MARKETSCOPE : Trust in Markets

March, 06 2023

CARPE DIEM

A bit of China, a bit of positive thinking. The latest statistics published in the United States and Europe continue to paint a rather improbable triptych. On the one hand, some economic disorders, especially in the manufacturing industry. On the other hand, inflation is struggling to slow down. And in the middle, entire sectors that seem to be ignoring the more restrictive financial conditions, such as the labor market, real estate and the service industry.

In this context, financial markets have finally recovered in this latest weekly sequence. Equity markets continue to drink in the words of central bankers who distill forecasts that are not always easy to relate to one another.

There is a permanent and sometimes contradictory gap between the economy and the markets. In the long term, we can say that the two will inevitably come together, but in the short term, it is hard to know what to do.

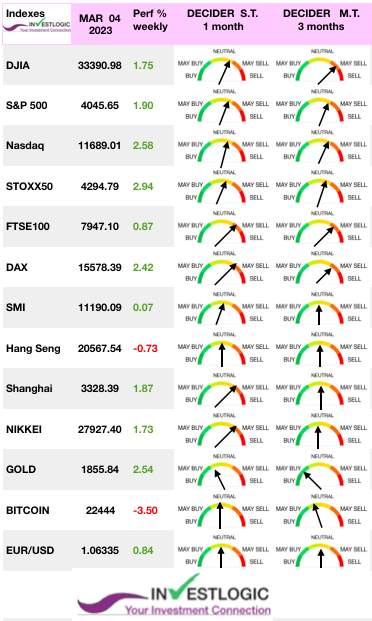

Stocks rallied Friday to close a volatile week and regained some ground following their worst weekly decline in two months. Energy and materials shares outperformed. Economic reports were mixed. US durable goods orders posted their steepest decline since April 2020. The ISM Manufacturing PMI ticked higher in February for the 1st time since May (although it remained in contraction territory at 47.7).

Stocks rallied Friday to close a volatile week and regained some ground following their worst weekly decline in two months. Energy and materials shares outperformed. Economic reports were mixed. US durable goods orders posted their steepest decline since April 2020. The ISM Manufacturing PMI ticked higher in February for the 1st time since May (although it remained in contraction territory at 47.7).

U.S. Treasury yields pulled back from their recent highs. The US 10-year pulled back from an intra-week high of 4.09% to end the week only slightly higher while credit spreads continued to compress. aThe US 10-year pulled back from an intra-week high of 4.09% to end the week only slightly higher while credit spreads continued to compress.

Shares in Europe rose as markets focused on signs of an improving economic outlook while ECB’s Lagarde signaled a 50 bps rate hike in March. Chinese stocks rose for the 2nd week as strong economic data raised prospects for a better-than-expected recovery.

In the weekly news the jobs report could be the biggest talking point of next week after Federal Reserve governor Christopher Waller warned interest rates may have to be raised more than expected if economic data comes in hot.

Equity markets look set to remain volatile, central banks in Japan, Canada and Australia are to meet and data out of the U.K. will show how the struggling economy held up at the start of the year.

