MARKETSCOPE : The Sum Of All Greed

January, 29 2024

Despite a few disappointing quarterly results, the week ended on a bullish note for the stock markets. Wall Street continues its record-breaking run, buoyed by a robust US economy and the prospect of imminent rate cuts.

US GDP rose by 3.3% in the fourth quarter, against a forecast of 2%, reinforcing the scenario of a soft landing for the economy. The core personal consumption expenditures (PCE) price index – the Federal Reserve’s preferred inflation gauge – rose 0.2% M/M in December 2023, matching the consensus figure.

As a result, the S&P 500 hit new all-time highs, while the yield on the US 10-yr bond peaked below 4.23/25%. The gains were relatively broad, although the small-cap Russell 2000 Index remained nearly 20% below its all-time intraday high.

As a result, the S&P 500 hit new all-time highs, while the yield on the US 10-yr bond peaked below 4.23/25%. The gains were relatively broad, although the small-cap Russell 2000 Index remained nearly 20% below its all-time intraday high.

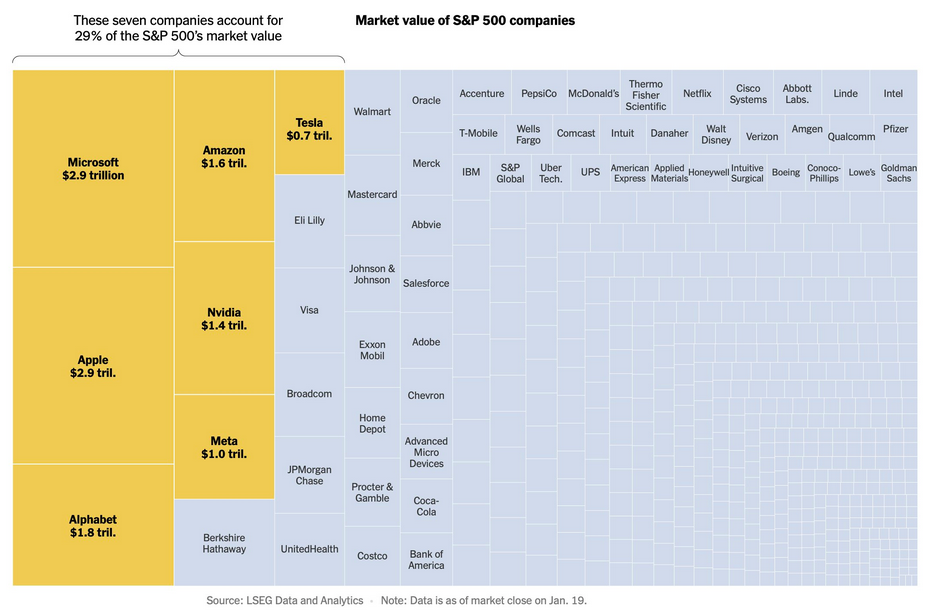

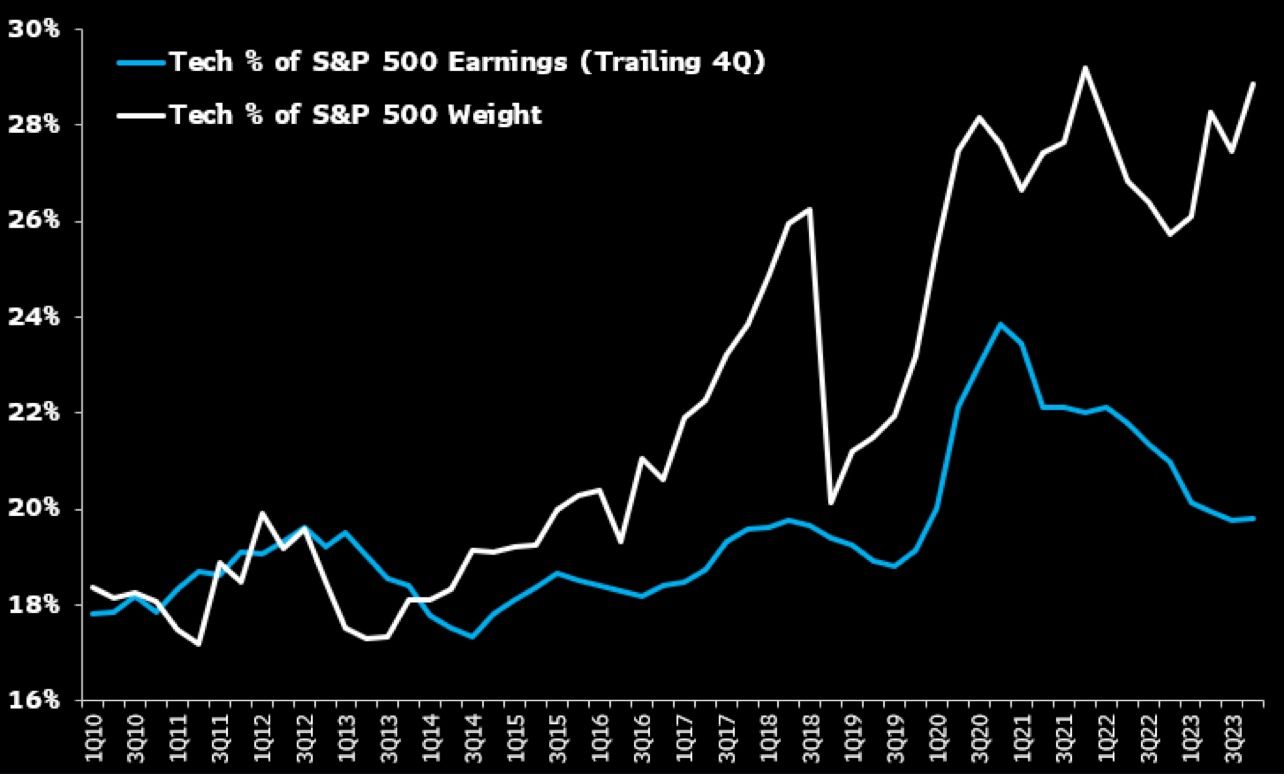

While the Technology sector can grow earnings in a slower economic environment, market liquidity has chased just a handful of stocks over the last year.

The week of January 29 is crucial for the market’s narrative, with earnings growth, fiscal and monetary policy, and economic data in focus. The US Treasury will announce its Marketable Borrowing Estimates, potentially impacting rates and financial conditions.

