Weekly Market Comments as of June 30

July, 02 2013FED Total Information Awareness

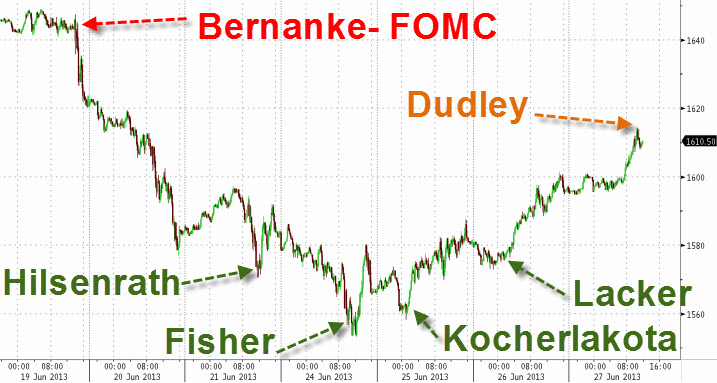

This week calm was restored when it became clear that the Fed wanted to convince that Chairman Bernanke’s signal that the tapering of asset purchases might begin later this year interpreted by many as, “the Fed was heading for the exit” and tighter monetary policy was imminent, was a misinterpretation, and dispatched a number of Fed Presidents and Governors—doves and hawks alike—to provide some clarity on the issue.

First, the timing of tapering is not written in stone and is data dependent. Indeed, if the improvement in the economy and the labor market fall short of expectations, tapering would be delayed, dragged out longer, halted or even reversed. Second, tapering does not represent a tightening of the stance of monetary policy. In fact, policy would continue to become more accommodative as the Fed’s balance sheet continues to grow, albeit at a slower pace. Third, and perhaps most importantly, tapering does not signal that actual policy tightening is imminent.

A key lesson from this episode is that the Fed still needs to do a lot of work to improve its messaging. To be sure, some have argued that this “tightening scare” may have served a useful purpose of wringing out some of the excesses that have likely built up in markets. However, as we opined last week, difficulty by the Fed in signaling its intentions clearly could prove far less constructive and far more painful as we get closer to actual policy tightening.

Equities: Equities were mostly higher this week as risk appetites improved in the wake of efforts by several Fed officials to reassure markets that tighter monetary policy was not imminent. Finally, emerging market equities and commodities continued to underperform, reflecting slower growth in many major EM economies. Although the economy and markets have overcome many of 2012’s risks, recent market -5% volatility may be indicative of an eventful second half of 2013. A rush of Japanese economic data published Friday painted a mostly upbeat picture for May, with industrial production making a particularly strong showing. Industrial output rose 2% during the last month.

Even so, G7 equity performances for Q2 overall was decidedly mixed with shares up strongly in Japan, moderately in the US and Germany, flat in France, and down in Canada and Italy. Equities were also down in Q2 for Australia and emerging markets overall.

