MARKETSOPE : The Market Is Always Right !

April, 18 2023BULLS IN THE STARTING BLOCKS ?!

Sentiment remains bearish, and “JOMO” joy of missing out, turns back into “FOMO” fear of missing out.

Over the past two weeks, both bulls and bears have lost. A lot of excitement for bulls and bears, but little net progress… Technically speaking (aka evidence), ‘things’ are starting to look quite bullish, as we will see further down. Fundamentally, (aka emotions), ‘things’ continue to look quite bearish (earnings recession, debt ceiling, no Fed-Pivot, etc…).

The deceleration of inflation in the United States and the good results of luxury stocks in Europe have enabled the financial markets to regain height last week.

Core inflation and supercore inflation (which strips out the most volatile pandemic categories) are both receding from peak.

Consumer Price Index climbing 5% compared to last year, slowing from an annual pace of 6% seen in February. However, core CPI, which excludes volatile food and energy prices, rose 5.6% Y/Y, in-line with expectations and higher than the 5.5% increase seen the previous month.

Fed staff also projected a “mild recession” starting later in 2023 while bets are increasing that the central bank will go for another 25 basis points on May 3, bringing the Fed Funds Rate above 5% for the first time since the lead-up to the Global Financial Crisis.

Fed staff also projected a “mild recession” starting later in 2023 while bets are increasing that the central bank will go for another 25 basis points on May 3, bringing the Fed Funds Rate above 5% for the first time since the lead-up to the Global Financial Crisis.

Past week, the initial earnings from a few very large banks suggest that the quick work of the FDIC and Federal Reserve in the wake of Silicon Valley Bank’s failure have prevented broader damage. Materials and industrials shares outperformed while Technology lagged mainly due to NVIDIA decline. On Friday, the University of Michigan’s preliminary gauge of consumer sentiment rose surprisingly, so U.S. Treasury yields jumped Friday, lifting 10-year and 30-year rates to their biggest weekly gains in two months.

In Europe stocks rose as recession fears waned. In China Shanghai Comp’s breaking out. Index now within 1% of the July 2022 high. China’s economic recovery appears on track following the release of stronger than expected growth data.

The appetite for risk remains intact, thanks in particular to the good first results of American banks. But a stronger decline of US retail sales soured the mood, fueling fears of a hard landing for the economy.

Topping over the cake, Treasury Secretary Janet Yellen, does not forget her previous function as FED Chair, said in an interview on CNN :

“US lenders may pull back on credit in the wake of recent bank failures — enough to do some of the Federal Reserve’s work for it, but not enough to significantly change the economic outlook….Banks are likely to become somewhat more cautious in this environment. That does tend to lead to somewhat greater restriction in credit that could be a substitute for further interest-rate hikes that the Fed needs to make.”

Volatility could remain high depending on the next corporate results. A month ago, financial markets were focused on how badly the Federal Reserve had broken the banking system.

MARKETS : Bears Running Away

From a market perspective, not much changed.

