MARKETSCOPE : Goodbye High Rates, Hello Easy Money!

December, 18 2023

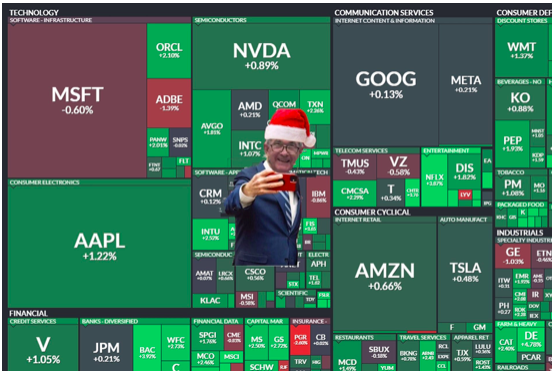

Happy Ending. This year, the market decided to play Santa Claus early. For the final act of 2023, the Fed pulled out all the stops. Even the most optimistic wouldn’t have dared dream of such a spectacle.

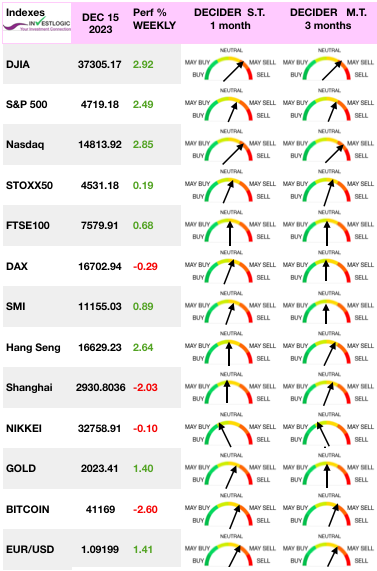

The financial markets posted a series of record highs last week, sparked by the end of rate hikes, the decline in US inflation and Jerome Powell’s statement opening the door to rate cuts next year. There is still disagreement over the pace of the decline.

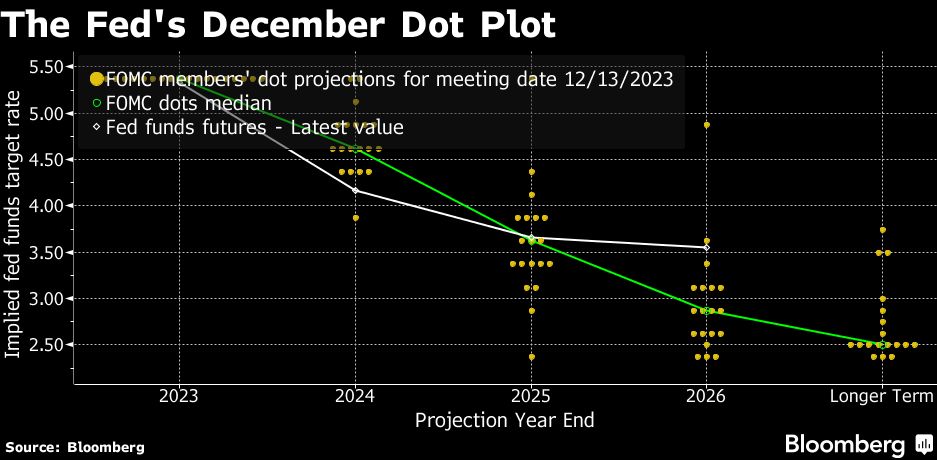

Stocks had their biggest advance of the week on Wednesday as the Fed indicated through their quarterly “dotplot” more rate cuts in 2024 (the median projection was for 75 basis points of rate cuts coming in 2024, up from the 50 basis points of easing in their previous projection). Last week pivot rally : Who Let The Bull Out?

