Russia : Are you contrarian enough ?

September, 11 2013Do You Think Russia’s Economy Is Doomed?

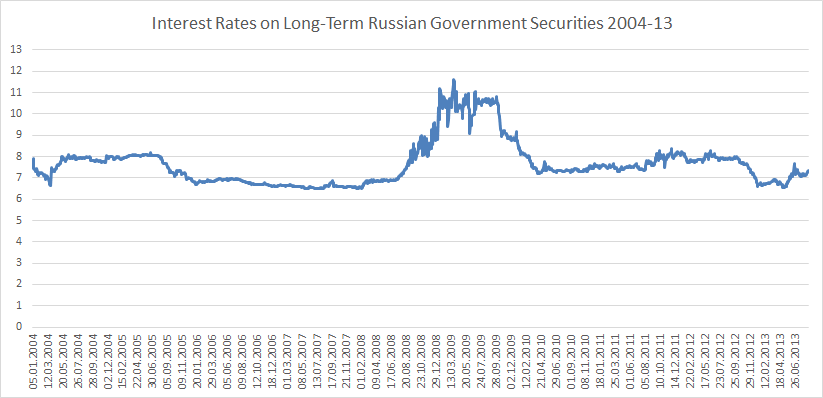

However, if Russia really was rapidly approaching an economic dead-end, if there was increasingly recognition that its model was not going to survive, you would expect to see the Russian government’s borrowing costs go up. Yes Russia’s stock of government debt is not particularly large (at only around 10% of GDP) but if the market came to an understanding that the economic situation was going to get a lot worse in the not too distant future then investors would demand higher returns. Demand for Russian debt would go down, and the interest rates on that debt would go up.

The Bond Market Doesn’t Agree

And that’s exactly what happened during the worst days of the 2008-09 crisis: Russia’s borrowing costs skyrocketed from around 7% to almost 11% because there were serious, and perfectly understandable, doubts about Russia’s ability to weather the economic storm.

Since the crisis ended, however, the interest rates on long-term Russian government securities haven’t done much – they’ve bounced around within a relatively narrow range and are at about the same level now that they were back in 2006. This would seem, to me at least, to reflect market expectations of business as usual: not overly-rapid economic growth, but certainly not some sort of spectacular collapse.

Is it possible that the bond market is wrong? Sure. Almost anything is possible. But it certainly does not seem likely that the bond market would be so studiously immune to a mounting economic catastrophe. What that chart says to me is that things will continue in pretty much same vein, and that there aren’t going to be any big changes one way or another.

From Laggard to Leader

We are happy to share East Cap Investment case in Russia as there are some inflows mainly on the basis of the following reflections:

- Large performance gap in last 2 years between developed and emerging market

- Low valuations in Russia despite the company results are still strong in a solid macroeconomic environment

- Oil price rising on the back of the winds of war in Syria

- Resilience of the Russian equity market during Summer volatility

Being the presentation rather long and accurate I would recommend you to take a look in particular at the following slides:

n. 8: Russian macro situation

n. 11-12: earnings growth vs market performance – the market has not priced yet the soundness of Russian companies

n. 19: today it’s not just the oil sector that keeps the Russian average P/E down but many other sectora look very chaep as well compared to their peers in other EMs (and DMs of course

n. 23: local pension funds’ allocation in local stocks to increase in medium term.