MARKETSCOPE : The Bear Season … Episode VI

May, 02 2022The Market is Always Right

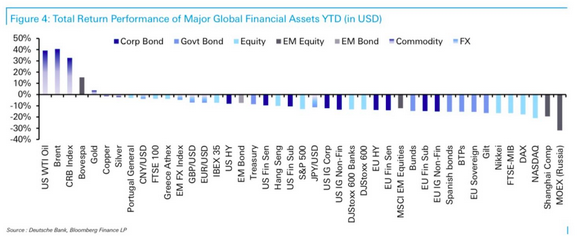

We’re in a world-wide tightening cycle now, and so we have to let the air out of many of these assets. Futures now predict meaty 50 basis point increases at each of the next three FOMC meetings, fueling concerns about the economic outlook and even talk about a coming recession.

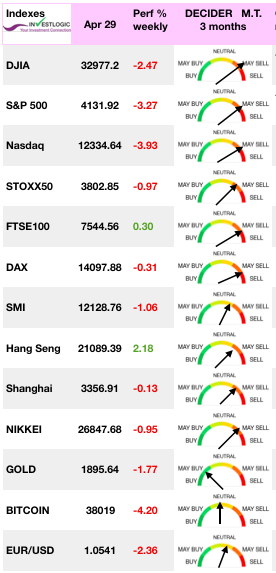

Another tough week, and month, for the market. Ongoing concerns about inflation, earnings, and economic growth, continue to pressure stocks.

Another tough week, and month, for the market. Ongoing concerns about inflation, earnings, and economic growth, continue to pressure stocks.

Overall, the week ended with a negative result for the financial markets, despite qualitative company results and China’s willingness to do everything possible to support its economy. Volatility seems to persist, however, with traders unsure of how to act between the ongoing tensions in Ukraine, fears of drastic tightening of central bank monetary policies and an economic outlook that remains less solid.