MARKETS : Appearances can be deceptive

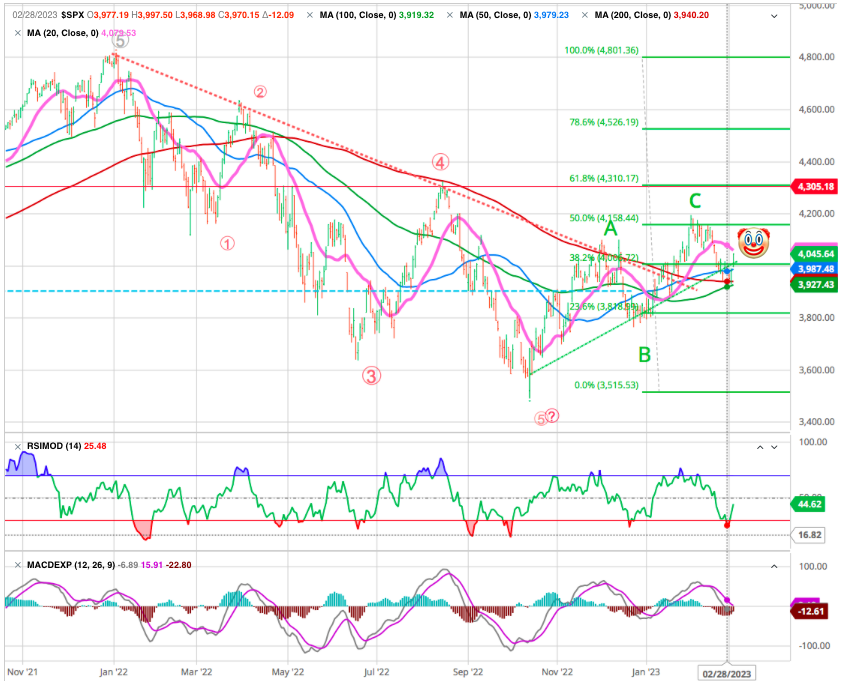

The bulls stepped in to rally the markets off that 200-DMA support, keeping the rising trend intact. In the case of the S&P 500 the ‘turnaround’ couldn’t have happened at a more perfect time for tealeaves readers technical analysts, as the index reversed gear right on top of its 200-day moving average.

However, the rally is now challenging existing resistance at the 20-DMA, but the previous highs around 4200 are the most logical target currently. Importantly the MACD “sell signal,” is beginning to reverse. However, that reversal occurs midway through regular oscillation, suggesting that the upside is somewhat limited.

The market remains confined to a rising trend channel (dotted green). That channel suggests the markets could rally as high as 4350 (61.8% Fibo retracment) over the coming months, which remains in line with the seasonally strong period.

However, if that channel is broken, there is roughly an equal amount of downside. In other words, the reward versus the risk from current levels is not great.

Except for the reversal on Friday, yields marched constantly higher, with the Tens reaching an intraday high of 4.08% on Thursday – it’s highest since November last year.

Given the pick up in yields, it probably comes at no surprise that Real Estate, Comunication and Consumer Discretionary are amongst the biggest losers of the month – though it is mildly surprising that tech stocks did not fare worse.

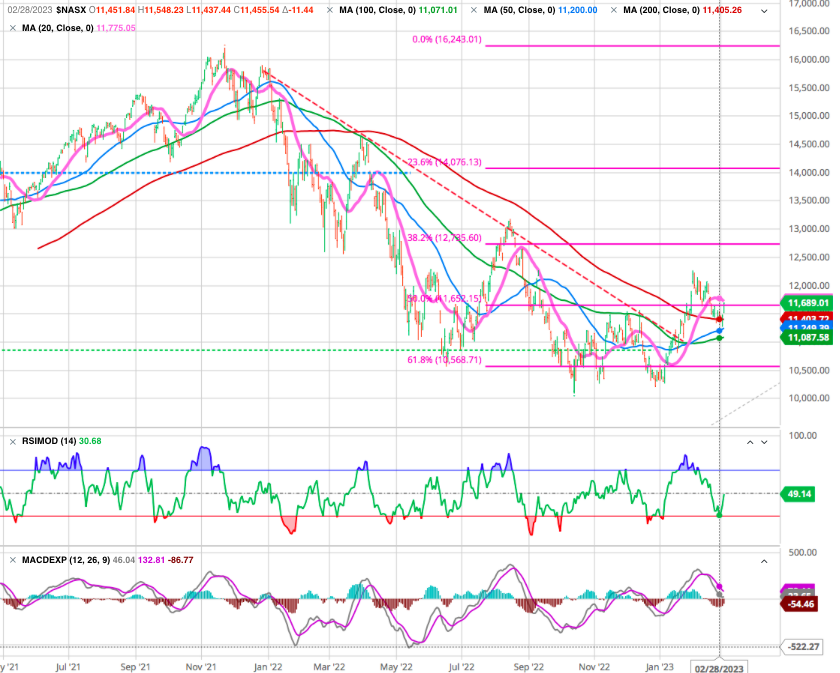

The situation remains at risk for the NASDAQ and most of the High Tech stocks.

Maybe seasonal tailwinds will be able to keep stocks afloat into early summer, but don’t forget to hedge (reduce) when you can, not when you have to!