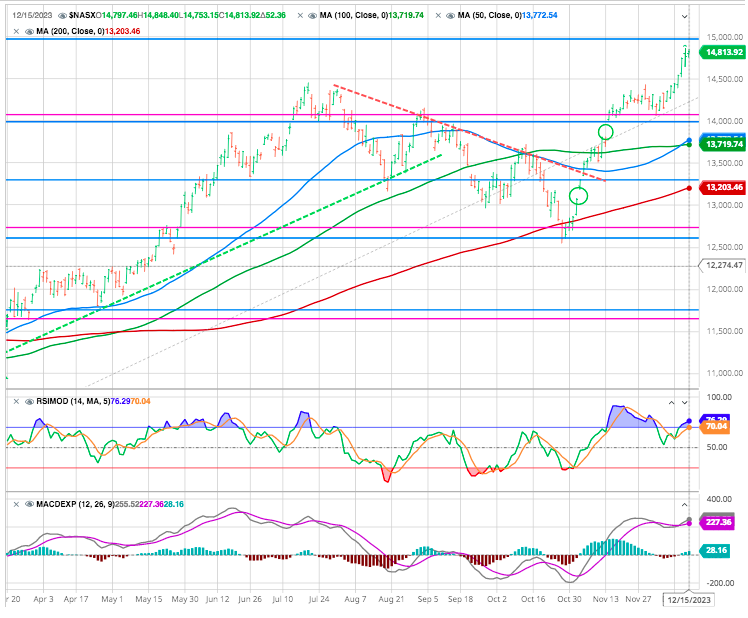

The S&P 500 Index, Nasdaq Composite, and Dow Jones Industrial Average recorded their 7th consecutive week of gains—the longest streak for the S&P 500 since 2017. The gains lifted the first two benchmarks to 52-week highs and the Dow to an all-time record.

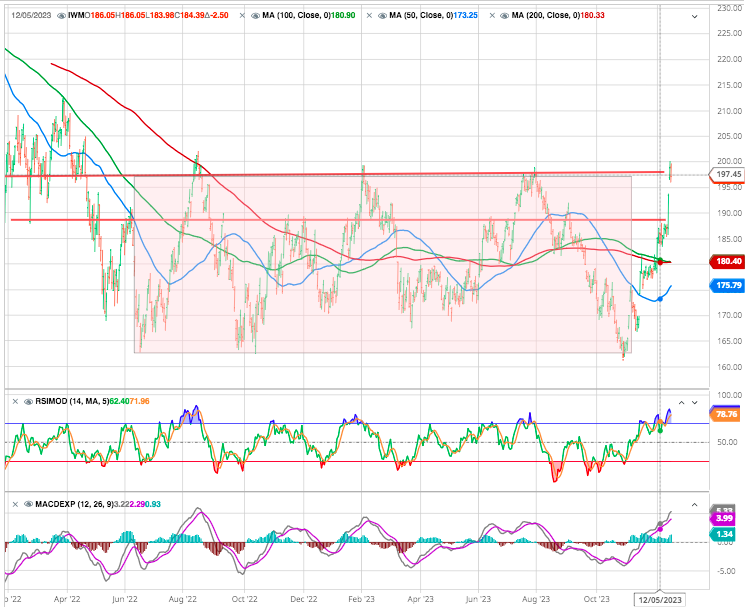

Small-caps also outperformed. The CBOE Volatility Index (VIX), the “fear gauge,” fell to its lowest level in the post-COVID era.

Risk appetite remains intact as the holiday season approaches, a period that’s traditionally upbeat for equity markets.

Risk appetite remains intact as the holiday season approaches, a period that’s traditionally upbeat for equity markets.

In the 1st part of the week, investors’ sentiment was driven by a benign inflation environment; Tuesday’s US CPI was roughly in line with estimates while Wednesday’s PPI report surprised modestly on the downside. Long-term U.S. Treasury yields fell sharply on the inflation data and Fed signals, bringing the US 10-year Treasury yield below 4% for the 1st time since the end of July.

The Fed indicated through their quarterly “dotplot” more rate cuts in 2024 (the median projection was for 75 basis points of rate cuts coming in 2024, up from the 50 basis points of easing in their previous projection)..

EURO STOXX 600 Index ended the week 0.92% as the ECB kept borrowing costs at record high (as the BoE and the SNB did). The European Central Bank held interest rates steady for the second meeting in a row, as it revised its growth forecasts lower and announced plans to shrink its balance sheet. Weakness in European PMIs suggests that the ECB, despite its more combative attitude than expected, may have to consider a rate cut soon.

Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining 2.1%. Chinese equities declined as persistent deflationary pressures weighed on the economic outlook.

