What is the “sell in May and go away” theory?

“Sell in May and go away” is a stock market adage based on what the Stock Trader’s Almanac calls the “best 6 months of the year.” Historical data reveals that the top performing 6-month rolling period, on average, has been November through April. Hence, the saying investors should “sell in May and go away”—and come back in November.

History shows this trading theory has flaws. More often than not, stocks tend to record gains throughout the year, on average. Thus, selling in May generally doesn’t make a lot of sense. So, why do some investors tailor their strategy to this calendar-based trading pattern? Well, there is some reasoning behind it.

As the seasonality chart below shows, May-Oct tends to be messy in markets — returns tend to be choppier, smaller, and volatility tends to drift higher.

So it does seem to be a worse time of the year for markets all else equal.

Source: Callum Thomas Topdown Charts

Since 1990, the S&P 500 has gained an average of about 2% from May through October. That compares with a roughly 7% average gain from November through April.

This outperformance is seen not just in large-cap stocks, but also small-cap stocks and global stocks (as measured by respective S&P indexes). What’s more, rotational strategies across market caps have historically shown even better average performance.

Source Fidelity Investment

It goes without saying that returns have varied widely, not only between the November through April and May through October periods, but also within these time frames.

With that said, if you are making tactical trades with some percentage of your portfolio, and calendar trends are a component of your strategy, sector rotation may be a more appropriate takeaway from the sell in May calendar trend.

According to the Center for Financial Research and Analysis -CFRA-, since 1990 there has been a clear divergence in performance among sectors between the 2 time frames—with cyclical sectors easily outpacing defensive sectors, on average, during the “best 6 months.”

Consumer discretionary, industrials, materials, and technology sectors notably outperformed the rest of the market from November through April. Alternatively, defensive sectors outpaced the market from May through October during this period.

If you do have positive gains and want to lock in some of those profits, you could also consider a “sell in May and potentially stay” strategy. In other words, consider selling only those positions in May that you don’t want to be in for the long haul, have that cash on hand to adjust your investment mix as needed, and stick with your strategy for the rest of your portfolio.

It’s also worth acknowledging that these types of strategies may only be suitable for active investors with shorter investment horizons, and even active investors need to consider their trading strategies within the context of a diversified portfolio that reflects their time horizon, risk tolerance, and financial situation.

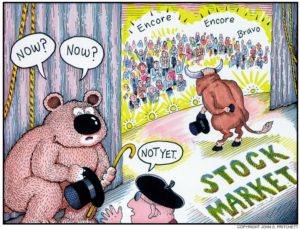

Should you sell this May?

Probably not. But here are some reasons to be cautious about stocks.

Seasonal trends appear to be holding true over the past 12 months. The S&P 500 gained about 5% from May 1, 2023, to October 31, 2023, vs. a roughly 20% gain from November 1, 2023, through April 24, 2024.

And the winds appear to have shifted to some degree in recent weeks as the soft part of the calendar approaches (historically speaking). Since peaking on March 31 near 5,300, the S&P 500 has dipped 3%.

Several fundamental factors appear to be weakening the market’s momentum including:

- Investor sentiment. Market breadth, as measured by advancing vs. declining stocks, has weakened notably over the past several weeks. Market breadth had been a source of strength at the outset of the year before reversing in April.

- Earnings and valuations. Q1 earnings season is in its early stages, and early results have been somewhat mixed. Several major tech companies in particular responsible for much of the market’s gains in recent years have lofty valuations that may require strong earnings results to support.

- Inflation worries. The most recent CPI report for March revealed a 3.5% year-over-year increase in inflation. This was a reminder that inflation continues to be a potential pressure valve on stocks. Oil prices—a key component of inflation—have risen notably thus far this year.

Of course, there are a number of reasons to be bullish about stocks, and they have clearly had momentum over the past couple years.

In sum, should you “sell in May and go away”? Probably not, according to the historical data, as there may be better strategies. Moreover, calendar stock market trends like “sell in May” do not account for the uniqueness of each period: the economic, business cycle, and market environment that differentiates now from the past.

Consider, for example, the evolving earnings outlook and your unique investing goals and risk constraints before rigidly following calendar trading patterns.

Until next time

The Clash “Should I Stay or Should I Go ?”

*Source Fidelity Active Investor