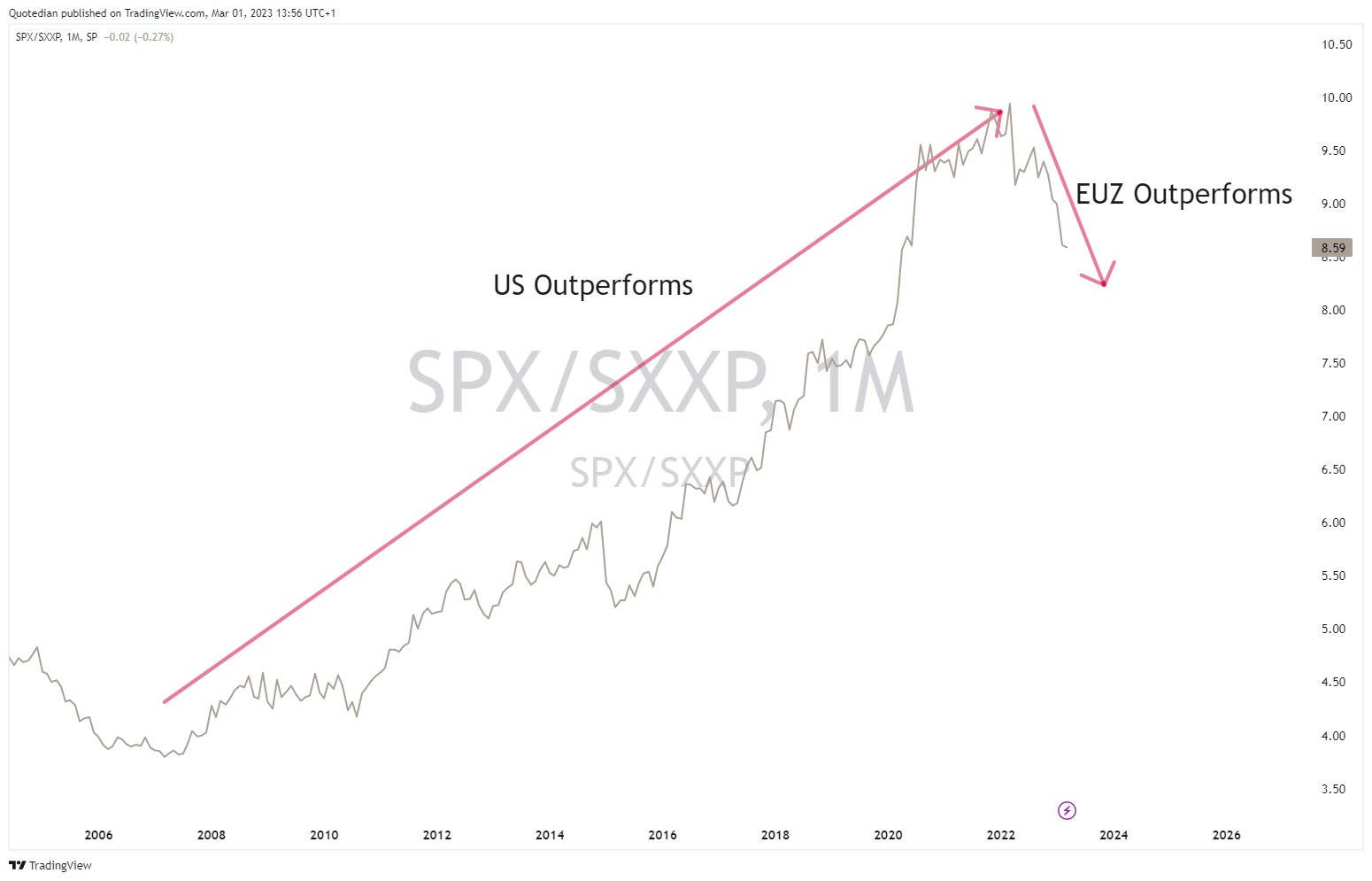

Though on a relative basis, the US continues to be the multi-decade winner, despite the recent ‘correction’, European stocks (stoxx 50) already had a more constructive pattern and are about to break out to new recovery highs:

This chart does not look bearish and can be interpreted as a few more weeks to months of equity gains ahead before heading into a probably (very) volatile summer. Hence, Europe’s outperformance over over the US continues be alive and healthy.