FED PLOTS : Don’t Fight the Market ?

It seems the new mantra for the Fed is “don’t fight the market” (instead of don’t fight the Fed”). Until this meeting, Powell and the Fed were pushing back market expectations for more aggressive rate cuts next year.

They decided to adjust closer to market expectations through the dot plots + the view on inflation / jobs. It is true that US macro numbers have been disappointing on the downside over the last few months and the FED is thus getting more comfortable in turning dovish next year.

The wall of maturities (bonds + loans), positive real rates at the time of ever-increasing government debt and November 2024 presidential elections are probably forcing their hands.

However, after a 2-week Fed blackout., NY Fed President Williams said the Fed is NOT talking about rate cuts now. This is the exact OPPOSITE of what Powell said on Wednesday. Later Fed’s Bostic also came out considerably less dovish, suggesting just two rate-cuts in 2024, and likely after Q3.

Federal funds futures trading implied a 95% probability that the Fed’s target rate would be lower than the current level after the May FOMC meeting. And markets were pricing in as many as 150bps in cuts for 2024, sending Treasury yields sharply lower. The market is now assigning a 69% probability that the Fed will start lowering rates in March next year.

The Fed’s updated economic projections indicate a median expectation of 75 basis points in rate cuts for the coming year, surpassing the earlier anticipation of a 50-basis-point reduction.

Our view is the market is pricing in too many rate cuts , too fast for the next year. We think the experience of this rate cycle is that it pays to listen to the Fed. The Fed will refrain from further rate hikes and will start trimming rates by the middle of 2024, delivering 75bps in cuts by the end of next year.

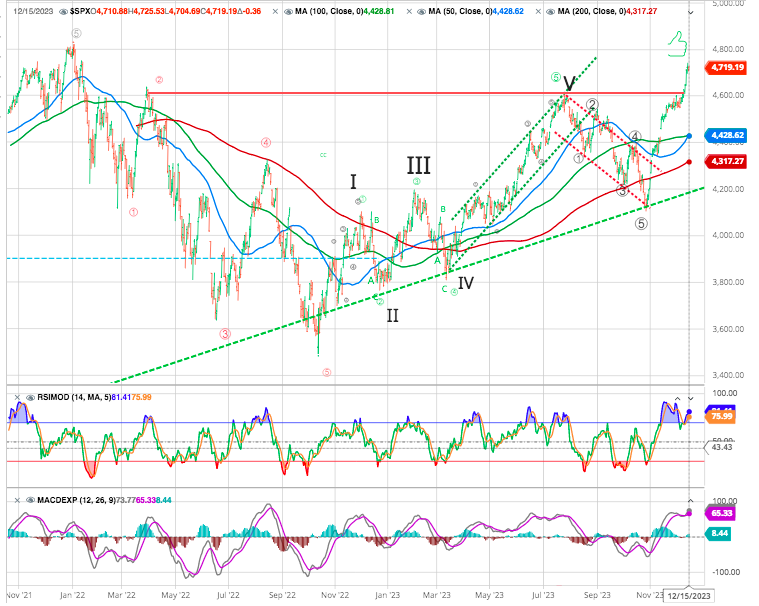

MARKETS : SKY IS THE LIMIT

A lot of good news are already priced into equities

The S&P 500 followed up last week with another rally, which leaves the index less than 2% from its all-time closing high made on 1/3/22. On a total return basis, however, the S&P has already reached new highs along with the Dow Jones Industrial Average and the popular mega-cap “FAANG+” index.

While many failed to acknowledge a new bull market when major US indices rallied 20%+ off the October 2022 lows, it’s impossible to ignore once new all-time highs are made. Moreover, this week we’ve seen net new highs hit their highest level since the middle of 2021.

No one knows what the future holds, but for now, there’s once again open space for equities to run and finally make another leg higher after two years of going nowhere.

On Friday equities also fluctuated amid some volatility on a day that marked a quarterly “triple witching” event. The tech-heavy Nasdaq Composite advanced 0.35% to settle at 14,813.92.