The S&P 500 earnings season is about to get more interesting with all the mega cap technology companies reporting over the next few days. If we had to choose just ten – and that’s complicated enough – we would mention Microsoft, Apple, Alphabet, Amazon, Meta Platforms and ExxonMobil in the USA, and Novo Nordisk, Novartis, BNP Paribas and Glencore and Dassault Systemes in Europe. Blimey, that’s eleven already.

The narrative of a dramatic narrowing in the stock market market into the “Magnificent Seven” has officially reached the mainstream media.

This week’s ECB meeting left its rates and rhetoric unchanged reiterating that monetary policy would stay at “sufficiently restrictive levels for as long as necessary” to bring inflation down to the 2% target.STOXX Europe 600 Index ended 3.1% higher on encouraging corporate results and a strong luxurious sector.

China is taking to try new measures to get out of its rut. It’s hard to say exactly what Beijing is up to, but the choice has been made to support the financial markets rather than announce a more comprehensive economic stimulus plan. Chinese indexes reacted positively, but investors remain, once again, a little disappointed. The blue-chip CSI 300 gained 1.96 while the Hang Seng Index advanced 4.2%.

The week of January 29 is crucial for the market’s narrative, with earnings growth, fiscal and monetary policy, and economic data in focus. The US Treasury will announce its Marketable Borrowing Estimates, potentially impacting rates and financial conditions.

