NEWSLETTER : Turbulence in the Financial System

March, 21 2023

Concerns about the stability of the international financial system have increased in recent days. The recent turmoil in the world financial sector clearly shows that rising interest rates can have serious actual consequences. So we remain cautious.

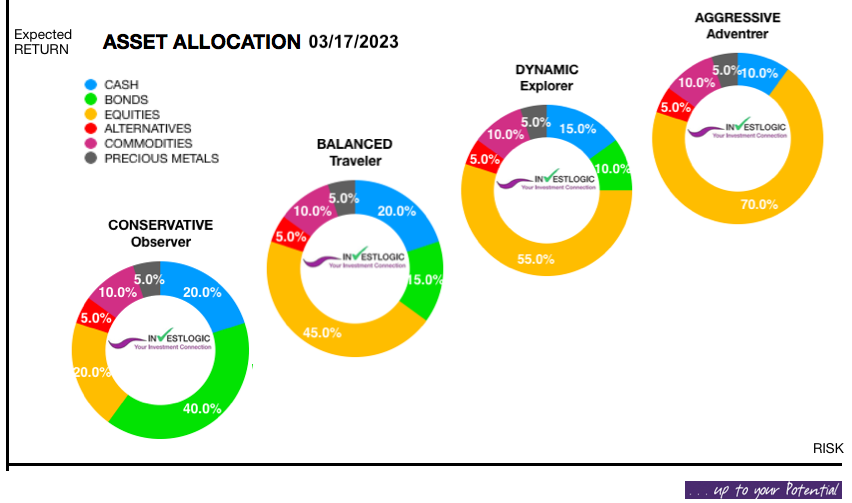

STRATEGY : Defensive positioning to be maintained

The dynamics of the last few days are likely to have a lasting impact on economic developments and to affect portfolios.

Recent developments have put central banks in an uncomfortable dilemma. Further interest rate hikes, which would in fact be necessary to dampen the persistent inflationary dynamics, could further threaten the stability of the financial system. Central banks are thus faced with the choice of allowing high inflation rates to take hold or worsening the banking crisis.

While the recent turmoil around Silicon Valley Bank may prompt central banks to keep inflation rates higher for the sake of financial stability, the pressure on interest rates remains.

Faced with this dilemma, we expect central banks to place greater emphasis on financial stability and thus accept higher inflationary dynamics. Against the backdrop of increasing risks in the financial markets, we maintain our defensive stance and our underweight in equities and bonds. However, we will continue to monitor the situation closely for our clients.

In such an environment, risky investments are struggling to gain traction. We are therefore maintaining our defensive stance.

See also our MARKETSCOPE No Wedding, Three Funerals and One Burial.

What Happened

News has been breaking fast in recent days in the aftermath of the closures of Sillicon Valley Bank and Signature Bank. While the news cycle has been moving quickly and markets are still adjusting, here is an initial look at what has happened so far, and what it may mean for markets.

The failure of the U.S. bank Silicon Valley Bank last Friday has sent shock waves through the financial system. SVB suffered significant losses on its long-term investments due to the sharp interest rate hikes by the US central bank. At the same time, short-term liabilities to depositing customers were maintained, eroding equity. When a large number of investors wanted to withdraw their deposits, the SVB no longer had sufficient liquidity and could no longer meet its commitments.

In response to the collapse, the U.S. authorities decided to fully protect the deposits of SVB’s clients and allow them unlimited access. In addition, the authorities ensured that all US banks would now receive sufficient liquidity to avoid an obligation to sell long-term investments and thus a similar case.

Admittedly, the SVB was not an ordinary commercial bank, but a bank mainly active in the riskier area of start-ups and venture capital. Nevertheless, the failure of the SVB has had a lasting effect on investor confidence. This is evidenced by the fact that fears have spread from the American continent to the European continent.

