MARKETSCOPE : FED running for [the] President ! ?

March, 25 2024

“We’ve got nine months of 2.5% inflation, now we’ve had two months of kind of bumpy inflation…Now, there were some bumps and the question is, are they more than bumps? And we can’t know that, that’s why we are approaching this question carefully.” –Jerome Powell

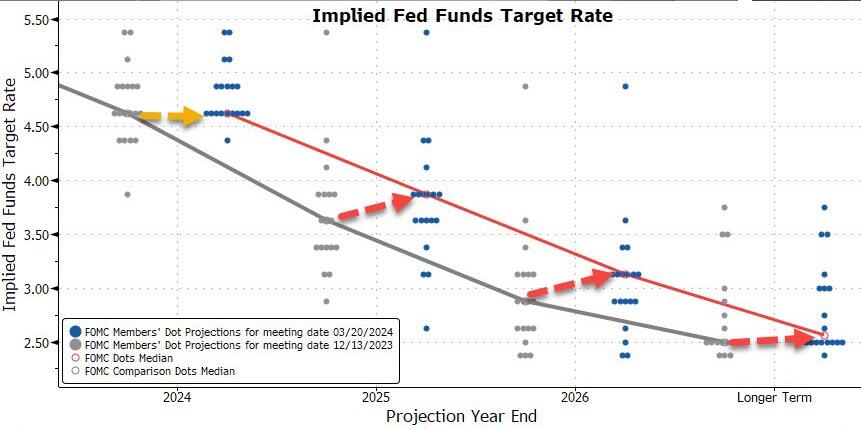

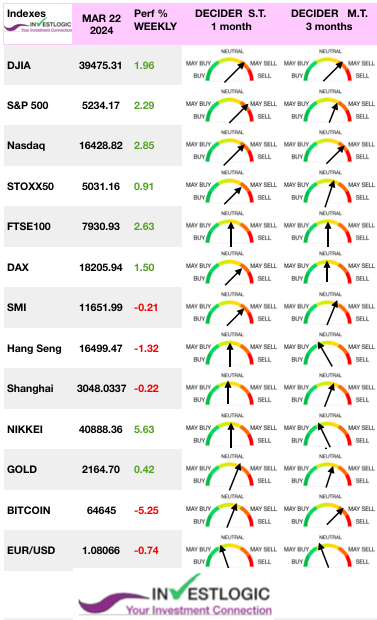

Recent decisions by central banks, announced throughout the week, have only served to reinforce investors’ conviction that interest rate cuts are just around the corner. Wall Street’s bull run was rekindled after Wednesday’s FOMC meeting announcement. While the meeting was largely as expected, with no real change to outlook, the outcome was seen as primarily “dovish” as Powell reaffirmed the Fed was still on track to cut rates three times this year.

Of course, the Fed is supposed to be completely out of politics, etc., etc.. But we all live in this on planet Earth. So you could have your debate. Let’s say that maybe this is about getting Biden re-elected.

While the Fed kept its median dot at 3 cuts for 2024, beyond that the dots signal considerably less aggressive Fed rate-cutting. We also note that while the median 2024 dot remained the same, 8 Fed voters were for 50bps or less in Dec, now it’s 9. The Fed now expects one less rate-cut in 2025 and 2026… and the so-called ‘neutral’ rate has also been increased.

Many market participants were fearing much worse, and Fed Chair Jerome Powell further allayed concerns with a relaxed attitude towards recent hot inflation reports. The S&P 500 on Friday marked its best weekly performance of 2024, snapping a two-week losing streak in the process.

The news from the Fed helped drive a decline in longer-term Treasury yields over the week. It has consolidated only slightly below its 4.35% resistance. Bear in mind that only a break of 4.07% will confirm the end of the rebound underway since last December.

The news from the Fed helped drive a decline in longer-term Treasury yields over the week. It has consolidated only slightly below its 4.35% resistance. Bear in mind that only a break of 4.07% will confirm the end of the rebound underway since last December.