The S&P 500 earnings season is about to get more interesting with all the mega cap technology companies reporting over the next few days. If we had to choose just ten – and that’s complicated enough – we would mention Microsoft, Apple, Alphabet, Amazon, Meta Platforms and ExxonMobil in the USA, and Novo Nordisk, Novartis, BNP Paribas and Glencore and Dassault Systemes in Europe. Blimey, that’s eleven already.

MARKETS : YOLO : “If you aren’t long, you’re short”

“Understanding is a three-edged sword, your side, their side, and the truth.” — Vorlon proverb, Babylon 5

The US stock market may suffer a correction in coming months as the economy slows, according to Deutsche Bank. The world’s largest economy may post 0.8% annual growth this year, down from a forecast of 2.3% for 2023. As that deceleration seeps into the stock market, a drop of 5% to 10% from current levels is likely to occur in the near term.

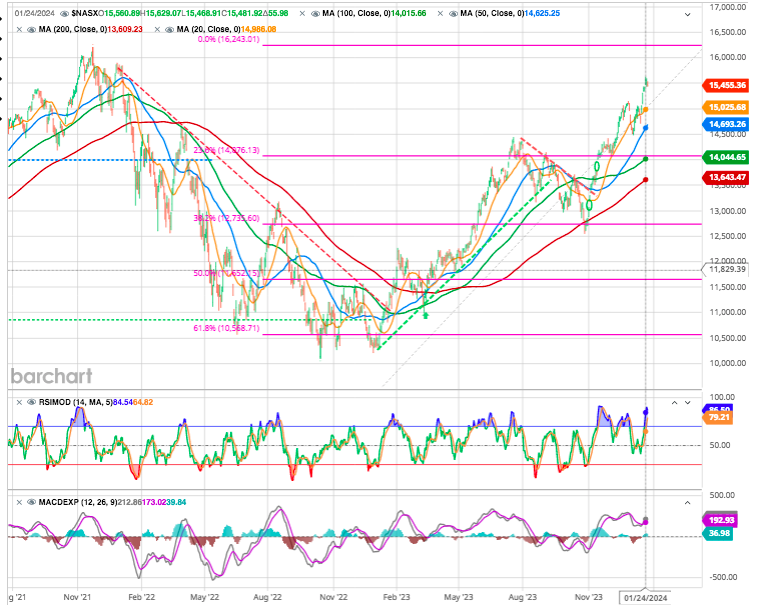

The MACD “buy signal” is firmly intact, although at a high level, suggesting the bullish bias remains. While the market is overbought in the short term, corrections will likely remain mild with 4800, where the market broke out, remaining essential support.

Be aware the current advance is getting rather long concerning time. The market will have a correction at some point over the next few months, which will provide a better entry point for increasing exposure.

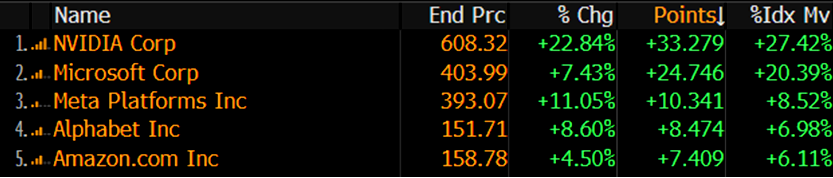

Nonetheless, the market continues its advance, but as we show it is back to the Mega-caps leading the way, with everything else lagging.

YTD performance top contributors

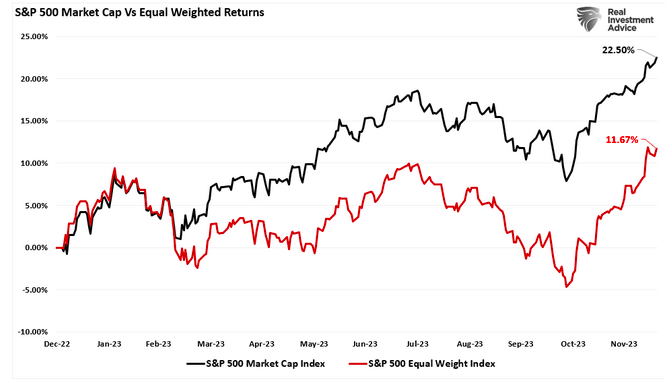

Through the end of 2023, the S&P 500 market-capitalization weighted index doubled the return of the equal-weighted index. The reason is that the top-10 stocks in the index absorb more than 30% of all flows into passive indexes.