CHECK our monthly “What are the Charts Telling Us?” here

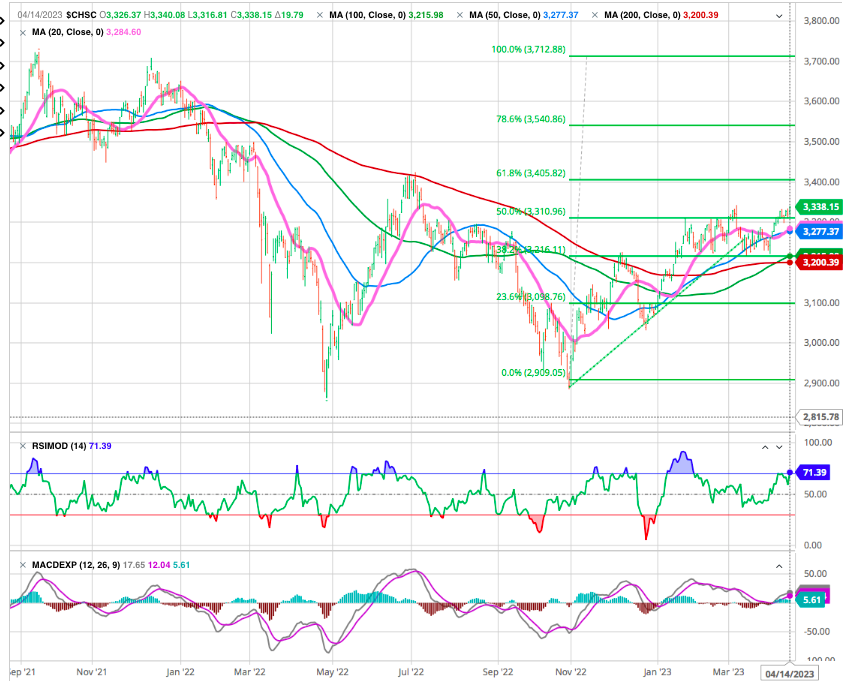

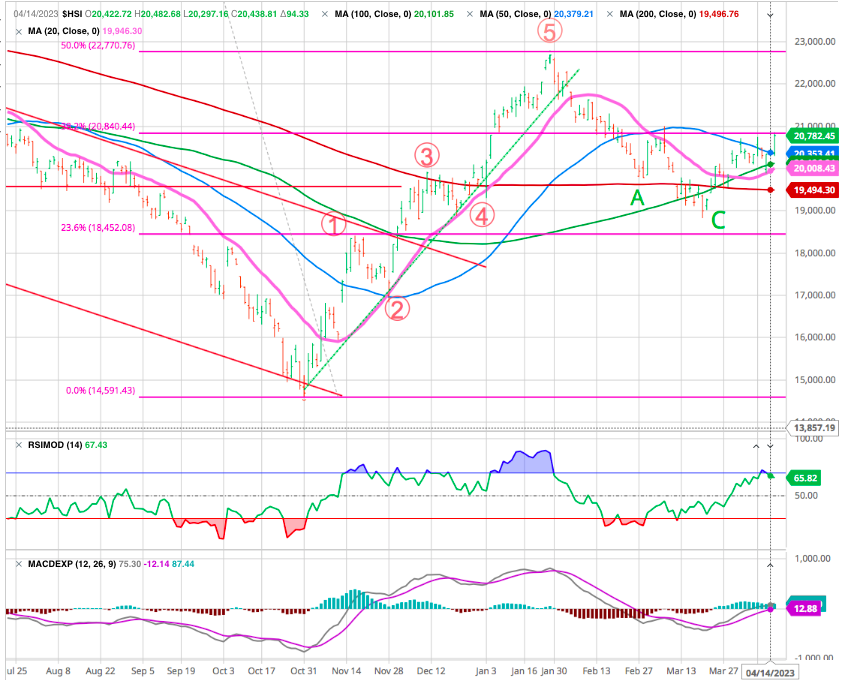

Overall, the technical outlook continues to show signs of strength, particularly in Europe where the French CAC 40 index has reached a new all-time high. In the U.S, the price action has been more muted, with strength in large tech stocks masking weakness in small caps. In Asia, the Hang Seng Index has rebounded after testing support given by its 200-day moving average.

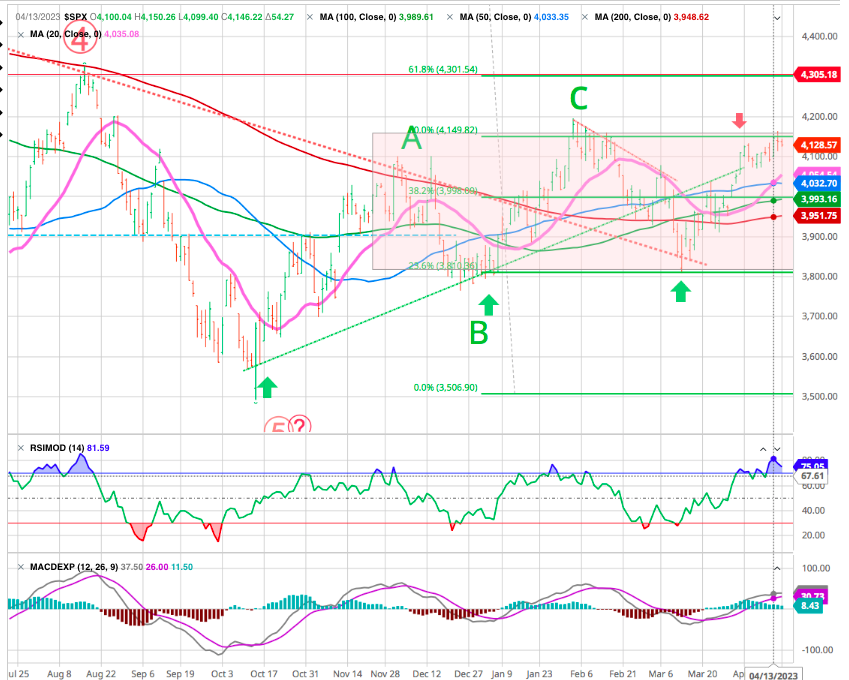

The bull market is back, with trend of higher highs and higher lows intact and the 50-DMA now well above the 200-DMA and BOTH moving averages trending higher. Notably, the MACD buy signals remain intact.