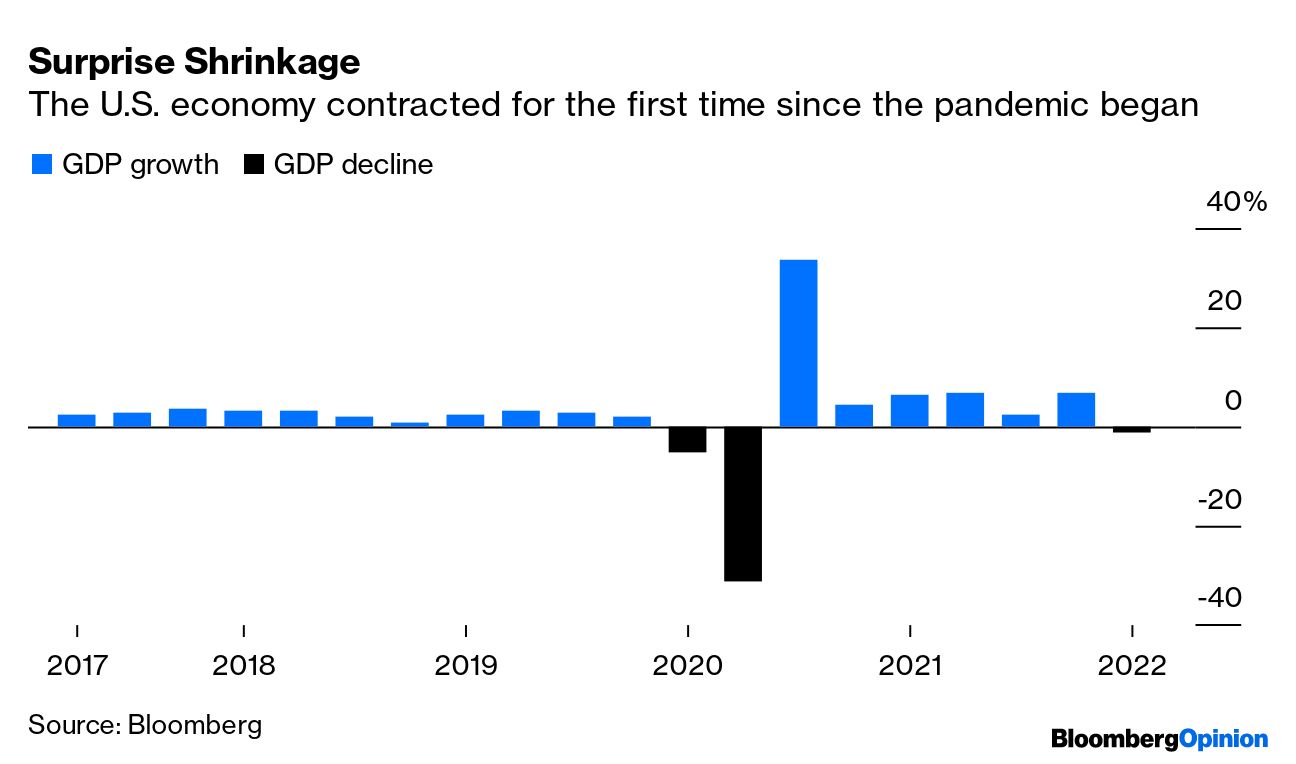

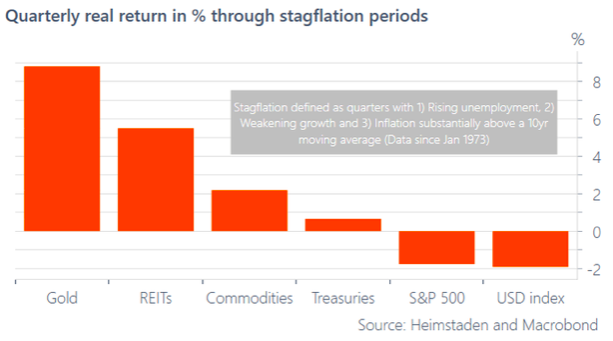

The week’s economic data increased “stagflation” risk as US GDP for 1Q contracted at an annualized rate of 1.4%, well below consensus expectations of a roughly 1.0% expansion. After decreasing early in the week, the yield on the US 10-year ended near where it began.

In Europe, equities pulled back on concerns about slowing economic growth, high inflation, and tightening monetary policy. Core eurozone bond yields fell, as mounting concerns about inflationary pressures and weakening economic growth appeared to increase demand for high-quality government bonds.

MARKETS : Roller Coaster

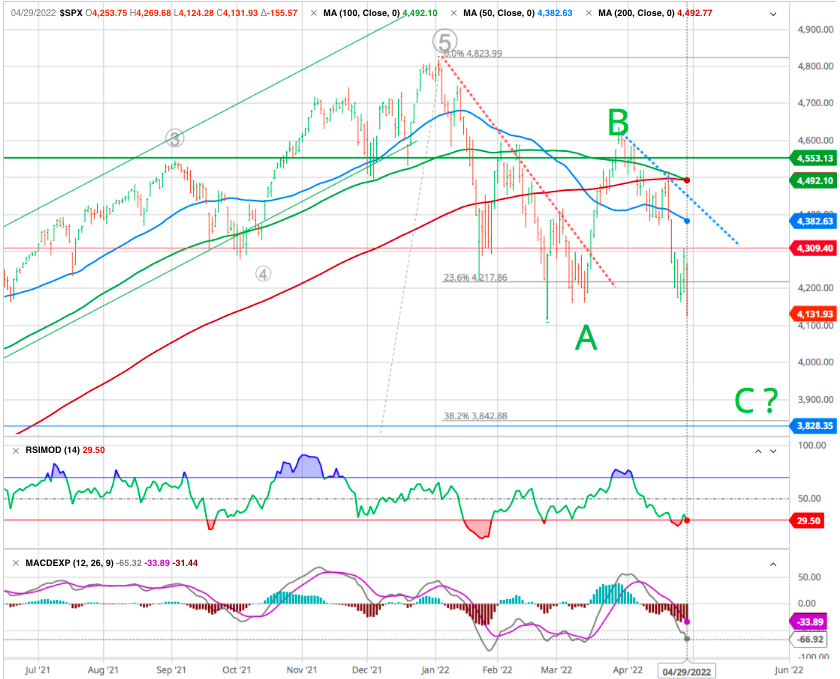

Markets tested lows on Tuesday. That sell-off led to a sharp rally on Thursday, only to retrace to lows on Friday. We continue to stick to our road book regarding the market direction (SPX 3800 and IXIC 10250).

A week of earnings releases, a week of thrills in an unforgiving market. The week started in the red with the first earnings releases. Among the heavyweights, Microsoft, Meta Platforms and Apple reassured while Amazon and Alphabet disappointed investors. The resulting sharp variations, such as Facebook at +17% after publication or Amazon at -14% from its recent pea, are somewhat disconcerting for investors looking for calm and serenity positioned on the blues chips of the U.S. market.