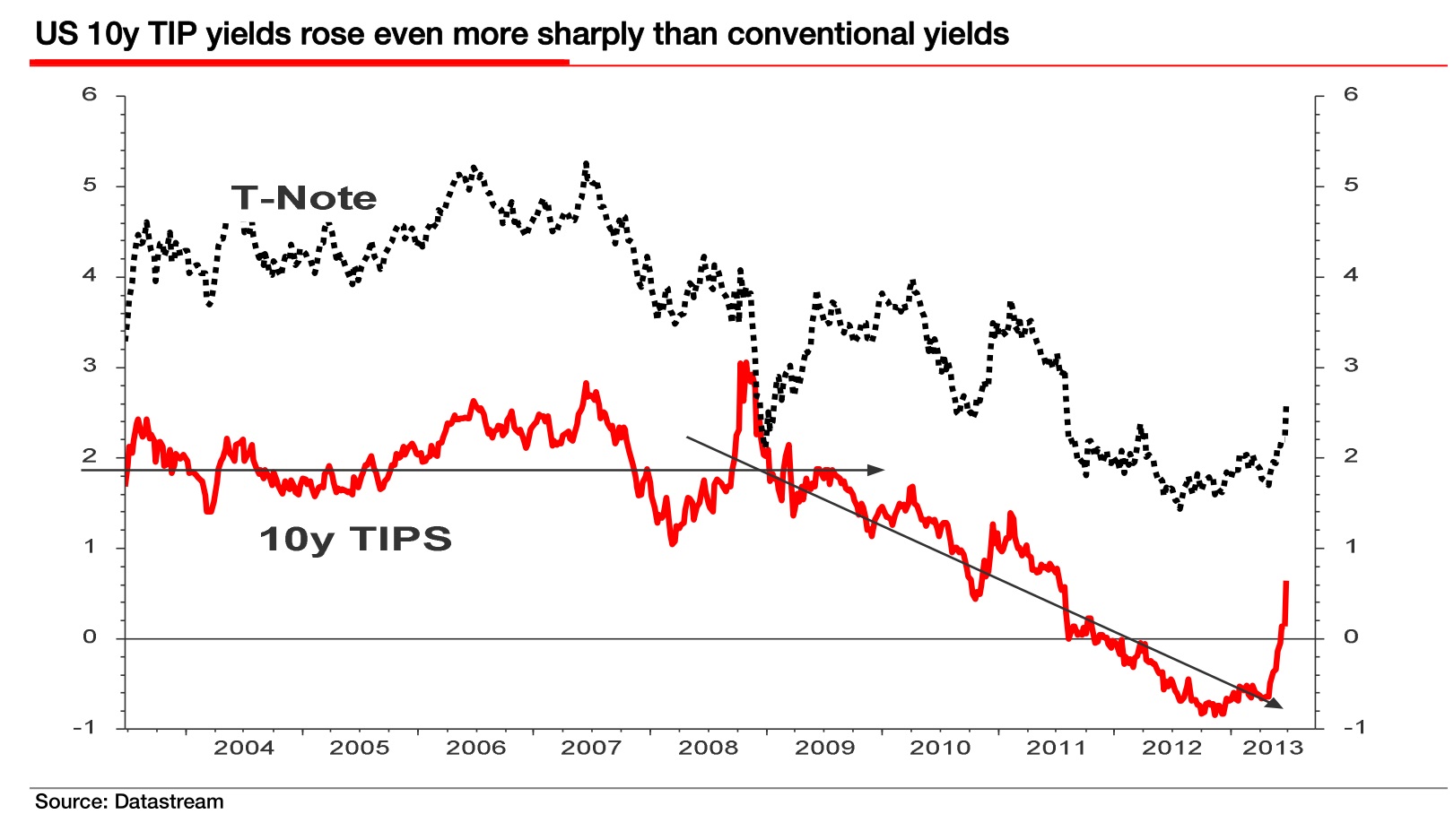

Bonds: G7 government bond yields generally stabilized this week as Fed officials pushed back against what many of them saw as an over-reaction to Bernanke’s guidance on tapering. However, this still left yields sharply higher for Q2 and year-to- date across the G7, although Italian spreads have benefited from improved risk appetites. Perhaps the one that surprised the most was the dramatic rise in yields on inflation linked bonds, outdoing the rise in yields seen on conventional bonds. To be fair, the dramatic sell-off in bonds began right at the start of May when T-Note yields bottomed at 1.63 percent, well ahead of Bernanke’s speech last week.

The bloodbath in the bond markets has led some commentators to see this as the end of the long bull market. Indeed, a recent Bloomberg article headlines an impending “lost decade for bonds”.

Perhaps the one that surprised the most was the dramatic rise in yields on inflation linked bonds, outdoing the rise in yields seen on conventional bonds. To be fair, the dramatic sell-off in bonds began right at the start of May when T-Note yields bottomed at 1.63 percent, well ahead of Bernanke’s speech last week.

Currencies: Even as Fed officials flashed more dovish signals, USD remained bid, perhaps reflecting China worries. The AUD remains chronically weak. It was above 1.05 in mid-April. Now it is flirting with 0.90.