Unless this is the mother of all bull traps, this is not bearish…

The medium-term technical outlook remains uncertain, and the price could continue to oscillate in a wide sideways range between 3,760 and 4,200.

Given the tug-of-war between market expectations and economic realities, we can expect a continued increase in market volatility in the coming months. But, overall, the market action remains decidedly more bullish than bearish, and we must trade it as such.

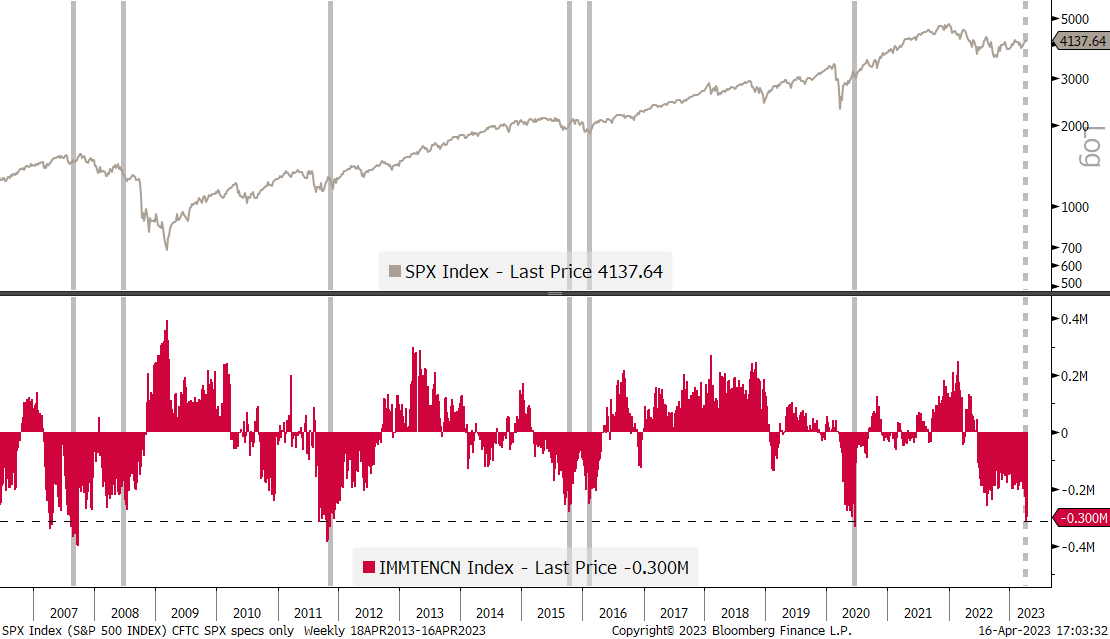

Speculators has been quite bearish (which is a contrarian bullish signal). Positioning is very short and fundamental investors are under exposed given low net HF exposure. CFTC data:

Outside the GFC, such extreme short positioning has not been a sign of an impending market top.

There has been an upward bias in the market the last 6 months. Yet will be hard to see too much more upside until the bears are thoroughly convinced that no recession will be in the offing.

Meaning the clear new bull market breakout will not happen until more bears are convinced of an improving forecast. When more of them turn tail and start buying in earnest is when the new bull market will begin.

Be In the Right Sector

Looking at how stocks did last year – and how they’ve done so far here in 2023 – proves our approach about stock selection in spades. Want proof? Check out this handy table by Fidelity Investments below

Just one of the 11 S&P 500 Index industry sectors has outperformed the index itself over the last one-month, three-month, and year-to-date periods. That’s Information Technology. One other sector has positive year-over-year returns: Energy. And one other sector has had respectable returns in 2023: Consumer Staples.

And it just so happens that those are among our recommendations for past several months.

CHINA

Shanghai Comp’s breaking out. Index now within 1% of the July 2022 high the 61.8% fibo retracement.

As for the Hang Seng the technical outlook continues to improve and the recent break above its 50-day moving average reinforces the positive scenario. Recent consolidation has sent the index back down towards its 200-day SMA from where a rebound attempt is currently under way.

A close above the 38.2 % Fibonacci retracement of the decline that started in January would trigger an upside move to the next technical hurdle at 22000.

Gold : Very shiny

After Gold came within $10 of its all-time high as a number of drivers propelled the precious metal and its peers toward new records. Catalysts include economic worries and fears about a recession, as well as lower U.S. Treasury yields and a weaker dollar.