Citi warns that Nasdaq 100 futures positioning is near the highest in three years, with investors appearing to favor growth stocks into the earnings season. Profit levels, in particular for Nasdaq, are the growing concern, with positioning and profits extended. The average long position is near 5% in profit, elevating the risk of profit-taking unwinds and creating a potential headwind for a continued rally in the near term.

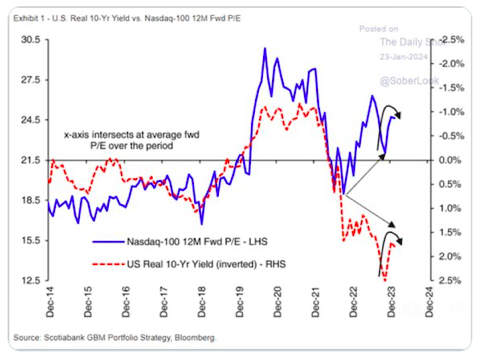

The gap between tech and rates continues to get wider as NASDAQ has “decoupled” from rates, but is that “sustainable”?

In 2024, that deviation continues as the chase for “artificial intelligence” dominates media headlines.But if the AI profits don’t soon materialize, it may be difficult to justify the lofty valuations tech stocks carry today.

European stock markets went up sharply due to renewed hopes about the Chinese economy and the revival of the luxury goods

LVMH

After a double bottom price does appear to be in an area where it can find a low and bounce higher. It will be the structure of that bounce and then the reaction once 3 waves up complete that will show us what’s most likely next.

Take note that the Dior chart is telling us a similar story. To be clear: Price in both LVMH and Dior should bounce in a corrective fashion.

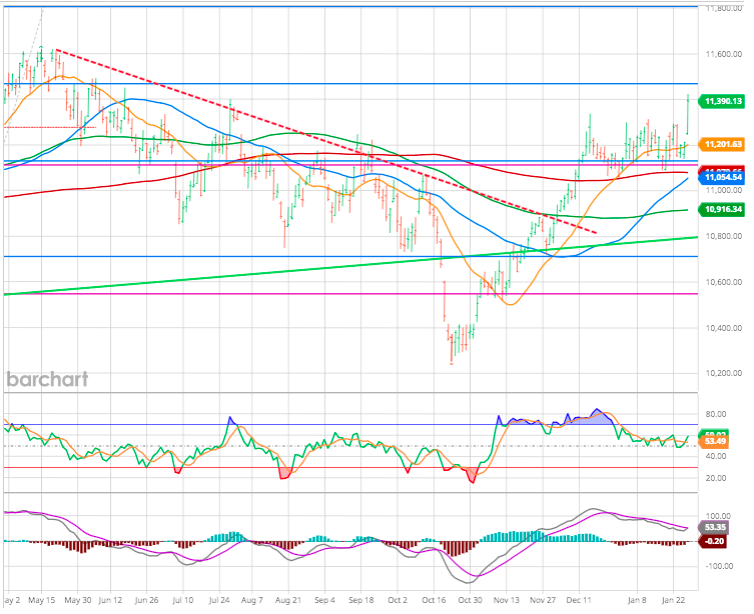

Swiss Market Index

Energy

Positive economic data and the ongoing troubles in the Red Sea supported crude oil prices. Brent crude managed to break the USD 80/barrel barrier.