As the FELDER REPORT’s two graphs show : At the start of the month, the five largest components of the index (Microsoft, Amazon, Nvidia, Tesla and Apple, aka MANTA) traded at about 55-times their aggregate free-cash-flow (and nearly 70-times when you back out stock based compensation). Now that might not be totally obscene if it weren’t for the fact that free cash flow growth has recently turned negative. In that context, however, it’s hard to see how the most extreme valuation in the history of this group is at all sustainable.

The bearish tandem of falling free cash flow and waning liquidity (second graph) suggests extreme valuations could revert in a major way, depending on just how much and for how long free cash flow declines and by how much and for how long the Fed is committed to draining the markets of excess liquidity.

Energy stocks outperformed within the S&P 500 after Russia announced that it was cutting off natural gas exports to Poland and Bulgaria.

Cutting off energy to Europe is the biggest economic weapon that Putin can deploy as the Kremlin hopes to get Western nations to think twice before helping Ukraine. However, along with other moves that were intended to divide the bloc, the decision could backfire and instead strengthen the EU’s resolve. Oil and gas sales account for about 40% of Russia’s annual revenue and are its most lucrative source of foreign earnings.

Cutting off energy to Europe is the biggest economic weapon that Putin can deploy as the Kremlin hopes to get Western nations to think twice before helping Ukraine. However, along with other moves that were intended to divide the bloc, the decision could backfire and instead strengthen the EU’s resolve. Oil and gas sales account for about 40% of Russia’s annual revenue and are its most lucrative source of foreign earnings.

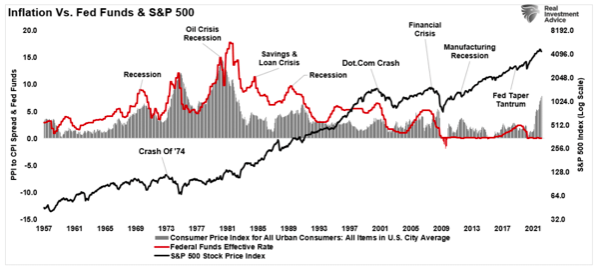

With the Federal Reserve almost certainly set to deliver a half-percentage-point rate hike at its upcoming meeting on Wednesday, investors will be awaiting further insights on its next steps to combat surging inflation.

Meanwhile, the Bank of England is expected to deliver its fourth rate hike in a row, one day after the Fed, on Thursday.

All this could also triggering stagflationary dangers for Europe and European stock markets will suffer in the coming months.

Although the Swiss Market is more defensive (because of its components and the safe haven role) on the weekly hart we can identify a possible Head and Shoulders. A break of the neckline (11600). would trigger a wave to the original target of a 61-8% of the 2020 uptrend (9900).

CURRENCIES : Scylla, meet Charybdis.

The euro dropped to a five-year low against the dollar during Tuesday trading, falling further than during the worst of Covid panic in March 2020. It adds pressure exactly when it’s not needed on the European Central Bank, and on investors in European assets.

The fundamental reason for a weakening euro is clear enough. Expectations for rate hikes in the U.S. have increased far beyond similar expectations in the eurozone since the beginning of the year. The ECB is itself growing more hawkish, but the gap is still widening.

A strong dollar helps to tighten financial conditions in the U.S., suiting the Federal Reserve. But a weak euro, which tends to make imports more expensive, is exactly what the ECB doesn’t need. Import price inflation in the major European economies is already easily at its highest since the creation of the euro in 1999. A weaker euro directly increases prices of imports — and increases the risk of demand destruction as families simply give up on spending.