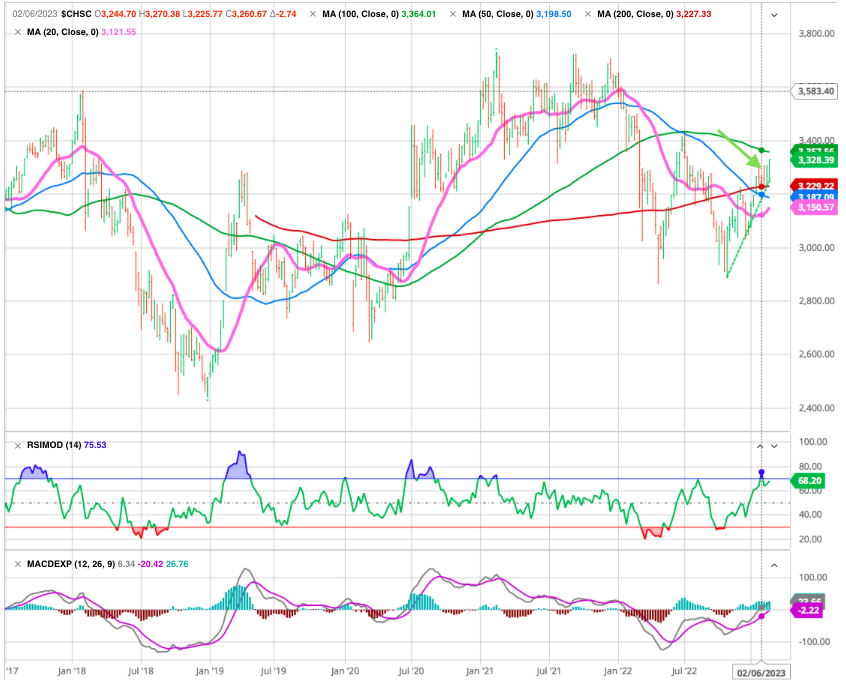

Let’s also have a look at some emerging markets … Starting with Chinese equity, we note that theShanghai index has spent February consolidating some of its strong gains since November.

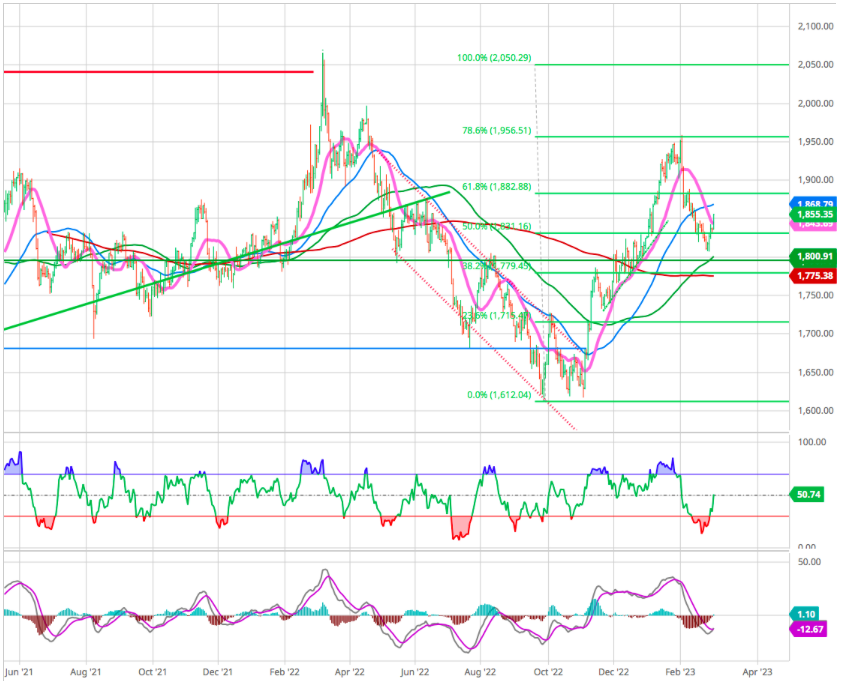

Gold

Where the recent drop in Febraury has been painful, as it came just as many market observers started paying attention again:

Though overall, this chart remains constructive to us.

