MARKETSCOPE : What Goes Up, Must Come Down

February, 19 2024“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

— William Arthur Ward

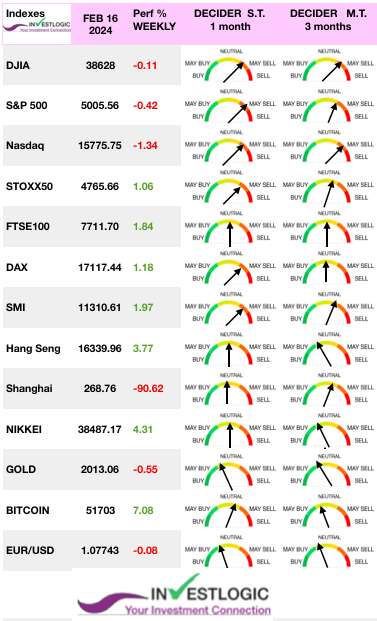

Stocks ended the week in the negative following a second inflation report that sparked concerns the Federal Reserve may cut interest rates later rather than sooner. The market rebounded mid-week from the disappointing inflation report but stumbled again on Friday after producer inflation.

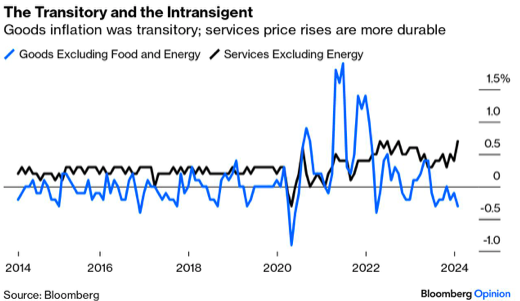

The US consumer price index came in above expectations at +3.9% annualized, versus +3.7% expected. It pointed that service sector wages and housing costs will continue to be the biggest issues.

Then the January producer price index released Friday rose by a larger than expected 0.3%, while core PPI excluding food and energy prices jumped 0.5%.

The next deadline is February 29, with the publication of the PCE Core, the Fed’s preferred indicator of price trends.

The 10-year Treasury yield spiked above 4.3% following the hot PPI reading, and the two-year Treasury yield topped 4.7% to its highest level so far this year.

The message “Slower for Longer”on rates remains very fertile ground for equity gains, which are mainly allergic to rapid changes up or down in yields.

All three US major stock market indexes broke their five-week winning streaks, The declines were concentrated in large-cap growth stocks, however, with an equally weighted version of the S&P 500 reaching a record intraday high on Thursday. Small caps (or Russell 2000) have tempted to break out from a 10-month base.

All three US major stock market indexes broke their five-week winning streaks, The declines were concentrated in large-cap growth stocks, however, with an equally weighted version of the S&P 500 reaching a record intraday high on Thursday. Small caps (or Russell 2000) have tempted to break out from a 10-month base.

However several Western stock market indices set new records this week, boosted by corporate earnings and the promise of artificial intelligence. The STOXX Europe 600 Index ended the week 1.39% higher as signs of cooling inflation and a better outlook for interest rate cuts cheered investors.

In Japan, the Nikkei 225 Index gained 4.3% over the week. Financial markets in mainland China were closed for the week.

And Bitcoin hit $52,000, its highest since November 2021.

Equity markets in mainland China return this Monday after being off for a week for the Lunar New Year. However, Wall Street will be closed for George Washington’s birthday. Other events of note are the minutes of the latest US central bank meeting (Wednesday).

Investors will not have much in the way of economic data to wade through this week to settle the debate about whether the economy is more at risk of overheating or drifting into a recession.

Heavyweight earnings reports from Nvidia and Walmart could impact sentiment broadly in their respective sectors. HSBC. Nestlé and Mercedes.

MARKETS : Half Full or Half Empty ?