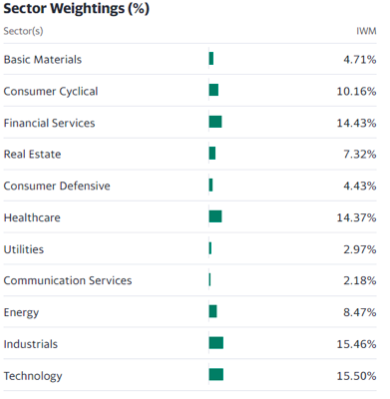

The small-cap Russell 2,000 made a new 52-week high today after hitting a 52-week low just 48 days ago. That’s the shortest turnaround time in the index’s history to go from 52-week low to 52-week high dating back to the 1970s!

To us at least, that sounds uncomfortably like the lunacy we witnessed in 1999. If there’s a downside to the Fed’s pivot, it’s the risk of a melt-up.

Small and mid caps are now testing critical breakout levels, and despite the strength in equities in the past month, investors have arguably not trusted this rally. If they succeed in doing so, there is high potential for explosive upside.

As IWM is made up of a more diverse number of sectors, unlike SPY and QQQ which are dominated by technology, we are likely to see a higher frequency of sector rotations. Rotations are the lifeblood of a bull market, and would be constructive for the rally.

A dovish Fed without the actual action of cutting rates is the most constructive scenario for small and mid caps now.

Gold

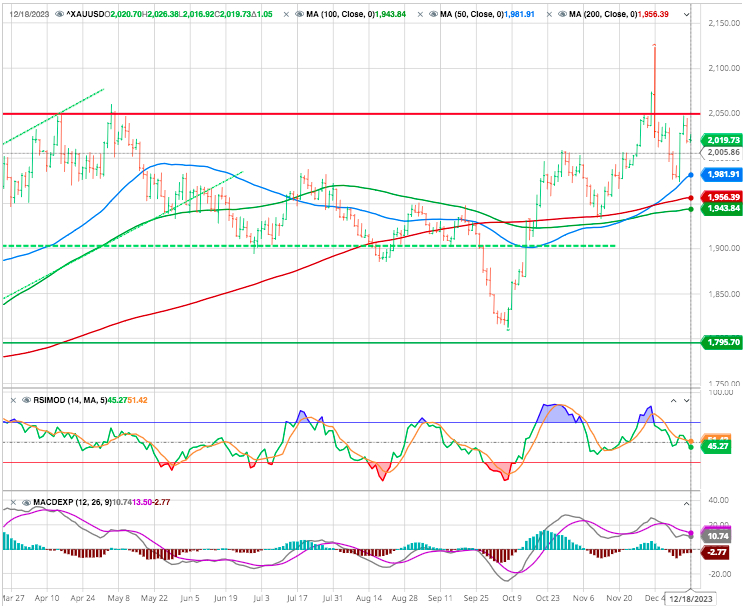

We see the price of gold significantly higher over the next two years.

The gold market is currently benefiting from several favourable winds. China’s frenetic and significant accumulation of gold is one of them. As we enter the New Year, a number of factors could help gold to continue its ascent.

Firstly, the fall in US real interest rates and a depreciation of the dollar in 2024 could create a favourable dynamic for gold expressed in dollars. Let’s not forget that gold expressed in currencies weaker than the dollar has reached even more impressive levels this year.

Another important factor to consider is that, while central banks have accumulated very large quantities of gold, investors have not (yet) done the same.We might see another gold rush from private investors.

So gold remains a great setup.

We also look at fundamentals and when these things align, we watch the chart to identify favorable risk reward opportunities. While we can’t tell you today exactly what those levels will be as patterns adapt, but we will use Fibonacci and Elliott Wave guidance to make decisions in a logical manner about entering and exiting positions.

We continue to see opportunity, both near term and longer term in the precious metals and miners space for investors and traders alike. We identify these opportunities and monitor them as the market ebbs and flows.

Crypto:

After eight consecutive weeks of gains, bitcoin has fallen by 2.5% since Monday, dropping back below the $41,000 mark. In its wake, ether, the native cryptocurrency of the Ethereum blockchain, is also retreating, falling back to around $2250, down 3.8% last week.

After gaining over 56% in just two months, a good number of crypto-asset market players are taking profits on BTC, which may explain this week’s slowdown. Meanwhile, the most eagerly awaited event remains the approval of a Bitcoin Spot ETF by the US Securities and Exchange Commission (SEC).