Commodities: Dollar strength continued to weigh heavily on gold. The metal flirted with $1200 per ounce this week, down more than 35% from its peak, and its lowest since the summer of 2010. In contrast, oil found a bid, likely reflecting some supply concerns and perhaps greater optimism on US growth.

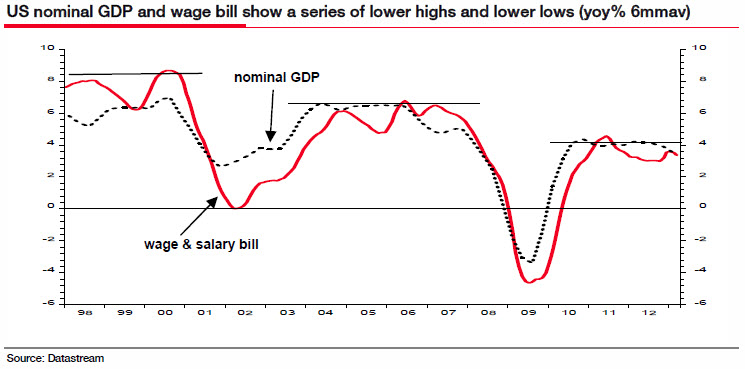

QE99 here we come

We note that, amid the carnage in the government bond market, implied inflation not only remains subdued but has fallen decisively. Maybe that reflects an acknowledgement that the economy is indeed nowhere near exit velocity. Certainly the divergence between the ISM and inflation expectations has been unusual and history suggests it is inflation expectations that eventually catch up with the economic reality … And with events unfolding in emerging markets as they are, I see a good chance of a repeat of 1998 where a deflationary wave of manufactured goods washed up from Asia. Deflation risks remain high.

Despite Bernanke having removed much of that uncertainly, the bond markets (and much else besides) certainly did not like what they heard. Indeed the bond rout occurred despite some commentators describing Bernanke’s speech as rather dovish in making clear very robust economic prerequisites for tapering. But amid the six-week sell-off ahead of last week’s speech, a considerable head of bearish steam had already built up – with it morphing into red mist and clouding clear vision, the “feral hogs” in the bond markets charged.

He asserts that deflation risks remain high. He points to persistently low inflation, which the Fed has seemingly dismissed as transitory, and the crisis unfolding in emerging markets right now, which he says present a “good chance of a repeat of 1998 where a deflationary wave of manufactured goods washed up from Asia.”

The recent surge in bond yields was driven by a sharp rise in real yields, implying a sharply reduced outlook for inflation in the marketplace. Edwards doesn’t see that as sustainable, and given his outlook for weaker economic data in the future, he doesn’t see any way the Fed will be able to ease off the QE pedal. And that will eventually force yields back down again. “Indeed, let’s put the recent bond sell-off into a longer term context. Bond yields at 2.5% still remain locked in a technically well-established bull trend that will not be broken until yields spike above 3.5 percent,” writes Edwards.

So where does that leave us in terms of QE. Edwards fully concurs with the legendary Marc Faber :

“If you say that if he means what he says, then you believe in Father Christmas. He said if the economy does not meet the expectations of the Fed in one years’ time, they will consider additional measures. In other words, if the economy has not fully recovered by mid-2014, more QE will be forthcoming.”

Gold and Silver Update :

As we have previously seen, moves higher in Gold are accelerated by either:

- Global stresses – Europe and China come to mind as potential catalysts, with the possibility of another Euro crisis becoming more real as highlighted in Chart of the Week. The potential for tapering by the Fed has shown just how sensitive asset markets are and how easily panic selling can take place.

- Increasing balance sheets of Central Banks / debt levels of governments – “taper talk” is still just talk and even when/should it begin, there is no plan to actually reduce the size of the Fed’s balance sheet; meanwhile, other major Central Banks are still in the process of accommodating or increasing their balance sheets. On the debt side, there is no indication that any major economy is actually reducing the size of outstanding debt any time soon. This might actually suggest that when Gold begins to rally again, the price change in other currencies may be greater than that in USD (a topic we will likely revisit in the future).

One interesting comment by C.B. Worth from Oppenheimer :”No new thoughts : Sell ”