The Swiss National Bank fired the first shot, unexpectedly, by cuting borrowing costs by a 25 basis points to 1.5%, to counter the effects of the strong franc. Markets expect the Fed, ECB and Bank of England to follow suit within three to four months.

Europe PMI surveys showed that the output of goods and services in the eurozone came close to stabilizing in March. STOXX Europe 600 Index ended near a record high, climbing 1.03%. The BoE kept its key interest rate unchanged at 5.25% for a 5th consecutive time.

The only exception is Japan, where the BOJ raised rates for the first time since the 2008 financial crisis. But the decision was so eagerly awaited that it changed nothing. Japanese equities surged (+5.6% for the Nikkei 225 index).

Chinese equities retreated as concerns about the property sector slump offset optimism about better-than-expected economic data.

Ahead : Several markets will be closed for Easter on Friday March 29. Paris, Zurich and Brussels will also be closed on Monday April 1. On the macroeconomic agenda, investors will be keeping a close eye on the big series of US indicators (real estate, confidence, latest GDP estimates, etc.), culminating in February’s PCE inflation figures, to be announced on Friday, just before a speech by Jerome Powell to close the week.

MARKETS : Trees Don’t Grow To The Sky

As they say at amusement parks, “Make sure your seat belts are fastened securely and enjoy the ride.”