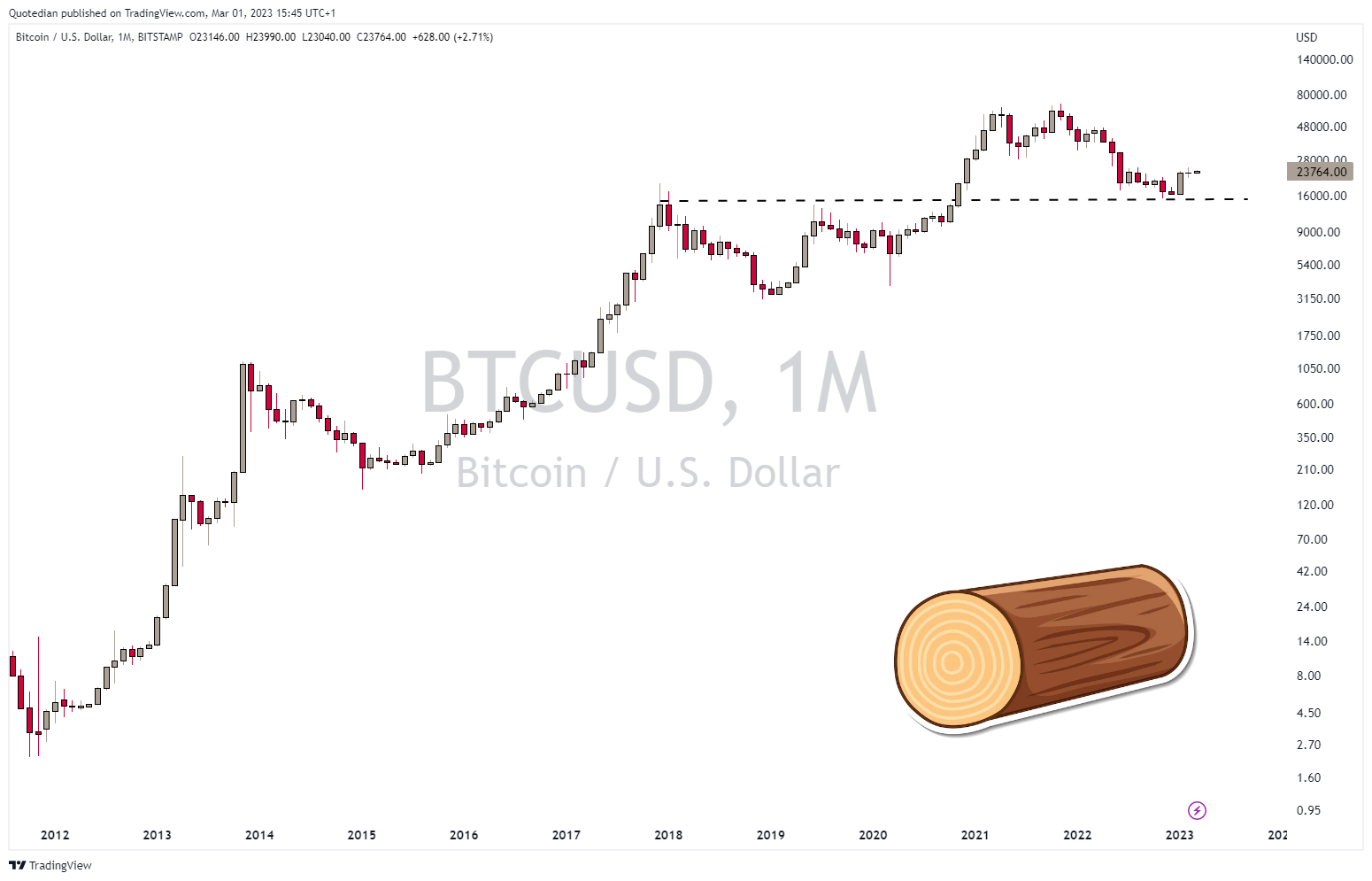

Cryptocurrencies

Amid a growing regulatory crackdown in the US on crypto-currencies, and less than optimal macro conditions for risky assets, bitcoin is stalling. The crypto-asset market leader is letting go of 5% of its capitalization this week and is back flirting with $22,000. Without strong positive catalysts, bitcoin, and the crypto-currency market as a whole, may still struggle to regain the hearts and confidence of investors.