Copper

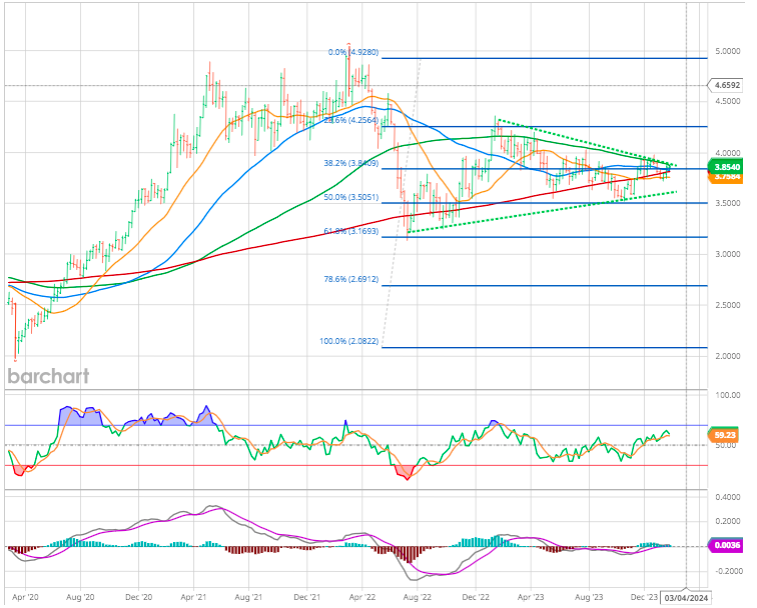

After peaking in 2021, copper prices declined sharply before bouncing around for a few years. That “bouncing” ended up following the twists and turns of Fibonacci rules. (Weekly)

The initial decline hit the 61% Fib before bouncing to the 23% Fib. After a touch of the 38% Fib, Copper fell to the 50% Fib… before bouncing again.

All of this price action ended up forming a large pennant pattern. And if Copper will trade below its 50 % Fibo retracement level it would send a contraction message in regards of the economy. A break of the triangle above the 38.2% level would point to a stronger economy (China ?)

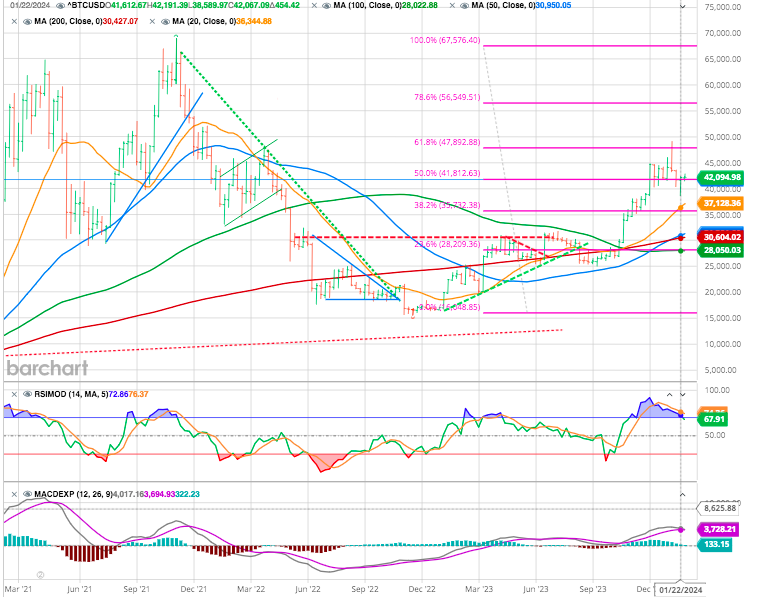

CRYPTOS

Bitcoin chatter is rising again. With new ETFs coming to market, crypto investors are getting very bullish.

Is this a good thing? Or is too much bullishness about to send Bitcoin spiraling?

Look at a long-term “weekly” chart with Fibonacci levels to show why bears may be circling Bitcoin right now.