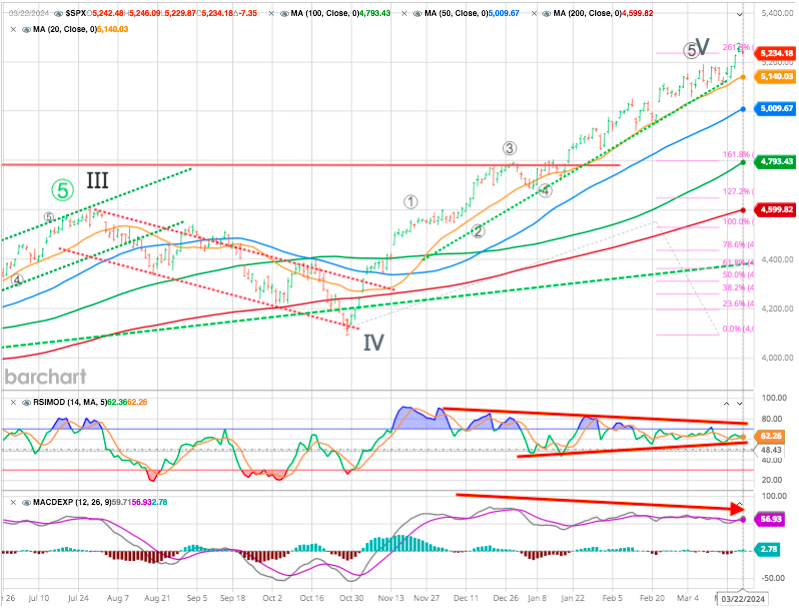

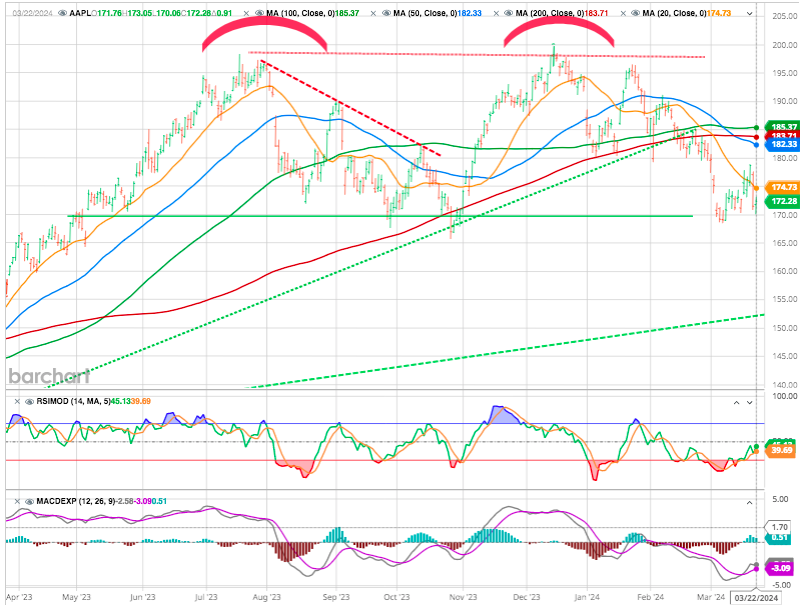

The S&P 500 20-DMA continues as critical support where computer algorithms continue to “buy dips,” and sellers resurface at the channel’s top. For now, this mind-numbingly narrow channel, with extremely low volatility and high complacency, remains. What will change that dynamic? We have no idea.

Several weeks ago, we had a set-up which points us to the 5285 (2.618 % of wave 1) the next resistance level (see Marketscope March 11). We outlined that “as long as the market holds do not break back below 4950 (which is basically where the market bottomed during that last pullback and 50 DMA) we have a set-up which will then point us to the 5350”.

Thus far, the market has clearly respected that, and has been hitting its head on the 5285 resistance we have been highlighting as well. The problem for investors is that this bullish trend has already lasted much longer than expected and could continue.

At this point in time, we would say that as long as the market holds over 5140 (20 DMA) we still have a set up in place pointing to 5350. However, should the market break down below then that could open the door to begin our confirmation of what may be a major market top.

What triggers will reverse that trend it is unknown, but a good warning sign will be a violation of the 20-DMA. As noted, we suspect such a violation will trip the algorithms into “sell” mode and increase downside price pressures.

So for now we would only remain vigilant for a break of the trend channel to take more aggressive risk reduction actions.