We need to balance the pessimism of intelligence with the optimism of will. -Romain Rolland

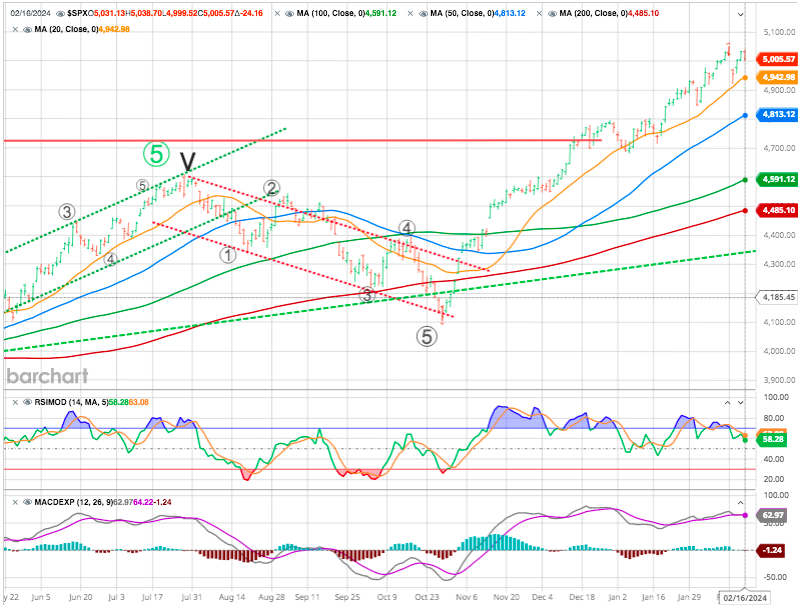

The market held support as the internal deterioration continued. The market retested and held the 20-DMA, keeping the bull trend intact.

Immediate resistance is in the 5057. As long as the market respects that resistance, we can expect quite possibly a 3-5% pullback in stock prices. Upper support is in the 4940, which if broken, will likely suggest that the pullback has begun, pointing down to the 4810 (50 DMA).

However, if the market sees a sustained break out through the 5050-60 then it would lead to a more direct move toward the next resistance region in the 5155. Such a direct move up before a bigger pullback is seen, then the market could complete a blow-off top on that rally.

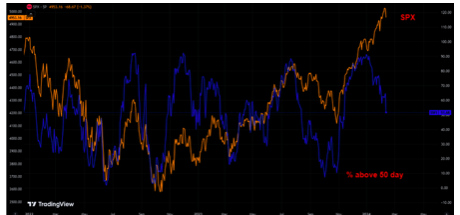

The breadth of the market remains weak, with an increasing number of stocks trading below their respective 50 and 200-DMA. With the markets very overbought, that negative divergence is a risk.

Percentage of stocks above the 50 day moving average has crashed.

February is the weak link in the Best Performing Months and as we have pointed out on several occasions. We must also be aware that a correction or consolidation is needed if this bull market continues to increase. As such, we must maintain exposure to garner performance while we can. However, once signals are triggered, we will become more aggressive in the risk reduction process.

Everything is overextended, there are geopolitical tension that could flare up at any moment, the markets seem to be convinced that we won’t have any landings and we disagree, we think the jury is still out and the markets are very expensive.

Even though, for now the bull trend remains intact, investor sentiment remains bullish, and momentum is strong, at this juncture we would prefer not to have the an overexposure in tech now.

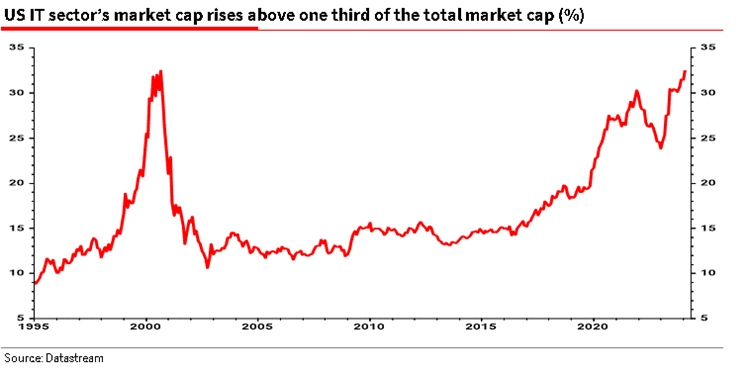

As noted last week Albert Edwards at Societe Generale recently discussed the rising capitalization of the technology market.

“I never thought we would get back to the point where the value of the US tech sector once again comprised an incredible one third of the US equity market. This just pips the previous all-time peak seen on 17 July 2000 at the height of the Nasdaq tech bubble.

