MARKETSCOPE : The Matrix (Exploded)

July, 17 2023“There is no route out of the maze. The maze shifts as you move through it, because it is alive.”

— VALIS, Philip K. Dick

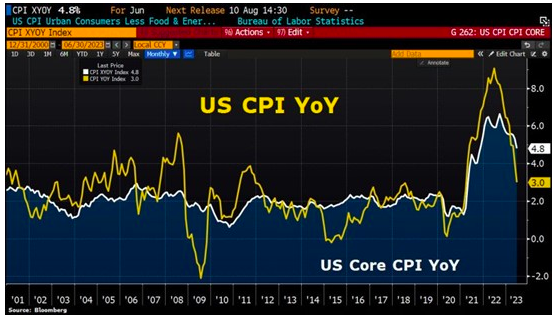

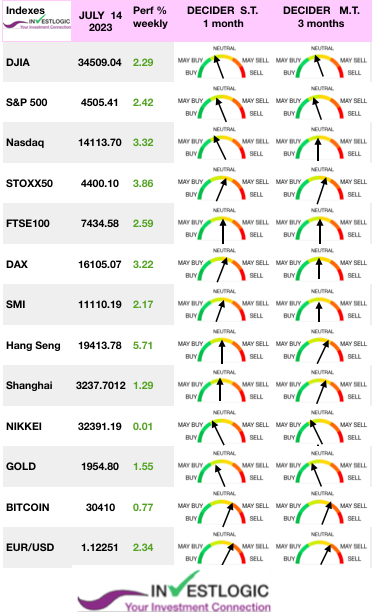

Stocks scored solid gains for the week, as surprisingly moderate U.S. inflation data prompted hopes that the Federal Reserve could soon stop its pattern of interest rate hikes. With June consumer prices and producer prices showing smaller than expected increases, both US headline and core inflation rose 0.2% in June, a tick below expectations, the annual increase in headline inflation slowed to 3.0%, its slowest pace since March 2021, investors are now considering whether a strong economy could push stocks higher by the end of the year.

Source Bloomberg

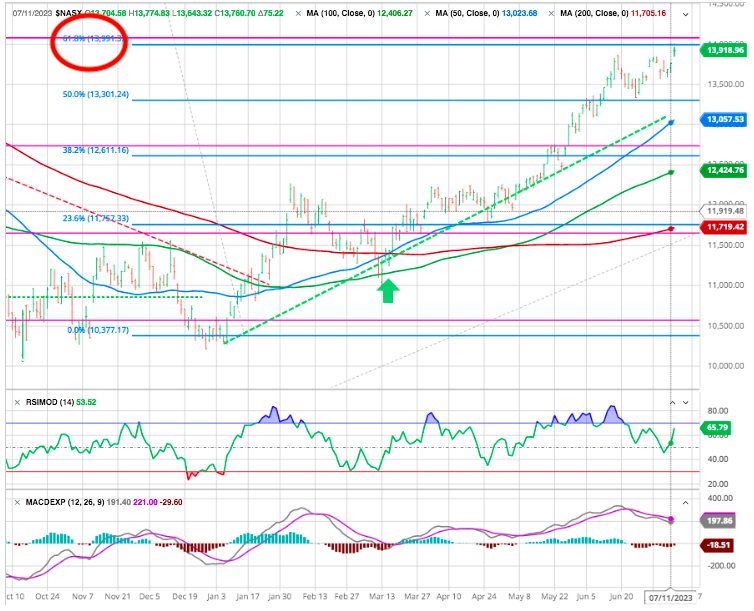

The Nasdaq Composite recorded an even stronger gain but remained 12.9% below its record peak. US Treasury bond yields fell below 4% on the back of cooler inflation data.

The Nasdaq Composite recorded an even stronger gain but remained 12.9% below its record peak. US Treasury bond yields fell below 4% on the back of cooler inflation data.

The STOXX Europe 600 Index ended the week 2.95% higher—the biggest weekly gain in about three-and-a-half months.

The market’s weekly performance was helped by gains in heavyweight growth sectors such as Communication Services, Consumer Discretionary and Technology. The latter most sector continued to add to its blistering run this year, with a few notable developments among megacap names: Amazon’s popular Prime Day shopping event set a sales record; Alphabet’s Google unit expanded its artificial intelligence chatbot Bard to Europe and Brazil.