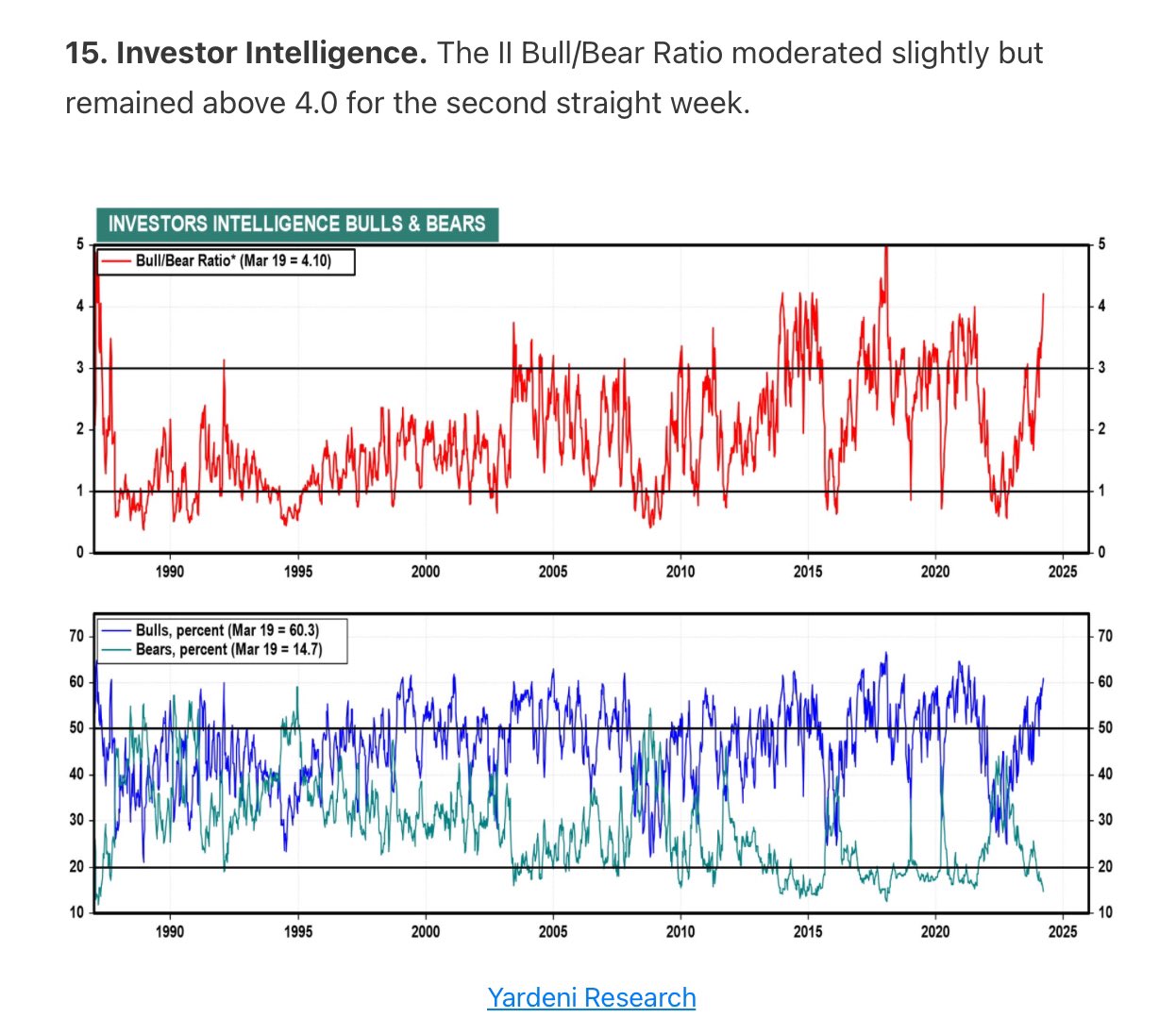

It’s not just retail investors who are unusually bullish on the equity market (AAII Survey) but newsletter writers bull/bear ratio is unusually high too. And with vol unusually low, even the most trenchant bull must surely see a correction coming.