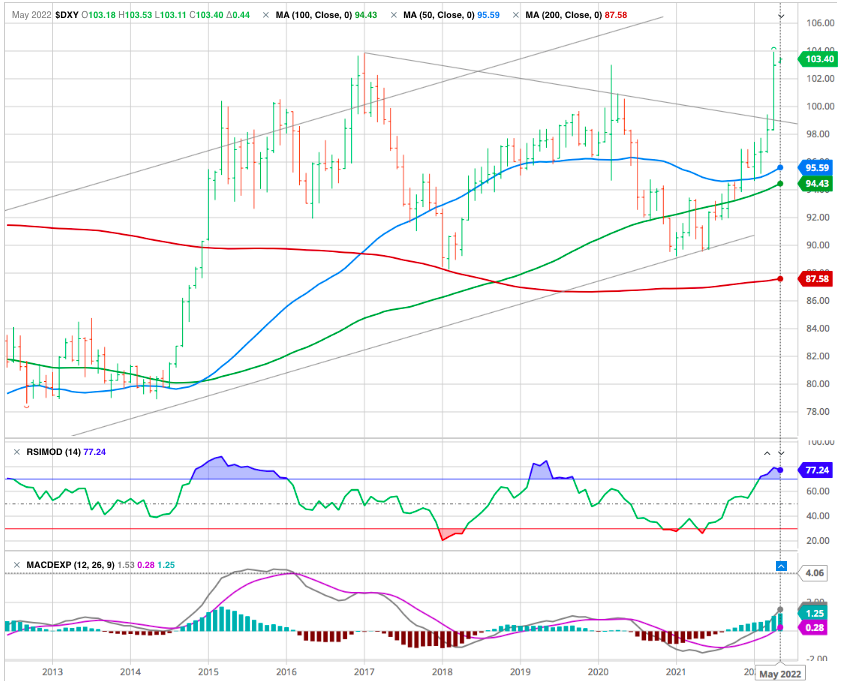

On the other hand of the equation the greenback is at its highest level in two decades, climbing another 1% on Thursday to just under 104 in the U.S. Dollar Index, marking its strongest level since 2002. The USD still in the long term uptrend channel.

As a result, a rising DXY tends to increase foreign demand for dollars while also making them harder to obtain. And if the rise is severe enough, it has the potential to create a vicious, self-reinforcing cycle that pushes the DXY higher and higher until something “breaks.”

As in 2020 a skyrocketing DXY triggered a panic in the U.S. Treasury market as foreign holders dumped bonds to raise dollars. And it was reportedly this problem – rather than the big decline in stocks – that prompted the Federal Reserve to resume easing soon after.

China’s authorities have left the Yuan exchange rate drop sharply by about 3.9% since mid April. That was the sharpest drop since the 2015 mini devaluation that roiled global market. The strong dollar is helping the FED’s effort to rein in inflation, however it is a drag on overseas earnings for US corporates.

Volatile currency markets tend to reflect unstable conditions that can find their way into bonds and stock markets.

Will the Fed be able to engineer a “soft landing”?

The ongoing economic sanctions with Russia, China shut down, and a flight to safety by foreigners into the U.S. dollar, all increase the risk of a slower global economic growth.. Furthermore, periods of tighter monetary policy have also coincided with recession warnings.

A soft landing at this point is wishful thinking ! How the FED will act will determine the means to the inevitable end ( a recession) and how quickly the economy will emerge.

Looking back historically, high levels of inflation (bars) combined with Fed tightening of monetary policy (red) led to either a recession, bear market, or a crisis.

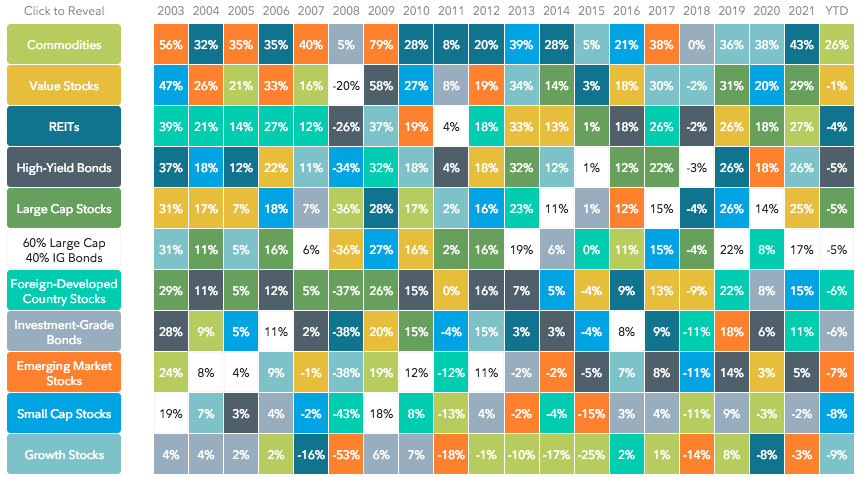

Here is our tip on what to buy and sell, if you think we are headed for stagflation soon :

Happy Trades