On the Friday heatmap of the S&P 500 the three and the nearly four and a half percent rips on Amazon and Google respectively stand out

Earnings season started Friday with reports from some of the big banks, but investor expectations for this season are decidedly downbeat, with the analyst consensus forecasting a 7% year-over-year decline in S&P 500 earnings.

A big agenda next week. First on the companies’ earnings : headliners include Novartis, Tesla, ASML, IBM, Rio Tinto, SAP, Netflix and Johnson & Johnson.

Second on the economic front, with the main dates being an estimate of second-quarter Chinese growth (on Monday morning), followed by June’s US retail sales (on Tuesday). Christine Lagarde is due to speak on Monday, but her American peers are entering a blackout period ahead of the Fed’s decision on July 26.

MARKETS

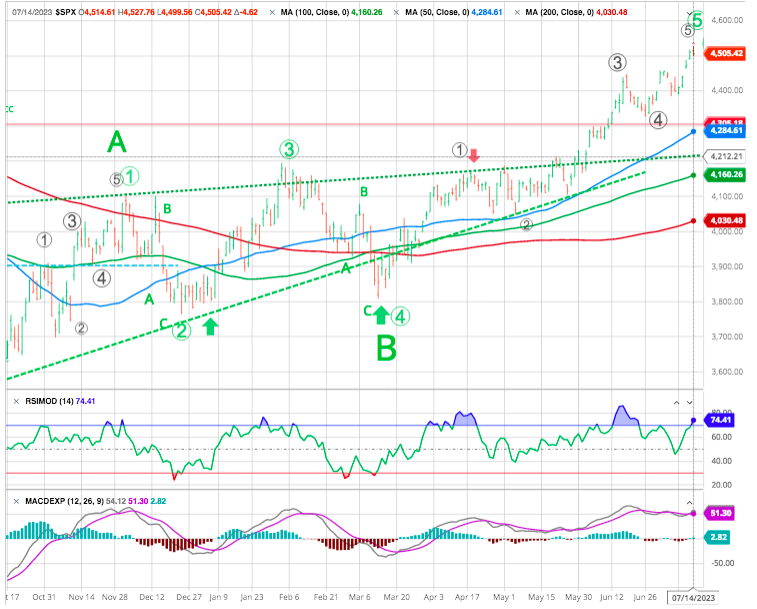

The stock market has seemed to defy expectations in 2023, ourselves included. We have rightfully been quite bearish on the market for good reasons.

Stocks have crossed the threshold for a bull market, but it doesn’t change the reality on the ground. The Fed is likely to keep hiking interest rates to balance the economy, and corporate profits should continue to slowly fall.

The market is back to overbought levels in the short term and remains well extended above longer-term moving averages. A correction back to the 200-DMA would entail a 10.5% decline. With the MACD “buy signal” triggered, albeit at an elevated level, it continues to suggest higher prices in the near term, although likely somewhat more limited.

The Nasdaq is back 61.8 % of the downside and facing a major resistance.

Markets have an amazing capacity to do crazy things, but there’s only so far that things can stretch. Far from being an unstoppable surge driven by fundamentals, this year’s bull market looks increasingly driven by speculation, not by underlying corporate fundamentals. If they believe the business cycle has been legislated out of existence then investors can pile in here all they want. However, if history is any guide, they’re likely to be disappointed with their results.

Many investors and analysts have made calls multiple times that the Fed would be done as far back as March, but the Fed is not done, and at least one more rate hike in July appears to be on the way, and probably another in the fall, which creates even more risk.

CRYPTOS

The cryptocurrency trading platform Coinbase (+36%) caught fire after a legal victory deemed historic in a closely watched lawsuit against Ripple Labs. A US judge ruled that the company did not violate federal securities law by marketing its token on open exchanges.

The SEC had accused Ripple Labs and its executives of selling unregistered securities. Since the judge ruled that XRP “is not necessarily a security”, some observers are calling it a Pyrrhic victory. But in the short term, the blockchain ecosystem is delighted with the victory over the SEC.

This was also enough to lift Bitcoin out of its multi-week consolidation period, but still on a major resistance.

USD

Let’s press on into the currency space, where the US Dollar is getting hammered on lower inflation and lower yields. Here’s the US Dollar index which now very clearly has broken longer-term support and is reinstating out bearish view on the greenback.

A weakening dollar might drive commodities higher and cause others to turn from their declines. That will drive future inflation.

The next support is the 61.8% fibo correction at 98.4.