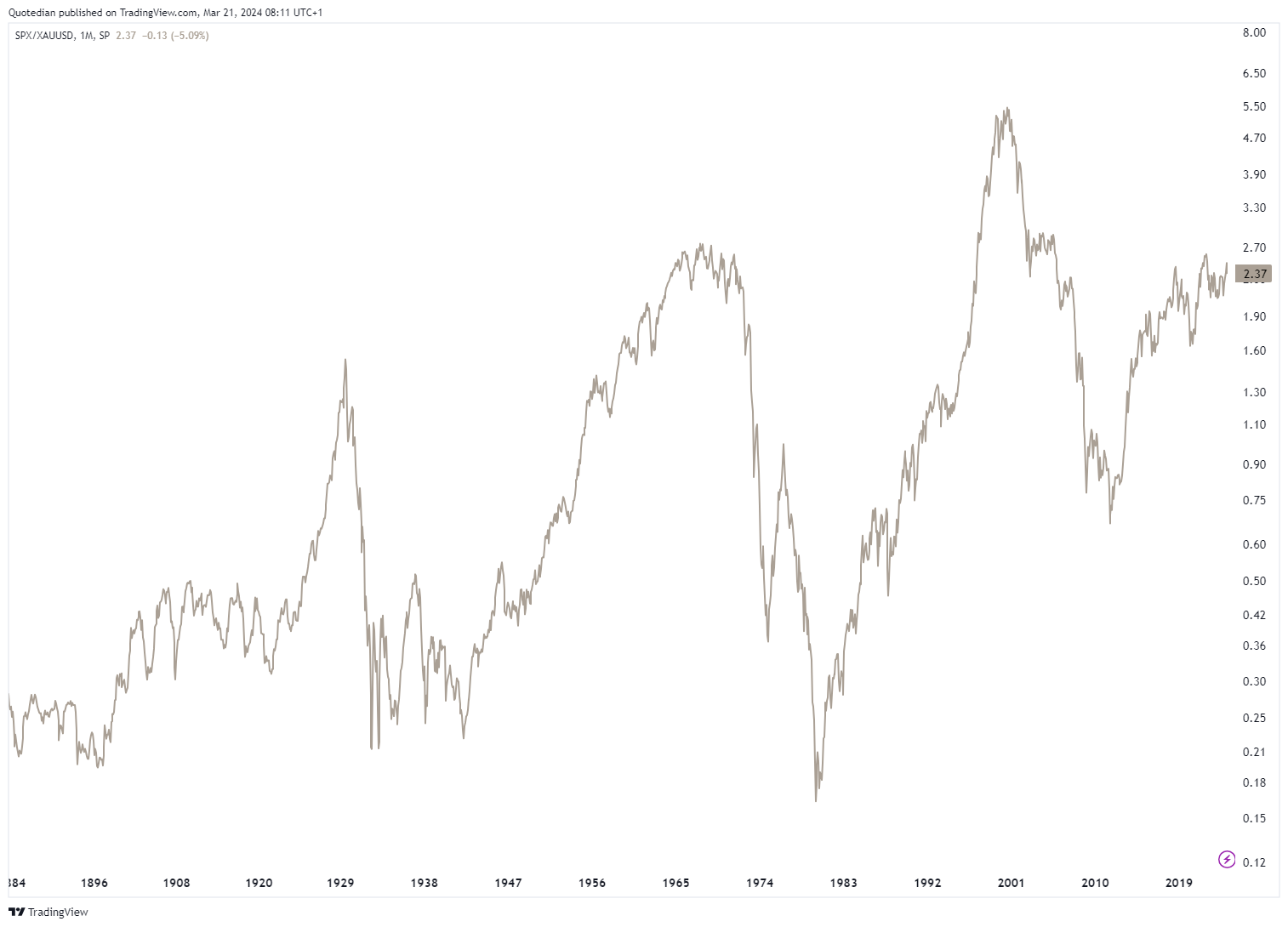

Let’s finish off then with the chart of the day week month year decade century centuries.

Here is the S&P 500 divided by the price of Gold

Apple : Game of monopoly

The Biden administration is not letting Big Tech out of its sights as it hardens its tough antitrust stance.

Last year, the DOJ filed a suit against Google over digital advertising, in addition to a legacy trial focusing on internet search, while the FTC sued Amazon for illegally maintaining a monopoly and targeted Meta in an attempt to unravel its WhatsApp and Instagram acquisitions.

Apple finally made the hit list, with the DOJ accusing the iPhone maker of violating antitrust law by monopolizing the smartphone market. The news sent Apple sliding 4% on Thursday, erasing over $110B in market value.

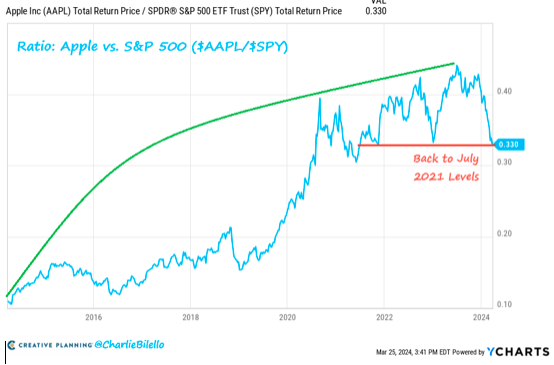

Apple has been an incredible outperformer over the last decade (+891% vs. +235% for the S&P 500) but its recent slide has brought its relative strength back to July 2021 levels.

source : Charlie Bilello The Week in Charts

REDDIT : r/IPO

Interest in IPOs made a comeback last week as social media platform Reddit soared nearly 50% in its market debut.

About 8% of Reddit’s float was reserved for power users, prompting speculation that RDDT could turn into a meme stock, especially for a company that has never turned a profit in its nearly two-decade existence.