Credit Suisse Wreckage

The large Swiss bank Credit Suisse (CS) was the focus of attention and saw its share price fall massively due to the high level of insecurity among market participants.

On Sunday evening the Federal Council announced that the Crédit Suisse will be bought by UBS.

- UBS agreed to buy Credit Suisse in a historic, government-brokered, all-share deal. UBS will pay 3 billion Swiss francs ($3.23 billion) for 167-year-old Credit Suisse and assume up to $5.4 billion in losses in a deal backed by a massive Swiss guarantee and expected to close by the end of 2023. The price per share marked a 99% decline from Credit Suisse’s peak in 2007. Shareholders don’t get to vote on this.

- Switzerland’s government is putting a lot of taxpayer money at risk to ensure that UBS went through with the deal. If UBS’s attempts to sell off hard-to-value assets on Credit Suisse’s books result in losses, it will take the first 5 billion Swiss francs, and the next 9 billion will be borne by the government. This could be taken to imply that there is a problem of solvency, and not just liquidity.

- The Swiss National Bank’s extension of $54 billion in liquidity to Credit Suisse has, within two trading days, been found insufficient, suggesting the pressure on its deposits must have been extreme.

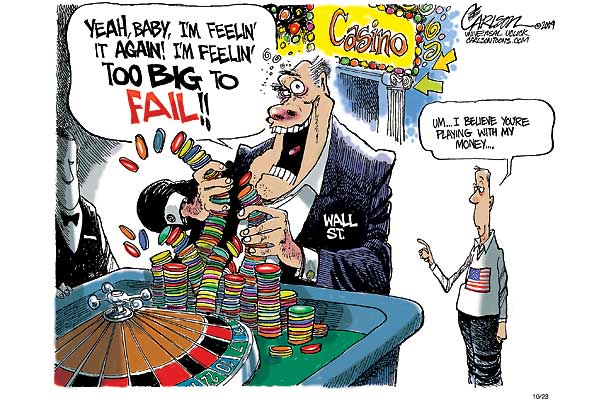

The critical point here is to avoid what is known as “moral hazard” — the propensity to encourage even more risk-taking by making it clear that there will be a bailout from its consequences. It’s hard to rescue a big bank without amping up moral hazard.

Globally there could be broader implications for the financial sector

There’s an old adage that says during Fed tightening cycles, the Fed usually keeps raising rates until something “breaks.” In 2007 it was subprime mortgages, in 1998 it was Long-Term Capital Management, and so on.

But first it’s important to remember that this has been primarily a liquidity event (i.e., there were insufficient liquid assets on hand to meet immediate cash demands), rather than a solvency crisis (such as one in which a bank simply has insufficient equity relative to its debt). The financial crisis in 2008 was both, and the regulation that followed has left the banking sector in a much stronger position.

At the same time, this episode does bring to light the fact that banks have been paying depositors much less than competing short-term vehicles do.

This typically happens during tightening cycles, but the spread is particularly large now—with banks generally paying about 0.5% on deposits right now, compared with a 4.5% average money-market yield.

After the events of the past week, banks may now have to start competing for those deposits, by paying higher rates. But paying higher rates on deposits could eat into net interest margins (the difference between what banks earn on the loans they make and pay on the deposits they hold), impacting the overall profitability of the financial sector.

Currently the yield curve is “inverted,” with short-term rates significantly higher than long-term rates. This inversion is, essentially, a by-product of the Fed’s rate-hike cycle. And it’s also led to the mismatch experienced by SVB and other institutions.

And herein lies the dilemma that the Fed faces. On the one hand, inflation remains too high and unemployment is at multi-decade lows—which suggests more rate hikes. But now, the Fed needs to create a liquidity backstop to solve a problem that is the very by-product of this rate-hike cycle.

Is the Fed going too far in its hawkish posturing ? There will be a moment of truth for the Fed and for this market cycle. In that case, the Fed might have to choose between financial stability and containing inflation expectations.

Stay tuned