GOLD

In precious metals, gold has broken out of its previous horizontal consolidation zone (between 1900 and 1930 USD) and is now trading at around USD 1955 an ounce.

Watch Out the Gap

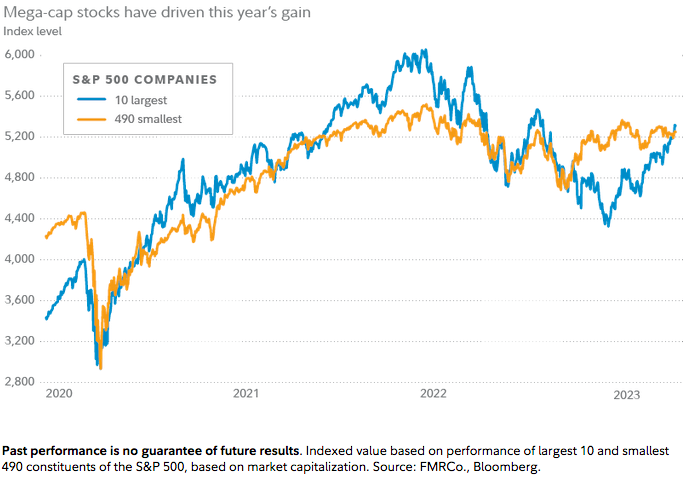

The stock market rally of the last few months has been famously narrow and dominated by a few big internet platform companies now known as the Magnificent Seven (Check BONUS below).

They were once called the FAANGs, and then MAMAA stocks, before evolving into the Magnificent Seven. But whatever Mad Money’s Jim Cramer wants to call it, the group’s outsized influence is starting to cause some trouble for market indices.

Megacap tech shares have powered six fantastic months for the stock market. Their sudden resurgence after a terrible 2022, fueled in large part by the frenzy over artificial intelligence, has been the unexpected theme of the year. So much so that the advance in the S&P 500, according to Bloomberg Intelligence, has been more concentrated among its largest stocks than in any six-month time frame since the turn of the millennium.

Therefore the title “Watch Out the Gap” refering to the decorrelation that has taken place between the Nasdaq 100 index (red), Nasdaq 100 Equal-Weight index (blue) and the (inverted) yield on 10-year US Treasuries (grey)

The usual correlation, that held up well in the past, makes intuitively sense, has high duration stocks in the Nasdaq should be sensitive to change in interest rates.

One has to correct ! In our view one more sucker rally in stocks and we are done.

Do not confuse ‘Pause’ with ‘Pivot’

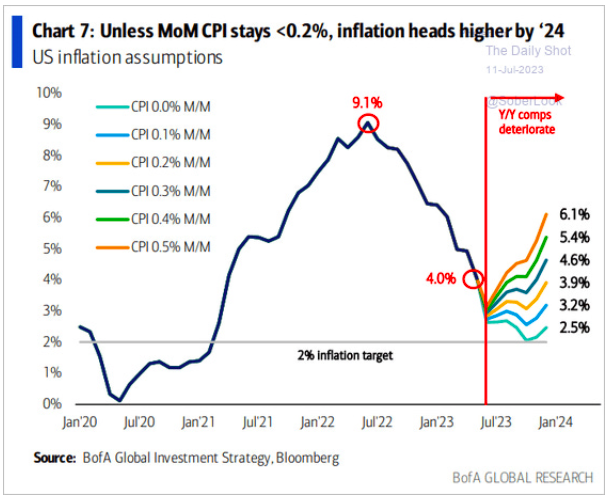

Economists and analysts are clearly divided about the latest inflation report card, but markets seem to think otherwise. The Consumer Price Index dropped to 3% Y/Y in June, down from a 4% headline rate in May, while core inflation – which excludes volatile food and energy prices – only grew by 0.2% M/M, after climbing by 0.4% or more for the past six months.

The Fed isn’t likely to take much comfort in one month of better data. Core goods and services are still relatively high, even after modest improvement. It will put into question the fantasy the stock market has had now for some time that inflation is just going to vanish and melt away.

Beware PPI reading is likely to mean that the Fed will raise rates once more by 25 basis points at the end of the month (26.7.) and then will go back into ‘PAUSE’ mode. Rates will remain elevated until something really bad happens.

Month-on-month readings have to stay below 0.2% over the coming readings, otherwise the base effect (yoy comp data droping off), could lead to higher CPI readings again.

BONUS

Clash – The Magnificent Seven