What’s more, this high has been reached with only three of the ‘Magnificant-7’ internet stocks actually being in the tech sector (Apple, Microsoft, and Nvidia)! If you add in the market cap of Amazon, Meta, Alphabet (Google) and Tesla, then the IT and ‘internet’ stocks dominate like never before.”

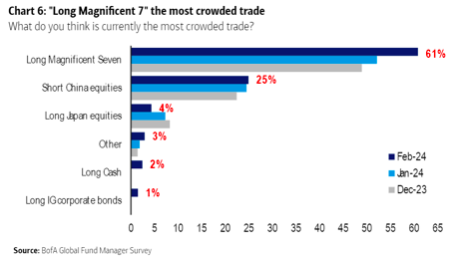

The Magnificent Seven have become the most crowded trade on the planet has grown overwhelming, with 61% naming it. This hasn’t, in aggregate, stopped plenty of fund managers from piling into the stocks and worsening the problem.

RUSSELL 2000

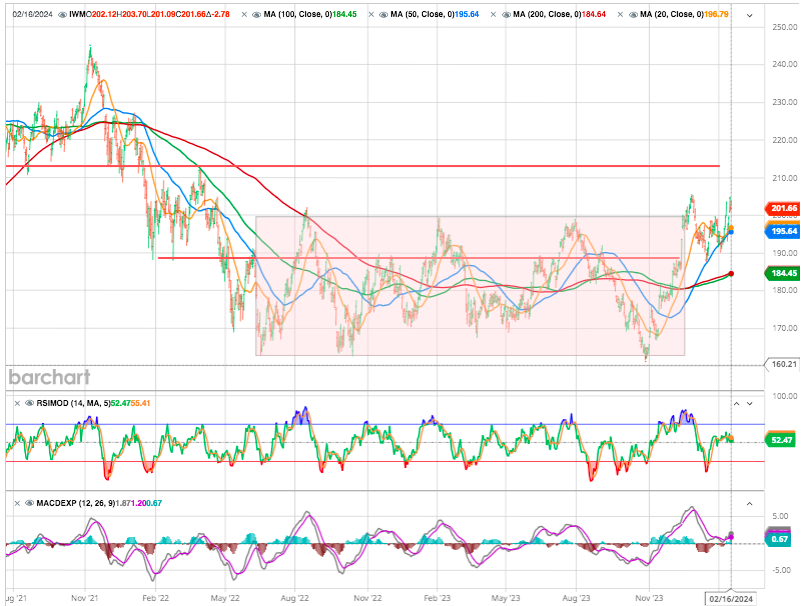

Interesting enough The small capitalisation stocks (IWM) tried again to break their 10-months base after rebounding twice on their 50 DMA.

A breakout would suggest the beginning of a powerful bull market in small and mid-caps, and potential outperformance over large and mega caps. And would imply that the broad market may now be ready to participate in the rally.

If Russell 2000 were to get above $205 that would really signal that breadth is picking up. But don’t forget the Russell is still down -17% from where it peaked so there’s plenty of time and space if you have patience. FOMO is a feeling.

Buy The Rumor, Sell The News !

APPLE

Last week Warren Buffett’s Berkshire Hathaway announced that he trimmed its flagship position in Apple in the fourth quarter. Berkshire also reduced its position in HP, while adding to its stakes in Chevron and Occidental Petroleum.

Apple closed under the 200 DMA for the first time since October. The $180 support area is key to watch. If it goes, as we noted several times, could it take the rest of the market with it.