A 10 year logarythm chart gives us a realtive different view !

Several “big picture” risks remain.

For example, recent data suggests inflation could be rising again. That, in turn, means the Federal Reserve is likely to keep rates “higher for longer” than expected even a few weeks ago.

Corporate earnings have also been weakening and could fall even further if the economy ultimately falls into recession in the months ahead.

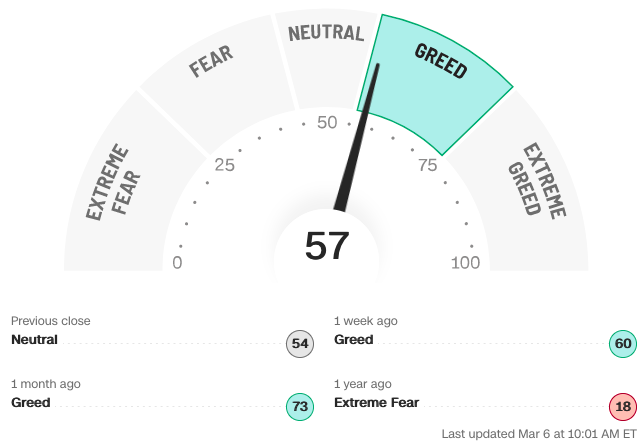

Investor sentiment is also still a concern. As you can see below, Fear & Greed Index has moved out of the “extreme greed” territory it was in earlier this month. However, it’s still closer to levels that have marked previous broad-market tops.

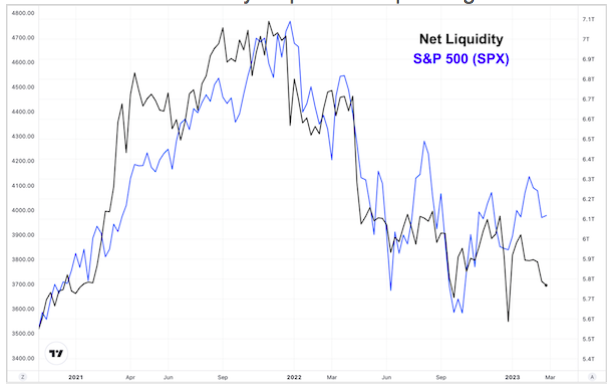

It’s also worth mentioning that “net liquidity” conditions we have discussed in the previous Marketscope. It has been acting as a short-term headwind as well. In fact, as you can see below, net liquidity (black) has actually been falling over the past couple of weeks as the Fed’s quantitative tightening (QT) program and rising reverse repo balances have more than offset U.S. Treasury Department spending.

Now, barring a swift (and unexpected) agreement to raise the debt ceiling by Congress, liquidity is likely to rise significantly over the next few months, supporting some rebound.

However, until that happens, this trend could put further near-term pressure on the broad stock market (blue line in the previous chart).

Echo Bubbles.

Driven by hints that interest rate rises could be coming to an end, tech assets started bouncing back in the past three months. Crypto, including Bitcoin, is up more than 60 per cent; Chinese tech is up more than 50 per cent; profitless tech, which includes names like Spotify and Lyft, is up more than 40 per cent; clean energy, which includes Tesla, is up more than 20 per cent. And the famous US Big Tech “Fangs” (Facebook, Amazon, Netflix and Google) are up more than 30 per cent.

These are classic echo bubbles. Investors refuse to give up on ideas that recently made them a lot of money and so they keep piling back in. The echoes gradually fade away, until serial disappointments kill the faith.

Echo bubbles are known to reignite false hopes, often repeatedly. The dotcom bust between 2000 and 2002 was punctuated by three echo bubbles; the biggest saw a nearly 50 per cent increase in the Nasdaq.

When people are as uncertain about the future as they are now, they tend to stick to what they were doing, hoping for the best. But markets move on.

The hopeful noises about comebacks in various corners of tech are the familiar sound of echo bubbles. History suggests money will more likely be made in sectors and stocks that were not caught up in the bubble of the last decade. (see Ruchir Sharma)

Happy Trades