Gold corrected and tested its support at 2000 in so it is doing gold buyers a favour.

Ready For Another Earnings Season

Earnings season is heating up this week as investors shift their focus from banking to other sectors of the economy while Federal Reserve policymakers will have a last chance to air their views ahead of next month’s policy meeting.

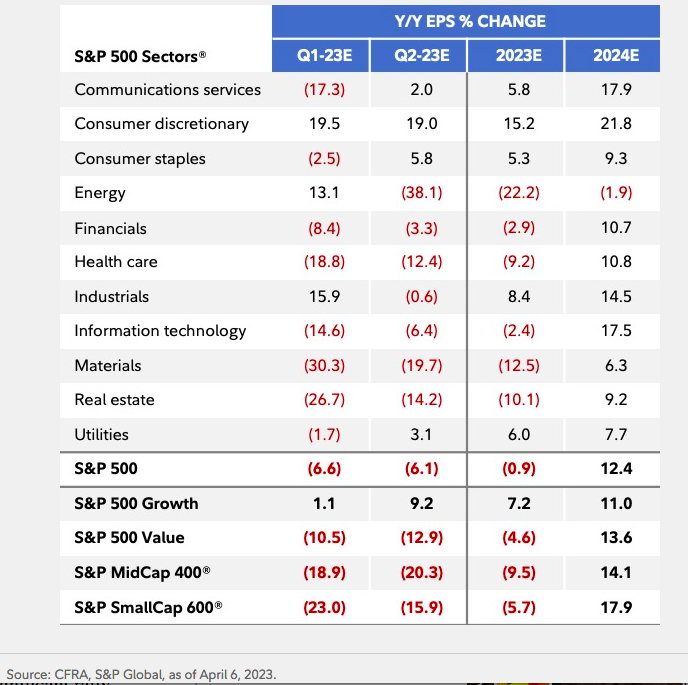

Get ready for some red. 2023 Q1 earnings is beginning, and the S&P 500 is expected to see a year-over-year decrease in earnings per share. Earnings for S&P 500 companies are expected to have declined 4.8% Y/Y in the first quarter, according to data from Refinitiv, marking the second consecutive drop in year-over-year earnings growth.

While that would translate into the first “earnings recession” since the pandemic, it could be somewhat of a good sign. In fact, earnings for the S&P 500 are not expected to turn positive until Q4 of this year. With that said, a few sectors are forecasted to buck the negative earnings trend this quarter and, as always, stock performance will hinge greatly on how earnings come in compared to expectations.

Inflation is coming down, which is weighing on pricing and profit margins, while the economy is still growing with many firms reporting strong top-line figures. A bigger problem could arise if executives start issuing downbeat forecasts or companies surprise investors with some serious or severe quarterly losses.

Earnings season picks up serious steam in the final full week of April, with a host of bank earnings following Friday’s opening salvo of positive prints from JPMorgan, Wells Fargo, and Citi. In particular, the beleaguered regional banks will be up to bat with Bank OZK, Zions Bancorporation, and other expected to complement reports from bigger banks like Bank of America, Goldman Sachs, and Morgan Stanley.

Elsewhere, investor favorites Netflix , Lockheed Martin, Johnson & Johnson, and, of course, Tesla are expected to post quarterly updates.

But What If A Recession Does Form ?

Check our strategy “Investing in Recession” here

Indeed, those recessionary storm clouds still linger especially as the Fed’s primary goal is to stamp out inflation by “lowering demand”. Lowering demand is just a fancy way of saying they want to slow down the economy.

In a perfect world that is a soft landing near 0% GDP before the economic growth engines restart. In that scenario we have already seen the stock market lows and the next bull market would emerge.

However, just as likely is that all the steps to “lower demand” actually spark a recession with negative growth, job loss and yes, much lower stock prices (below the October lows).

Recent shocking declines in ISM Manufacturing, Service and Retail Sales report do paint the picture of an economy potentially tipping over into negative territory.

And again, remember that the FOMC minutes did point to their increased concerns that the recent banking issues will be harmful to the economy likely leading to a recession by end of the year.

As long as these serious threats linger, then there will be enough people rightfully bearish to prevent the overall market from heading much higher.

The sum total of this stand off between bulls and bear is a trading range environment likely with serious resistance at 4,200 as was found in February. We don’t even believe the May 3rd Fed announcement has the muscle to change that outcome.

Thus, a trading range scenario is in place for a good part of the summer until investors can better determine the true likelihood of recession.

Happy trades