NVDIA

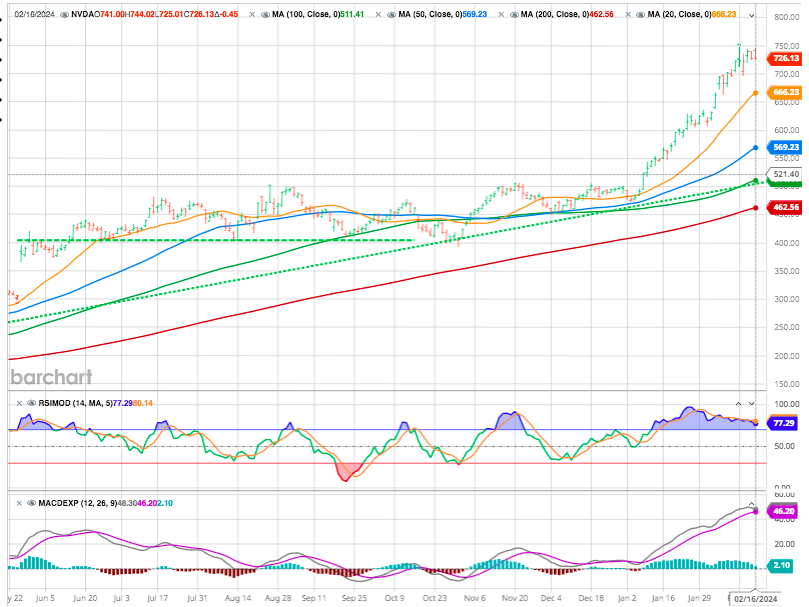

Nvidia’s earnings report this week will have a significant impact on the NASDAQ 100 index, as the company has delivered a large portion of the index’s gains.

The market is extremely bullish on Nvidia, leading to high implied volatility and a heavy weighting of call options. The problem is that the market is so bullish on Nvidia, and the prospects of the stock rising after it reports results that it could almost be considered bearish.

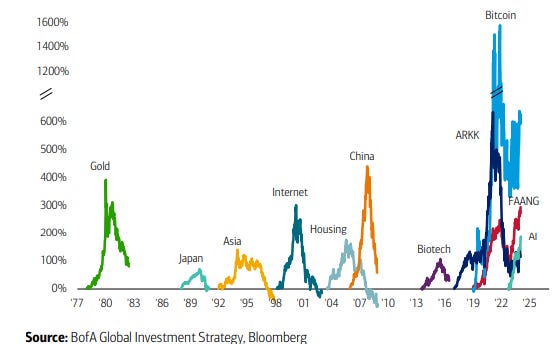

The question of whether the “frenzy for AI has given birth to a new bubble” has become an unavoidable topic in the US stock market.(see Bonus below).

As billionaire and former hedge fund manager Leon Cooperman said, it is hard not to think of the fervent atmosphere of the market during the Internet bubble era when looking at NVIDIA.

“In the year 2000, everyone on the Internet was shouting enthusiastically about Cisco, Cisco, Cisco. Cisco was priced at $80 at that time. When tech stocks declined, the market crashed, and its stock price fell by 90% to $6. Today, 23 years later, Cisco’s stock price still hasn’t reached the level of 2000.”

Will Nvidia become the next Cisco?

Some argue that investors in NVIDIA and AMD are currently happy, but unfortunately, investors in Cisco and Intel were also happy in 2000.

We are not implying anything. We shall just shut up. We won’t say anything.!

Crypto

Bitcoin is continuing on the same upward trend as last week, gaining 8% since Monday to reach $53’000 . Once again, this surge is largely due to the flow of capital into Bitcoin Spot ETFs in the US.

In the crypto sector, expect more buzz about the Bitcoin halving event that is expected to occur in May to reduce the reward for Bitcoin mining by half. The first Bitcoin halving occurred in November 2012, followed by halving events in July 2016 and May 2020. Bitcoin typically trades with increased volatility in the months ahead of the halving event.

Slower For Longer

Let’s concentrate to isolate “sticky” inflation. The kind that is more persistent like wages and housing that the Fed pays more attention to than gas and food prices.

Goods suffered a huge shock that is now over; services inflation, however, has moved to a level notably higher than before the pandemic.

Let me assure you that the Fed is more patient than the rest of us. They will NOT lower rates until they are 110% convinced that inflation is heading back to 2% for good. And there is simply no way to look at recent inflation data and say that we have arrived at that point.

Happy trades

BONUS

The ever more probable soft- or even no-landing scenario of the US economy is injection new life blood into the AI ‘bubble’.

Is the AI ‘bubble’ really a bubble ? Looking at the chart below : Perhaps.

Will it already trickle out as have the housing and Asia bubble at similar levels? Perhaps.

Or will it resemble anything between the internet and the bitcoin bubbles? Of course, also perhaps.

Stay tuned …