There might be money in advertising and content licensing deals, although ironically, some popular subreddits like r/WallStreetBets and r/stocks called Reddit a “pump and dump scheme.” Analyst at PropNotes also called it the ultimate boom or bust stock.

NIKKEI

Japanese stocks closed the week at a fresh all-time high.BOJ’s rates hike can’t even slow that market down !

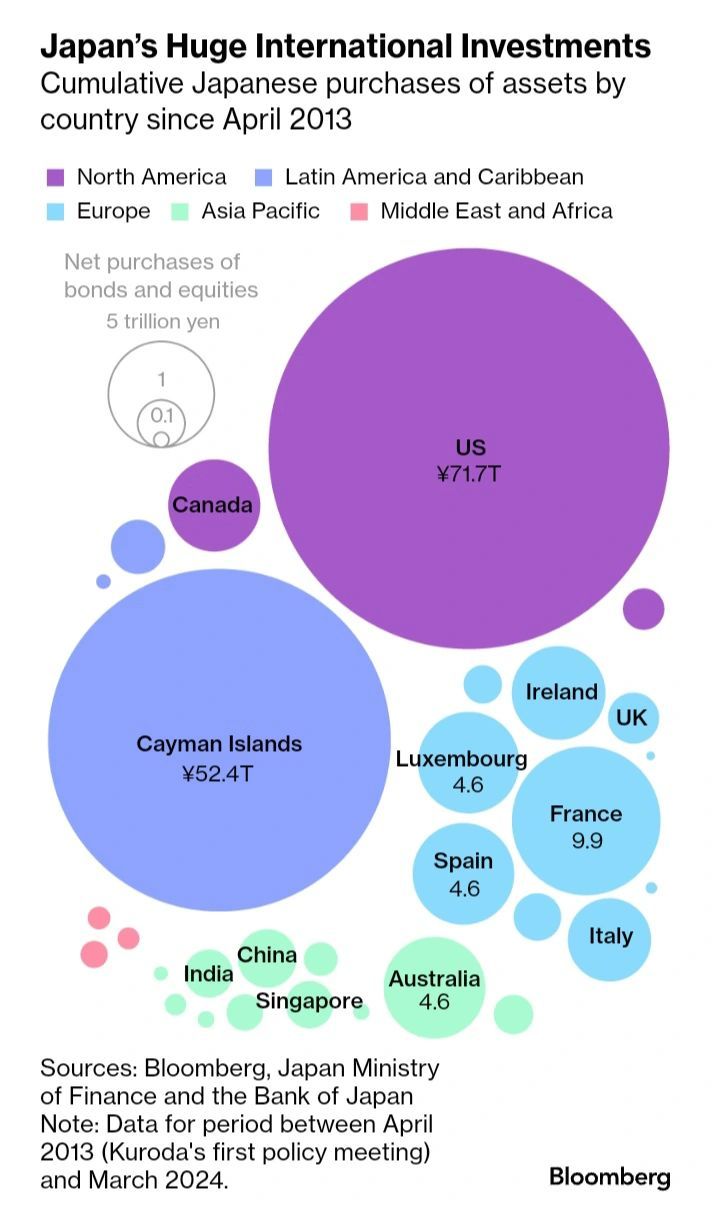

The Bank of Japan’s decision to end its negative interest rate experiment has left over $4 trillion in funds searching for higher returns abroad. This move is set to impact money flows not just in Japan, but across the globe.

One of the biggest questions being asked is what will happen to the large sum of money currently invested in assets overseas. While markets have reacted positively to Japan’s first interest-rate hike since 2007, the long-term effects remain uncertain. It will be interesting to see how this decision will impact the global economy in the coming months.

But not even a dovish Fed was able to push the Yen meaningfully higher

It seems the market is pushing to test the resolve of the Bank of Japan (BOJ) to intervene at the 0.00658 level. A failure to do so and a push above that resistance would lead to an absolute minimum target of 0.0065.

Did You Spot The Gorilla In The Fed’s Meeting Room?