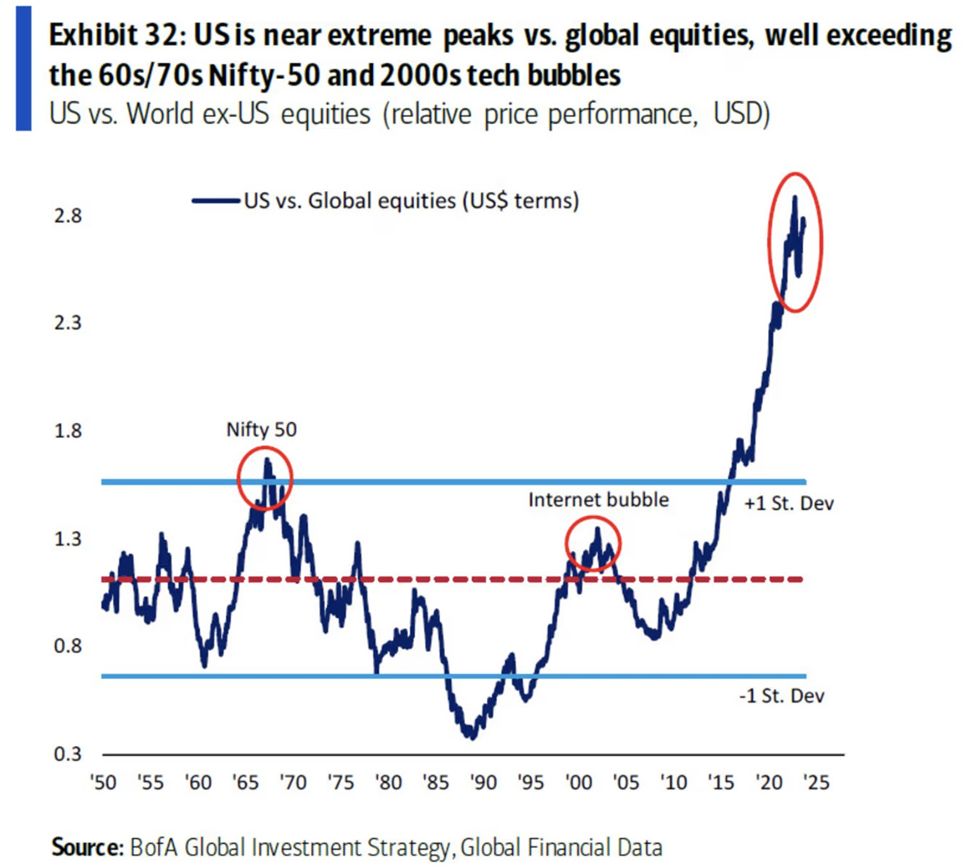

Chart of the day

A good chart to reflect on a week like the previous one.

US stocks have an exorbitant valuation compared to global equities.

Primarily propelled by technology firms, the current environment stands out as one of the most speculative periods for American stocks in history. The next decade is poised for a substantial mean reversion in the chart below, presenting one of the best opportunities to invest in foreign markets.

We believe that economies abundant in natural resources, along with gold and other hard assets, are poised to emerge as significant beneficiaries in the upcoming cycle.

Season’s Greetings & Until next time

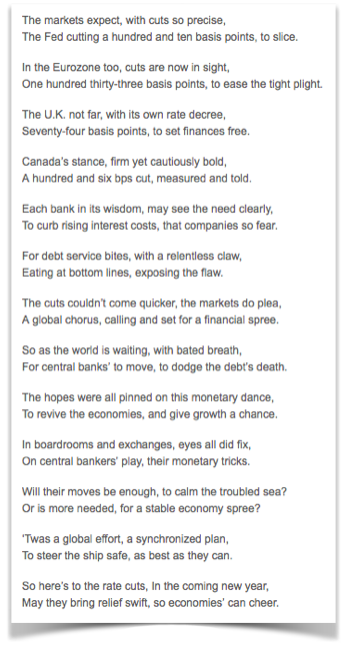

BONUS : Unavoidable