury yields were comparatively steady most of this week but jumped on Friday following the upbeat jobs report.

A log-scale snapshot of the 10-year yield offers a more accurate view of the relative change over time. Here is a long look since 1965, starting well before the 1973 Oil Embargo that triggered the era of “stagflation” (economic stagnation with inflation). The trendline connecting the interim highs following those stagflationary years starts with the 1987 closing high on the Friday before the notorious Black Monday market crash. The S&P 500 fell 5.16% that Friday and 20.47% on Black Monday.

Conclusion : the exit strategy for the FED is nil and it can only keep going on, if rates keep going higher, the only support for the stocks (hence P/E ) is higher earnings per share – we doubt it – !

Currencies: EUR and GBP fell as the ECB and BoE struck dovish tones. JPY weakened to above 100 for the first time in a month. AUD continued to slide, as the RBA talked the currency lower. It’s flirting with 0.90 for the first time in nearly 3 years.

Commodities: USD strength continued to weigh on gold. Oil (Brent) jumped to a 3-month high on political turmoil in Egypt and production outages in Libya.

Has Gold’s ‘Bubble’ Burst Or Is This A Golden Buying Opportunity?

“Throughout all of history, there has never been a single instance where a fiat currency did not end in hyperinflation and complete collapse. There is not one example of a successful fiat currency. Because the simple thing is that if you give a printing press, in simplified terms, to a politician, a king, an emperor, a president, a prime minister, you name it, they will overuse it every single time. That is just human nature. And that is what happens…”

In terms of the short term , there is probably no other choice but to print more, because if the Fed pulled back in its quantitative easing, we would have a massive depression. So for the moment, you print more. But the problem is, what happens down the road?

interview with Nick Barisheff (39m:49s):

The short term outlook for the precious metals is, as ever, uncertain. Further weakness is possible although there is strong support for gold at the $1,200/oz level from a technical and fundamental perspective. There is robust international demand for gold at these levels and gold is becoming increasingly uneconomical to mine at these depressed price levels.

Longer term we continue to believe that gold is in a secular bull market which will continue from 2015 to 2020. We continue to believe that gold should reach and surpass its inflation adjusted high of $2,400/oz in the coming years.