The Federal Reserve kept interest rates on hold and largely stuck to its path for interest-rate cuts to come later in the year, with policymakers undeterred by the recent pickup in inflation data. Chair Jerome Powell said prices pressures will continue to ease and it will likely be appropriate to start cutting later in 2024.

Post-press conference, there was a whiff of optimism. Market fears that Jerome Powell might dismiss rate cuts were unfounded. Investors took note, pricing in a 74.4% chance for a rate reduction by June—an optimistic leap from recent days.

The Fed’s minor macroeconomic forecast adjustments were seen as affirming their comfortable stance with current policies. They indicated the potential for rate cuts amidst robust economic conditions—a sign that resonates well with the short-term outlook of most financiers.

Normally, we are used to a Fed that talks like a giant riddle that you can’t figure out what they’re saying, we are less used to this where Fed just comes out and says, “oh, we’re still data dependent now”.

But then they just came out and said it, “oh we’re just going to lower interest rates this year”, even though they’re data dependent. What if the data comes back and inflation’s starting to percolate up ?

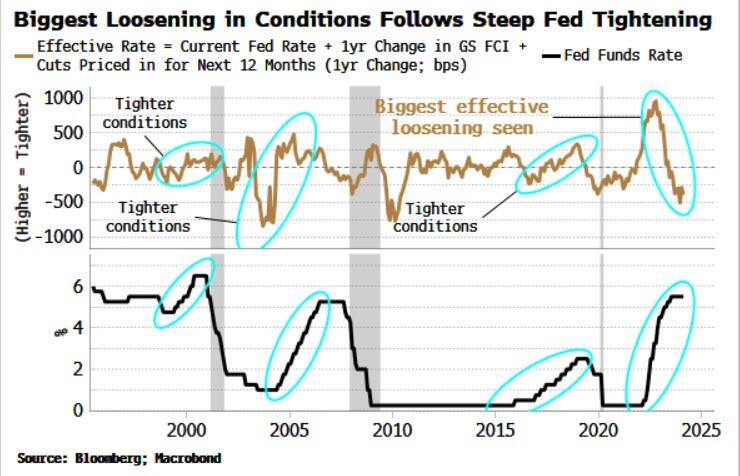

But as noted by Simon White, Bloomberg macro strategist “Monetary policy remains exceptionally loose given one of the fastest rate-hiking cycles seen”.

A famous experiment asks volunteers to watch a video of a basketball game and count the passes. Half way through, a gorilla strolls through the action. Almost no-one spots it, so focused they are on the game. As we count the dots and parse the language at this week’s Fed meeting, it’s easy miss the fact that policy overall remains very loose despite over 500 bps of rate hikes. The gorilla has gone by largely unnoticed.

In the three prior rate-hiking cycles the Effective Rate tightened; this time the rate has loosened, by more than it has done in at least 30 years. It is against this backdrop the Fed’s pivot in December is even more inexplicable.

Of course, the Fed is supposed to be completely out of politics, etc., etc.. But we all live in this on planet Earth. So you could have your debate. Let’s say that maybe this is about getting Biden re-elected.

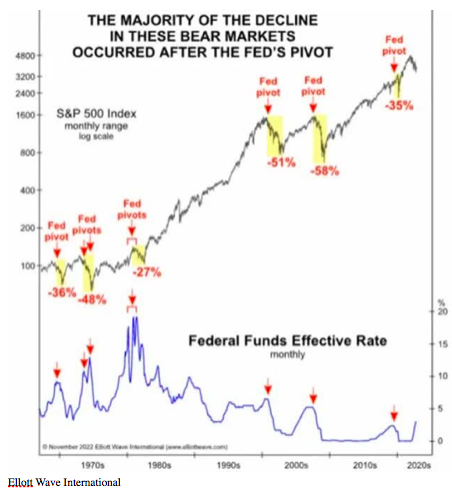

We also would remind you again that usually the majority of the decline in the markets occurred AFTER the Fed’s pivot

Happy trades