A couple of week ago, Bitcoin created a bearish reversal at its 61.8 % Fibonacci retracement level. And continued weakness took place afterward… Bitcoin broke below its 50% Fib level (41812) before retesting it.

It’s also worth noting the RSI divergence in the top pane. Looks like Bitcoin may be attempting a trading u-turn of sorts here.

The S&P 500 earnings season is about to get more interesting with all the mega cap technology companies reporting over the next few days. The sector is expected to post 16% earnings growth in 4Q and top overall index growth in each quarter of 2024. The chart below suggests companies may be under significant pressure to beat this relatively high bar as the sector share of the index is near its 2021 peak but its share of earnings has been shrinking.

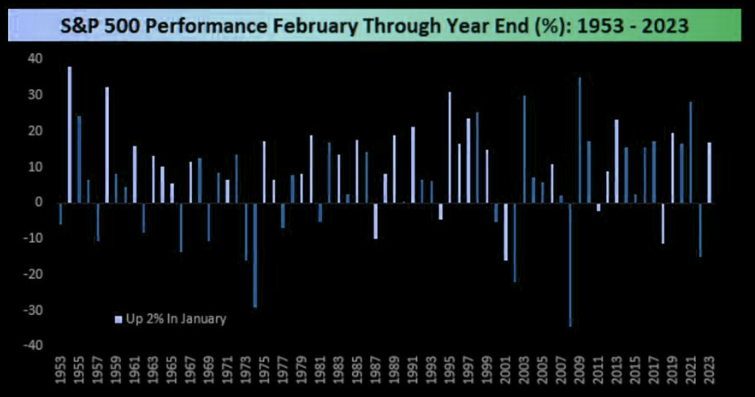

January Effect

Since 1953, when the S&P 500 ended January up at least 2%, it finished the rest of the year with a median gain of 13.5% and finished green 84% of the time.

FED under pressures

The Federal Reserve is largely expected to hold interest rates steady and make only a subtle change to the policy statement, but the Jerome Powell presser will be closely watched for any hawkish or dovish tilt. The Fed will probably discuss extensively the merits of cutting interest rates against the risk of future inflation, which has yet to fall to the 2.0% target.

Market is pricing close to a 50 probability of an interest rate cut in March.

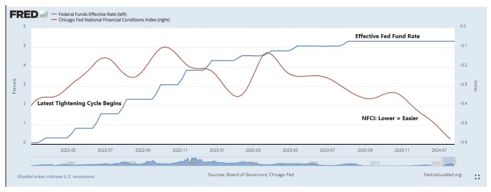

Looking at the Chicago Fed’s National Financial Conditions -purple line- (Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average) the trend is to easier monetary conditions.

It is hard to see how the Fed can start cuts as early as March, with disinflation stalled and inflation still above target. We think that markets are still too ambitious in pricing the timing and extent of Fed rate cuts, and until it adjusts more, there is still upside risk for the dollar, especially as the economic impulses from Europe remain weak.

If high real rates are worrying investors about the future for asset prices, they are not showing it, at all !

Happy trades

BONUS “If you aren’t long, you’re short”

YOLO “you only live once”

Ok, those of you of the “buy low, sell high” religion, may want to skip this section today, as feelings may get hurt or, in other words, the following is not for the sensitive eye…

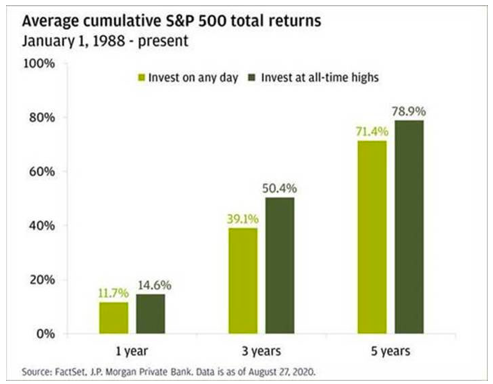

As the chart below shows, money invested when the market is at all-time highs (such as now) has outperformed money invested on any given day.